Mastering ICT session profiles is the key to consistent and profitable forex trading. ICT session profiles, developed by the Inner Circle Trader (ICT), are detailed templates that map out the expected price movements and market behavior during specific trading sessions. These profiles provide traders with a precise framework for anticipating market trends, identifying optimal entry and exit points, and avoiding common trading mistakes.

For traders working with a regulated forex broker, ICT session profiles offer an invaluable tool to maximize gains and minimize risks. By leveraging these profiles, traders can gain a deeper understanding of market dynamics, allowing them to make more informed decisions and execute trades with greater confidence. This article will guide you through the intricacies of ICT session profiles, explaining how they can be effectively utilized to enhance your trading strategy and improve your success rate in the forex market.

Understanding ICT Session Profiles

What Are ICT Session Profiles?

ICT session profiles are structured trading templates designed to predict specific market behaviors during particular trading sessions or under certain market conditions. These profiles, created by the Inner Circle Trader (ICT), provide traders with a detailed understanding of how markets typically move within a session. Unlike generic trading strategies, ICT session profiles focus on the timing, price levels, and expected movements within a specific trading period, such as the London or New York session. By understanding and applying these profiles, traders can anticipate market trends with greater accuracy, identify optimal entry and exit points, and reduce the likelihood of making emotional trading decisions.

Read More: Mastering ICT Weekly Profiles

Importance of ICT Session Profiles in Forex Trading

ICT session profiles play a crucial role in enhancing a trader’s ability to navigate the Forex market. Here’s why they are indispensable:

- Precision Trading: ICT profiles offer traders a high level of precision by providing clear guidelines on when and how to enter and exit trades based on historical market patterns. This precision helps traders to minimize risks and maximize profits.

- Risk Management: Effective risk management is the cornerstone of successful trading. By following ICT session profiles, traders can better manage their exposure to risk. These profiles offer insights into when to avoid the market or when to take calculated risks, thereby protecting capital and enhancing profitability.

- Consistency: Consistency is key in Forex trading, and ICT session profiles foster this by reducing emotional responses and promoting disciplined trading practices. Traders who consistently apply these profiles can build a stable trading routine that yields reliable results over time.

- Market Understanding: ICT profiles help traders gain a deeper understanding of market dynamics. By studying these profiles, traders can learn how different sessions interact with one another, leading to more informed decisions and the ability to stay ahead of market trends.

The Essential ICT Session Profiles

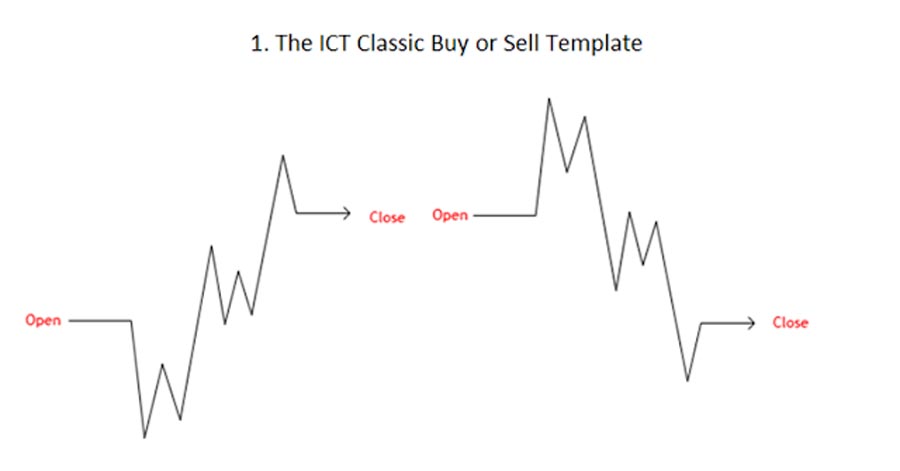

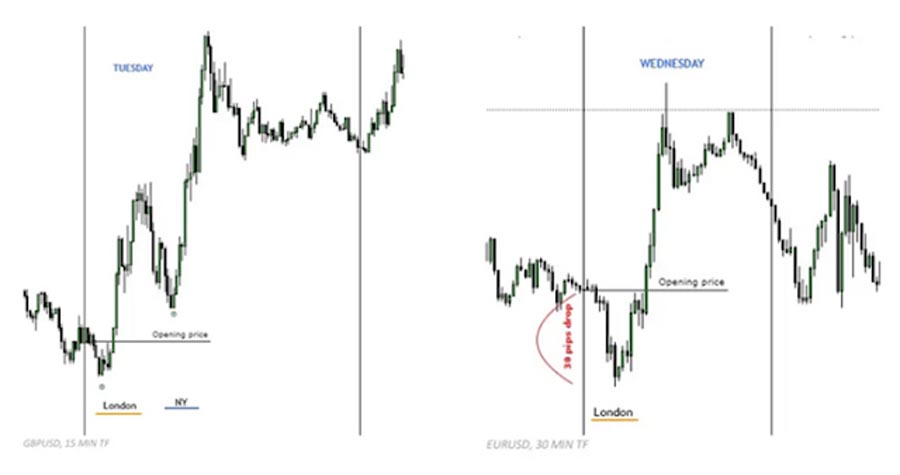

1. The Classic Buy Day or Sell Day Template

The Classic Buy Day or Sell Day Template is one of the most powerful strategies for traders aiming to capture significant market movements, especially during the London session. This template is particularly effective on Mondays, Tuesdays, and Wednesdays when the market typically sets a definitive trend.

Key Strategies:

- Buying Strategy: Always buy when the market dips to a key support level below the opening price, particularly during the London session. If the price starts above the opening price, wait for it to trade below before entering a buy position.

- Selling Strategy: For a sell day, look for the price to trade above the opening price and then drop to a resistance level. This strategy capitalizes on the market’s tendency to establish a high before declining during the session.

- Timing: The daily range usually lasts for 7 to 8 hours, with the most significant moves occurring within the first few hours of the London session. This timing aligns with the period when liquidity is highest, offering the best opportunities for profitable trades.

- Profit Target: Aim to secure small, consistent profits of 20–30 pips around 12:00 EST. This target aligns with the market’s typical mid-session movements, allowing traders to capitalize on predictable price fluctuations.

This template is ideal for traders who can actively monitor the market during the London and New York sessions, where the template’s signals are most reliable.

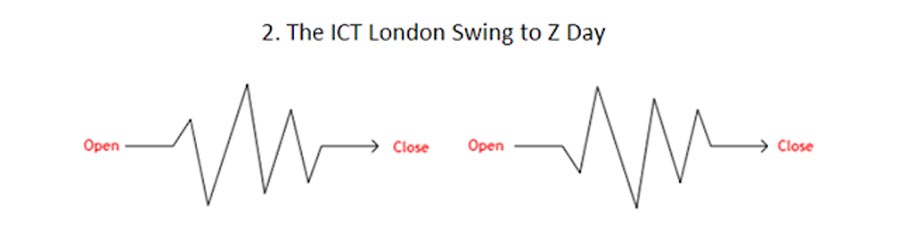

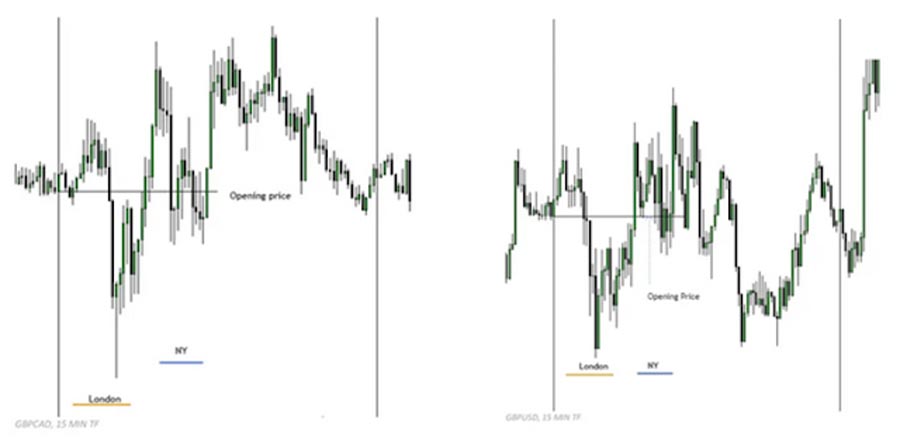

2. The London Swing to Z Day Template

The London Swing to Z Day Template typically appears on Thursdays and is most effective after a strong market move. This setup occurs when the market trend begins to lose momentum and enters a consolidation phase, often following two or three days of significant price action.

Key Strategies:

- Consolidation Phase: After several days of strong market movement, expect the market to pause and consolidate. This template unfolds when the market initially drops below the opening price, rallies above it, and then reverts to a consolidation range. Traders can exploit this consolidation by identifying key support and resistance levels where the price is likely to bounce.

- Avoiding False Moves: Be cautious during this setup, as the market may initially appear to continue in the direction of the previous trend before settling into consolidation. Traders should wait for confirmation of the consolidation before entering trades to avoid getting caught in a false breakout.

- Exit Strategy: Once consolidation is evident, take profits early and avoid looking for continuation trades into the New York session. This strategy helps traders lock in gains before the market potentially reverses or enters a less predictable phase.

This template is perfect for traders who prefer to capitalize on short-term consolidation patterns following significant market movements.

Read More: Mastering ICT Monthly Profiles

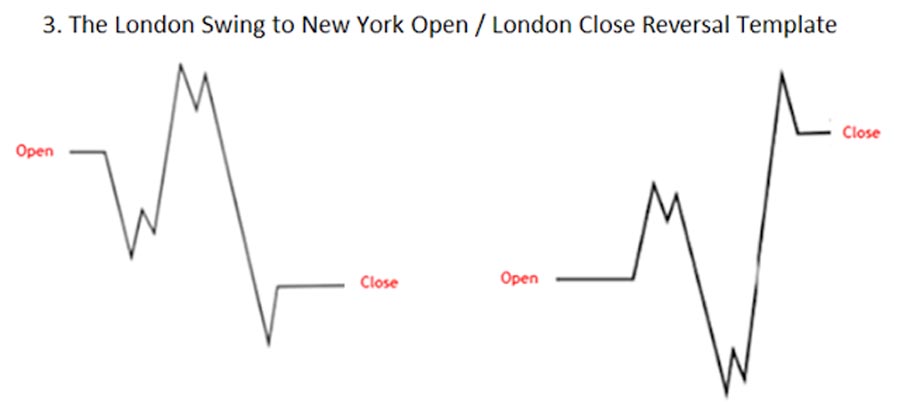

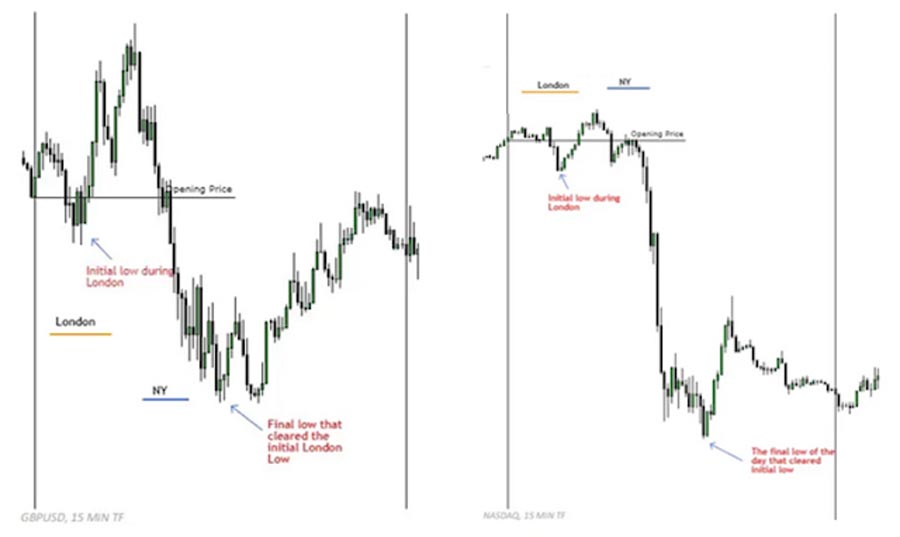

3. The London Swing to New York Open / London Close Reversal Template

The London Swing to New York Open / London Close Reversal Template is a potent setup that signals potential market reversals. This template often begins similarly to the Classic Buy or Sell Day Template but results in a significant reversal during the New York session.

Key Strategies:

- Bullish Reversal: Look for a decline below the opening price during the London session, followed by a rally to a higher time frame Point of Interest (POI) during the New York session. This setup is often accompanied by increasing volume, indicating a potential reversal.

- Bearish Reversal: For a bearish reversal, the market will initially rally above the opening price before reversing to lower levels during the New York session. Traders should be on the lookout for signs of exhaustion in the upward move, such as decreasing momentum or divergence on technical indicators.

- Visual Patterns: This template often aligns with classic chart patterns, such as an inverted head and shoulders on a higher time frame. Recognizing these patterns can provide additional confirmation of the reversal.

- Timing: Reversals typically consolidate into the next trading day, especially around 18:00 GMT. Understanding this timing allows traders to hold their positions with confidence or plan for the next trading session.

This template is particularly effective for identifying key reversal days, allowing traders to position themselves advantageously ahead of significant market movements.

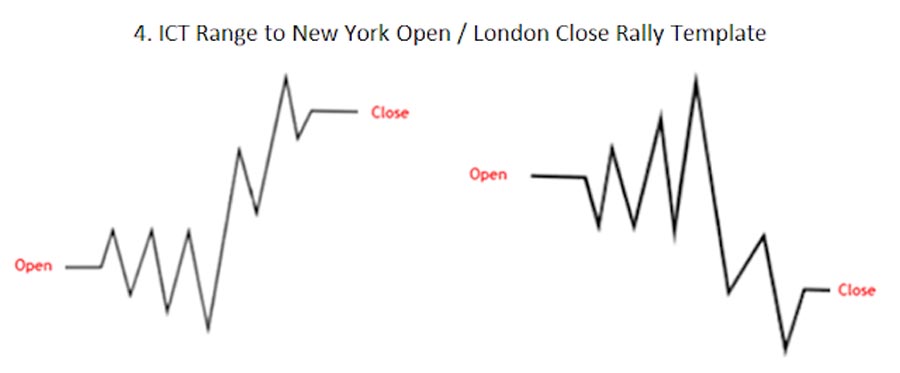

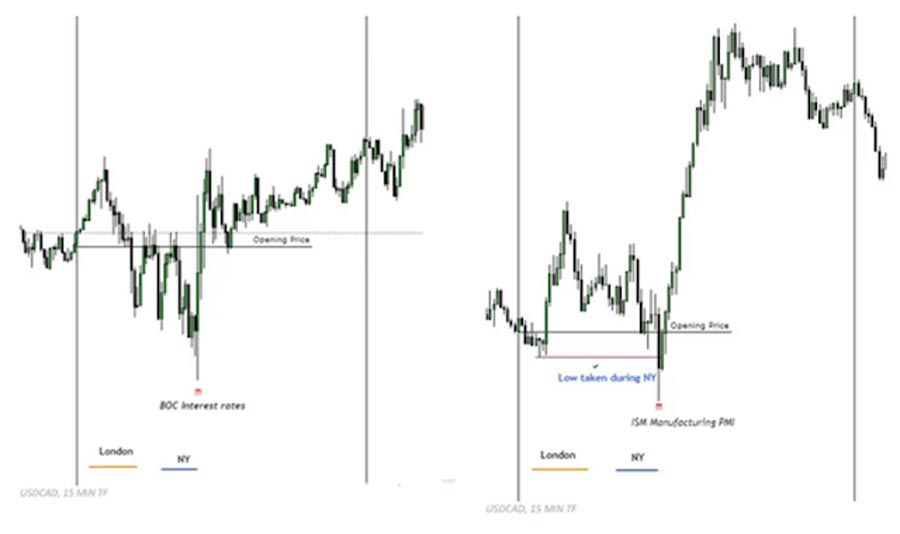

4. The Range to New York Open / London Close Rally Template

The Range to New York Open / London Close Rally Template typically unfolds on days with high-impact news events, such as interest rate announcements or Non-Farm Payroll (NFP) releases. This setup is characterized by price consolidation during the Asian and London sessions, followed by a directional move after the news event.

Key Strategies:

- Pre-News Consolidation: Expect the market to consolidate and clear lows during the London session, setting up for a rally after the news release. This consolidation phase is crucial for establishing the boundaries of the range that will likely be broken following the news.

- Cross-Pair Analysis: Monitor cross pairs of the major currency pair you’re trading. For example, if the Dollar is dropping and EUR/USD is consolidating, watch EUR/JPY for buying opportunities. Cross-pair analysis can provide insights into broader market sentiment and potential trade setups.

- Post-News Rally: After the news, expect a strong directional move. Enter trades aligned with the cross pairs’ direction after they hit key support or resistance levels. This strategy allows traders to capture significant moves that often follow major news releases.

This template is valuable for traders who thrive on trading news events, offering clear guidelines for capturing post-news volatility.

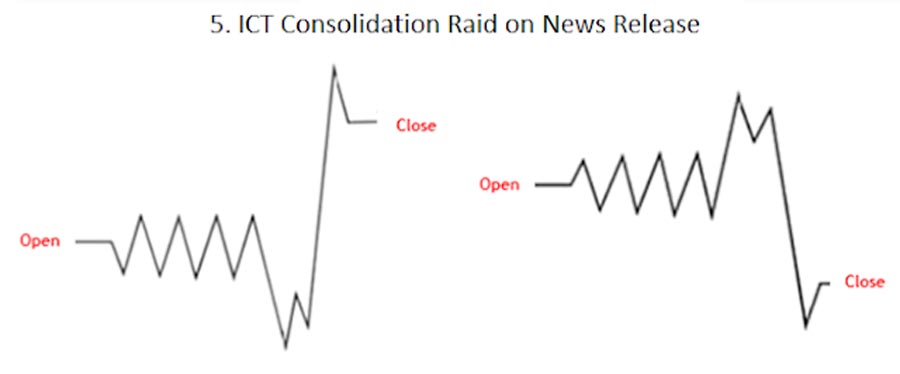

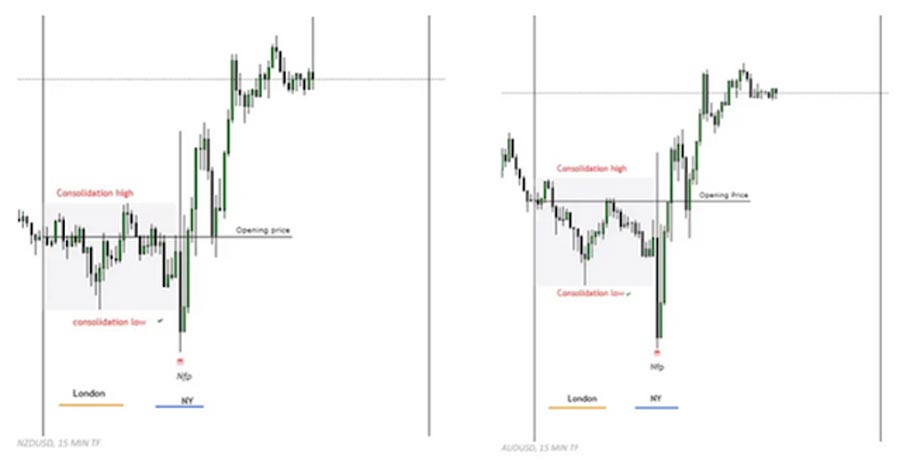

5. The Consolidation Raid on News Release Template

The Consolidation Raid on News Release Template is another strategy for high-impact news days, particularly during the New York session. This template involves the market taking out old highs and lows of prior consolidation levels during or shortly after the news event.

Key Strategies:

- Pre-News Setup: Before the news release, the market will often consolidate, setting up for a raid on stops during the news. This setup is common when the market is indecisive, and traders are positioning themselves for the next significant move.

- Post-Raid Reaction: After inducing traders by breaching prior highs or lows, the market will typically move in the true direction of the trend. Traders should be prepared to enter the market after the initial stop raid, aligning with the prevailing trend.

- Entry Points: Buy when a low is taken out during consolidation, and sell when a high is breached. These entry points are designed to capitalize on the market’s manipulation of stops, which often precedes a strong move in the opposite direction.

This template is essential for traders looking to exploit market manipulations during high-volatility news events.

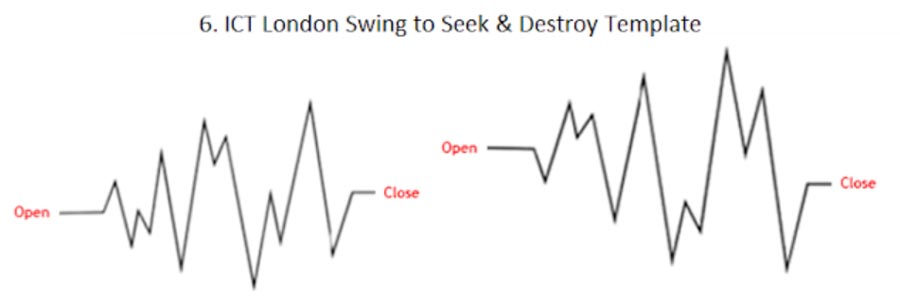

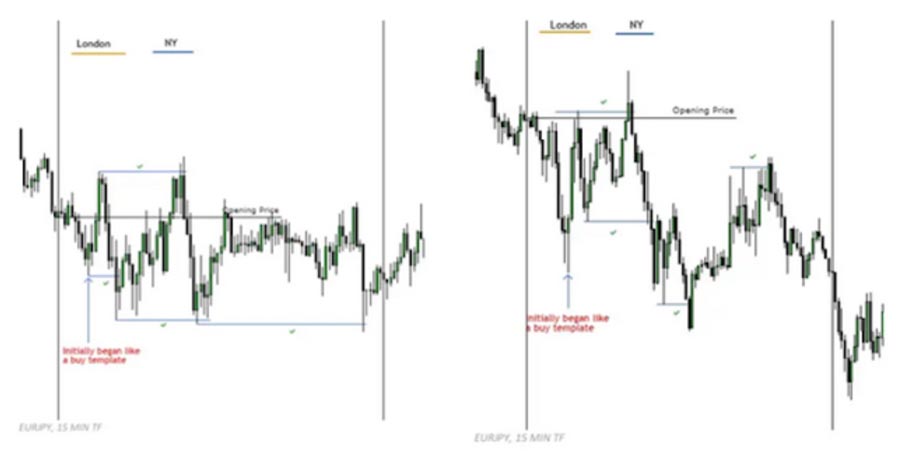

6. The London Swing to Seek & Destroy Template

The London Swing to Seek & Destroy Template is one of the most challenging setups to navigate and often leads to losses if not approached cautiously. This template typically unfolds after a significant price swing, where the market aims to take out both buyers and sellers in a narrow range.

Key Strategies:

- Market Caution: This setup is best avoided if you’re unsure of the market’s direction. It often results in an inside day with minimal profit potential. Traders should be especially cautious in low-liquidity environments where price movements can be erratic.

- Avoid Support/Resistance Traps: Avoid trading pairs already near key support or resistance levels, as the market may either break through or fail to hold these levels. This strategy helps traders avoid getting caught in false breakouts or breakdowns that can lead to losses.

This template serves as a reminder to exercise caution, particularly on days when the market appears indecisive or is consolidating after significant moves.

Read More: Mastering ICT Daily Profiles in Forex

Implementing ICT Session Profiles for Consistent Success

1. Choosing the Right Session Profile

Selecting the appropriate ICT session profile depends on several factors, including the day of the week, market conditions, and your trading style. For instance, the Classic Buy Day or Sell Day Template might be ideal for traders looking to capitalize on early week movements, while the London Swing to Seek & Destroy Template requires a more cautious approach due to its complexity.

2. Backtesting and Practice

Before implementing these session profiles in live trading, it’s crucial to backtest them using historical data. Backtesting allows you to see how these profiles would have performed in past market conditions, providing insights into their potential effectiveness. Additionally, practicing these setups on a demo account can help you build confidence and refine your execution strategies.

3. Combining ICT Session Profiles with Other Tools

While ICT session profiles are powerful on their own, combining them with other trading tools, such as technical indicators or fundamental analysis, can enhance your trading strategy. For example, using moving averages or Fibonacci retracements in conjunction with ICT profiles can provide additional confirmation for your trades.

4. Staying Disciplined and Adapting

Consistency in applying ICT session profiles is key to long-term success. However, it’s also important to remain flexible and adapt to changing market conditions. Markets are dynamic, and what worked yesterday may not work today. Staying disciplined while being open to adjustments is the hallmark of a successful trader.

Unlock Your Trading Potential with OpoFinance

If you’re looking for a reliable and regulated Forex broker to enhance your trading experience, consider OpoFinance. OpoFinance is ASIC-regulated, ensuring a secure trading environment for all traders. Their social trading service allows you to follow and copy the trades of top-performing traders, making it easier to implement strategies like ICT session profiles. With OpoFinance, you gain access to a wide range of trading instruments, competitive spreads, and a user-friendly platform designed to meet the needs of both novice and experienced traders. Start your journey to consistent profitability with OpoFinance today!

Conclusion

Mastering ICT session profiles is a powerful way to enhance your Forex trading strategy. These profiles provide a structured approach to the market, offering clear guidelines on when and how to trade for maximum profitability. By understanding and applying these profiles, traders can navigate the Forex market with greater confidence and consistency. Remember to backtest and practice these setups, combine them with other tools, and stay disciplined in your approach. With the right mindset and strategies, consistent trading success is within reach.

What are ICT session profiles?

ICT session profiles are structured trading templates that predict specific market behaviors during particular trading sessions, offering traders precise guidelines for entering and exiting trades.

Which ICT session profile is best for beginners?

The Classic Buy Day or Sell Day Template is ideal for beginners due to its simplicity and clear guidelines for trading during the London session.

How can I backtest ICT session profiles?

You can backtest ICT session profiles by using historical market data on trading platforms like MetaTrader 4 or TradingView, allowing you to see how these profiles would have performed in past market conditions.

What is the importance of timing in ICT session profiles?

Timing is crucial in ICT session profiles as it determines when to enter and exit trades. Understanding the typical timing of market movements during different sessions is key to successful trading.

How does OpoFinance enhance trading with ICT session profiles?

OpoFinance offers a secure and regulated trading environment with a social trading service, allowing you to follow top traders and implement strategies like ICT session profiles more effectively.