Risk management in forex trading is the cornerstone of successful trading strategies. The forex market is the largest financial market globally, with a daily turnover exceeding $6 trillion. This immense liquidity and 24-hour trading opportunities attract traders from all walks of life. However, this market’s high volatility also brings significant risk, making effective risk management essential for both novice and advanced traders. Selecting the right broker for forex trading plays a crucial role in ensuring effective risk management.

In this comprehensive guide, we will explore essential risk management principles, providing practical advice, detailed examples, and insights to help you navigate the volatile world of forex trading. Whether you’re a beginner looking to build a strong foundation or an experienced trader aiming to refine your strategies, this guide will equip you with the knowledge and tools needed to manage risk effectively.

Understanding Risk Management in Forex

What is Forex Risk Management?

Forex risk management involves a systematic approach to identifying, assessing, and mitigating the risks associated with trading currencies. It encompasses various techniques and strategies to protect your trading capital from significant losses. Effective risk management allows traders to stay in the game long enough to achieve consistent profitability.

Importance of Risk Management in Forex

The forex market’s inherent volatility means that prices can change rapidly due to various factors such as economic data releases, geopolitical events, and changes in market sentiment. Without proper risk management, traders can quickly deplete their trading accounts, leading to financial ruin. Implementing robust risk management strategies helps traders:

- Protect Capital: Preserve trading capital to ensure longevity in the market.

- Reduce Stress: Minimize emotional stress by knowing that risks are controlled.

- Enhance Discipline: Promote disciplined trading by adhering to predefined risk parameters.

- Improve Decision Making: Make rational trading decisions based on strategy rather than emotions.

Fundamentals of Forex Risk Management

Key Concepts

- Risk Tolerance

Your risk tolerance is the degree of variability in investment returns that you are willing to withstand. It depends on your financial situation, trading goals, and psychological comfort with risk. Assessing your risk tolerance helps determine the appropriate risk level for your trading activities.

- Risk/Reward Ratio

The risk/reward ratio compares the potential profit of a trade to its potential loss. For example, a 2:1 risk/reward ratio means that for every dollar risked, you aim to make two dollars in profit. This ratio helps traders evaluate whether a trade is worth taking and ensures that profitable trades outweigh losing ones over time.

Position sizing involves determining the number of units or lots to trade, ensuring that the risk per trade does not exceed a predetermined percentage of your trading capital. Proper position sizing prevents overexposure and helps manage the impact of losses on your account.

Developing a Trading Plan

A trading plan outlines your trading strategy, risk management rules, and goals. It serves as a roadmap, helping you stay disciplined and focused. Key components include:

- Trading Goals: Define your short-term and long-term goals. Having clear objectives helps you stay motivated and measure your progress.

- Risk Management Rules: Set rules for position sizing, risk/reward ratios, and stop-loss orders. These rules act as safeguards to protect your capital.

- Trading Strategy: Outline your entry and exit strategies based on technical and fundamental analysis. A well-defined strategy reduces uncertainty and improves decision-making.

Read More: Margin in Forex: A Comprehensive Guide

Risk Management Strategies for Novice Traders

Education and Research

Continuous learning is vital for novice traders. Understanding market fundamentals, technical analysis, and trading psychology helps you make informed decisions. Utilize online resources, books, and courses to enhance your knowledge. Some recommended resources include:

- Babypips: A comprehensive website offering free forex education for beginners.

- Investopedia: Provides detailed articles and tutorials on various trading topics.

- Books: “Currency Trading for Dummies” by Brian Dolan, “Technical Analysis of the Financial Markets” by John Murphy.

Starting Small

Begin with a demo account to practice trading without financial risk. Demo accounts simulate real market conditions, allowing you to test strategies and gain experience. Once confident, start with small trades to gain real market experience while limiting potential losses. Trading small amounts reduces financial stress and allows you to learn from mistakes without significant consequences.

Diversification

Diversifying your trades across different currency pairs reduces the impact of adverse movements in a single pair. This strategy helps spread risk and smoothens your overall trading performance. For example, instead of trading only EUR/USD, you can diversify by including pairs like USD/JPY, GBP/USD, and AUD/USD in your portfolio.

Stop-Loss Orders

A stop-loss order automatically closes a trade when the price reaches a predetermined level. This tool limits potential losses by exiting losing trades early. Ensure your stop-loss levels are well-placed to avoid premature exits during market fluctuations. For instance, if you enter a long trade on EUR/USD at 1.2000, you might set a stop-loss order at 1.1950 to cap your loss at 50 pips.

Risk/Reward Ratio

Adopt a favorable risk/reward ratio, such as 2:1 or 3:1. This strategy ensures that even if you lose more trades than you win, your profits outweigh your losses. For example, if you risk $100 per trade and aim for a $200 profit, you only need to win one out of three trades to break even.

Advanced Risk Management Techniques

Hedging

Hedging involves taking a position in one market to offset potential losses in another. For example, if you have a long position in EUR/USD, you might take a short position in a correlated pair like GBP/USD to hedge your risk. Hedging can also be done using options and futures contracts. For instance, if you are long on EUR/USD, you can buy a put option to protect against a decline in the currency pair.

Advanced Position Sizing

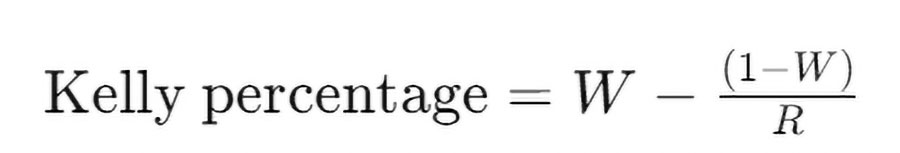

Advanced techniques, such as the Kelly Criterion, help determine the optimal position size based on your trading edge and account size. This method maximizes growth while minimizing risk. The Kelly Criterion formula is:

Where:

- W is the probability of winning.

- R is the ratio of the average win to the average loss.

For example, if you have a 50% win rate and a risk/reward ratio of 2:1, the Kelly percentage suggests risking 25% of your account on each trade. However, many traders use a fraction of the Kelly percentage to reduce volatility.

Portfolio Optimization

Regularly reviewing and rebalancing your portfolio ensures that your risk exposure aligns with your trading plan. Use portfolio optimization tools to assess and adjust your positions. Tools like Modern Portfolio Theory (MPT) help in creating a diversified portfolio that maximizes return for a given level of risk.

Leverage Management

Leverage amplifies both profits and losses. Use leverage cautiously, ensuring that your leveraged positions do not exceed your risk tolerance. Many experienced traders use lower leverage ratios to manage risk effectively. For example, if your broker offers 100:1 leverage, consider using only 10:1 leverage to reduce the risk of significant losses.

Read More: How to Make Consistent Profits in Forex Trading

Algorithmic Trading and Automation

Automated trading systems and algorithms can execute trades based on predefined criteria, eliminating emotional bias. Ensure your algorithms incorporate robust risk management rules. Backtest your automated strategies using historical data to validate their performance. For instance, if your algorithm uses a moving average crossover strategy, backtest it over several years to ensure it performs well under different market conditions.

Psychological Aspects of Risk Management

The psychological aspect of trading is a critical yet often overlooked component of risk management in forex trading. Your mindset and emotional responses can significantly impact your decision-making process and overall trading performance. Understanding and managing these psychological factors are essential for maintaining discipline and achieving long-term success.

1. Discipline and Patience

Discipline and patience are foundational traits for successful trading. Discipline involves sticking to your trading plan and not deviating from your predefined rules, even in the face of potential opportunities or losses. Patience is crucial for waiting for the right trading setups and not rushing into trades out of impulse or fear of missing out (FOMO).

- Developing Discipline: Creating and adhering to a detailed trading plan is the first step toward discipline. Your plan should include entry and exit criteria, risk management rules, and position sizing guidelines. By following your plan consistently, you reduce the likelihood of making emotional decisions that can lead to significant losses.

- Cultivating Patience: Patience can be developed by understanding that not every market movement requires a reaction. Waiting for high-probability setups that meet your trading criteria increases your chances of success. Practicing patience can be challenging, but it is essential for avoiding impulsive trades that do not align with your strategy.

2. Avoiding Overtrading

Overtrading is a common pitfall for many traders, often driven by emotional reactions such as greed, fear, or the desire to quickly recover from losses. Overtrading can lead to increased transaction costs, higher exposure to risk, and ultimately, larger losses.

- Setting Trading Limits: To avoid overtrading, set clear limits on the number of trades you will execute per day or week. For instance, you might decide to place no more than three trades per day. This limit forces you to be selective and only trade the best setups.

- Maintaining a Trading Journal: Documenting each trade in a journal can help you identify patterns of overtrading. By reviewing your journal regularly, you can spot emotional triggers that lead to unnecessary trades and adjust your behavior accordingly.

3. Handling Losses

Losses are an inevitable part of trading. How you handle losses can significantly impact your long-term success. It is crucial to develop strategies for managing the emotional impact of losing trades.

- Accepting Losses: Accept that losses are a natural part of trading and do not reflect on your abilities as a trader. Each loss provides an opportunity to learn and improve your strategy.

- Reviewing and Learning: After experiencing a loss, take time to review the trade. Identify what went wrong and whether it was due to market conditions, a flaw in your strategy, or an emotional decision. Learning from each loss helps you refine your approach and avoid repeating mistakes.

4. Dealing with Trading Stress

Trading can be highly stressful, particularly during periods of high volatility or after consecutive losses. Effective stress management is crucial for maintaining mental clarity and making rational decisions.

- Mindfulness and Relaxation Techniques: Practicing mindfulness meditation, deep breathing exercises, and other relaxation techniques can help reduce stress and improve focus. Setting aside time each day for these practices can enhance your overall well-being.

- Maintaining a Healthy Lifestyle: Regular exercise, a balanced diet, and sufficient sleep are essential for managing stress. Physical health directly impacts mental clarity and emotional stability, both of which are vital for effective trading.

5. The Role of Trading Psychology

Trading psychology encompasses the emotional and mental factors that influence your trading decisions. Key aspects include managing fear, greed, overconfidence, and the urge to recoup losses quickly.

- Managing Fear and Greed: Fear can prevent you from taking valid trading opportunities, while greed can lead to overleveraging and excessive risk-taking. Recognizing these emotions and understanding their impact on your trading decisions is the first step in managing them. Implementing strict risk management rules, such as setting stop-loss and take-profit levels, can help mitigate these emotional extremes.

- Controlling Overconfidence: After a series of successful trades, it is easy to become overconfident and take on excessive risk. Remember that the market can change rapidly, and past success does not guarantee future results. Staying humble and adhering to your risk management rules is essential for long-term success.

6. Building a Support System

Having a support system of fellow traders, mentors, or a trading community can provide valuable emotional and psychological support. Sharing experiences, discussing strategies, and receiving feedback can help you stay grounded and focused.

- Joining Trading Groups: Participating in trading forums, online communities, or local trading groups can provide a sense of camaraderie and support. Engaging with other traders allows you to share insights, learn from others’ experiences, and stay motivated.

- Seeking Professional Help: If trading stress or emotional challenges become overwhelming, consider seeking help from a trading coach or psychologist who specializes in trading psychology. Professional guidance can provide personalized strategies for managing emotions and improving your trading mindset.

7. Continuous Learning and Adaptation

The forex market is dynamic, and continuous learning is essential for staying ahead. Adapting to changing market conditions and refining your strategies based on new knowledge helps you maintain an edge and manage risk effectively.

- Educational Resources: Regularly engage with educational content such as books, webinars, and courses. Staying informed about market developments, new trading techniques, and psychological strategies enhances your overall trading performance.

- Adapting Strategies: Be flexible and willing to adapt your trading strategies based on market conditions and personal experiences. Regularly reviewing and updating your trading plan ensures that it remains effective and aligned with your goals.

By focusing on the psychological aspects of risk management, traders can develop the mental resilience and emotional control necessary for consistent success in the forex market. Cultivating discipline, patience, and a healthy mindset is just as important as mastering technical and fundamental analysis. Recognizing the impact of emotions on your trading decisions and implementing strategies to manage them can significantly enhance your risk management practices and overall trading performance

Case Studies and Examples

Successful Risk Management Example

Trader A uses a 2:1 risk/reward ratio and strict stop-loss orders. Over 100 trades, Trader A wins 40% of the time but achieves a 10% account growth due to the favorable risk/reward ratio.

Example Breakdown:

- Total Trades: 100

- Winning Trades: 40

- Losing Trades: 60

- Risk/Trade: $100

- Reward/Trade: $200

Calculations:

- Total Risk: 60 trades * $100 = $6,000

- Total Reward: 40 trades * $200 = $8,000

- Net Profit: $8,000 – $6,000 = $2,000

Poor Risk Management Example

Trader B uses high leverage and no stop-loss orders. Despite having a high win rate, Trader B experiences significant losses due to a few large losing trades, resulting in a 20% account depletion.

Example Breakdown:

- Total Trades: 100

- Winning Trades: 70

- Losing Trades: 30

- Risk/Trade: Variable (high leverage)

- Reward/Trade: Variable

Calculations:

- Total Risk: High due to leverage and lack of stop-loss

- Total Reward: High win rate but inconsistent due to leverage

- Net Loss: Significant due to a few large losses

Real-World Example: The Swiss Franc Shock

In January 2015, the Swiss National Bank (SNB) unexpectedly removed the Swiss Franc’s peg to the Euro, causing extreme volatility. Many traders who were over-leveraged and did not have stop-loss orders in place suffered significant losses, with some even facing negative account balances. This event underscores the importance of risk management and preparedness for unexpected market events.

Key Lessons:

- Always Use Stop-Loss Orders: Protects against sudden market movements.

- Avoid Over-Leverage: Reduces the impact of unexpected events.

- Stay Informed: Be aware of potential market-moving events and central bank policies.

Tools and Resources for Risk Management

Trading Platforms

Modern trading platforms offer various tools and features to help manage risk effectively. Some popular platforms include:

- MetaTrader 4/5: Offers advanced charting tools, automated trading capabilities, and risk management features like stop-loss and take-profit orders.

- cTrader: Known for its intuitive interface, advanced order types, and risk management tools.

- NinjaTrader: Provides extensive customization options, automated trading, and robust risk management features.

Risk Management Software

Dedicated risk management software can help traders monitor and control their risk exposure. Some options include:

- TradeBench: An online trading journal and risk management tool that helps traders plan, analyze, and improve their trading performance.

- Myfxbook: A social trading platform that provides performance analysis, risk metrics, and automated trading capabilities.

Educational Resources

Continuous learning is essential for effective risk management. Consider these resources:

- Websites: Babypips, Investopedia, TradingView.

- Books: “Trading for a Living” by Dr. Alexander Elder, “The Disciplined Trader” by Mark Douglas.

- Courses: Online courses on Coursera, Udemy, and specific trading platforms.

Books and Courses

- Books: “Trading for a Living” by Dr. Alexander Elder, “The Disciplined Trader” by Mark Douglas.

- Courses: Online courses on Coursera, Udemy, and specific trading platforms.

Conclusion

Effective risk management in forex trading is essential for long-term success. By understanding and implementing key principles, novice traders can build a strong foundation, while advanced traders can refine their strategies. Continuously educate yourself, develop and follow a robust trading plan, and remain disciplined and patient. Remember, successful trading is not about eliminating risk but managing it effectively.

Final Tips and Best Practices

- Regularly Review Your Trading Plan: Ensure it evolves with your experience and market conditions.

- Keep a Trading Journal: Document your trades, decisions, and outcomes to learn from your successes and mistakes.

- Stay Informed: Keep up with market news, economic indicators, and geopolitical events that can impact forex markets.

- Practice Risk Management Consistently: Make risk management an integral part of every trade, not just an afterthought.

By following these principles and continuously improving your risk management strategies, you can navigate the forex market with confidence and increase your chances of long-term trading success.

Reference: +

What is the most important principle of risk management in forex trading?

The most important principle of risk management in forex trading is capital preservation. Protecting your trading capital ensures that you can continue to trade and take advantage of future opportunities. This involves setting stop-loss orders, using appropriate position sizes, and avoiding over-leverage.

How can I determine my risk tolerance in forex trading?

Determining your risk tolerance involves assessing your financial situation, trading goals, and psychological comfort with risk. Consider how much capital you can afford to lose, your investment horizon, and your emotional reaction to potential losses. It’s crucial to align your trading strategy with your risk tolerance to avoid undue stress and impulsive decisions.

What is the role of a stop-loss order in risk management?

A stop-loss order is a predetermined order to sell a security when it reaches a specific price, limiting your potential losses. It acts as a safety net, automatically closing your position to prevent further losses. Properly placed stop-loss orders help you manage risk by ensuring that losses on individual trades do not exceed a certain level.

How does leverage affect risk management in forex trading?

Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also magnifies losses. Effective risk management involves using leverage cautiously and ensuring that your leveraged positions align with your risk tolerance. Over-leveraging can lead to significant losses and even account wipeout.

Can diversification reduce risk in forex trading?

Yes, diversification can reduce risk by spreading your trades across different currency pairs. This strategy minimizes the impact of adverse movements in a single pair. Diversifying your portfolio helps smoothen your overall trading performance and reduces the likelihood of significant losses from a single trade.

How do I handle a losing streak in forex trading?

Handling a losing streak involves taking a step back to analyze your trading strategy and identifying any mistakes. Consider reducing your trade size, taking a break from trading, and revisiting your trading plan. Maintaining a positive mindset and focusing on long-term goals can help you stay disciplined and regain confidence.

What is the Kelly Criterion, and how does it apply to forex trading?

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets to maximize logarithmic growth of capital. In forex trading, it helps calculate the optimal position size based on your trading edge and account size. The formula considers the probability of winning and the risk/reward ratio, helping traders manage risk more effectively.

Why is a trading journal important for risk management?

A trading journal is important for risk management because it allows you to document and analyze your trades, decisions, and outcomes. By keeping a detailed record, you can identify patterns, learn from mistakes, and refine your trading strategies. A trading journal helps improve discipline and provides valuable insights for continuous improvement.

How can I manage the psychological aspects of forex trading?

Managing the psychological aspects of forex trading involves developing emotional control and maintaining discipline. Techniques such as mindfulness meditation, regular exercise, and maintaining a healthy work-life balance can help manage stress. Additionally, having a solid trading plan and adhering to it can reduce the impact of emotional decision-making.

What are some common mistakes to avoid in forex risk management?

Common mistakes to avoid in forex risk management include over-leveraging, not using stop-loss orders, failing to diversify, and letting emotions drive trading decisions. Avoiding these mistakes involves adhering to a well-defined trading plan, maintaining discipline, and continuously educating yourself on best practices in risk management.

One Response

Effective risk management is key to long-term success in Forex trading. Whether you’re a beginner building a solid foundation or an experienced trader refining your strategies, understanding and applying key principles is essential. The best approach is to keep learning, stick to a well-thought-out trading plan, and stay disciplined and patient. It’s not about removing risk entirely, but about managing it wisely. For more tips on improving your risk management, FXleaders can offer valuable insights to help guide your trading journey.