Forex trading, or foreign exchange trading, involves the buying and selling of currencies on the global market. Its popularity has surged over the years, attracting both individual and professional traders. However, as with any income-generating activity, it’s crucial to understand the tax implications of forex trading. Navigating the complexities of tax regulations can be challenging but is essential for legal compliance and financial efficiency. Partnering with a reliable forex broker can further streamline your trading experience.

Understanding Forex Trading Taxes

Forex trading, while potentially lucrative, involves navigating complex tax regulations that can vary significantly based on the trader’s status, the types of trades conducted, and the country of residence. This section delves deeper into the intricacies of forex trading taxes, providing a comprehensive understanding of the various factors that influence tax treatment.

Categorization of Forex Traders and Tax Implications

- Individual Traders: Engage in forex trading as a secondary activity or hobby alongside other sources of income. Tax treatment varies based on trade frequency, volume, and intention (income generation versus investment).

- Professional Traders: Forex trading is their primary occupation, involving larger volumes and sophisticated strategies. They may qualify for trader tax status (TTS) in the U.S., allowing deductions for trading-related expenses and potential tax benefits not available to individual traders.

- Full-Time vs. Part-Time Traders:

- Full-Time Traders: Dedicate most working hours to forex trading, often relying on it as their main income source. Eligible for comprehensive deductions like home office expenses and business-related costs.

- Part-Time Traders: Balance forex trading with other activities. Tax implications and deductible expenses may differ compared to full-time traders.

Taxation Principles Applied to Forex Trading

The taxation of forex trading income is influenced by various factors, including the trader’s status, types of trades, and holding periods.

- Ordinary Income vs. Capital Gains:

- Ordinary Income: Profits from frequent, short-term trades are taxed at the trader’s marginal tax rate. This applies to day traders and others who trade frequently within short time frames.

- Capital Gains: Profits from trades held longer can be taxed as:

- Short-Term Capital Gains: Taxed at ordinary income rates for assets held one year or less.

- Long-Term Capital Gains: Taxed at lower rates for assets held over one year, incentivizing longer-term investments.

- Tax Treatment by Country:

- United States: Traders can choose between Section 1256 (favorable 60/40 tax treatment) and Section 988 (ordinary income treatment). Elections must be made at the beginning of the tax year.

- United Kingdom: Profits can be taxed as capital gains or income based on trading frequency and intent, with different tax rates and allowances.

- Australia: Generally taxed as ordinary income with deductions for trading-related expenses like software and education.

- Germany: Taxed under the flat rate Abgeltungsteuer, currently at 25%, with potential deductions available.

Read More: Forex Market vs Other Markets

Reporting Forex Income and Losses

Accurately reporting forex trading activity is critical for compliance and minimizing tax liabilities. Here’s how to navigate the process:

Guidelines for Accurate Reporting

- Importance of Accurate Reporting: Ensures compliance and avoids penalties. Traders must document all trading activities, including profits, losses, and expenses.

- Forms and Documentation Required:

- United States: Forms like IRS Form 8949, Schedule D (Form 1040), and Form 6781 for Section 1256 contracts.

- Other Countries: Varies, such as self-assessment in the UK, individual tax returns in Australia, and annual tax returns in Germany.

Impact of Short-Term and Long-Term Trading on Tax Rates

- Short-Term Trading: Taxed as ordinary income, subject to marginal tax rates.

- Long-Term Trading: Taxed at lower capital gains rates for assets held over one year, providing potential tax savings.

Reporting Requirements for Different Traders

- Individual Traders: Report all trading activities on personal tax returns, deducting eligible trading expenses.

- Professional Traders: Those with trader tax status (TTS) in the U.S. can deduct more expenses and may use mark-to-market accounting.

- Foreign Traders: Navigate international reporting requirements and tax treaties to manage cross-border trading.

Handling Forex Losses

- Carryforward and Carryback: Many jurisdictions allow losses to offset future gains or be carried back to previous years for refunds.

- Net Operating Losses (NOL): TTS traders can use NOLs to offset other income, providing flexibility in tax planning.

Common Mistakes and How to Avoid Them

- Incomplete Records: Maintain detailed records to ensure accurate reporting and avoid penalties.

- Misclassification of Trades: Accurately classify trades as short-term or long-term to apply the correct tax treatment.

- Overlooking Deductible Expenses: Track and report all trading-related expenses to reduce taxable income effectively.

Read More: Is forex trading haram ?

Common Tax Challenges for Forex Traders

Dealing with Inconsistent Trading Profits

Forex trading can result in highly variable profits and losses, posing a challenge for tax reporting. Traders must accurately report each trade’s outcome and may need to carry forward losses to offset future gains.

Managing Forex-Related Expenses and Deductions

Forex traders incur various expenses, such as trading platform fees, internet costs, and educational materials. These expenses can often be deducted from taxable income, reducing the overall tax burden. Keeping detailed records and receipts is essential for substantiating these deductions.

Handling International Forex Trades and Currency Conversion Issues

Trading on international forex markets introduces additional complexities, such as currency conversion for tax reporting. Traders must accurately convert profits and losses to their home currency using official exchange rates at the time of each trade.

Record-Keeping Best Practices

Essential Records to Maintain

Maintaining comprehensive records is critical for accurate tax reporting and audit protection.

Trade Logs: Detailed logs of each trade, including dates, amounts, and currency pairs.

Broker Statements: Monthly and yearly statements from trading platforms showing account activity.

Tools and Software for Effective Record-Keeping

Utilizing specialized tools and software can streamline record-keeping and ensure accuracy.

Spreadsheet Software: Programs like Microsoft Excel or Google Sheets allow for customized tracking of trades and expenses.

Dedicated Trading Software: Many trading platforms offer built-in reporting tools that generate detailed transaction reports.

Importance of Regular Record Audits and Updates

Regularly auditing and updating records helps ensure accuracy and readiness for tax reporting. Traders should review their records periodically to catch and correct any errors early.

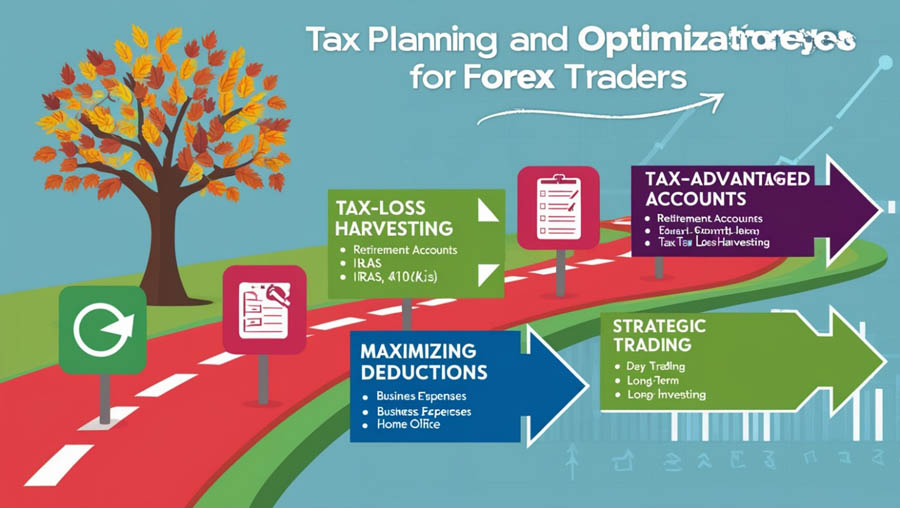

Tax Planning and Optimization Strategies for Forex Traders

Effective tax planning and optimization strategies can significantly enhance the profitability of forex trading by minimizing tax liabilities and maximizing deductions. This section explores various legal and ethical strategies that forex traders can employ to optimize their tax positions.

Utilizing Tax-Advantaged Accounts

1. Individual Retirement Accounts (IRAs): Forex traders can use IRAs to defer taxes on trading profits. By trading within a Traditional IRA, taxes on gains are deferred until withdrawals are made, typically during retirement. Roth IRAs, on the other hand, allow for tax-free withdrawals in retirement, provided contributions were made with after-tax dollars.

- Traditional IRAs: Contributions are tax-deductible, and taxes on gains are deferred. For example, if a trader earns $10,000 in a Traditional IRA, they won’t pay taxes on this amount until they start withdrawing funds, potentially at a lower tax rate in retirement.

- Roth IRAs: Contributions are made with after-tax dollars, and qualified withdrawals are tax-free. This means that a trader can grow their investments tax-free and withdraw the funds without paying additional taxes.

2. Self-Employed Retirement Plans: Self-employed forex traders can benefit from retirement plans such as Solo 401(k)s or SEP IRAs, which offer higher contribution limits and tax-deferred growth.

- Solo 401(k): Allows for both employee and employer contributions, significantly increasing the amount that can be contributed annually. For instance, in 2023, a trader under 50 can contribute up to $22,500 as an employee, plus up to 25% of their business income as an employer, up to a total limit of $66,000.

- SEP IRA: Simplified Employee Pension plans allow contributions up to 25% of net earnings from self-employment, with a maximum contribution limit of $66,000 in 2023.

Maximizing Deductions

1. Business Expense Deductions: Traders who qualify for trader tax status (TTS) can deduct a wide range of business expenses related to their trading activities.

- Home Office Deduction: Traders can deduct a portion of their home expenses, such as rent, utilities, and internet costs, if they use a part of their home exclusively for trading.

- Education and Research: Costs for trading courses, seminars, and financial publications can be deducted as business expenses.

- Trading Equipment and Software: Expenses for computers, monitors, trading platforms, and software subscriptions are deductible.

2. Health Savings Accounts (HSAs): HSAs offer triple tax benefits: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. Traders with high-deductible health plans can use HSAs to save on taxes while covering medical costs.

3. Section 475(f) Election: U.S. traders can elect Section 475(f) mark-to-market accounting, which treats all trading gains and losses as ordinary income, allowing for the deduction of trading losses against other types of income. This election can simplify tax reporting and provide greater flexibility in managing tax liabilities.

Read More: Is Forex Trading Legal ?

Managing Capital Gains and Losses

1. Tax-Loss Harvesting: Tax-loss harvesting involves selling losing investments to offset gains and reduce taxable income. For example, if a trader has $10,000 in gains and $4,000 in losses, they can sell the losing position to offset the gains, resulting in a net gain of $6,000.

- Wash Sale Rule: Traders must be aware of the wash sale rule, which disallows the deduction of losses if the same or substantially identical security is repurchased within 30 days before or after the sale.

2. Deferring Income: Traders can defer income to future tax years to manage their tax brackets and reduce current-year tax liabilities. For example, delaying the sale of profitable positions until the next tax year can push the tax liability to a year when the trader expects to be in a lower tax bracket.

Leveraging Tax Treaties and Credits

1. Foreign Tax Credits: Traders who pay taxes on forex gains in foreign countries may be eligible for foreign tax credits, which can offset their U.S. tax liability. This prevents double taxation and ensures that traders are not taxed twice on the same income.

2. Tax Treaties: Many countries have tax treaties that provide favorable tax treatment for residents of the treaty countries. These treaties can reduce or eliminate withholding taxes on forex transactions and provide other tax benefits.

Seeking Professional Tax Assistance

Seeking professional tax assistance is crucial for forex traders navigating complex tax regulations. Tax professionals offer specialized knowledge and tailored advice, ensuring compliance and optimizing tax positions. Here’s why consulting a tax professional is essential and the benefits they provide:

Importance of Consulting a Tax Professional

- Expertise in Tax Regulations: Tax professionals have deep knowledge of forex trading tax laws, keeping traders compliant and informed of regulatory changes.

- Personalized Tax Planning: They develop customized tax strategies based on traders’ financial goals and trading activities, maximizing deductions and minimizing liabilities.

- Accurate Tax Filings: Tax professionals handle complex tax forms and maintain detailed records, ensuring precise and timely filings to avoid errors and penalties.

Benefits of Professional Guidance

- Maximizing Deductions and Credits: Identifying eligible deductions and credits, such as trading expenses and foreign taxes paid, to optimize tax benefits.

- Optimal Tax Strategies: Recommending tax-efficient strategies aligned with traders’ financial objectives.

- Managing Complex Situations: Handling international tax issues, diverse income sources, and significant trading volumes effectively.

- Support During Audits: Representing traders in audits, responding to inquiries, and providing documentation to support tax filings.

- Continuous Monitoring and Advice: Proactively advising on tax law changes and adjusting strategies throughout the year for ongoing optimization.

Finding the Right Tax Professional

- Qualifications and Experience: Choose a tax professional with credentials like CPA, EA, or CTA, specializing in forex trading tax matters.

- Recommendations and Reviews: Seek referrals and read reviews to gauge reputation and service quality.

- Initial Consultation: Evaluate expertise, communication style, and fee structure during an initial meeting.

- Ongoing Support: Select a professional who offers continuous support and updates on tax developments.

Recent Changes in Forex Tax Regulations

Recent changes in forex tax regulations reflect evolving policies and economic conditions globally. Traders must stay updated to ensure compliance and optimize tax positions. Here’s a summary of recent regulatory changes and their implications:

Changes in Tax Legislation

- Adjustments in Capital Gains Tax Rates:

- United States: Proposed increases in long-term capital gains tax rates for high-income earners could raise rates from 20% to 39.6% for incomes over $1 million.

- United Kingdom: Potential changes aim to align capital gains tax rates more closely with income tax rates, potentially increasing the tax burden for high-income traders.

- Australia: Reductions in the capital gains tax discount for foreign residents impact tax liabilities on forex gains.

- New Reporting Requirements:

- U.S. Foreign Account Tax Compliance Act (FATCA): Expanded requirements mandate forex traders with foreign accounts to disclose detailed financial information to the IRS.

- OECD Common Reporting Standard (CRS): Requires financial institutions to report account holder information to tax authorities, affecting forex traders with accounts in participating countries.

- Changes in Tax Treatment of Forex Derivatives:

- Section 1256 Contracts (U.S.): Increased scrutiny on the classification of forex contracts under Section 1256, impacting tax rates and treatment eligibility (60/40 tax rates versus ordinary income).

Conclusion

Navigating the tax implications of forex trading can be complex, but understanding the key principles and strategies can help traders manage their tax obligations effectively. By maintaining accurate records, employing tax planning strategies, and seeking professional advice, traders can optimize their tax positions and ensure compliance with all relevant regulations.

What are the penalties for not properly reporting forex trading income? Failure to report forex

Failure to report forex trading income accurately can result in significant penalties, including fines and interest charges. In severe cases, it may also lead to legal action.

Can I claim losses from forex trading on my personal tax return?

Yes, in many jurisdictions, forex trading losses can be claimed on personal tax returns. These losses can often be used to offset other income, reducing overall tax liability.

How does tax treatment differ for forex trading versus stock trading?

Yes, in many jurisdictions, forex trading losses can be claimed on personal tax returns. These losses can often be used to offset other income, reducing overall tax liability.

Are there specific tax laws for algorithmic or automated forex trading?

While algorithmic or automated forex trading follows the same general tax principles as manual trading, specific rules may apply to the software and technology used. Consulting a tax advisor familiar with algorithmic trading is advisable to ensure compliance.