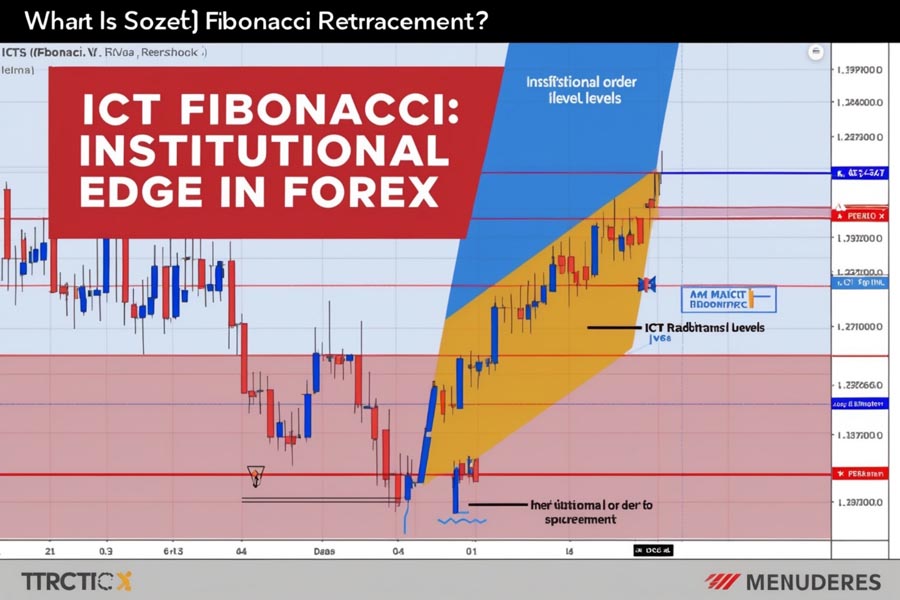

Are you ready to take your forex trading to the next level? Look no further than ICT Fibonacci Retracement, a powerful tool that can revolutionize your trading strategy. ICT Fibonacci Retracement combines institutional trading concepts with traditional Fibonacci levels to provide traders with a unique edge in the market. This advanced technique, popular among forex trading brokers and seasoned traders alike, offers a fresh perspective on price action and market structure. In this comprehensive guide, we’ll explore the ins and outs of ICT Fibonacci Retracement, including its settings, levels, and practical applications in forex trading. Whether you’re a novice trader looking to expand your skillset or an experienced professional seeking to refine your approach, this article will equip you with the knowledge to leverage ICT Fibonacci Retracement effectively in your trading journey. Choosing the right online forex broker can further enhance your ability to apply these techniques and improve your trading results.

What is ICT Fibonacci Retracement?

ICT Fibonacci Retracement, also known as ICT fib retracement, is an advanced trading concept that merges institutional trading principles with traditional Fibonacci tools. This innovative approach was developed by the Inner Circle Trader (ICT) and has gained significant traction in the forex trading community. By incorporating institutional order flow analysis and modifying traditional Fibonacci levels, ICT Fibonacci Retracement aims to provide traders with a more accurate and reliable method for identifying key support and resistance levels, potential reversal points, and high-probability trade setups.

Key Components of ICT Fibonacci Retracement

- Institutional Order Flow: ICT fib retracement focuses on identifying and trading with institutional order flow, which is believed to drive major market movements. This approach helps retail traders align their strategies with the “smart money” in the market.

- Modified Fibonacci Levels: Unlike traditional Fibonacci retracements, ICT fib levels incorporate unique ratios and settings tailored to institutional trading patterns. These modified levels are designed to capture more precise price action and market structure.

- Market Structure Analysis: The technique emphasizes the importance of understanding market structure and key support and resistance levels. By analyzing the broader context of price movements, traders can make more informed decisions based on ICT Fibonacci levels.

- Price Action Confirmation: ICT Fibonacci Retracement relies heavily on price action confirmation to validate potential trade setups. This combination of technical analysis and price behavior helps traders filter out false signals and identify higher-probability trades.

Read More: The Fibonacci Strategy In Forex

The Science Behind ICT Fibonacci Retracement

To fully appreciate the power of ICT Fibonacci Retracement, it’s essential to understand its theoretical foundations and how it builds upon traditional Fibonacci concepts.

The Fibonacci Sequence and Golden Ratio

At the heart of ICT fib retracement lies the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, 21, …). This sequence gives rise to the golden ratio (approximately 1.618), which appears frequently in nature and is believed to have significance in financial markets. Traders have long used Fibonacci ratios to identify potential support and resistance levels, retracement targets, and extension levels in various financial instruments.

ICT’s Institutional Perspective

The Inner Circle Trader’s approach modifies traditional Fibonacci concepts by incorporating institutional trading principles. This includes:

- Focusing on larger timeframes to align with institutional decision-making

- Emphasizing key swing points that are likely to attract institutional interest

- Incorporating order block theory to identify potential areas of institutional activity

- Adapting Fibonacci ratios to better reflect institutional trading patterns and order flow

By combining these institutional trading concepts with Fibonacci analysis, ICT Fibonacci Retracement aims to provide a more accurate representation of market dynamics and potential price movements.

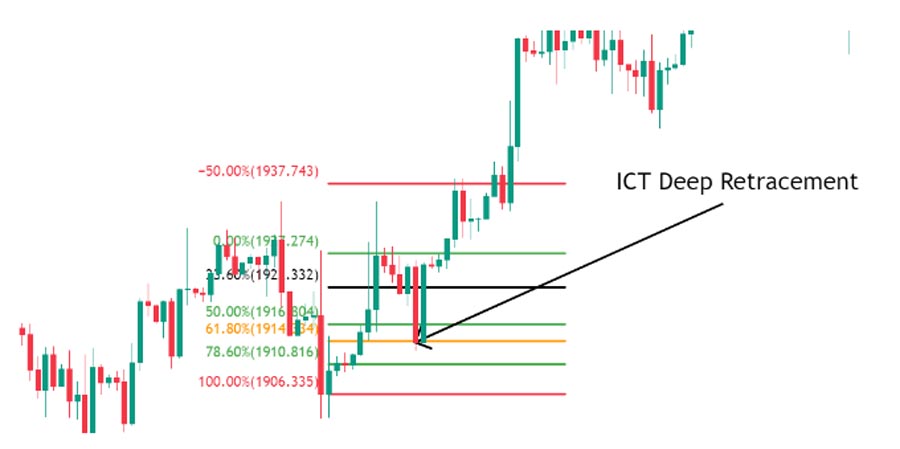

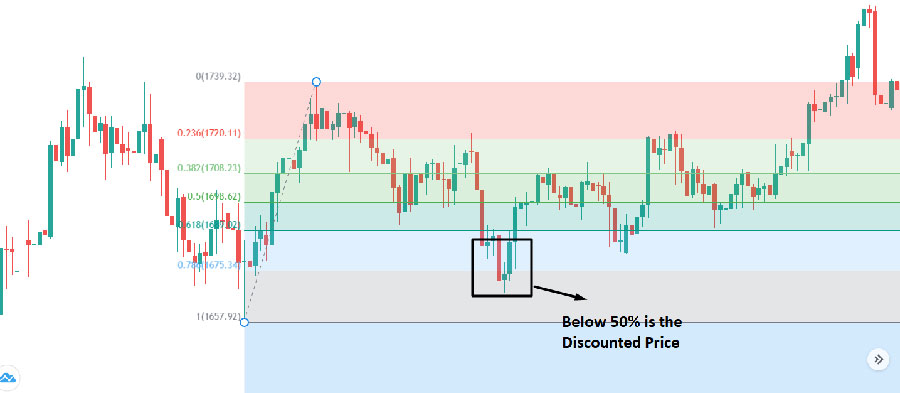

ICT Fibonacci Levels

ICT Fibonacci levels are crucial for finding optimal trade entries (OTE) and managing trades effectively. These levels and their descriptions are given in the table below:

| ICT Fib Level | Description |

| 0 | 100% (original position) |

| 0.505 | Equilibrium (50% level) |

| 0.618 | 62% Retracement |

| 0.705 | Optimal Trade Entry (OTE) |

| 0.79 | 79% Retracement |

| 1.0 | First Profit Scaling |

| -0.62 | Target 2 |

| -0.27 | Target 1 |

| -1 | Symmetrical Price |

Understanding these ICT Fibonacci levels is essential for identifying high-probability trade setups and managing your positions effectively. Each level serves a specific purpose in the ICT methodology, from pinpointing optimal entry points to determining profit targets and potential reversal zones.

7 Expert Strategies for Applying ICT Fibonacci Retracement

Now that we’ve covered the basics, let’s dive into seven expert strategies for leveraging ICT Fibonacci Retracement in your forex trading. These strategies will help you apply ICT fib concepts effectively and improve your overall trading performance.

1. Master ICT Fibonacci Settings

To effectively use ICT fib retracement, it’s crucial to understand and apply the correct settings. These settings differ from traditional Fibonacci levels and are designed to capture institutional price levels more accurately.

Key ICT Fibonacci Settings:

- Primary Ratios: 0.65 and 0.79

- Secondary Ratios: 0.50 and 0.88

- Tertiary Ratios: 0.33 and 0.25

These unique ICT fib settings are designed to capture institutional price levels more accurately than traditional Fibonacci ratios. By focusing on these specific levels, traders can align their analysis more closely with potential institutional order flow and key market structures.

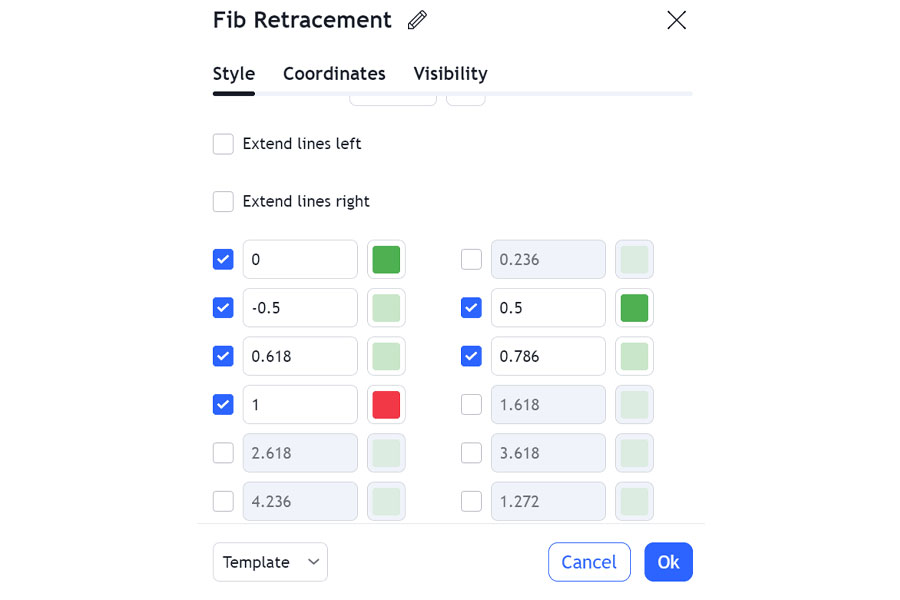

ICT Fib Settings on TradingView

For those using TradingView, here’s how to set up ICT Fibonacci levels:

- Set up Fibonacci Settings:

- Click on the Fibonacci retracement tool in your trading platform.

- Place it on the chart by clicking and dragging from the swing high to the swing low (or vice versa) that you want to use as reference points.

- Adjust Fibonacci Levels:

- Double-click the Fibonacci retracement tool on the chart.

- Right-click on the tool to access the settings.

- Go to “Fib levels” and modify the levels according to the ICT Fibonacci ratios.

- Save Your Settings:

- After setting the levels, click “Save” to apply the changes.

By customizing your TradingView settings to match ICT Fibonacci levels, you’ll be able to spot potential trade setups more easily and accurately. This step is crucial for implementing ICT Fibonacci Retracement effectively in your trading platform.

Read More: ICT Top-Down Analysis

2. Identify High-Probability ICT Fib Levels

Not all ICT fib levels are created equal. To maximize the effectiveness of your ICT Fibonacci Retracement strategy, focus on identifying high-probability levels by:

- Looking for confluence with key support and resistance zones

- Prioritizing levels that align with significant swing highs and lows

- Considering the overall market structure and trend

Pay special attention to the 0.705 level (Optimal Trade Entry) and the 0.79 level (79% Retracement), as these are often considered the most significant in ICT methodology. When these levels coincide with other technical indicators or key market structures, they can provide particularly strong trade signals.

3. Combine ICT Fibonacci Retracement with Order Blocks

Order blocks are a cornerstone of ICT methodology. Enhance your ICT fib retracement strategy by:

- Identifying significant order blocks on higher timeframes

- Looking for ICT fib levels that intersect with these order blocks

- Using these confluence zones as potential entry, stop loss, or take profit points

The combination of ICT Fibonacci levels and order blocks can create powerful zones of interest in the market. These areas often represent institutional supply and demand zones, making them prime candidates for trade entries and exits.

4. Implement Multi-Timeframe Analysis

ICT Fibonacci Retracement becomes even more powerful when applied across multiple timeframes. This approach helps traders align their trades with larger market trends while fine-tuning entries on lower timeframes.

Multi-Timeframe ICT Fib Strategy:

- Identify the dominant trend on a higher timeframe

- Apply ICT fib retracement to significant swings on this timeframe

- Drop down to lower timeframes to fine-tune entries and exits using ICT fib levels

By aligning ICT Fibonacci levels across multiple timeframes, traders can increase their confidence in potential trade setups and improve their risk management. This multi-timeframe approach is particularly effective for capturing high-probability trades in line with the overall market trend.

5. Utilize ICT Fibonacci Extension Levels

While retracements are valuable, don’t overlook ICT Fibonacci extensions for projecting potential targets. These levels can help traders set realistic profit targets and manage their trades more effectively.

Key ICT Fibonacci Extension Levels:

- 1.27

- 1.618

- 2.618

These extension levels can provide excellent take profit targets, especially when combined with other technical indicators. Traders often use these levels to scale out of positions or set trailing stops as price approaches key extension levels.

6. Incorporate Fair Value Gaps (FVGs)

Fair Value Gaps are another essential concept in ICT methodology that pairs well with ICT Fibonacci Retracement. FVGs represent areas of imbalance in the market that often attract price in the future.

ICT Fib and FVG Strategy:

- Identify significant Fair Value Gaps on your chosen timeframe

- Apply ICT fib retracement to the swing that created the FVG

- Look for trades where ICT fib levels align with the edges of the FVG

The convergence of ICT Fibonacci levels and Fair Value Gaps can create high-probability trade setups. These areas often represent institutional interest and can lead to strong price reactions.

7. Develop an ICT Fibonacci Retracement Trading Plan

To consistently profit from ICT fib retracement, create a comprehensive trading plan that includes:

- Specific entry and exit criteria based on ICT fib levels

- Risk management rules tailored to ICT methodology

- A journaling system to track and analyze your ICT fib trades

A well-structured trading plan is essential for success with ICT Fibonacci Retracement. It helps maintain discipline, manage risk effectively, and continuously improve your trading performance over time.

Read More:Mastering ICT Weekly Range Profiles for Strategic Trading

Common Pitfalls to Avoid with ICT Fibonacci Retracement

While ICT Fibonacci Retracement can be a powerful tool, it’s important to be aware of potential pitfalls:

- Over-reliance on ICT fib levels: Remember that no single indicator is infallible. Always use ICT Fibonacci Retracement in conjunction with other analysis techniques and confirm signals with price action.

- Ignoring market context: ICT fib levels are most effective when considered within the broader market structure and trend. Don’t blindly trade ICT Fibonacci levels without considering the overall market environment.

- Neglecting proper risk management: Even with high-probability ICT fib setups, always adhere to sound risk management principles. Define your risk per trade and use appropriate position sizing.

- Failing to adapt: Markets evolve, and so should your ICT Fibonacci Retracement strategy. Regularly review and refine your approach based on market conditions and your trading results.

Advanced ICT Fibonacci Retracement Concepts

For traders looking to further enhance their ICT fib retracement skills, consider exploring these advanced concepts:

ICT Fibonacci Time Analysis

Incorporate time-based Fibonacci tools to predict potential market turning points and improve trade timing. This advanced technique combines price and time analysis to identify high-probability trade opportunities.

Harmonic Patterns with ICT Fib Levels

Combine ICT Fibonacci Retracement with harmonic trading patterns for even more precise entry and exit points. Harmonic patterns like the Gartley, Butterfly, and Bat can be enhanced by incorporating ICT Fibonacci levels into their structure.

ICT Fibonacci Retracement in Algorithmic Trading

For the tech-savvy trader, consider developing algorithmic trading systems based on ICT Fibonacci principles. This approach can help automate your trading strategy and remove emotional decision-making from the process.

OpoFinance: Your Trusted Partner for ICT Fibonacci Retracement Trading

When it comes to implementing advanced strategies like ICT Fibonacci Retracement, having a reliable forex broker is crucial. OpoFinance stands out as an ASIC-regulated broker that provides traders with the tools and support needed to excel in today’s competitive forex market.

Key Benefits of Trading with OpoFinance:

- Advanced trading platforms compatible with ICT Fibonacci Retracement tools

- Competitive spreads and low trading costs

- Robust educational resources to help you master ICT fib techniques

- Excellent customer support from experienced forex professionals

What sets OpoFinance apart is its innovative social trading service, which allows you to connect with and learn from successful ICT Fibonacci Retracement traders. This feature can be invaluable for those looking to refine their ICT fib skills and gain insights from seasoned practitioners.

By choosing OpoFinance as your forex broker, you’ll have access to the tools, resources, and community support needed to successfully implement ICT Fibonacci Retracement strategies in your trading.

Conclusion

ICT Fibonacci Retracement represents a powerful evolution in forex trading analysis. By combining institutional trading concepts with time-tested Fibonacci principles, traders can gain a unique edge in identifying high-probability trade setups. The seven strategies outlined in this article provide a comprehensive framework for incorporating ICT Fibonacci Retracement into your trading approach.

Remember, mastering ICT fib retracement requires practice, patience, and a commitment to continuous learning. As you incorporate these advanced techniques into your trading arsenal, always prioritize risk management and maintain a disciplined approach. With dedication and the right tools, ICT Fibonacci Retracement can become a cornerstone of your forex trading success.

As you embark on your journey with ICT Fibonacci Retracement, consider leveraging the resources and support offered by regulated brokers like OpoFinance. Their advanced platforms, educational materials, and community of traders can provide invaluable assistance as you refine your ICT fib skills and strive for consistent profitability in the forex market.

How does ICT Fibonacci Retracement differ from traditional Fibonacci tools?

ICT Fibonacci Retracement incorporates unique ratios and settings designed to align with institutional trading patterns. Unlike traditional Fibonacci tools, ICT fib levels focus on ratios like 0.65 and 0.79, which are believed to more accurately reflect institutional order flow. Additionally, ICT Fibonacci Retracement places a greater emphasis on market structure and order blocks, integrating these concepts into the overall analysis.

Can ICT Fibonacci Retracement be used in markets other than forex?

While ICT Fibonacci Retracement was primarily developed for forex trading, its principles can be applied to other financial markets such as stocks, commodities, and cryptocurrencies. However, it’s important to note that the effectiveness may vary depending on the market’s liquidity and the presence of institutional players. Traders should thoroughly backtest and adapt the ICT fib methodology to the specific characteristics of their chosen market before implementation.

How long does it typically take to become proficient in using ICT Fibonacci Retracement?

The time required to master ICT Fibonacci Retracement varies depending on individual learning pace and trading experience. For most traders, it can take several months of consistent practice and study to become proficient. Key factors in accelerating the learning process include:

Regularly analyzing charts and identifying ICT fib setups

Participating in ICT trading communities and forums

Keeping a detailed trading journal focused on ICT fib trades

Continuously refining your strategy based on real-world results

Remember that becoming truly skilled in ICT Fibonacci Retracement is an ongoing process, and even experienced traders continue to learn and adapt their techniques over time.