Institutional order flow is the pattern of buying and selling activity by large financial institutions in the forex market. It’s a crucial concept for traders to understand, as it can significantly impact currency price movements and overall market dynamics. In the world of forex trading, where finding an edge is paramount, mastering institutional order flow can be the key to unlocking trading success. This comprehensive guide will delve deep into the world of institutional order flow, exploring its nuances and revealing how you can harness its power to elevate your forex trading game.

For traders working with a regulated forex broker, understanding institutional order flow is particularly valuable. It provides insights into the actions of major market players, helping you make more informed trading decisions. Whether you’re a seasoned trader or just starting out, this article will equip you with the knowledge and strategies needed to navigate the complex landscape of institutional trading. We’ll cover everything from identifying institutional order flow and its impact on the market to practical strategies for incorporating this knowledge into your trading approach.

By the end of this article, you’ll understand why institutional order flow matters, how to recognize it, and how to use this information to potentially improve your trading results. Let’s dive in and unlock the power of institutional order flow to take your forex trading to the next level.

What is Institutional Order Flow?

Institutional order flow refers to the way large institutions and banks interact with the market, either as buyers or sellers, to achieve their intended purpose. This can involve taking participants out of the market as counterparties to their trades. Importantly, institutional order flow is not visible on volume profile analysis, depth of market, ladder, or level 2 data, as these can be spoofed. Instead, it can be identified through price action and understanding how price is being delivered in the market.

Institutional order flow is characterized by large-scale transactions that can significantly impact market dynamics. These institutions, which include hedge funds, pension funds, and central banks, often have access to vast resources and sophisticated trading strategies. Their actions can create ripples throughout the market, influencing price movements and overall market sentiment.

Read More: Smart Money Concepts Terminology

The Impact of Institutional Orders

Institutional orders have a profound effect on the forex market due to their sheer size and frequency. Here’s how they influence the market:

- Price Movements: Large buy or sell orders can cause sudden and significant price shifts. When an institution executes a substantial order, it can create immediate price impacts, leading to rapid moves in currency pairs.

- Liquidity: Institutional trades often provide liquidity to the market, allowing for smoother execution of smaller trades. This added liquidity can help reduce bid-ask spreads and make it easier for retail traders to enter and exit positions.

- Trend Creation: Sustained institutional buying or selling can establish or reinforce market trends. When large players consistently take positions in a particular direction, it can create or amplify existing trends, influencing market direction over extended periods.

- Market Sentiment: The actions of major institutions can shape overall market sentiment and expectations. Other market participants often look to institutional activity as a signal of market direction, potentially leading to herd behavior.

- Volatility: Institutional order flow can contribute to increased market volatility, especially during key economic events or when large positions are being accumulated or distributed.

Why Institutional Order Flow Matters for Traders

Understanding institutional order flow is crucial for several reasons:

- Anticipating Market Moves: By recognizing institutional activity, traders can better predict potential price movements. This foresight can provide a significant edge in timing entries and exits.

- Risk Management: Knowledge of large institutional positions can help in setting appropriate stop-loss and take-profit levels. Understanding where institutions might place their orders can help retail traders avoid common pitfalls and protect their capital.

- Strategy Refinement: Aligning your trading strategy with institutional flow can improve your chances of success. By “swimming with the tide” of institutional activity, traders can potentially benefit from the market-moving power of these large players.

- Market Context: Institutional order flow provides valuable context for interpreting price action and chart patterns. It can help explain why certain technical patterns play out differently than expected or why support and resistance levels hold or break.

- Long-term Perspective: Institutional order flow often reflects longer-term economic and financial trends. Understanding this can help traders maintain a broader perspective on market dynamics.

How to Identify Institutional Order Flow

Identifying institutional order flow requires a combination of skills, tools, and analysis. Here are some key methods:

1. Price Action Analysis

Price action is the primary method for identifying institutional order flow. This involves studying the movement of price itself, without relying on indicators or oscillators. Key aspects to look for include:

- Significant changes in the state of delivery (buy side to sell side or vice versa)

- Violation of opening prices indicating a shift in market direction

- Formation of order blocks

- Sudden and sustained price moves with high volume

- Price rejection at key levels

Price action analysis requires a deep understanding of candlestick patterns, support and resistance levels, and market structure. It’s about interpreting the “footprints” left by large institutional traders in the price charts.

2. Market Structure Analysis

Understanding market structure is crucial for identifying institutional order flow. This involves:

- Identifying different phases of the market cycle (accumulation, manipulation, distribution)

- Anticipating potential price movements and reversals based on these phases

- Recognizing key swing highs and lows

- Identifying trends and potential trend reversals

Market structure analysis helps traders understand the bigger picture of where the market is in its cycle. This can provide context for interpreting smaller time frame movements and identifying potential areas of institutional interest.

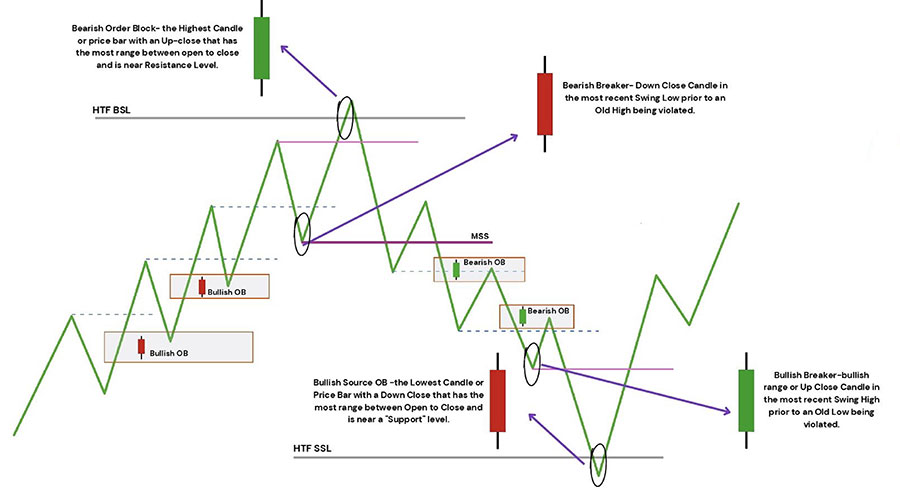

3. Order Blocks

Order blocks are key to understanding institutional activity. They represent areas where large volumes of orders are placed, often by institutional players. To identify order blocks:

- Look for areas where price makes a strong move in one direction, followed by a period of consolidation

- Identify zones where price returns to before making another strong move

- Pay attention to the last candle before a significant move, as this often represents an order block

Order blocks often act as support and resistance levels and can be powerful areas for entering trades or placing stop losses.

4. Liquidity Pools

Liquidity pools are concentrated areas of resting orders, often placed by retail traders. Institutions frequently target these areas to fill their large orders. To identify liquidity pools:

- Look for areas just above key swing highs or just below key swing lows

- Identify zones where many traders might place their stop losses

- Pay attention to round numbers or psychologically significant price levels

Understanding liquidity pools can help traders anticipate potential price movements as institutions seek to tap into these areas of concentrated orders.

Strategies for Trading with Institutional Order Flow

Once you’ve identified institutional order flow, how can you incorporate it into your trading strategy? Here are some effective approaches:

1. Top-Down Analysis

Use multiple time frames to identify dominant trends and key levels. This approach involves:

- Starting with higher time frames (weekly, daily) to determine overall market direction

- Moving to lower time frames (4-hour, 1-hour) for trend confirmation

- Using even smaller time frames (15-minute, 5-minute) for optimal entry and exit points

Top-down analysis helps align your trades with the bigger picture of institutional activity while allowing for precise entry and exit points.

2. Fair Value Gaps (FVGs)

Fair Value Gaps represent areas where price has moved rapidly, leaving a gap between what the market perceives as fair value and the current price. To utilize FVGs:

- Identify gaps between current market price and fair value (determined by longer-term moving averages)

- Look for price to return to these gaps as potential reversal points

- Use FVGs in conjunction with other institutional order flow concepts for confirmation

FVGs can provide valuable insights into potential areas of institutional interest and future price movements.

3. Down Close Candle Strategy

This strategy leverages the concept that down close candles can act as support levels for price movements. Key points include:

- Monitoring price action above the low of a down close candle

- Looking for breaks above short-term highs following down close candles to validate bullish sentiment

- Using this concept in conjunction with broader market structure analysis

The down close candle strategy can be particularly effective in identifying potential turning points in the market.

4. Order Block Trading

Trading based on order blocks involves:

- Identifying shifts from buy side to sell side (or vice versa) in the market

- Entering trades when price returns to order block areas

- Using order blocks as areas for stop loss placement or profit taking

Order block trading aligns closely with institutional activity and can provide high-probability trade setups.

Read More: Market Makers in Forex Market

Time Frame Analysis in Institutional Order Flow

Understanding how to analyze institutional order flow across different time frames is crucial for a comprehensive trading approach:

Daily Analysis

Daily analysis provides a broad overview of market conditions and institutional activity. It involves:

- Looking at trading activity and order flow patterns throughout the day

- Identifying key levels, areas of accumulation or distribution, and overall market sentiment

- Recognizing potential longer-term trends and market phases

Daily analysis sets the stage for understanding the broader context of institutional order flow.

Weekly Analysis

Weekly analysis offers an even broader perspective, helping traders to:

- Take a broader perspective to identify longer-term trends and market structure

- Spot significant accumulation or distribution areas and potential market turning points

- Understand the bigger picture of institutional positioning

Weekly analysis is crucial for aligning trades with major institutional moves and long-term market direction.

Intraday Analysis

Intraday analysis allows for more precise trading decisions and includes:

- Analyzing shorter time frames (5-minute, 15-minute, or 1-minute charts)

- Gaining insights into short-term market dynamics and fine-tuning entry/exit points

- Identifying intraday order blocks and liquidity pools

Intraday analysis is particularly useful for day traders and those looking to optimize their entry and exit points.

Limitations of Traditional Order Flow Tools

It’s important to understand the limitations of common order flow tools:

Depth of Market (DOM) and Level Two Data

- Potential for Manipulation: DOM data can be manipulated, with orders being placed and pulled to create false impressions of market interest.

- Focus on Past Events: These tools show historical transaction information, which may not accurately predict future price movements.

- Limited Predictive Value: The presence of buyers or sellers at certain price levels doesn’t guarantee future market direction.

Advanced Concepts in Institutional Order Flow

To truly master institutional order flow, consider these advanced concepts:

- Market Phases: Understand accumulation, manipulation, and distribution phases.

- Order Blocks: Identify areas where major players block positions and seek liquidity.

- Liquidity Pools: Recognize high concentrations of resting orders.

- Fair Value Gaps (FVGs): Use these to determine market bias and potential reversals.

- Top-Down Analysis: Analyze multiple time frames to identify dominant trends and key levels.

Read More: The Smart Money Concept

OpoFinance: Your Partner in Institutional-Grade Forex Trading

When it comes to leveraging institutional order flow in your trading strategy, having the right broker is essential. OpoFinance, an ASIC-regulated forex broker, offers traders the tools and platform needed to effectively analyze and act on institutional order flow. With their advanced trading technology and commitment to transparency, OpoFinance provides traders with institutional-grade execution and access to deep liquidity pools.

One standout feature of OpoFinance is their innovative social trading service. This platform allows retail traders to observe and potentially mirror the strategies of successful traders who may have insights into institutional order flow. By connecting with a community of skilled traders, you can enhance your understanding of market dynamics and potentially improve your trading outcomes.

Conclusion

Institutional order flow is a powerful concept that can significantly enhance your forex trading strategy. By understanding how large institutions move the market through price action and market structure, you can make more informed decisions and potentially improve your trading results. Remember, successful trading with institutional order flow requires patience, practice, and continuous learning.

As you incorporate these insights into your trading approach, always stay vigilant and adaptable. The forex market is constantly evolving, and so too should your strategies. With the right knowledge, tools, and a reliable broker like OpoFinance, you’ll be well-equipped to navigate the exciting world of institutional order flow and take your forex trading to the next level.

How does institutional order flow differ from retail order flow?

Institutional order flow differs from retail order flow in several key ways:

Volume: Institutional orders are typically much larger, often in the millions or billions of dollars, compared to retail orders which are usually much smaller.

Impact: Due to their size, institutional orders can significantly move market prices, while individual retail orders generally have minimal impact.

Frequency: Institutions may trade less frequently but in larger amounts, while retail traders often make more frequent, smaller trades.

Strategy: Institutional traders often have longer-term strategies and more complex objectives, such as hedging large portfolios, while retail traders may focus more on short-term profits.

Information: Institutions often have access to more advanced research, data, and analysis tools, giving them a potential information advantage.

Understanding these differences can help retail traders better interpret market movements and potentially align their strategies with institutional activity.

Can institutional order flow be manipulated, and how can traders protect themselves?

While rare, institutional order flow can potentially be manipulated. Here are some ways this can occur and how traders can protect themselves:

Spoofing: Large fake orders are placed to create the illusion of institutional interest, then quickly canceled. Protection: Look for orders that persist and actually get filled, not just those that appear briefly.

Layering: Multiple orders are placed at different price levels to create a false sense of depth. Protection: Use multiple indicators and don’t rely solely on order book depth.

Wash Trading: Institutions trading with themselves to create artificial volume. Protection: Look for genuine price movement accompanying high volume, not just volume alone.

Front-Running: Brokers or other insiders acting on knowledge of upcoming large orders. Protection: Choose reputable, regulated brokers and be cautious of sudden, unexplained price moves.

Dark Pools: Large orders executed privately, potentially distorting visible order flow. Protection: Stay informed about overall market conditions and don’t rely exclusively on visible order flow.

To protect yourself, always use a combination of analysis tools, maintain a healthy skepticism, and never risk more than you can afford to lose.

How can retail traders compete with institutional traders who have access to advanced order flow data?

While retail traders may not have the same resources as institutions, they can still compete effectively by:

Leveraging Price Action: Focus on price action and market structure rather than easily manipulated data.

Understanding Market Phases: Learn to identify accumulation, manipulation, and distribution phases.

Utilizing Multiple Time Frames: Employ top-down analysis to align with larger market trends.

Identifying Key Levels: Recognize order blocks, liquidity pools, and fair value gaps.

Continuous Education: Stay informed about market dynamics, economics, and trading psychology.

Risk Management: Use proper position sizing and risk management techniques to protect capital.

Patience and Discipline: Avoid overtrading and wait for high-probability setups aligned with institutional flow.

Collaboration: Join trading communities or use social trading platforms to pool knowledge and insights.

By focusing on these areas and developing a deep understanding of institutional order flow, retail traders can find opportunities to succeed alongside institutional players in the forex market.