Do you ever feel lost trying to trade Forex, mostly reacting to price changes instead of predicting them? It’s a common struggle. Time and Price Theory offers a clear, structured way to analyze the markets. It highlights the vital connection between when the market tends to move and where it’s likely headed. Particularly when using ICT (Inner Circle Trader) methods, this theory helps traders get in sync with potential institutional moves. This guide will break down what Time and Price Theory involves and show how you, working with your regulated forex broker, can put it into practice.

Understanding the Basics

So, what’s the main idea behind Time and Price Theory? Basically, it suggests that market movements aren’t just random. They often follow predictable patterns linked to both specific times and important price levels. Think of it as learning the market’s natural rhythm. By figuring out when major activity usually occurs and where price is likely to react, you can make smarter trading choices. It’s a framework that applies across different timeframes, useful for both short-term and long-term trading styles. Understanding Time and Price Theory is fundamental.

What is Time and Price Theory?

It’s a way of analyzing markets that combines looking at time-based patterns (like certain hours or days) with looking at key price zones (like support, resistance, or areas where many orders might be). Instead of just relying on indicators, you try to grasp the market’s underlying structure. The goal is to anticipate where big players might act based on the alignment of time and price. This application of Time and Price Theory helps explain the ‘why’ behind market moves.

Key Concepts: Time, Price, and Interaction

The theory balances two main elements:

- The Time Element: This involves spotting regular time slots when the market usually gets more active or moves decisively. It could be specific hours during trading sessions (like the London open), certain days, or broader cycles. The core idea is that markets have predictable high-activity times.

- The Price Element: This focuses on finding price levels that really matter. Where has price strongly reacted before? Where might clusters of stop-loss orders (liquidity) be located? Where are there imbalances (like Fair Value Gaps) that price might return to? It’s about mapping out crucial price zones.

The real value comes when you combine these – looking for chances where a key price level might be tested during a known high-activity time. That’s the core of using Time and Price Theory effectively.

Historical Background and Evolution

Thinking about time in trading isn’t entirely new – traders like W.D. Gann explored time cycles decades ago. But the modern, structured method of tightly linking specific time windows with precise price levels, especially focusing on institutional behavior, gained traction more recently. Analysts like the Inner Circle Trader (ICT) have greatly popularized and detailed these concepts, bringing ideas about market structure and liquidity into the retail trading world. This evolution gives us a more practical framework for using Time and Price Theory today.

ICT Forex – Time and Price Theory Explained

When discussing how to apply Time and Price Theory in today’s retail Forex trading, the Inner Circle Trader (ICT) method frequently comes up. Developed by Michael Huddleston, ICT provides a specific approach that strongly emphasizes how time and price work together, aiming to help retail traders align their actions with those of large institutions, often called “smart money.”

Read More:ICT Optimal Trade Entry

Introduction to ICT Methodology

The central idea in ICT is that markets aren’t perfectly random; large institutions often ‘engineer’ price movements to access liquidity. This involves pushing price to levels where many stop-loss or entry orders are likely gathered (like above old highs or below old lows). Once this liquidity is grabbed, price can then move more freely in the intended direction. The ICT application of Time and Price Theory concentrates on spotting these institutional actions through concepts like market structure shifts, order blocks, liquidity pools, and, very importantly, specific time windows.

Explanation of Key ICT Concepts

Let’s unpack some specific ICT terms that make Time and Price Theory actionable:

Optimal Trade Entry (OTE)

OTE is a vital price concept within the ICT framework. It’s not just any pullback; it refers specifically to the zone between the 62% and 79% Fibonacci retracement levels of a key price swing within an established trend. Why this area? ICT suggests this “sweet spot” offers a good trade-off: letting the price pull back significantly while still offering a potentially strong risk-to-reward entry point. It often lines up with areas where institutions might look to get back into the market. Finding other confirming factors (like an order block) within the OTE zone makes the potential setup stronger. Many successful strategies incorporate OTE as part of their Time and Price Theory rules.

Market Sessions and Kill Zones

Time is extremely important in ICT, mainly through the concept of “Kill Zones.” These aren’t dangerous times to avoid, but rather specific periods during major trading sessions known for having the highest chance of significant price moves and institutional involvement. Think of them as peak hours for potential trading setups. The main Kill Zones (usually referenced in New York time) include:

- Asian Kill Zone (approx. 8 PM – 10 PM ET)

- London Kill Zone (approx. 2 AM – 5 AM ET)

- New York Kill Zone (approx. 7 AM – 9 AM ET)

- London Close Kill Zone (approx. 10 AM – 12 PM ET)

Concentrating your analysis and potential trade entries during these specific windows is a fundamental part of the ICT Time and Price Theory approach.

Liquidity Pools and Institutional Order Flow

Understanding where liquidity is located is crucial. Where are stop losses likely sitting? Typically above recent swing highs (buy-side liquidity) and below recent swing lows (sell-side liquidity). ICT teaches that institutions often aim for these pools. By spotting these zones and watching how price acts when it nears them, especially during a Kill Zone, traders can anticipate possible reversals or continuations driven by this institutional hunt for orders. This concept clearly links specific price levels (liquidity pools) with potential action during key times, a core idea in Time and Price Theory.

Practical Application in Forex Trading

Knowing the ideas behind Time and Price Theory is the first step; applying them consistently in your trading is where the real work begins. It involves creating a routine that uses these concepts to identify potentially strong setups as they develop.

Read More: order flow in forex trading

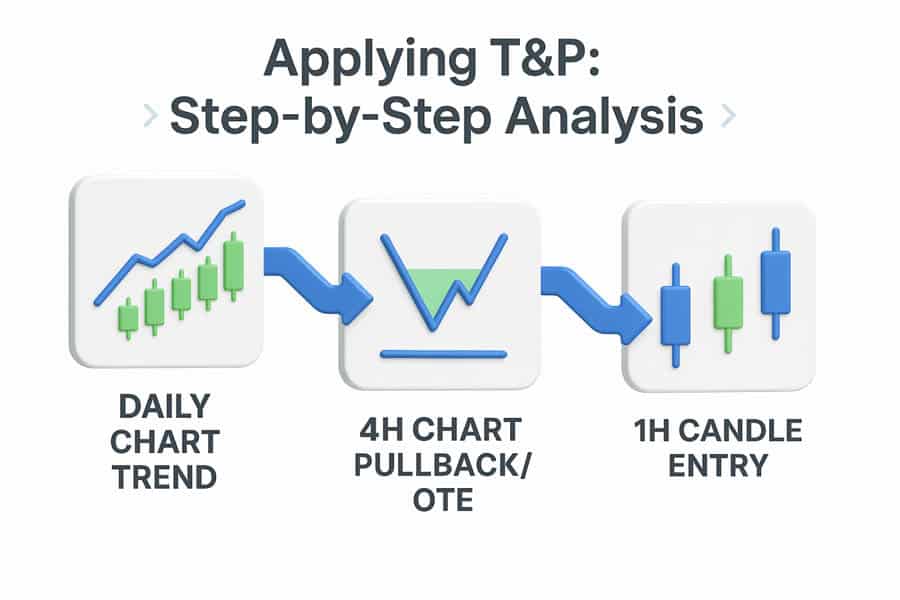

Step-by-Step Guide to Using the Theory

Here’s a practical workflow you could adopt:

- Understand the Context (Higher Timeframe Bias): Always start by looking at the daily and 4-hour charts. Is the market generally moving up or down? Where are the major turning points and clear liquidity areas? This gives you the overall picture.

- Identify Key Price Levels: Switch to your trading timeframe (e.g., 1-hour or 15-minute). Mark important immediate levels: recent highs/lows, clear order blocks (where price moved away sharply), and Fair Value Gaps (FVGs – obvious imbalances in price).

- Be Aware of Time (Kill Zones): Know when the relevant ICT Kill Zones are coming up for the currency pairs you trade. Be ready to pay closer attention during these periods.

- Watch for OTE Pullbacks: If the market is trending and starts pulling back, use your Fibonacci tool (from low to high in an uptrend, high to low in a downtrend). Keep an eye on the 62%-79% OTE zone.

- Look for Confirmation: Don’t just enter because price touches the OTE. You need a specific reason to get in, especially during a Kill Zone. This might be seeing price react strongly to an order block within the OTE, filling an FVG and reversing, or showing a clear change in direction (market structure shift) on a lower timeframe.

- Execute and Manage: If confirmation occurs, enter the trade. Place your stop loss logically (e.g., just beyond the swing point used for the OTE). Have realistic profit targets in mind, perhaps aiming for an opposing liquidity area. Good risk management is essential when using Time and Price Theory.

Identifying High-Probability Setups

The best setups often happen when several factors come together. For example, imagine price pulls back to the 70.5% OTE level, which also lines up with a 4-hour order block, and this happens right at the start of the New York Kill Zone. This combination of trend, price level, structure, and time significantly boosts the potential success rate, according to Time and Price Theory principles.

Examples in Practice

Let’s see how time and price work together in common scenarios:

Using London and New York Session Timings

A frequent pattern traders watch for is the London session potentially targeting liquidity resting above the Asian session high or below its low. Traders using Time and Price Theory might look for setups related to this during the London Kill Zone (2 AM – 5 AM ET). Likewise, the New York Kill Zone (7 AM – 9 AM ET) often sees moves continue or reverse from the London session’s action.

Trading Around Fair Value Gaps (FVGs)

FVGs represent inefficient price movement. ICT traders often expect price to revisit these gaps. A potential trade could involve waiting for price to dip into an FVG that sits within an OTE zone, especially during a Kill Zone, expecting the market to then continue its original path after filling the gap. This is a direct application of Time and Price Theory.

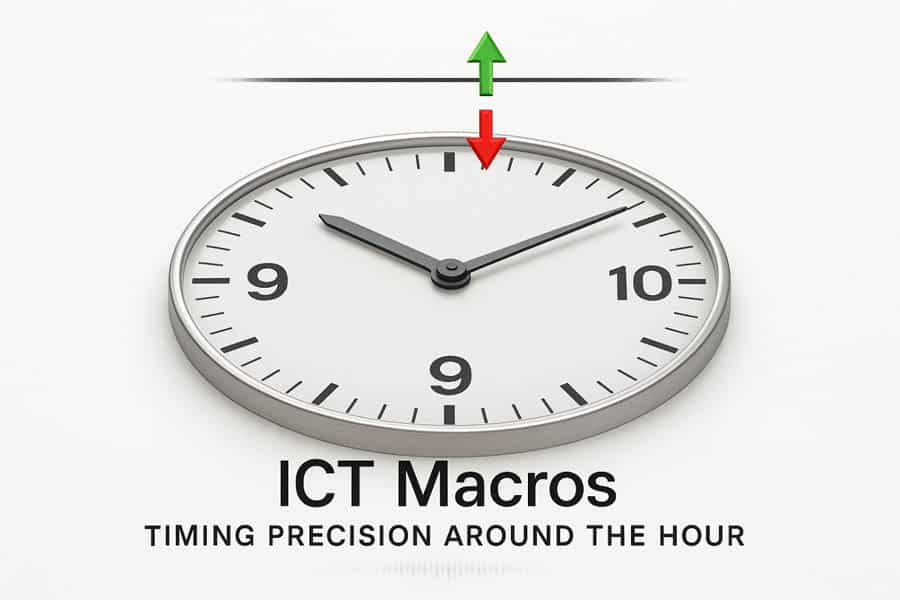

ICT Macros and Time-Based Strategies

For traders wanting even more precise timing, the ICT approach introduces “Macros.” These are specific, short time intervals within the hour, often linked to algorithmic actions, adding another dimension to the Time and Price Theory toolkit. This specific application is sometimes referred to as ICT Macros Time and Price Theory.

What are ICT Macros?

As described by ICT, Macros often focus on periods like the last 10 minutes of one hour and the first 10 minutes of the next. The theory is that during these brief windows, particularly within active Kill Zones, trading algorithms might execute quick “stop runs”—pushing price just beyond a recent high or low to trigger stops—before starting the main move intended for the next hour. Understanding this potential dynamic of ICT Macros Time and Price Theory helps traders anticipate short bursts of volatility and possible turning points right around the hour change.

Using Macro Timing for Different Styles

How you might use macros depends on your trading approach:

- Scalping with Macros: Scalpers often operate on 1-minute or 5-minute charts. They might watch for a liquidity grab just before or during a macro window (e.g., 8:50 AM – 9:10 AM ET) and then quickly enter in the opposite direction if price shows immediate rejection. It involves capitalizing on the reaction to these fast algorithmic moves.

- Swing Trading Confirmation: Swing traders usually don’t base entries only on macros. But if their analysis already points to an entry zone, seeing price act supportively during a macro period can provide extra confirmation to take the trade. The 15-minute chart often helps set the scene before looking at macro timing.

Combining Macros with Price Action

Macros are most effective when viewed within the context of price action. Before a macro window starts, identify nearby liquidity (recent highs/lows) and imbalances (FVGs). During the macro period (like the first 10 minutes of the hour), watch closely: Does price aggressively target that liquidity? Does it reverse sharply after taking it? Does it move towards filling a nearby FVG? A trade setup might appear if price sweeps liquidity during the macro and then strongly reverses, suggesting the likely direction. This combines the precise timing of ICT Macros Time and Price Theory with essential price level analysis.

Advanced Techniques and Tools

Once you have a solid grasp of the basics of Time and Price Theory and ICT methods, you can explore more advanced techniques. This might involve integrating other analytical tools, using technology effectively, and fine-tuning your risk management for time-sensitive strategies.

Integrating with Other Trading Tools

While ICT provides a complete system, some traders find it helpful to use other tools for extra confirmation (not as primary signals):

- Fibonacci Extensions: Good for estimating potential profit targets after entering a trade based on OTE.

- Classic Support/Resistance: Sometimes standard horizontal levels align with ICT zones like order blocks, reinforcing their importance.

- Moving Averages: Can help visually confirm the overall trend direction identified through market structure.

- Volume Profile: Can show high and low activity price zones that might relate to liquidity or imbalances.

The idea is to find alignment – using these tools to support what your main Time and Price Theory analysis indicates.

Algorithmic and Indicator-Based Approaches

Technology can certainly assist. Custom indicators can highlight Kill Zones, FVGs, or OTE levels automatically. Algorithmic strategies can scan markets for specific Time and Price Theory setups based on your rules. AI tools are also developing, promising deeper pattern finding. However, be very careful of overfitting: creating a system that looks great on past data but fails in live trading because it learned random noise instead of real patterns. Simplicity and thorough testing are crucial here. Many traders stick to discretionary application of Time and Price Theory.

Risk Management During Volatile Times

Trading during active periods like Kill Zones or Macros often involves higher volatility. Your risk management must adapt:

- Adjusted Position Sizing: Maybe use slightly smaller sizes during typically volatile times or if your stop loss needs to be wider based on structure.

- Time-Based Exits: For very short-term trades (like macro scalps), some traders exit if the trade doesn’t move positively within a set time, regardless of the price stop.

- Taking Partial Profits: Locking in some profit at logical price levels can reduce risk and protect gains during potentially fast market moves, a sensible approach within Time and Price Theory trading.

Smart risk management when applying Time and Price Theory means recognizing that risk levels can change depending on the time of day.

Common Challenges and Solutions

Using Time and Price Theory, especially with ICT’s specific methods, comes with its own set of challenges. Knowing what problems might arise and how to deal with them can help you stay consistent and improve over time.

Typical Mistakes Traders Make

Be mindful of these frequent errors:

- Inflexibility: Expecting time cycles or price levels to work perfectly every time. Markets change, so you need to be adaptable.

- Ignoring Context: Focusing only on short-term setups without checking the bigger picture (daily/4-hour trend and levels).

- Chasing Trades: Entering late after the ideal time or price has passed, often resulting in bad entries and higher risk.

- Overcomplication: Trying to use too many ICT concepts at once, leading to confusion and inaction. Start simple and build gradually. This is key to learning Time and Price Theory.

Avoiding Overfitting or Misinterpreting Signals

Overfitting means your backtests look fantastic, but live trading disappoints. Misinterpretation involves seeing patterns that aren’t really significant or using a concept in the wrong situation.

How to address this:

- Keep It Simple: Master one or two core setups before adding more layers.

- Test Realistically: Use data the strategy hasn’t seen before (out-of-sample) to check if it holds up.

- Look for Alignment: Don’t rely on a single signal. Seek setups where multiple time and price factors agree.

- Journal Everything: Record why you took each trade (time, price context, reason). Reviewing helps identify recurring judgment errors in applying Time and Price Theory.

Tips for Backtesting and Refining Your Strategy

Effective backtesting for Time and Price Theory strategies requires:

- Quality Data: Use historical data with accurate timestamps.

- Realistic Simulation: Include costs like spread, potential slippage, and commissions.

- Diverse Conditions: Test your strategy in different market types (trending, sideways) and time periods.

- Careful Adjustments: Make small, logical changes based on results, don’t constantly overhaul your entire approach. Refine your understanding of Time and Price Theory.

Future Trends and Research

The way traders analyze markets is always evolving, and Time and Price Theory is part of that evolution. New technologies and ongoing research are changing how these concepts are applied, potentially making strategies even more effective.

How Technology and AI are Shaping Analysis

Artificial intelligence (AI) and machine learning (ML) are becoming more influential. These technologies could lead to tools that:

- Find complex time cycles or correlations in data that humans might overlook.

- Adjust their analysis automatically as market conditions change.

- Help predict institutional activity by analyzing order flow together with time and price data.

- Combine news sentiment with technical Time and Price Theory setups for better context.

The trend seems to be towards AI assisting traders by handling heavy data analysis, allowing humans to focus more on strategic decisions based on richer information related to Time and Price Theory.

Latest Research and Developments

Research continues to explore new angles:

- Dynamic Cycle Models: Developing models that accept that market cycles aren’t always fixed in length or intensity.

- Complexity Theory: Using ideas from non-linear dynamics to better understand sudden market shifts potentially linked to time/price thresholds.

- Behavioral Integration: Studying why specific times or price levels trigger predictable reactions from market participants.

- Quantum Computing (Future): While still in early stages, quantum computing might one day offer huge power for analyzing complex probabilities related to time and price across markets.

Keeping an eye on these developments can help you adapt your Time and Price Theory framework as new tools and insights emerge.

Read More: ICT Killzone Times

Opofinance Services for Time and Price Traders

To effectively trade strategies based on precise timing and price levels, such as those derived from Time and Price Theory, having a dependable broker with suitable tools is crucial. Opofinance, regulated by ASIC, provides features that support this style of trading well:

- Versatile Trading Platforms: Choose from industry favorites like MT4 and MT5, or advanced options like cTrader and their proprietary OpoTrade platform. All support the multi-timeframe analysis essential for identifying time and price alignments.

- Helpful AI Tools: Utilize their AI Market Analyzer for pattern insights, AI Coach for strategy feedback based on your trading, and AI Support for quick assistance.

- Community and Capital Options: Connect with other traders through social trading features, potentially sharing ideas on time-based strategies. Explore proprietary trading opportunities to manage larger amounts of capital.

- Smooth Funding: Manage your account easily with secure deposit and withdrawal methods, including popular crypto payments, with the benefit of zero fees charged by Opofinance for these transactions.

For strategies where execution speed is critical—like entering during a fast-moving Kill Zone or Macro window—Opofinance’s attention to low latency execution can be a significant benefit for traders focused on Time and Price Theory.

Considering applying Time and Price Theory more rigorously? Take a look at Opofinance and see if their offerings match your trading requirements.

Conclusion

Time and Price Theory offers a logical and effective way to analyze financial markets. By concentrating on when and where significant moves are likely, traders can gain a real advantage. The ICT method provides practical tools like Kill Zones and OTE to apply these ideas, especially in Forex. Mastering this requires effort, but understanding the synergy between time and price helps you anticipate market structure instead of just reacting. Applying Time and Price Theory can lead to more strategic, confident trading and potentially more consistent results over the long run.

Key Takeaways

- Time and Price Theory: Links when (time cycles, sessions) with where (key price levels, liquidity) to anticipate market direction.

- ICT Kill Zones: Specific time windows (Asian, London, NY) with expected higher volatility and institutional action.

- Optimal Trade Entry (OTE): A high-probability pullback zone (62%-79% Fib) for trend entries.

- ICT Macros: Short time periods around the hour change, potentially used for algorithmic liquidity grabs. Understanding ICT Macros Time and Price Theory can refine entries.

- Liquidity Pools: Areas above/below highs/lows where stop orders gather, acting as price magnets. Identifying these is key in Time and Price Theory.

- Alignment Matters: The strongest setups combine multiple time, price, and market structure factors.

- Discipline and Context are Vital: Stay flexible, always consider the bigger picture, and manage risk effectively when using Time and Price Theory.

Is Time and Price Theory applicable only to Forex trading?

No, while very popular in Forex due to distinct session-based activity, the core principles of Time and Price Theory can be applied to other markets like indices, commodities, and even cryptocurrencies. The key is to identify the specific time-based tendencies and important price levels relevant to that particular asset class. For instance, stock indices have clear opening and closing times that create distinct volatility patterns, while commodities might be influenced by inventory report release times.

What is the single biggest mistake beginners make when learning ICT Time and Price Theory?

One of the most common mistakes is focusing too heavily on finding perfect textbook examples of patterns like Order Blocks or FVGs without first establishing the correct higher timeframe narrative and market structure bias. A perfectly formed FVG is less likely to be respected if it goes against the dominant trend or occurs outside a key time window. Beginners often jump to lower timeframe execution signals before confirming the broader context, which is foundational to the ICT approach to Time and Price Theory.

How do unexpected news events impact strategies based on Time and Price Theory?

High-impact news events can override typical time and price patterns. While ICT Kill Zones anticipate volatility, major news releases (like NFP or central bank decisions) can introduce extreme, unpredictable volatility that disrupts normal algorithmic behavior. Experienced traders often avoid entering new positions just before major news or significantly reduce their risk exposure. While price might still react around key levels identified by Time and Price Theory, the timing aspect can become unreliable during these specific news-driven moments.