Are you looking to enhance your trading performance with effective EUR/USD scalping strategies? This article provides direct answers and insights into the best practices for scalping this popular currency pair. Scalping involves making quick trades to capitalize on small price movements, and it’s particularly effective with EUR/USD due to its high liquidity and volatility.

The EUR/USD pair is the most traded in the forex market, accounting for a significant portion of daily trading volume. This makes it an ideal target for scalpers who seek to profit from rapid price fluctuations. To succeed in this fast-paced trading style, partnering with a reliable online forex broker is essential. A good broker not only offers competitive spreads but also ensures fast execution speeds, which are crucial for capturing fleeting opportunities in the market.

In this comprehensive guide, we will explore proven strategies, essential tools, and expert tips to help you navigate the complexities of EUR/USD scalping. Whether you’re a beginner or an experienced trader, understanding the nuances of this trading style will empower you to make informed decisions and optimize your trading potential. From technical analysis to risk management, we will cover all the key aspects that contribute to successful scalping in the forex market. Get ready to unlock the secrets of EUR/USD scalping and take your trading to the next level!

Understanding EUR/USD and Scalping

What is EUR/USD?

The EUR/USD currency pair, often referred to as “Fiber” in trading circles, represents the exchange rate between the Euro and the US Dollar. As the most traded currency pair in the forex market, EUR/USD accounts for nearly 30% of daily trading volume, making it an ideal target for scalpers. The pair’s popularity is driven by its high liquidity, which allows traders to enter and exit positions quickly, minimizing the risk of slippage.

The economic relationship between the Eurozone and the United States significantly influences the EUR/USD exchange rate. Factors such as interest rates, inflation, and geopolitical events can create volatility in this pair. Understanding these factors is crucial for successful scalping, as they can lead to rapid price movements that scalpers can exploit.

Defining Scalping

Scalping is a high-frequency trading strategy that aims to profit from minor price fluctuations in a short time frame. Scalpers typically open and close multiple positions within minutes or even seconds, leveraging small price movements to accumulate profits throughout the trading day. This strategy requires a deep understanding of market mechanics and a disciplined approach to risk management.

Successful scalpers often rely on technical analysis, utilizing various indicators and price action techniques to make quick decisions. The ability to react swiftly to market changes is essential, as scalping involves executing trades in highly volatile conditions.

Why Scalp EUR/USD?

- Unparalleled Liquidity: The EUR/USD pair’s high trading volume ensures tight spreads and minimal slippage, crucial for successful scalping. This liquidity allows traders to execute large orders without significantly affecting the market price.

- Volatility: While generally stable, EUR/USD experiences enough intraday volatility to create profitable opportunities for scalpers. Traders can take advantage of price swings that occur due to economic news releases and market sentiment shifts.

- Round-the-Clock Action: The pair trades 24 hours a day, five days a week, offering ample opportunities for scalpers in different time zones. This flexibility allows traders to adapt their strategies to their personal schedules.

- Abundance of Information: As the most popular pair, EUR/USD has extensive market analysis and news coverage, providing scalpers with valuable insights. Traders can utilize various resources, including economic calendars and market sentiment reports, to inform their trading decisions.

Understanding the factors that influence the EUR/USD exchange rate can provide scalpers with a competitive edge. Economic indicators such as GDP growth, unemployment rates, and interest rate changes can create significant price movements. By staying informed about these factors, traders can better anticipate market reactions and adjust their strategies accordingly.

Read More: xauusd scalping strategy

Key Components of a Successful EUR/USD Scalping Strategy

Technical Analysis Tools

To execute precise trades in the fast-paced world of scalping, you’ll need a robust set of technical indicators. Here are some essential tools for your EUR/USD scalping arsenal:

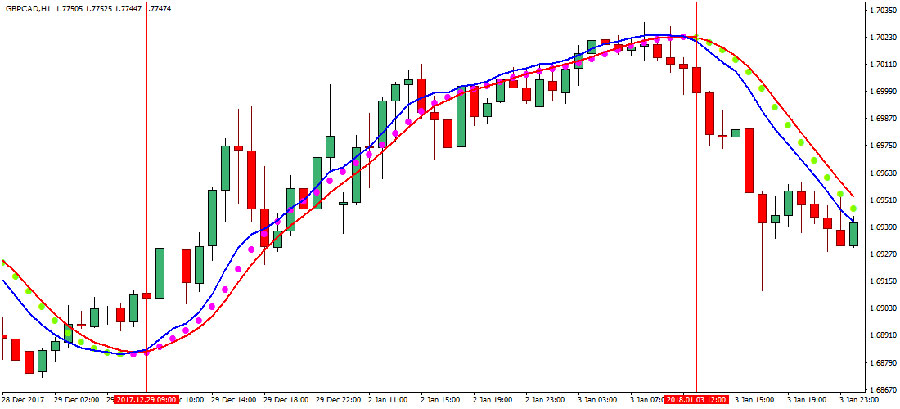

- Moving Averages (MAs): Use short-term MAs (5, 10, 20 periods) to identify trend direction and potential entry/exit points. MAs smooth out price data to help traders identify trends more clearly. For scalping, the 5-period and 10-period MAs are particularly useful for spotting quick reversals.

- Bollinger Bands: These help gauge volatility and overbought/oversold conditions, crucial for range-based scalping. When the price touches the upper band, it may indicate an overbought condition, while touching the lower band may signal oversold conditions. Scalpers can use Bollinger Bands to identify potential reversal points and set entry and exit levels.

- Relative Strength Index (RSI): A momentum oscillator that helps identify potential reversals and overbought/oversold levels. An RSI above 70 may suggest overbought conditions, while below 30 may indicate oversold conditions. Scalpers often use RSI in conjunction with price action to confirm potential trade setups.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator can signal potential trend changes and momentum shifts. Traders often look for crossovers between the MACD line and the signal line for entry/exit signals. The MACD histogram can also help identify the strength of a trend, providing additional confirmation for scalpers.

- Stochastic Oscillator: Useful for identifying overbought and oversold conditions in ranging markets. This indicator compares a particular closing price of a security to a range of its prices over a certain period. Scalpers can use the Stochastic Oscillator to confirm potential reversals at key support and resistance levels.

Price Action Analysis

While indicators are helpful, don’t underestimate the power of pure price action:

- Support and Resistance Levels: Identify key price levels where the EUR/USD pair tends to reverse or pause. These levels can provide excellent entry and exit points for scalpers. Drawing horizontal lines at these levels can help traders visualize potential trade setups.

- Candlestick Patterns: Recognize patterns like pin bars, engulfing candles, and doji to anticipate potential reversals. Understanding these patterns can enhance your ability to read market sentiment. Scalpers should pay attention to candlestick formations at key support and resistance levels to confirm potential entries.

- Trend Lines: Draw trend lines to visualize the overall direction and strength of the EUR/USD pair’s movement. Trend lines can help identify potential breakout points. Scalpers can use trend lines to spot potential reversal zones or breakout opportunities.

- Chart Patterns: Spot formations like triangles, flags, and head and shoulders patterns for potential breakout opportunities. These patterns can signal continuation or reversal of trends. Recognizing chart patterns can provide scalpers with valuable insights into future price movements.

News and Economic Calendar Awareness

Stay informed about economic releases and geopolitical events that can impact EUR/USD movements. Use an economic calendar to plan your trades around high-impact news events, as these can create volatile conditions ideal for scalping. Economic indicators such as GDP, unemployment rates, and interest rate decisions can lead to significant price movements.

Traders should be aware of the scheduled release times for major economic reports, as these events can dramatically affect market volatility. For example, Non-Farm Payrolls (NFP) data releases can lead to sharp price movements in the EUR/USD pair. Scalpers should adjust their strategies accordingly, either by avoiding trading during these times or preparing for potential volatility.

Read More: gbpusd scalping strategy

Scalping Strategies for EUR/USD

Now that we’ve covered the essentials, let’s explore five powerful EUR/USD scalping strategies:

Momentum Scalping

- Entry: Enter when price breaks above/below a short-term moving average with increasing volume. This strategy relies on the strength of price movements. Look for confirmation through additional indicators such as RSI or MACD.

- Exit: Set a tight stop-loss and take profit at 5-10 pips, or when momentum begins to wane. Quick exits are essential to lock in profits. Scalpers should be prepared to exit quickly if the market moves against them.

- Best Time: During major market opens or following significant news releases, when volatility and volume are high. Scalpers can capitalize on the increased activity during these times.

Range Scalping

- Entry: Buy at support and sell at resistance levels within the range. This strategy works best in sideways markets. Identifying clear support and resistance levels is crucial for this approach.

- Exit: Place stops just outside the range and take profits a few pips before the opposite boundary. This approach minimizes risk while maximizing potential gains. Scalpers should be cautious of false breakouts that can occur at these levels.

- Best Time: During Asian trading sessions or midday lulls in European/US sessions, when price action tends to consolidate. These periods often exhibit reduced volatility, making them ideal for range trading.

News Scalping

- Entry: Enter quickly as soon as the news hits and price begins to move sharply in one direction. Speed is crucial in this strategy. Scalpers need to be prepared to act immediately after news releases.

- Exit: Use a wider stop-loss due to increased volatility and aim for 15-20 pips profit. Adjust your targets based on the news impact. Scalpers should be aware of the potential for slippage during high-impact news events.

- Best Time: During major economic releases affecting EUR or USD, when significant price movements are expected. Traders should have a plan in place to manage risk during these volatile periods.

Trend-Following Scalping

- Entry: Enter on pullbacks in the direction of the overall trend, confirmed by multiple timeframe analysis. This strategy is effective in strong trending markets. Scalpers should identify the prevailing trend on higher timeframes before executing trades on lower timeframes.

- Exit: Use a trailing stop to maximize profits and exit when price action suggests a potential reversal. This allows you to capture larger moves. Scalpers can adjust their stop-loss levels as the trade moves in their favor.

- Best Time: During strong trending markets, often in the European or US sessions, when trends are more pronounced. Traders should look for signs of trend continuation to increase their chances of success.

Breakout Scalping

- Entry: Enter as price convincingly breaks through key support/resistance levels or chart patterns. Look for increased volume to confirm breakouts. Scalpers should wait for confirmation before entering, as false breakouts can lead to losses.

- Exit: Set a stop-loss just below the breakout point and take profit at the next significant level. This helps manage risk effectively. Scalpers should be ready to adjust their targets based on market conditions.

- Best Time: Often occurs at the start of major trading sessions or following periods of low volatility when breakouts are more likely. Scalpers should be vigilant during these times for potential trading opportunities.

Read More: nasdaq scalping strategy

Developing Your EUR/USD Scalping Strategy

To create a winning EUR/USD scalping strategy, follow these steps:

- Choose Your Timeframe: Most scalpers focus on 1-minute to 5-minute charts. Select a timeframe that matches your trading style and reaction speed. Scalpers often prefer shorter timeframes to capitalize on quick price movements.

- Set Clear Entry and Exit Rules: Define specific criteria for entering and exiting trades. This might include indicator readings, price action signals, or a combination of both. Having a well-defined plan helps reduce emotional decision-making.

- Implement Proper Risk Management: Never risk more than 1-2% of your account on a single trade. Use stop-losses religiously and maintain a positive risk-reward ratio. Effective risk management is crucial for long-term success in scalping.

- Practice and Refine: Start with a demo account to test your strategy without risking real capital. Keep a trading journal to track your performance and identify areas for improvement. Continuous learning and adaptation are key components of successful trading.

Common Pitfalls to Avoid in EUR/USD Scalping

Even the most promising strategy can fail if you fall into these common traps:

- Overtrading: Don’t feel pressured to be in the market constantly. Wait for high-probability setups that meet your criteria. Overtrading can lead to unnecessary losses and emotional fatigue.

- Ignoring Transaction Costs: Factor in spreads and commissions when calculating potential profits. High transaction costs can eat into your profits. Scalpers should choose brokers with competitive spreads to maximize their earnings.

- Emotional Trading: Stick to your pre-defined strategy and avoid impulsive decisions based on fear or greed. Emotional discipline is key to success. Scalpers should maintain a calm mindset and follow their trading plan.

- Neglecting Market Context: Always consider the bigger picture and current market sentiment. Understanding broader trends can inform your scalping decisions. Scalpers should stay updated on economic news and geopolitical events that may impact the market.

OpoFinance Services: Your Trusted Partner in EUR/USD Scalping

When it comes to executing your EUR/USD scalping strategy with precision and confidence, choosing the right broker is paramount. Look no further than OpoFinance, a regulated forex broker that offers a suite of features tailored for scalpers:

- Lightning-Fast Execution: OpoFinance’s advanced trading infrastructure ensures your orders are filled at the speeds required for successful scalping. Speed is essential for capturing quick price movements.

- Tight Spreads: Enjoy some of the most competitive spreads in the industry, crucial for maximizing your scalping profits. Lower spreads increase your potential for profit.

- Cutting-Edge Platforms: Access powerful charting tools and indicators through industry-leading platforms like MetaTrader 4 and 5. These platforms provide the tools needed for effective analysis.

- Robust Risk Management: Benefit from negative balance protection and segregated client funds for peace of mind. This ensures your capital is safeguarded.

- Social Trading: New to scalping? OpoFinance’s innovative social trading feature allows you to learn from and copy the trades of successful EUR/USD scalpers. This can accelerate your learning curve.

With OpoFinance, you’re not just getting a broker; you’re gaining a partner committed to your trading success. Their expert support team is available 24/7 to assist you with any questions or concerns, ensuring you can focus on what matters most – executing your scalping strategy with confidence.

Conclusion

Mastering EUR/USD scalping can be a lucrative endeavor for traders willing to put in the time and effort. By understanding the pair’s dynamics, utilizing the right tools, and implementing proven strategies, you can capitalize on the numerous opportunities this liquid market presents.

Remember, successful scalping requires discipline, quick decision-making, and continuous learning. Start by practicing on a demo account, refine your strategy, and gradually transition to live trading as you gain confidence and consistency.

With the right approach and a reliable broker like OpoFinance by your side, you’ll be well-equipped to navigate the fast-paced world of EUR/USD scalping and potentially unlock significant profits in the forex market.

How much capital do I need to start scalping EUR/USD?

While there’s no set minimum, it’s recommended to start with at least $1,000 to $5,000. This allows for proper risk management and the ability to withstand potential losing streaks. Remember, scalping requires a cushion to cover transaction costs and maintain a healthy risk-reward ratio.

Is EUR/USD scalping legal?

Yes, EUR/USD scalping is legal in most jurisdictions. However, some brokers may have restrictions on scalping strategies. Always check your broker’s terms and conditions and ensure you’re trading with a regulated entity like OpoFinance to avoid any legal issues.

Can I use expert advisors (EAs) for EUR/USD scalping?

Absolutely! Many traders use automated trading systems or expert advisors for EUR/USD scalping. These can execute trades based on predefined parameters, potentially removing emotional decision-making. However, it’s crucial to thoroughly backtest and forward test any EA before using it with real money.

What is the best time of day to scalp EUR/USD?

The best times to scalp EUR/USD are during the major market sessions, particularly when the London and New York sessions overlap. This period typically sees increased volatility and trading volume, creating more opportunities for scalpers.