Have you been looking for a way to diversify your Forex portfolio and tap into the exciting world of cryptocurrency? Then, Trading Bitcoin in Forex might just be your answer. This innovative approach merges the high-octane world of crypto with the established Forex market, creating unique opportunities and challenges for modern traders. But how to trade bitcoin in forex effectively and safely?

This comprehensive guide is your passport to understanding Bitcoin Forex trading. We will explore everything from the basics of what it is and how it works, to the best platforms, winning strategies, and crucial risk management tips. Whether you are a seasoned Forex veteran or a crypto-curious newcomer, understanding the synergy between Bitcoin and Forex can open up a new dimension in your trading journey.

This article will navigate you through the exciting yet complex landscape of Bitcoin Forex trading, providing you with actionable steps and expert insights to potentially enhance your trading outcomes. We will uncover the secrets of this dynamic market, arming you with the knowledge to confidently step into the realm where crypto meets FX. Let’s dive in and explore the world of Trading Bitcoin in Forex.

What is Bitcoin Forex Trading?

Bitcoin Forex trading represents an innovative evolution in the financial markets, effectively bridging the gap between traditional foreign exchange and the burgeoning world of cryptocurrencies. Unlike traditional Forex trading, which solely involves fiat currencies, Bitcoin Forex trading incorporates Bitcoin into the mix. This means you are not just trading EUR against USD; you’re also trading Bitcoin against fiat currencies like the US Dollar (BTC/USD) or the Euro (BTC/EUR).

Traditional Forex vs. Bitcoin Forex: Key Differences

The core concept of both markets is speculation on exchange rate fluctuations to generate profit. However, significant differences set them apart, especially for those considering how to trade bitcoin in forex:

- Assets Traded: Traditional Forex deals exclusively in fiat currency pairs. Bitcoin Forex trading expands this to include cryptocurrency pairs, primarily Bitcoin, against fiat currencies.

- Market Operation: Traditional Forex operates through a decentralized global network of financial institutions, with trading sessions tied to major financial hubs and operating five days a week. Bitcoin Forex, powered by blockchain technology, operates 24/7, offering continuous trading opportunities.

- Market Influences: Traditional Forex rates are heavily influenced by economic indicators, central bank policies, and geopolitical events. Bitcoin’s price, however, is swayed more by technological advancements, market sentiment, regulatory news, and adoption rates.

Bitcoin Pairs in the Forex Arena

In Bitcoin Forex trading, Bitcoin is commonly paired with major fiat currencies. Popular Bitcoin Forex pairs include:

- BTC/USD: Bitcoin against the US Dollar – often the most liquid and actively traded pair for those Trading Bitcoin in Forex.

- BTC/EUR: Bitcoin against the Euro – reflecting European market interest and Eurozone economic factors.

- BTC/GBP: Bitcoin against the British Pound – providing exposure to the UK market and Sterling volatility.

- BTC/JPY: Bitcoin against the Japanese Yen – tapping into Asian market dynamics and Yen’s safe-haven status.

These pairs allow traders to speculate on Bitcoin’s value relative to these major global currencies, leveraging the volatility and unique market drivers of both Forex and crypto markets.

Read More: Is Forex Riskier Than Crypto? A Comparative Analysis

How Bitcoin Trading Works in the Forex Market

Trading Bitcoin in the Forex market centers around speculating on Bitcoin’s price movements, just as in traditional Forex, but with its own unique flavor. Traders aim to predict whether Bitcoin will appreciate or depreciate against a fiat currency. Understanding how to trade bitcoin in forex involves mastering these price speculations.

Speculating on BTC Price Movements

Traders engage in Bitcoin Forex trading by taking positions based on their analysis of Bitcoin’s future price direction.

- Going Long (Buying): If a trader believes Bitcoin’s price will rise against the US Dollar, they will ‘buy’ BTC/USD. Profit is made if the price indeed increases, allowing them to sell at a higher rate.

- Going Short (Selling): Conversely, if they anticipate a price decline in Bitcoin relative to the Dollar, they will ‘sell’ BTC/USD. Profit is earned if the price drops, and they can buy it back at a lower rate.

Market Liquidity and Volatility: Fiat Forex vs. Bitcoin Forex

- Liquidity: Traditional Forex markets are the most liquid globally, meaning large trades can be executed with minimal impact on price. Bitcoin Forex, while growing, generally exhibits lower liquidity. This can lead to wider spreads and potential slippage, especially during high volatility periods, which is a key consideration for anyone Trading Bitcoin in Forex.

- Volatility: Bitcoin is notoriously more volatile than fiat currencies. Daily price swings in Bitcoin can be significantly larger than those seen in major Forex pairs. While high volatility presents enhanced profit opportunities, it also elevates the risk of substantial losses.

Trading Hours and Market Accessibility

Unlike traditional Forex, which has sessions tied to geographical trading hours, the Bitcoin Forex market operates 24 hours a day, 7 days a week. This round-the-clock accessibility is a major draw, allowing traders to react to market movements at any time, from anywhere in the world. This continuous nature also means that the market can be influenced by global events at any hour, requiring vigilant monitoring.

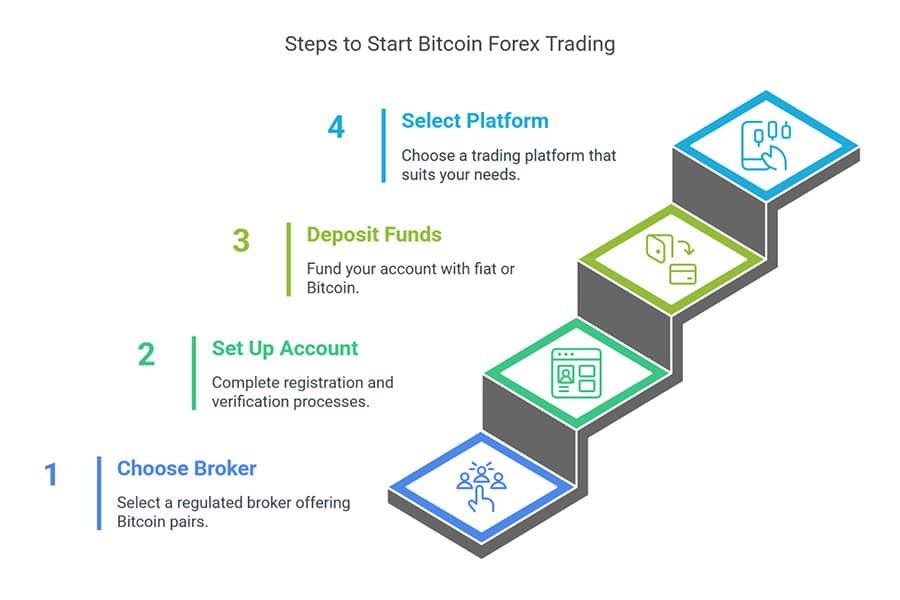

Steps to Start Trading Bitcoin in Forex

Ready to embark on your Bitcoin Forex trading journey? Here are the essential steps to get started, and effectively learn how to trade bitcoin in forex:

1. Choosing a Reliable Forex Broker that Supports Bitcoin

Your first crucial step is selecting a regulated forex broker that provides access to Bitcoin Forex pairs. Not all Forex brokers offer cryptocurrency trading, so ensure your chosen broker does. Look for brokers that are reputable, online forex broker with robust security measures, competitive trading conditions, and ideally, are regulated forex brokers for enhanced safety. When comparing a broker for forex trading, check if they specifically offer Bitcoin pairs and understand their associated fees and leverage options for Trading Bitcoin in Forex.

2. Setting Up Your Trading Account

Once you’ve selected a broker, the next step is account setup. This typically involves:

- Registration: Providing personal details and contact information.

- Verification: Completing KYC (Know Your Customer) procedures by submitting identification documents to comply with regulatory standards. This is a standard practice with any regulated forex broker or broker for forex trading.

3. Depositing Funds: Bitcoin or Fiat Currency

After verification, you need to fund your account. Brokers may offer options to deposit in:

- Fiat Currency: Traditional methods like bank transfers, credit/debit cards, or e-wallets. You can then use this fiat to trade BTC pairs.

- Bitcoin: Some brokers allow direct Bitcoin deposits from your crypto wallet, streamlining the process for crypto-holders.

4. Selecting a Trading Platform

Choose a platform offered by your broker that suits your trading style and experience level. Most brokers provide:

- Proprietary Platforms: Broker-specific platforms, often user-friendly and tailored to their services.

- MetaTrader 4 & 5 (MT4/MT5): Industry-standard platforms known for their advanced charting tools, automated trading capabilities (Expert Advisors), and extensive customizability.

- cTrader: Favored for its depth of market analysis tools and transparent order execution.

Ensure the platform offers the Bitcoin Forex pairs you wish to trade and provides the analytical tools you need for informed decision-making as you delve into Trading Bitcoin in Forex.

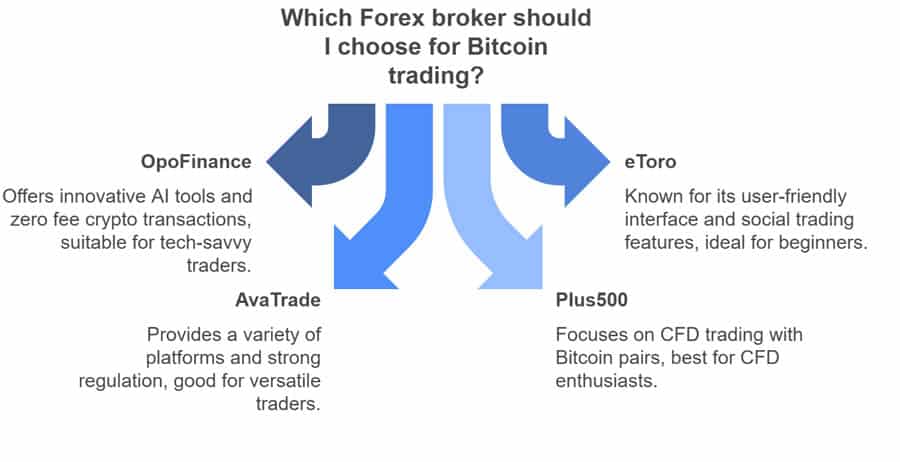

Best Platforms for Bitcoin Forex Trading

Selecting the right platform is crucial for a smooth and efficient Bitcoin Forex trading experience. Here are some top-rated forex trading broker platforms that support Bitcoin trading, along with key features to consider:

Top Forex Brokers Supporting Bitcoin Trading

- OpoFinance: Known for its ASIC regulation and diverse platform offerings including MT4, MT5, cTrader, and OpoTrade. It stands out with innovative AI tools like AI Market Analyzer, AI Coach, and AI Support. OpoFinance also offers social and prop trading, secure transactions, and supports crypto payments with zero deposit/withdrawal fees, making it a strong choice for Trading Bitcoin in Forex.

- eToro: Popular for its user-friendly interface and social trading features, eToro supports Bitcoin Forex trading and is well-regulated.

- AvaTrade: Offers a wide range of platforms including MT4 and AvaTradeGo, with strong regulation and Bitcoin trading options.

- Plus500: Known for its CFD trading platform, Plus500 provides access to Bitcoin pairs and is regulated in multiple jurisdictions.

Features to Consider When Choosing a Platform

- Security: Robust security measures, including two-factor authentication and cold storage of funds, are paramount to protect your digital assets when Trading Bitcoin in Forex.

- Regulation: Opt for platforms regulated by reputable financial authorities to ensure compliance and trader protection.

- Fees and Spreads: Compare transaction costs, including spreads, commissions, and deposit/withdrawal fees for Bitcoin Forex pairs.

- Leverage: Understand the leverage options for Bitcoin pairs and use leverage judiciously due to Bitcoin’s volatility.

- Trading Tools: Access to comprehensive charting tools, technical indicators, and real-time market data is vital for effective analysis.

- User Interface: An intuitive and easy-to-navigate platform interface, especially important for beginners.

Regulation and Legal Compliance

Always verify the regulatory compliance of your chosen platform in your jurisdiction. Regulations in the cryptocurrency space are still evolving, and a regulated broker offers a degree of security and legal recourse that unregulated platforms may not.

Bitcoin Forex Trading Strategies

To navigate the Bitcoin Forex market effectively, traders should employ well-defined strategies. Here are some popular approaches when considering how to trade bitcoin in forex:

Day Trading vs. Swing Trading Bitcoin

- Day Trading: This involves opening and closing trades within the same day, capitalizing on short-term price fluctuations. Day trading Bitcoin requires constant market monitoring and quick decision-making, relying heavily on technical analysis and intraday charts.

- Swing Trading: A medium-term approach where positions are held for several days to weeks to profit from larger price swings. Swing traders use technical analysis on longer timeframes (e.g., daily or 4-hour charts) to identify trends and reversals.

Leverage and Margin Trading: Handle with Care

Many platforms offer leverage for Bitcoin Forex trading, allowing you to control larger positions with less capital. While leverage can amplify profits, it equally magnifies losses. Given Bitcoin’s high volatility, using high leverage can be exceptionally risky. Employ leverage cautiously and ensure you understand margin requirements and risks of margin calls when Trading Bitcoin in Forex.

Technical and Fundamental Analysis for Bitcoin Trading

- Technical Analysis: Involves studying price charts and using technical indicators (e.g., Moving Averages, RSI, MACD) to identify patterns and predict future price movements. Common techniques include analyzing candlestick patterns, trend lines, and support/resistance levels.

- Fundamental Analysis: While traditional Forex fundamental analysis focuses on economic indicators, Bitcoin fundamental analysis includes monitoring:

- Blockchain Metrics: Hash rate, transaction volumes, active addresses.

- Technology Developments: Protocol upgrades, scalability solutions.

- Regulatory News: Government stances, legal frameworks impacting Bitcoin.

- Market Sentiment: Social media trends, news headlines, and overall market mood.

A blend of both technical and fundamental analysis can provide a robust trading strategy for Bitcoin Forex pairs.

Read More: Forex vs. Cryptocurrency trading

Risks & Challenges of Bitcoin Forex Trading

Bitcoin Forex trading, while offering potential rewards, comes with significant risks and challenges that anyone looking into how to trade bitcoin in forex should understand:

Volatility and Price Swings

Bitcoin’s notorious volatility is amplified in the Forex market context. Expect rapid and substantial price swings that can lead to significant profits but also quick, heavy losses. This heightened volatility requires robust risk management strategies, including stop-loss orders and careful position sizing.

Security Concerns and Scams

The cryptocurrency space is prone to scams and security breaches. Bitcoin Forex traders must be vigilant about platform security, protect their trading accounts and crypto wallets, and be wary of phishing attempts and fraudulent schemes. Choosing a regulated forex broker can mitigate some of these risks.

Regulatory Uncertainties

The regulatory landscape for cryptocurrencies is still evolving globally. Regulatory changes can significantly impact Bitcoin’s price and market access. Traders must stay informed about regulatory developments in their jurisdiction and choose platforms that comply with relevant laws.

Tips for Successful Bitcoin Trading in Forex

Navigating the Bitcoin Forex market requires skill, discipline, and a strategic approach. Here are key tips to enhance your success when Trading Bitcoin in Forex:

Managing Risk Effectively

- Use Stop-Loss Orders: Always set stop-loss orders to limit potential losses on trades, especially given Bitcoin’s volatility.

- Position Sizing: Never risk more than a small percentage of your trading capital on a single trade (1-2% is a common guideline).

- Diversification: Don’t put all your trading capital into Bitcoin Forex alone. Diversify across different markets and asset classes.

Choosing the Right Trading Strategy

- Align with Your Style: Select a trading strategy (day trading, swing trading, etc.) that fits your personality, time availability, and risk tolerance.

- Backtesting: Before deploying real capital, test your strategy using demo accounts or backtesting tools to evaluate its effectiveness.

- Adaptability: Be prepared to adjust your strategies as market conditions change. Bitcoin Forex is dynamic and requires flexible trading approaches.

Importance of Continuous Market Research

- Stay Informed: Keep abreast of both traditional Forex market news and cryptocurrency-specific developments. Follow crypto news sites, blockchain analytics, and relevant social media.

- Technical Analysis Practice: Continuously hone your technical analysis skills. Practice charting, indicator analysis, and pattern recognition.

- Community Engagement: Engage with trading communities and forums to gain insights and stay updated on market trends.

Pro Tips for Advanced Traders

- Algorithmic Trading: Explore algorithmic trading strategies to automate your Bitcoin Forex trades. Algorithmic trading can execute trades based on predefined criteria, removing emotional biases and capitalizing on 24/7 market opportunities.

- Volatility Indicators: Utilize volatility indicators like Bollinger Bands or Average True Range (ATR) to dynamically adjust your position sizes based on current market volatility levels. Reduce position size during high volatility and vice versa.

- Sentiment Analysis: Incorporate sentiment analysis into your trading decisions. Monitor social media and news sentiment around Bitcoin to gauge market mood, which can significantly impact short-term price movements.

- Hybrid Strategies: Combine technical analysis with on-chain metrics and fundamental analysis for a more holistic trading approach. For example, confirm technical signals with blockchain transaction data or upcoming regulatory announcements.

Opofinance Services: Your Gateway to Bitcoin Forex Trading

Looking for a broker for forex that combines cutting-edge technology with robust regulation? Consider OpoFinance, an ASIC-regulated broker, your ideal partner for navigating Bitcoin Forex trading. Here’s why OpoFinance stands out:

- Advanced Trading Platforms: Trade Bitcoin Forex on powerful platforms including MT4, MT5, cTrader, and OpoTrade, catering to all trader preferences and skill levels.

- Innovative AI Tools: Leverage the power of AI with OpoFinance’s suite of tools:

- AI Market Analyzer: Gain data-driven insights to enhance your trading decisions.

- AI Coach: Personalized guidance to refine your trading strategies.

- AI Support: Instant assistance to resolve queries and improve your trading experience.

- Social & Prop Trading: Connect with a community of traders and explore prop trading opportunities to amplify your trading potential.

- Secure & Flexible Transactions: Enjoy peace of mind with secure transactions and flexible deposit and withdrawal methods.

- Safe and Convenient Crypto Payments: Fund your account and withdraw earnings using cryptocurrencies with zero fees from OpoFinance, offering both convenience and cost-effectiveness for Trading Bitcoin in Forex.

Ready to elevate your Bitcoin Forex trading?

Conclusion

Bitcoin Forex trading represents a dynamic and exciting frontier in the financial markets. It offers the allure of cryptocurrency’s high growth potential combined with the established infrastructure of Forex trading. The 24/7 market, diversification opportunities, and potential for significant profits are strong draws. However, traders must be acutely aware of the inherent risks, especially Bitcoin’s extreme volatility, security challenges, and regulatory uncertainties. This comprehensive guide has aimed to equip you with the essential knowledge on how to trade bitcoin in forex.

Whether Bitcoin Forex trading is right for you depends on your risk tolerance, trading style, and level of preparedness. For traders who are comfortable with volatility, willing to continuously learn and adapt, and committed to robust risk management, Bitcoin Forex can be a highly rewarding venture. As the cryptocurrency market matures and integrates further with traditional finance, understanding Bitcoin Forex trading will become an increasingly valuable skill for the modern trader.

Key Takeaways

- Bitcoin Forex trading combines cryptocurrency and traditional Forex markets, offering unique trading pairs like BTC/USD and BTC/EUR.

- Bitcoin Forex operates 24/7 with high volatility and lower liquidity compared to traditional Forex.

- Key steps to start include choosing a regulated broker, setting up an account, funding it (potentially with Bitcoin), and selecting a trading platform to begin Trading Bitcoin in Forex.

- Popular strategies include day trading, swing trading, and utilizing technical and fundamental analysis tailored to Bitcoin’s market dynamics.

- Risks include high volatility, security threats, and regulatory uncertainties, requiring strong risk management and platform security awareness.

- Successful Bitcoin Forex trading requires continuous learning, strategy adaptation, and staying informed about both crypto and Forex market developments.

Is Bitcoin Forex trading suitable for beginners?

Bitcoin Forex trading can be more complex and volatile than traditional Forex, making it potentially challenging for absolute beginners. New traders should first gain a solid understanding of both Forex and cryptocurrency markets, practice on demo accounts, and start with smaller positions to manage risk effectively. Starting with less volatile Forex pairs before moving to Bitcoin pairs might be a prudent approach for novices when learning how to trade bitcoin in forex.

What are the typical costs associated with Bitcoin Forex trading?

Costs in Bitcoin Forex trading include spreads (the difference between the buying and selling price), commissions (charged by some brokers per trade), and potentially overnight or swap fees if positions are held longer than a day. Deposit and withdrawal fees can also apply, although brokers like OpoFinance offer zero fees for crypto transactions. It’s crucial to compare the fee structures of different brokers before choosing a platform for Trading Bitcoin in Forex.

How does regulatory oversight impact Bitcoin Forex trading?

Regulatory oversight is still developing for cryptocurrencies globally, and this directly affects Bitcoin Forex trading. Regulations can influence platform operations, security measures, KYC/AML compliance, and investor protection. Trading with regulated brokers offers a degree of security and compliance, but regulatory changes can also impact market accessibility and trading conditions. Traders should stay informed about the regulatory landscape in their jurisdiction and choose platforms that operate within legal frameworks.