Are you ready to unlock the secrets to profitable forex trading? The answer lies in understanding types of trend in forex trading. Yes, you heard it right! Trends are the backbone of the forex market, and mastering their identification is your golden ticket to potentially boosting your trading success. This article will be your ultimate guide, breaking down the essential type of trend in forex and equipping you with actionable strategies to navigate the dynamic world of currency exchange.

Whether you’re a newbie dipping your toes into the forex waters or a seasoned trader looking to refine your edge with a reliable online forex broker, understanding trends is non-negotiable. We’ll cut through the jargon and deliver practical insights, ensuring you grasp these concepts quickly and confidently. Get ready to transform your trading approach and potentially seize those lucrative opportunities that trends reveal!

Understanding Trends in Forex Trading

What is a Trend in Forex Trading?

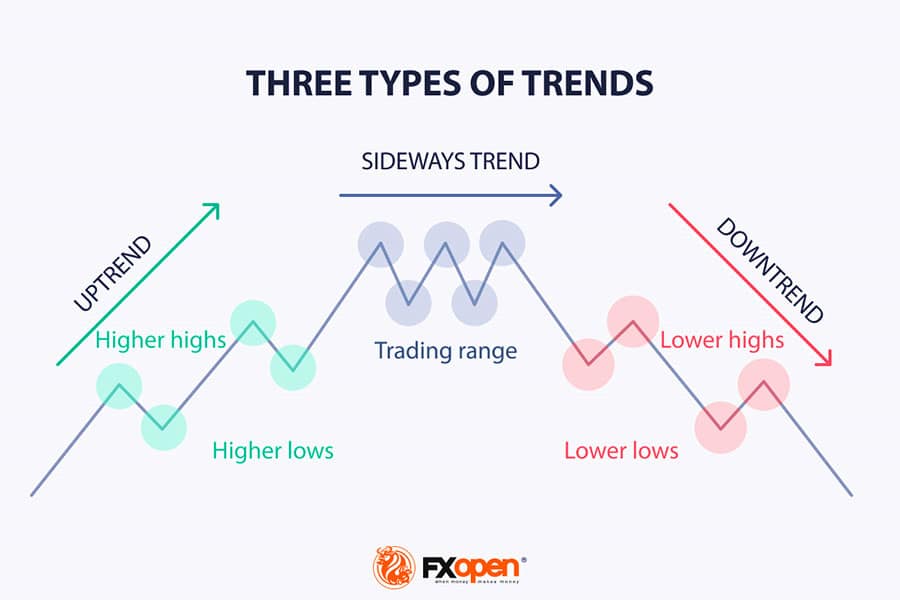

In forex trading, a trend is the general direction in which the price of a currency pair is moving over time. The types of trend in forex trading are typically categorized into three main groups:

- Uptrend: A market condition where prices consistently make higher highs and higher lows, indicating strong buying pressure.

- Downtrend: A situation where prices form lower highs and lower lows, signifying persistent selling pressure.

- Sideways or Range-bound Trend: When prices move within a narrow band, reflecting a balance between buyers and sellers.

Each type of trend in forex presents unique opportunities and challenges. Trends are not merely random fluctuations; they are influenced by global economic factors, market sentiment, and geopolitical events. This understanding is pivotal for developing effective trading strategies.

The Importance of Trend Analysis in Forex Trading

Trend analysis is the backbone of successful forex trading. By accurately assessing the types of trend in forex trading, traders can:

- Identify Market Momentum: Recognize whether the market is in an uptrend, downtrend, or moving sideways, which helps in timing your trades.

- Enhance Decision-Making: Align your trading decisions with the prevailing market trend, thereby increasing the probability of successful trades.

- Optimize Entry and Exit Points: Utilize trends to determine the best moments for entering or exiting trades, ultimately leading to higher returns.

- Mitigate Risks: Spot potential trend reversals early and adjust your risk management strategies accordingly, reducing losses during market reversals.

For instance, when using a broker for forex trading, having a clear understanding of trend types helps you select the right moments to trade, thus maximizing your profit potential and minimizing risk exposure.

How Trend Analysis Influences Forex Strategies

The types of trend in forex trading have a direct impact on various forex strategies. Here’s how understanding the type of trend in forex can refine your approach:

- Uptrend Strategies: In an uptrend, focus on buying opportunities, especially on dips. Look for signals such as a moving average crossover or a bullish breakout.

- Downtrend Strategies: When the market is in a downtrend, consider short-selling strategies. Use indicators like the Relative Strength Index (RSI) or MACD to confirm bearish signals.

- Range-bound Strategies: In a sideways market, the best approach may involve range trading, where you buy near support levels and sell near resistance levels. Alternatively, prepare for a breakout by closely monitoring price levels.

By tailoring your strategies to the specific types of trend in forex trading, you can improve your market entry and exit decisions, leading to a more robust and profitable trading plan.

Read More: Trend-Following Strategy

Main Types of trend in forex trading

Uptrend

Definition and Characteristics

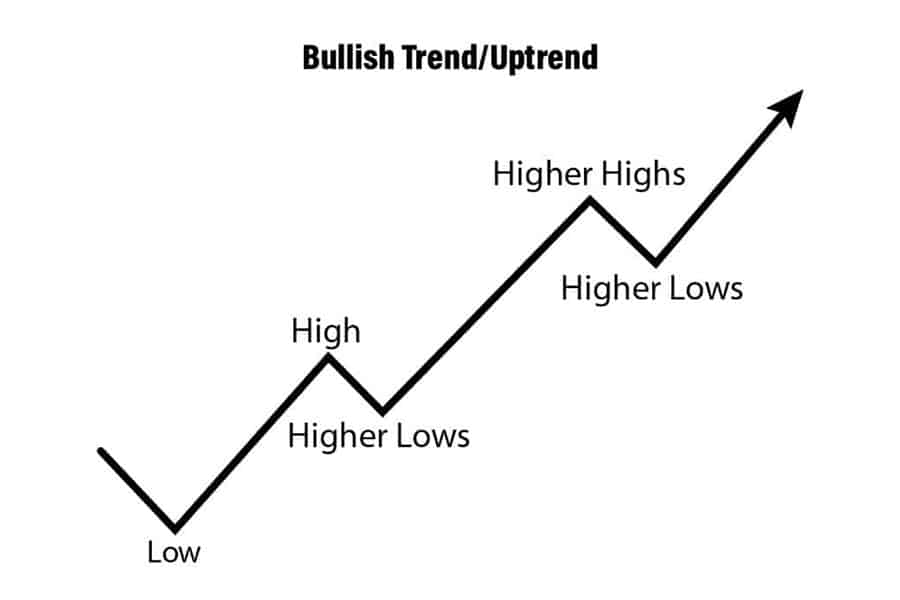

An uptrend is defined by a sequence of higher highs and higher lows, indicating that buyers control the market. Key characteristics of an uptrend include:

- Rising Price Levels: Each new high is higher than the previous one, confirming a sustained upward movement.

- Bullish Momentum: There is consistent buying pressure, often driven by positive economic data or strong investor sentiment.

- Support Levels That Rise: The support line follows the price upward, acting as a safety net during pullbacks.

In the context of the types of trend in forex trading, an uptrend represents the most sought-after condition for traders looking to buy. Recognizing an uptrend early can be incredibly valuable, as it allows you to ride the wave of bullish momentum.

Key Indicators and Examples

To confirm an uptrend, traders often rely on several technical indicators:

- Moving Averages: For instance, a 50-day moving average crossing above a 200-day moving average (often called a “golden cross”) is a powerful bullish signal.

- Trendlines: Drawing a trendline along the lows of the price movement provides a visual confirmation of the uptrend.

- RSI (Relative Strength Index): An RSI value above 50 typically reinforces the presence of bullish momentum.

- Volume Analysis: Increased trading volume during upward price moves further validates the strength of the uptrend.

Example: Imagine the USD/CAD pair experiencing an uptrend due to robust economic growth in the United States. Each successive swing demonstrates higher lows, supported by strong trading volumes and positive market sentiment, confirming the types of trend in forex trading as an uptrend.

Downtrend

Definition and Characteristics

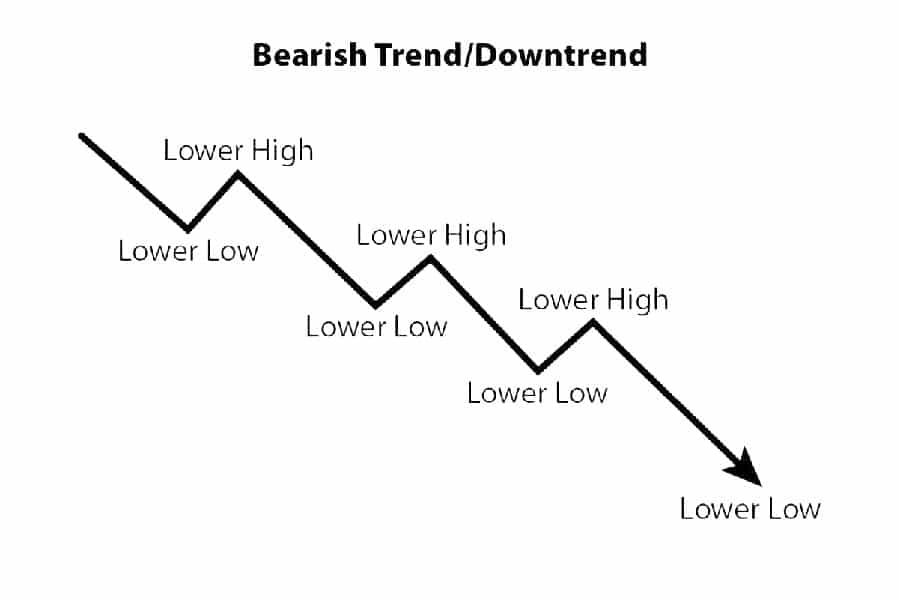

A downtrend is the opposite of an uptrend, characterized by a series of lower highs and lower lows. This indicates that sellers are dominating the market. Key features of a downtrend include:

- Declining Price Patterns: Prices continuously fall, creating a clear pattern of lower highs and lower lows.

- Bearish Sentiment: Negative news, poor economic data, or political instability can drive this trend.

- Falling Resistance Levels: The resistance line descends along with the price, providing a clear visual cue of the downtrend.

Understanding the type of trend in forex that is a downtrend is crucial for traders looking to capitalize on selling opportunities. Recognizing a downtrend early enables you to take advantage of market corrections and short-selling opportunities.

Key Indicators and Examples

Traders use several technical tools to identify a downtrend:

- Moving Averages: A short-term moving average falling below a long-term moving average (commonly known as a “death cross”) confirms bearish momentum.

- Trendlines: A downward-sloping trendline drawn through the highs of the price movement reinforces the downtrend.

- MACD (Moving Average Convergence Divergence): A bearish MACD crossover is a strong indicator that the momentum is shifting downward.

- Volume Analysis: An increase in volume during price declines signals strong selling pressure.

Example: Consider the GBP/USD pair during a period of economic uncertainty. As negative sentiment spreads and key economic indicators falter, the market witnesses a clear downtrend, marked by consistently lower highs and lower lows. Recognizing this type of trend in forex allows traders to execute well-timed short positions.

Sideways or Range-bound Trend

Definition and Characteristics

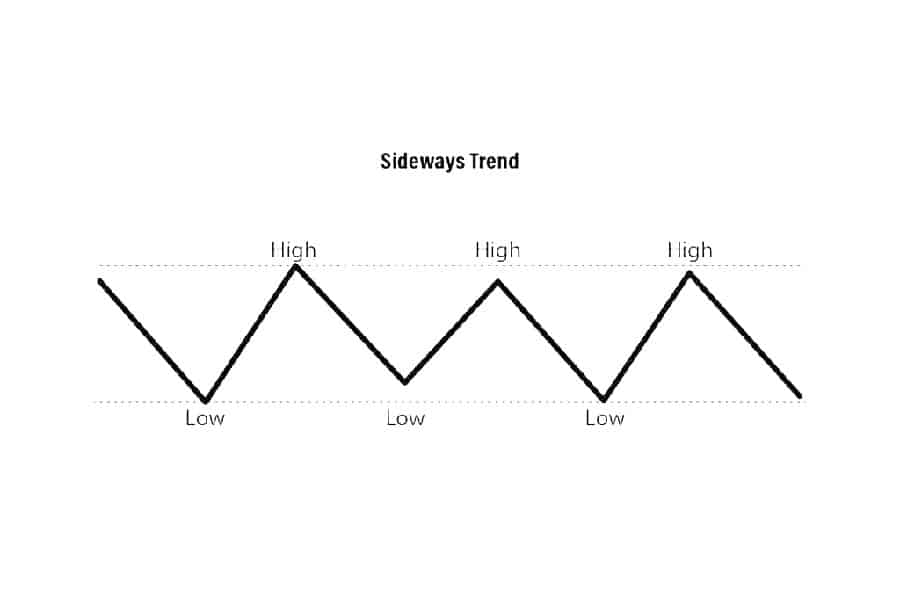

A sideways or range-bound trend occurs when the price of a currency pair moves within a relatively narrow band, without any clear upward or downward trajectory. This type of trend in forex trading is characterized by:

- Lack of Clear Direction: Prices oscillate between established support and resistance levels.

- Market Equilibrium: Neither buyers nor sellers dominate, resulting in a state of equilibrium.

- Volatility Within a Range: Although prices may fluctuate, they do not break out significantly in either direction.

In a range-bound market, traders must be more tactical. Since there is no definitive trend, strategies such as range trading or breakout trading become essential.

Trading Strategies for a Sideways Market

When dealing with a sideways trend, consider the following strategies:

- Range Trading: Buy near the lower support boundary and sell near the upper resistance boundary.

- Breakout Trading: Monitor the market for potential breakouts. A significant price move outside the established range can signal the beginning of a new trend.

- Oscillator Tools: Indicators like the Stochastic Oscillator or Bollinger Bands can help identify overbought or oversold conditions within the range.

Example: Suppose the EUR/JPY pair is caught in a range-bound market. Prices bounce between 130.00 and 132.50 without a clear direction. A trader can exploit this by buying near 130.00 and selling near 132.50, or wait for a breakout before making a significant move. This detailed understanding of the types of trend in forex trading equips traders with the necessary tools to navigate uncertain markets.

Read More: Daily Bias Trading Strategy

Tools and Techniques to Identify Trends

Technical Indicators

Identifying the types of trend in forex trading relies heavily on a variety of technical indicators. Here are some of the most effective tools:

- Moving Averages: Smooth out price fluctuations to reveal the underlying trend. Common choices include the 50-day and 200-day moving averages, which provide insights into medium and long-term trends.

- Trendlines: These are drawn manually on charts to connect significant lows (for uptrends) or highs (for downtrends), making the trend visually apparent.

- Bollinger Bands: These measure volatility and can signal when prices are likely to break out from a range-bound market.

- MACD and RSI: These oscillators help detect momentum shifts and potential reversals, adding another layer of confirmation to your trend analysis.

- Fibonacci Retracements: Often used to identify potential support and resistance levels during trend corrections, they help in understanding price retracements within a trend.

Chart Patterns

Chart patterns are an indispensable part of trend analysis. Recognizing these patterns can provide early signals about the type of trend in forex:

- Head and Shoulders: Typically indicates a trend reversal, suggesting that an uptrend might be shifting to a downtrend.

- Double Tops and Bottoms: Signal potential trend reversals and are useful in confirming a change in momentum.

- Triangles: Ascending or descending triangles often hint at upcoming breakouts or breakdowns.

- Flags and Pennants: Short-term continuation patterns that suggest the prevailing trend will continue after a brief consolidation period.

Volume Analysis

Volume analysis is a powerful technique to confirm the strength of the types of trend in forex trading. Consider the following:

- Volume Spikes: High trading volume during price movements strengthens the validity of the current trend.

- Divergence: When price trends move in one direction but volume trends in the opposite, it may indicate a weakening trend or a potential reversal.

- Trend Confirmation: Consistent volume increases during an uptrend or downtrend help validate the trend’s strength, providing traders with added confidence in their trading decisions.

Practical Applications: How to Use the Type of trend in forex Trading

Trading Strategies Tailored to Each Trend

Understanding the types of trend in forex trading enables you to customize your trading strategies. Here are some actionable strategies based on different market trends:

Uptrend Strategies

- Buy on Dips: Look for minor pullbacks during an uptrend as opportunities to enter long positions.

- Trend Continuation Trades: After a brief consolidation period, enter trades as the price breaks out in the direction of the uptrend.

- Utilize Breakout Strategies: Monitor key resistance levels. A breakout with high volume often signals that the uptrend will continue.

- Leverage Moving Average Crossovers: For example, a bullish golden cross can serve as a strong signal to initiate long trades.

Downtrend Strategies

- Sell on Rallies: In a downtrend, temporary price rallies can provide entry points for short positions.

- Bearish Reversal Confirmation: Use chart patterns like head and shoulders to identify potential continuations of the downtrend.

- Implement Stop-loss Strategies: Given the volatility in downtrends, it is critical to set tight stop-loss orders to protect your capital.

- Capitalize on Technical Indicators: A death cross or a bearish MACD crossover can offer compelling reasons to enter a short trade.

Sideways Market Strategies

- Range Trading: Buy near the lower support level and sell near the upper resistance level. This strategy works best when prices remain confined within a predictable range.

- Breakout and Breakdown Strategies: Prepare for potential breakouts by closely monitoring support and resistance levels. Once a breakout is confirmed, quickly adjust your strategy to ride the new trend.

- Oscillator-based Trading: Use oscillators such as the Stochastic Oscillator to determine overbought or oversold conditions, allowing you to time your trades more effectively.

Risk Management Techniques

No matter which type of trend in forex you are trading, risk management remains paramount. Here are some advanced risk management techniques:

- Position Sizing: Adjust the size of your trades based on the market’s volatility and the strength of the trend. Never risk more than a small percentage of your capital on a single trade.

- Stop-loss Orders: Set stop-loss orders at strategic points beyond key support or resistance levels to protect your capital in case of an unexpected market reversal.

- Diversification: Spread your investments across multiple currency pairs to minimize the risk associated with a single market event.

- Regular Review and Adjustment: Continually review your trading strategy and adjust it based on performance metrics and evolving market conditions.

Real-Life Case Studies and Examples

Consider a scenario where a trader uses a moving average crossover strategy in an uptrend. The trader observes that the 50-day moving average crosses above the 200-day moving average, signaling an emerging uptrend. With robust volume support and clear bullish chart patterns, the trader enters a long position, riding the wave of upward momentum. This practical application of the types of trend in forex trading demonstrates how technical indicators and market analysis can work together to create profitable trades.

Another example involves a trader navigating a downtrend in the AUD/USD pair. Recognizing a persistent pattern of lower highs and lower lows, the trader employs a short-selling strategy during brief rallies. By combining trendline analysis and MACD indicators, the trader identifies optimal entry points for short positions while mitigating risk through tight stop-loss orders. These real-life examples underline the importance of understanding the type of trend in forex for successful trade execution.

Read More: Trend Reversal Trading Strategy

Pro Tips for Advanced Traders

For those who already have a good grasp of forex trading basics, mastering the types of trend in forex trading can be a game-changer. Here are some pro tips to elevate your trading:

- Integrate Multiple Indicators: Don’t rely solely on one tool. Combine moving averages, RSI, MACD, and Bollinger Bands for a comprehensive analysis.

- Stay Ahead with Market News: Regularly monitor economic news and events. Real-time updates can alert you to sudden changes in trend direction.

- Refine Your Trading Journal: Maintain a detailed record of each trade, including the type of trend, technical indicators used, and the outcomes. This documentation can be invaluable for identifying patterns and improving your strategy.

- Experiment with AI-Powered Tools: Modern trading platforms offer innovative AI tools like market analyzers and predictive algorithms. These tools can forecast trend reversals and confirm the types of trend in forex trading with impressive accuracy.

- Backtest Your Strategies: Use historical data to simulate trades under various market conditions. This practice will help you identify the strengths and weaknesses of your strategy before applying it in a live market.

- Develop a Flexible Approach: Markets are dynamic. Be prepared to adjust your strategy as trends evolve, ensuring that you are always aligned with the current market momentum.

Opofinance: Your Partner in Navigating Forex Trends

When it comes to executing successful trades, partnering with a reliable broker is essential. For traders looking to maximize the benefits of mastering the types of trend in forex trading, consider an ASIC regulated opofinance broker. Their comprehensive suite of services is designed to support traders at every level. Here’s what opofinance offers:

- Advanced Trading Platforms:

Trade seamlessly on MT4, MT5, cTrader, and OpoTrade, ensuring you have the tools to analyze every type of trend in forex effectively. - Innovative AI Tools:

Utilize AI Market Analyzer, AI Coach, and AI Support to predict market trends and refine your trading strategies. - Social & Prop Trading:

Engage with a community of traders and benefit from social and proprietary trading solutions. - Secure & Flexible Transactions:

Enjoy safe, convenient deposit and withdrawal methods, including crypto payments, with zero fees.

Elevate your trading experience with opofinance—visit opofinance.com now and take advantage of these state-of-the-art features to dominate the market!

Conclusion

In conclusion, understanding the types of trend in forex trading is essential for any trader looking to achieve consistent success in the dynamic forex market. Whether you are trading an uptrend, downtrend, or a sideways market, being able to accurately identify and respond to these trends can significantly enhance your trading strategy. With the use of advanced technical indicators, chart patterns, and volume analysis, you can tailor your approach to match the prevailing market conditions. Always remember that risk management and continuous strategy refinement are key. Embrace these insights, implement the actionable strategies discussed, and take your trading to new heights with the support of advanced tools and platforms available through opofinance.

Key Takeaways

- Understand the Market: Recognize the distinct characteristics of uptrends, downtrends, and sideways trends.

- Use Advanced Tools: Leverage technical indicators like moving averages, RSI, MACD, and volume analysis to identify trends accurately.

- Tailor Your Strategy: Develop specific trading strategies for each type of trend in forex, ensuring you are positioned for success in any market condition.

- Risk Management is Crucial: Implement robust risk management techniques, including stop-loss orders and proper position sizing.

- Continuous Learning: Maintain a trading journal, stay updated on market news, and use AI-powered tools to refine your strategy.

- Broker Advantage: An ASIC regulated opofinance broker provides access to advanced trading platforms, innovative AI tools, and secure transactions to support your trading journey.

How do I adjust my trading strategy when the market shifts from an uptrend to a range-bound trend?

When transitioning from an uptrend to a sideways market, begin by reducing your trade sizes and shifting from momentum-based strategies to range trading. Focus on identifying strong support and resistance levels and be prepared for breakout opportunities. Additionally, consider using oscillators like the Stochastic Oscillator to signal potential changes in market sentiment.

What role do fundamental factors play in identifying the types of trend in forex trading?

Fundamental factors, such as economic indicators, geopolitical events, and interest rate decisions, can significantly impact market sentiment and cause shifts in trends. A strong economy may drive an uptrend, while economic downturns could trigger a downtrend. Combining fundamental analysis with technical indicators helps in validating the type of trend in forex and making more informed trading decisions.

Can I rely solely on automated trading systems to identify trends, or should I manually verify the data?

While automated trading systems can efficiently identify trends using technical indicators and historical data, it is essential to manually verify the data and remain aware of market conditions. A balanced approach—leveraging automation while incorporating manual oversight—ensures that you capture nuances and adjust for sudden market changes effectively.