Are you looking to dive into the fast-paced world of forex scalping? Mastering a USD/JPY scalping strategy could be your ticket to success in the forex market. This popular currency pair offers ample opportunities for quick profits, but it requires skill, precision, and the right approach. A well-executed USD/JPY scalping strategy can lead to consistent gains, making it an essential tool for day traders seeking to capitalize on short-term price movements.

To implement this strategy effectively, you’ll need a reliable online forex broker that can provide the speed and precision required for scalping. The right broker can make all the difference in your trading journey, offering tight spreads, fast execution, and robust trading platforms essential for successful scalping.

In this comprehensive guide, we’ll explore the ins and outs of USD/JPY scalping, equipping you with the knowledge and techniques to potentially boost your trading performance. From understanding the fundamentals of the currency pair to advanced scalping tactics, we’ll cover everything you need to know to start your USD/JPY scalping journey on the right foot.

Understanding USD/JPY and Scalping

What is USD/JPY?

USD/JPY represents the exchange rate between the United States dollar and the Japanese yen. As two of the world’s most traded currencies, this pair is known for its liquidity and volatility, making it an ideal candidate for scalping strategies. The USD/JPY pair is often referred to as the “gopher” in forex trading circles.

Several factors influence the USD/JPY exchange rate:

- Interest rate differentials between the US and Japan

- Economic indicators from both countries

- Geopolitical events affecting either nation

- Global risk sentiment (USD is often seen as a safe-haven currency)

- Bank of Japan interventions in the forex market

Defining Scalping in Forex

Scalping is a high-frequency trading strategy that aims to profit from small price movements within very short timeframes. Traders using this method open and close multiple positions throughout the day, often holding them for just a few minutes or even seconds.

Key characteristics of scalping include:

- High trade frequency (sometimes dozens or even hundreds of trades per day)

- Small profit targets (usually 5-20 pips per trade)

- Tight stop-loss orders to minimize risk

- Focus on highly liquid markets and timeframes

- Reliance on technical analysis and price action

Why Scalp USD/JPY?

- High liquidity: USD/JPY is one of the most traded currency pairs, ensuring easy entry and exit of positions.

- Consistent volatility: The pair often experiences enough price movement to create profitable opportunities for scalpers.

- Tight spreads: Due to its popularity, many brokers offer competitive spreads on USD/JPY.

- Well-regulated markets: Both the US dollar and Japanese yen are backed by stable economies and financial systems.

- Abundance of technical and fundamental analysis tools: Many traders focus on this pair, leading to a wealth of available resources and analysis.

Key Components of a Successful USD/JPY Scalping Strategy

Technical Analysis Tools

Moving Averages

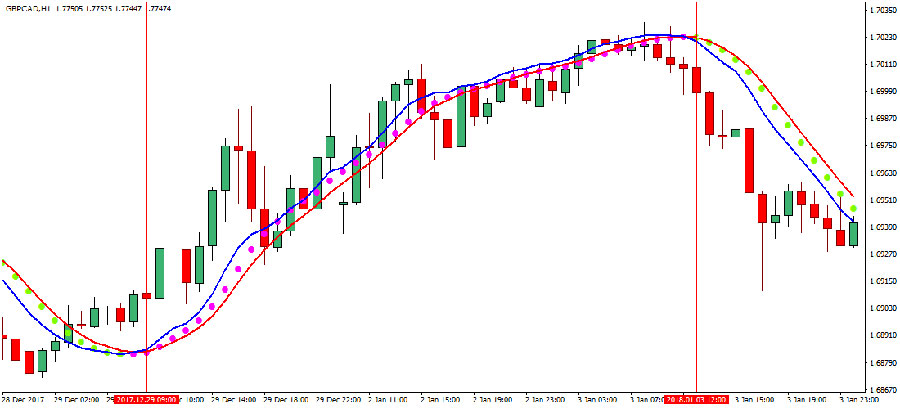

Moving averages help identify trends and potential entry/exit points. For USD/JPY scalping, consider using:

- 5 and 10-period Exponential Moving Averages (EMAs) for short-term trends

- 20 and 50-period EMAs for confirming broader market direction

Traders often look for crossovers between these moving averages as potential trade signals. For example, when the 5-period EMA crosses above the 10-period EMA, it might indicate a bullish move, while a crossover in the opposite direction could signal a bearish trend.

Bollinger Bands

Bollinger Bands can help identify overbought and oversold conditions, as well as potential breakouts. Use Bollinger Bands with a 20-period setting and 2 standard deviations for optimal USD/JPY scalping results.

Bollinger Bands consist of three lines:

- The middle band (20-period simple moving average)

- The upper band (2 standard deviations above the middle band)

- The lower band (2 standard deviations below the middle band)

Scalpers often look for price touches on the upper or lower bands as potential reversal points. Additionally, when the bands contract (known as the “Bollinger squeeze”), it often precedes a significant price move, which can be an excellent opportunity for scalpers.

Relative Strength Index (RSI)

The RSI is crucial for identifying momentum and potential reversal points. For USD/JPY scalping:

- Use a 14-period RSI

- Look for overbought conditions above 70 and oversold conditions below 30

Scalpers might consider entering short positions when the RSI moves above 70 and starts to decline, indicating a potential reversal. Conversely, long positions might be considered when the RSI dips below 30 and begins to rise.

MACD (Moving Average Convergence Divergence)

MACD helps confirm trend direction and momentum. For USD/JPY scalping:

- Use standard settings (12, 26, 9)

- Look for histogram changes and signal line crossovers

The MACD consists of two lines:

- The MACD line (difference between 12 and 26-period EMAs)

- The signal line (9-period EMA of the MACD line)

Scalpers often enter trades when the MACD line crosses above the signal line (bullish) or below it (bearish). The histogram can also provide valuable information about momentum strength.

Stochastic Oscillator

The Stochastic Oscillator is excellent for identifying potential reversals in USD/JPY. Use the following settings:

- %K period: 5

- %D period: 3

- Slowing: 3

This indicator helps identify overbought and oversold conditions, similar to the RSI. Scalpers might look for bullish trades when the Stochastic lines cross upwards below the 20 level, and bearish trades when they cross downwards above the 80 level.

Price Action Analysis

Support and Resistance Levels

Identifying key support and resistance levels is crucial for USD/JPY scalping. Pay close attention to psychological round numbers (e.g., 110.00, 115.50) as they often act as strong support or resistance.

To identify these levels:

- Look for areas where price has repeatedly reversed

- Use horizontal line tools on your charting platform

- Consider previous day’s high and low points

- Be aware of major pivot points

Scalpers often look to enter long positions near support levels and short positions near resistance levels, anticipating a bounce or rejection from these price points.

Candlestick Patterns

Familiarize yourself with important candlestick patterns such as:

- Doji: Indicates indecision and potential reversal

- Hammer and Inverted Hammer: Suggest potential bullish reversal

- Engulfing patterns: Strong reversal signals (bullish or bearish)

- Pin bars: Indicate rejection of certain price levels

These patterns can signal potential reversals or continuations in USD/JPY price action. Scalpers often use these patterns in conjunction with other technical indicators for confirmation before entering trades.

Trend Lines

Drawing accurate trend lines can help you identify the overall market direction and potential entry/exit points for your scalps. To draw effective trend lines:

- Connect at least two significant lows for an uptrend or highs for a downtrend

- Extend the line into the future

- Look for price reactions when it touches the trend line

Scalpers might look for buying opportunities when price touches an upward trend line or selling opportunities when it touches a downward trend line.

Read More: nasdaq scalping strategy

Chart Patterns

Look for common chart patterns that work well with USD/JPY scalping:

- Double tops and bottoms: Indicate potential trend reversals

- Head and shoulders: Another reversal pattern, often seen at market tops or bottoms

- Flag and pennant patterns: Continuation patterns that can signal brief pauses in the trend

Recognizing these patterns can help scalpers anticipate potential price movements and plan their entries and exits accordingly.

News and Economic Calendar Awareness

Stay informed about key economic releases affecting both the US dollar and Japanese yen. Always check the economic calendar before implementing your USD/JPY scalping strategy to avoid unexpected volatility during major news events.

Important economic indicators to watch include:

- Interest rate decisions by the Federal Reserve and Bank of Japan

- GDP releases

- Employment reports (e.g., US Non-Farm Payrolls)

- Inflation data (CPI, PPI)

- Retail sales figures

Consider adjusting your scalping strategy or avoiding trading altogether during high-impact news releases to manage risk effectively.

Scalping Strategies for USD/JPY

1. Momentum Scalping

Capitalize on strong short-term trends by entering in the direction of momentum and exiting quickly for small profits. This strategy involves:

- Identifying a strong price move using momentum indicators like RSI or MACD

- Entering a trade in the direction of the momentum

- Setting a tight stop-loss and a predefined take-profit level

- Exiting the trade quickly, usually within a few minutes

2. Range Scalping

Identify periods of consolidation and scalp between support and resistance levels within the range. This approach includes:

- Identifying a clear trading range using horizontal support and resistance lines

- Entering long trades near support and short trades near resistance

- Setting stop-losses just beyond the range boundaries

- Taking profits before price reaches the opposite end of the range

Read More: gbpusd scalping strategy

3. News Scalping

Take advantage of increased volatility during news releases, but be cautious of wider spreads and potential slippage. This strategy involves:

- Identifying high-impact news events on the economic calendar

- Waiting for the initial market reaction to the news

- Entering trades in the direction of the breakout

- Using wider stop-losses to account for increased volatility

- Taking profits quickly as price often retraces after the initial move

4. Trend-Following Scalping

Align your scalps with the overall trend direction for potentially higher probability trades. This method includes:

- Identifying the prevailing trend using higher timeframes (e.g., 15-minute or 1-hour charts)

- Looking for pullbacks or retracements on lower timeframes (e.g., 1-minute or 5-minute charts)

- Entering trades in the direction of the main trend when price shows signs of resuming the trend

- Setting stop-losses beyond recent swing highs/lows

- Taking profits at predetermined levels or when momentum starts to wane

5. Breakout Scalping

Enter trades as price breaks through key support or resistance levels, aiming to capture the initial move. This strategy involves:

- Identifying strong support and resistance levels

- Watching for price to approach these levels with increasing momentum

- Entering trades as price breaks through the level

- Setting a stop-loss just beyond the breakout point

- Taking profits quickly, as breakouts often experience quick retracements

Developing Your USD/JPY Scalping Strategy

Choose Your Timeframe

For USD/JPY scalping, focus on:

- 1-minute charts for ultra-short-term trades

- 5-minute charts for slightly longer scalps

- 15-minute charts for confirming broader market context

Consider using multiple timeframes to get a comprehensive view of the market. For example, use the 15-minute chart to identify the overall trend, the 5-minute chart for entry signals, and the 1-minute chart for precise entry and exit points.

Set Clear Entry and Exit Rules

Establish specific criteria for:

- Entry triggers (e.g., RSI crossovers, MACD signals)

- Take-profit levels (typically 5-10 pips)

- Stop-loss placement (2-5 pips, depending on volatility)

Having predefined rules helps remove emotion from your trading decisions and ensures consistency in your approach. Consider creating a trading plan that outlines these rules and stick to it rigorously.

Implement Proper Risk Management

- Limit risk to 1-2% of your account per trade

- Use a risk-reward ratio of at least 1:1.5

- Consider implementing a daily stop-loss to protect your account

Risk management is crucial in scalping due to the high frequency of trades. Always know your maximum allowable loss per trade and per day before you start trading.

Read More: xauusd scalping strategy

Practice and Refine

Continuous practice and refinement are crucial for success in USD/JPY scalping. Use a demo account to test and optimize your strategy before risking real capital. Keep a detailed trading journal to track your performance and identify areas for improvement.

Common Pitfalls to Avoid in USD/JPY Scalping

- Overtrading: Don’t force trades; wait for high-probability setups. Overtrading can lead to emotional decisions and increased transaction costs.

- Ignoring Transaction Costs: Factor in spreads and commissions when calculating potential profits. These costs can significantly impact your profitability in scalping.

- Emotional Trading: Stick to your predefined strategy and avoid impulsive decisions. Emotions like fear and greed can lead to poor trading choices.

- Neglecting Market Context: Always consider the bigger picture and overall market sentiment. A scalp trade against the broader trend may have a lower probability of success.

- Inadequate Technology: Ensure you have a reliable internet connection and trading platform. Even a few seconds of delay can make a significant difference in scalping.

- Lack of Adaptability: Be prepared to adjust your strategy as market conditions change. What works in one market environment may not work in another.

- Overleverage: Don’t risk more than you can afford to lose on a single trade. High leverage can lead to quick account depletion if not managed properly.

- Ignoring Correlation: Be aware of correlations between USD/JPY and other currency pairs or assets. For example, USD/JPY often has a negative correlation with gold prices.

OpoFinance Services: Your Trusted Partner for USD/JPY Scalping

When it comes to executing your USD/JPY scalping strategy, choosing the right broker is crucial. OpoFinance, an ASIC-regulated broker, offers a range of features tailored to meet the needs of scalpers:

- Lightning-fast execution speeds, essential for capturing small price movements

- Tight spreads on USD/JPY and other major pairs, reducing transaction costs

- Advanced charting tools and technical indicators for precise analysis

- Negative balance protection, ensuring you can’t lose more than your account balance

- 24/5 customer support to assist you with any issues or questions

Additionally, OpoFinance provides a cutting-edge social trading service, allowing you to learn from and copy the trades of successful USD/JPY scalpers. This feature can be particularly beneficial for those new to scalping or looking to refine their strategies. By observing and replicating the trades of experienced scalpers, you can gain valuable insights into effective trading techniques and risk management practices.

Conclusion

Mastering a USD/JPY scalping strategy can be a game-changer for forex day traders seeking consistent profits. By understanding the key components, implementing proven strategies, and avoiding common pitfalls, you can potentially enhance your trading performance. Remember, success in scalping requires discipline, patience, and continuous learning.

Always prioritize risk management and never risk more than you can afford to lose. With practice and dedication, you can develop a robust USD/JPY scalping strategy that aligns with your trading goals and risk tolerance. Stay informed about market conditions, continuously educate yourself on new trading techniques, and be prepared to adapt your strategy as needed.

As you embark on your USD/JPY scalping journey, remember that consistency is key. Focus on making small, regular profits rather than aiming for large, infrequent gains. Over time, these small wins can compound into significant returns. However, always be mindful of the risks involved and never trade with money you can’t afford to lose.

How much capital do I need to start scalping USD/JPY?

While there’s no fixed minimum, it’s generally recommended to start with at least $1,000 to $5,000. This allows for proper risk management and the ability to withstand potential losses. However, some brokers offer micro-lot trading, which can allow you to start with less capital. Always ensure you’re trading with funds you can afford to lose.

It’s important to note that the amount of capital you start with should be proportional to your risk tolerance and trading goals. A larger account balance provides more flexibility and the ability to weather drawdowns, but it’s crucial to develop your skills and prove your strategy’s effectiveness before committing substantial capital.

Is USD/JPY scalping suitable for beginners?

USD/JPY scalping can be challenging for beginners due to its fast-paced nature and the need for quick decision-making. However, with proper education, practice on a demo account, and a solid risk management plan, beginners can gradually develop the skills needed for successful scalping. It’s crucial to start small and focus on learning rather than profits initially.

How do I handle sudden spikes in volatility during USD/JPY scalping?

Sudden volatility spikes can be both an opportunity and a risk in USD/JPY scalping. To handle them effectively:

Use wider stop-losses during known high-volatility periods

Reduce your position size to manage risk

Be prepared to exit trades quickly if the market moves against you

Consider using guaranteed stop-loss orders if your broker offers them

Stay informed about potential market-moving events that could cause volatility