Have you ever wondered what position sizing means in forex? In essence, understanding position sizing in forex is crucial for managing risk and safeguarding your trading capital. This comprehensive guide explains exactly what position sizing in forex trading entails and provides clear answers to common questions such as “what does position sizing in forex mean?” and “how do you calculate position sizing in forex?”

Whether you are a beginner, an aspiring trader, or someone focused on risk management, this article will deliver practical insights into forex position sizing strategies while reinforcing the importance of effective risk control. Plus, if you’re in search of a trusted regulated forex broker, look no further—this guide even touches on how partnering with a dependable broker can support your journey. Let’s dive in and uncover the essential elements of position sizing in forex that can transform your trading strategy.

What Exactly is Position Sizing?

The question “what is position sizing in forex trading?” refers to the process of determining the optimal number of currency units to buy or sell on a given trade. Rather than choosing a lot size arbitrarily, effective position sizing involves a calculated approach that considers your overall account balance, risk tolerance, and stop-loss parameters. This methodology ensures that each trade is scaled appropriately so that you only expose a predetermined percentage of your capital to risk.

The Core Goal: Managing Risk Per Trade

When traders ask, “what does position sizing in forex mean?” they are seeking to understand how to protect their accounts from large losses. The primary goal of position sizing is to manage risk on a per-trade basis by limiting the potential loss to a small percentage of your trading capital. This disciplined approach prevents a single adverse trade from severely impacting your overall portfolio, thereby promoting long-term sustainability in forex trading.

Beyond Lot Size: It’s About Percentage and Control

Many novice traders mistakenly equate position sizing solely with selecting the right lot size. However, effective forex position sizing strategies focus on using a fixed percentage of your account—determined by factors such as stop-loss distance and market volatility—to decide the optimal trade size. By answering the question “what is position sizing in forex?” with an emphasis on percentage-based risk management, you gain greater control over your trades and improve your ability to adapt to dynamic market conditions.

Why is Position Sizing Crucial in Forex?

Mastering what position sizing means in forex trading is vital because it directly protects your trading capital. By calculating the correct position size, you ensure that no single trade has the potential to deplete your account. In volatile markets, where price swings can be drastic and unpredictable, disciplined position sizing helps maintain your financial safety net and prevents devastating losses.

Avoiding Margin Calls and Account Blowouts

Overleveraging is one of the common pitfalls in forex trading. Understanding how position sizing works in forex trading means you can avoid margin calls and account blowouts by keeping your exposure within manageable limits. By meticulously calculating your trade size, you safeguard your account from the severe repercussions of overexposure during adverse market conditions.

Consistent Risk Management for Sustainable Trading

A cornerstone of successful forex trading is consistent risk management. When you implement a disciplined approach to what position sizing in forex entails, you standardize your risk across all trades. This consistency not only protects your capital but also paves the way for a more sustainable trading strategy. Whether trading major pairs or more volatile exotic currencies, knowing how to calculate position sizing in forex allows you to adapt your risk management approach to different market environments.

Emotional Control: Trading Without Excessive Fear or Greed

Trading psychology plays a critical role in forex trading success. When you have a solid understanding of what position sizing in forex means, you can mitigate the emotional pressures of fear and greed. Knowing that only a small percentage of your account is at risk on each trade helps maintain discipline, enabling you to adhere to your trading plan even during periods of market turbulence.

Read More: Risk Management Techniques in Forex

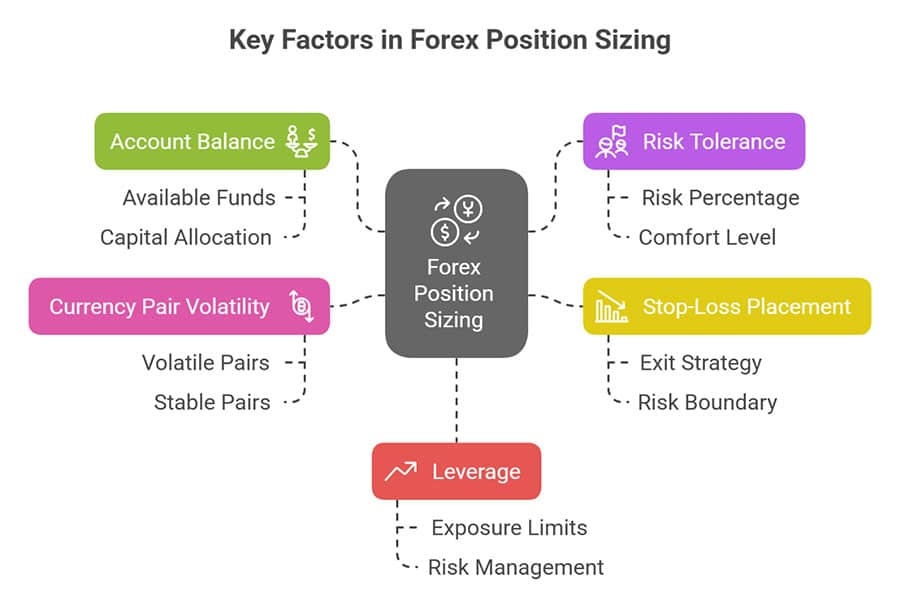

Key Factors in Forex Position Sizing

Account Balance: Your Starting Point

Every effective forex position sizing strategy starts with a clear assessment of your account balance. This total capital is the basis for calculating the appropriate risk per trade. When you know your available funds, you can accurately determine what position sizing in forex should look like for your unique financial situation.

Risk Tolerance: How Much Are You Willing to Lose?

Risk tolerance is a personal attribute that plays a pivotal role in defining what position sizing in forex means for you. Some traders prefer risking 1% of their account per trade, while others might be comfortable with a slightly higher or lower risk level. Understanding your risk tolerance allows you to tailor your forex position sizing strategies to match your individual comfort level and long-term financial objectives.

Stop-Loss Placement: Defining Your Exit Point

A well-defined stop-loss is integral to position sizing in forex trading. A stop-loss order determines the maximum loss you are willing to incur on a trade, and its placement directly impacts the calculation of your position size. By setting a proper stop-loss, you not only answer the question “how do you calculate position sizing in forex?” but also establish a clear risk boundary that protects your trading capital.

Currency Pair Volatility: Adapting to Market Swings

Different currency pairs have varying degrees of volatility. For example, highly volatile pairs like GBP/JPY require a more cautious approach compared to relatively stable pairs such as EUR/USD. Adjusting your position size to account for the volatility of the currency pair is an essential part of what position sizing in forex trading entails, ensuring that your risk remains controlled during market swings.

Leverage: Understanding Its Impact on Position Size

Leverage can amplify both gains and losses, making it a critical factor in what is position sizing in forex trading. Effective strategies incorporate leverage into the calculation of your trade size, ensuring that your exposure does not exceed safe limits. This understanding helps you answer practical questions such as “how do you calculate position sizing in forex?” while keeping your risk within manageable boundaries.

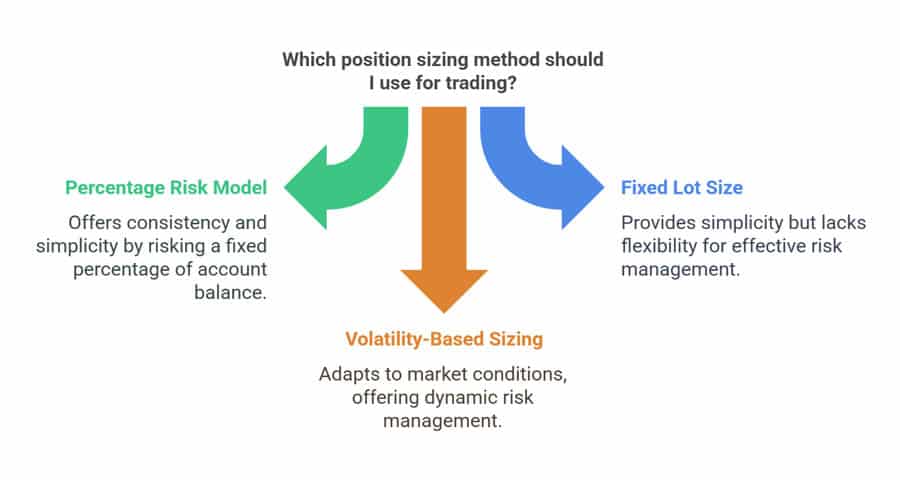

Common Position Sizing Methods

Percentage Risk Model: Risking a Fixed Percentage Per Trade

One of the most widely adopted methods in forex trading is the percentage risk model. This method involves risking a fixed percentage of your account balance on every trade. For instance, if you decide that position sizing in forex means risking 1% of your $10,000 account, you would risk $100 per trade. This approach provides consistency and simplicity, making it easier to adjust your position size as your account balance fluctuates.

Fixed Lot Size: Simplicity and Its Limitations

Some traders prefer using a fixed lot size for every trade. While this method is straightforward and easy to implement, it does not account for market volatility or changes in your account balance. Thus, while it answers the question “what is position sizing in forex?” in its simplest form, it often lacks the flexibility required for effective risk management in diverse market conditions.

Volatility-Based Sizing: Adjusting to Market Conditions

Volatility-based sizing is a more advanced method that adjusts your position size based on current market conditions. When markets are turbulent, you reduce your trade size to minimize risk, and when conditions are stable, you can afford to increase your position size. This adaptive approach exemplifies advanced forex position sizing strategies by directly addressing the need for dynamic risk management in response to market fluctuations.

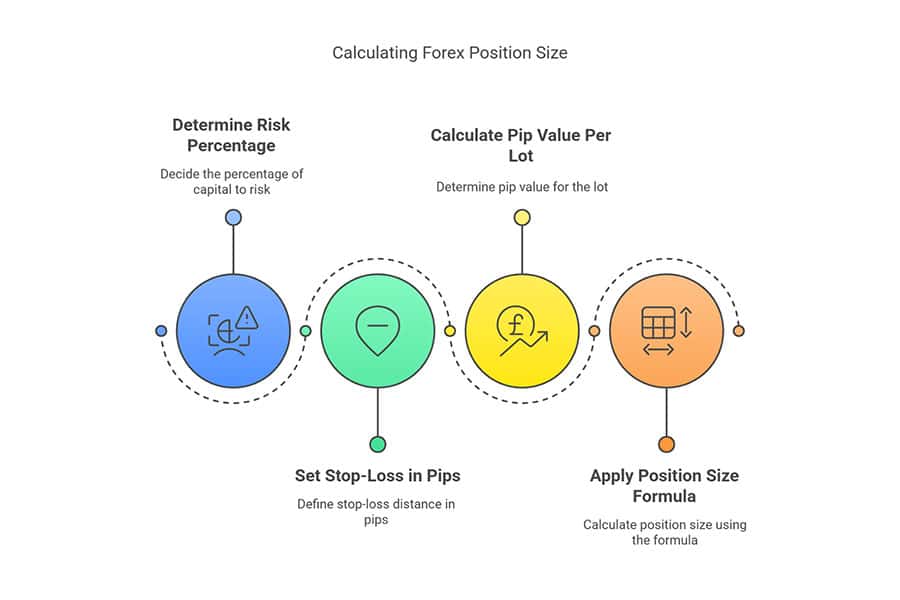

Step-by-Step Guide to Calculate Position Size (with Example)

Understanding how to calculate position sizing in forex is crucial for effective risk management. Follow these steps to determine the optimal trade size for your account:

1. Determine Your Risk Percentage

Decide on the percentage of your trading capital you are willing to risk on a single trade. For example, if you have a $10,000 account and choose to risk 1%, your risk per trade is $100. This initial step lays the foundation for all subsequent calculations.

2. Set Your Stop-Loss in Pips

Define your stop-loss level in pips, representing the distance from your entry point to the point where you will exit the trade to limit losses. The stop-loss distance is crucial for answering “how do you calculate position sizing in forex?” because it directly influences your risk calculation.

3. Calculate Pip Value Per Lot

Pip value is the monetary value associated with a one-pip movement in the currency pair you are trading. For a standard lot in many major pairs, one pip is typically worth $10, though this can vary. Confirming the pip value for your specific pair is essential for accurate calculations.

4. Apply the Position Size Formula

Use the following formula to determine your position size:

Position Size = (Account Risk in Dollars) / (Stop-Loss in Pips × Pip Value)

For example:

- Account Risk: $100 (1% of $10,000)

- Stop-Loss: 50 pips

- Pip Value: $10 per pip

Plug these numbers into the formula:

Position Size = $100 / (50 × $10) = $100 / $500 = 0.2 standard lots

This clear calculation demonstrates how to calculate position sizing in forex, ensuring that each trade is proportionate to your risk tolerance.

5. Real-World Example: Putting It All Together

Consider trading the EUR/USD pair with a $10,000 account and a 1% risk per trade. With a stop-loss of 50 pips and a pip value of $10 per standard lot, your calculation is as follows:

- Account risk = 1% of $10,000 = $100

- Stop-loss distance = 50 pips

- Pip value = $10 per pip

- Position size = $100 / (50 × $10) = 0.2 standard lots

This example clearly illustrates what position sizing in forex trading entails and provides a repeatable method for managing risk effectively.

Tips for Effective Position Sizing

To consistently succeed in forex trading, mastering the concept of position sizing in forex is essential. Here are some actionable tips to refine your approach:

- Start Conservatively: Begin with a conservative risk percentage, such as 1%, until you develop confidence in your trading strategy.

- Maintain Consistency: Apply your chosen method uniformly across all trades to ensure disciplined risk management.

- Adjust with Account Growth: Regularly recalculate your position size as your account balance changes to maintain a constant risk percentage.

- Utilize Technology: Leverage reliable position size calculators or trading software to reduce human error and maintain accuracy.

- Keep Emotions in Check: A disciplined approach to position sizing minimizes the influence of emotions like fear and greed on your trading decisions.

Read More: Is Forex a gamble?

Additional Insights and Value-Added Strategies

Successful forex traders integrate position sizing into their broader trading plans. Here are some advanced considerations to add value to your strategy:

- Diversification and Correlation:

Evaluate how multiple trades interact within your portfolio. Adjust your position sizes not only on individual trade risk but also based on correlations between different currency pairs. This diversification helps minimize systemic risk and protects your overall portfolio. - Dynamic Market Conditions:

Market conditions can change rapidly. By continuously monitoring economic indicators and news events, you can adjust your stop-loss and position sizing in real time. For example, during major economic announcements, you might reduce your position size to protect against sudden volatility. - Backtesting and Simulated Trading:

Before applying any new strategy with real money, backtest your position sizing method using historical data. This process helps you understand how your strategy would have performed in various market scenarios and builds confidence in your approach. - Trading Journals and Performance Reviews:

Maintain a detailed trading journal that records your position sizes, trade outcomes, and any adjustments made. Regularly reviewing this data allows you to refine your approach and learn from both successes and failures. - Stress Testing Your Strategy:

Conduct scenario analysis by simulating extreme market conditions. By stress testing your position sizing strategy, you can better prepare for worst-case scenarios, ensuring your risk management framework remains robust under pressure.

Case Study: Position Sizing in Action

Imagine a seasoned forex trader who meticulously follows a percentage risk model. Over a period of six months, this trader maintains a disciplined approach by risking only 1% per trade. During a period of heightened market volatility triggered by major geopolitical events, the trader notices increased fluctuations in several major currency pairs. By reducing the position size in anticipation of larger-than-normal price swings and subsequently adjusting stop-loss levels, the trader minimizes losses on several trades.

Despite a few short-term setbacks, the trader’s disciplined approach to position sizing ensures that overall portfolio losses remain contained, allowing for recovery and long-term profitability. This case study underlines the critical role that disciplined position sizing plays in safeguarding trading capital and promoting sustainable trading success.

Pro Tips for Advanced Traders

For those ready to take their strategy further, consider these advanced insights that enhance what position sizing in forex trading can do for you:

- Integrate Technical Analysis:

Use technical indicators like moving averages, RSI, and Bollinger Bands to adjust your position size dynamically based on market trends. - Backtest Rigorously:

Analyze historical market data to determine which position sizing methods yield the best risk-adjusted returns. - Employ Advanced Risk Metrics:

Consider metrics such as Value at Risk (VaR) and Conditional Value at Risk (CVaR) to better understand potential losses during extreme market conditions. - Dynamic Stop-Loss Management:

As trades move in your favor, consider trailing stop-loss orders to lock in profits while protecting against sudden reversals. - Monitor Economic Events:

Use economic calendars to anticipate market-moving events, allowing you to adjust your position sizes preemptively.

Read More: Risk management principles for both novice and advanced traders

Opofinance Services

Before we wrap up, it’s important to highlight a trusted partner that can elevate your trading experience. If you’re looking for an ASIC regulated opofinance broker with advanced technology and robust risk management tools, consider the services offered by opofinance.com. Here’s why traders choose opofinance:

- Advanced Trading Platforms: Trade seamlessly on MT4, MT5, cTrader, and OpoTrade for a superior trading experience.

- Innovative AI Tools: Enhance your decision-making with AI Market Analyzer, AI Coach, and AI Support.

- Social & Prop Trading: Enjoy secure and flexible transactions while tapping into collective market insights.

- Safe and Convenient Deposits/Withdrawals: Benefit from secure, fee-free deposits and withdrawals, including crypto payments.

- Reliable Regulation: Trade with confidence knowing your broker is fully regulated and committed to your financial safety.

Elevate your trading strategy today by partnering with opofinance. Visit opofinance.com now and experience the difference!

Conclusion

Understanding what position sizing in forex means is a game-changer for any trader. By learning how to calculate position sizing in forex and integrating robust forex position sizing strategies, you build a strong risk management framework that not only protects your capital but also optimizes your trading outcomes. Whether you’re asking “what is position sizing in forex?” or “what does position sizing in forex trading entail?”, the fundamental principles remain clear: protect your account, manage risk with precision, and maintain discipline regardless of market conditions. With the right approach, every trade becomes an opportunity to improve your skills and build a resilient trading strategy.

Key Takeaways

- Position Sizing in Forex: It’s the calculated process of determining the optimal trade size to manage risk effectively.

- Risk Management: Consistent use of position sizing strategies protects your trading capital by limiting risk per trade.

- Calculation Methods: Employ methods such as the percentage risk model, fixed lot sizing, or volatility-based sizing to tailor your approach.

- Dynamic Adjustments: Regular recalculations based on account balance and market conditions are essential for long-term success.

- Advanced Techniques: Pro tips include integrating technical analysis, rigorous backtesting, and dynamic stop-loss management.

- Trusted Partnerships: Partnering with a regulated forex broker like opofinance enhances your trading experience with advanced platforms and innovative AI tools.

- Continuous Improvement: Utilize trading journals, performance reviews, and stress testing to refine your position sizing strategy over time.

References: +

How do different trading styles affect the choice of position sizing in forex?

Different trading styles require tailored position sizing strategies. For example, day traders often use tighter stop-losses and smaller trade sizes due to rapid market movements, while swing traders may allow for wider stops, adjusting their position size accordingly.

Can automated systems effectively implement proper position sizing in forex trading?

Yes, automated trading systems can integrate sophisticated algorithms to determine the optimal position size. These systems continuously calculate risk based on real-time data, ensuring that position sizing in forex trading remains effective even during rapid market fluctuations.

What are the risks of neglecting proper position sizing in forex trading?

Neglecting proper position sizing can lead to overexposure, margin calls, and significant losses. Without a disciplined approach to managing trade size, traders may experience emotional stress, inconsistent performance, and a higher probability of deviating from their overall risk management plan.