Forex trading, known for its high volatility and potential for substantial returns, also carries significant risks. One of the key strategies employed by savvy traders to mitigate these risks is the 1% rule. The 1% rule trading strategy is a cornerstone of effective risk management, ensuring that traders limit their potential losses on any single trade. For traders seeking to implement this strategy effectively, selecting the right online forex broker plays a critical role. This article delves deeply into the 1% rule, exploring its application in position sizing, its critical role in risk management, the psychological benefits it offers, and how it can be integrated into advanced trading strategies.

What is the 1% Risk Rule?

The 1% risk rule in forex trading is a guideline suggesting that a trader should not risk more than 1% of their total trading capital on a single trade. This rule is designed to preserve capital and protect traders from the adverse effects of a series of losing trades. By adhering to this rule, traders can ensure that they remain in the game long enough to benefit from their winning trades and overall trading strategy.

Historical Context of the 1% Rule

The concept of risk management in trading has evolved over decades. The 1% rule emerged as part of a broader framework of risk management principles developed by professional traders and financial institutions. Historically, traders without a systematic approach to risk management often faced significant losses, leading to the adoption of more structured rules like the 1% risk rule. This rule has been endorsed by many successful traders and educators as a fundamental component of a disciplined trading strategy.

Application of the 1% Rule in Position Sizing

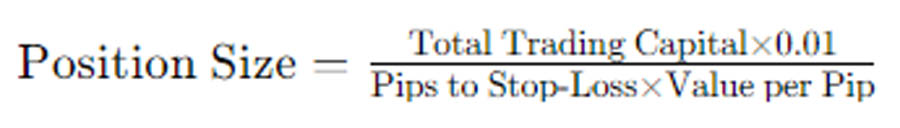

Position sizing is a critical aspect of forex trading, determining how much capital a trader allocates to a single trade. The 1% rule is instrumental in guiding position sizing decisions. Here’s how it works:

- Determine Total Trading Capital: Calculate your total available capital for trading.

- Calculate 1% of Trading Capital: This is the maximum amount you are willing to risk on any trade.

- Determine Stop-Loss Level: Decide on the stop-loss level for your trade, which is the price level at which you will exit the trade to limit your loss.

- Calculate Position Size: Use the 1% risk amount and the stop-loss level to determine the appropriate position size. The formula is:

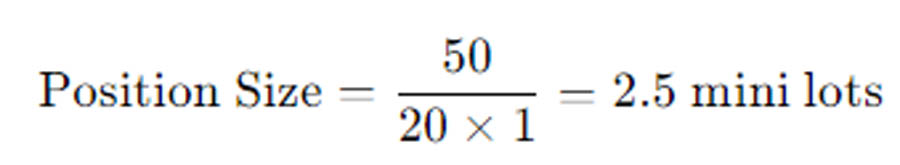

For instance, if your trading capital is $10,000, 1% of this is $100. If you set a stop-loss of 50 pips and each pip is worth $1, your position size would be:

By using this method, you ensure that you only risk a small, controlled portion of your capital on each trade.

Detailed Example of Position Sizing

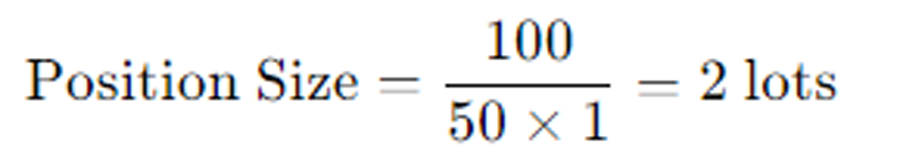

Consider a trader with a $50,000 account who wants to apply the 1% rule. Here’s a detailed breakdown:

- Trading Capital: $50,000

- 1% Risk Amount: $500

- Planned Trade: Buy EUR/USD

- Stop-Loss Level: 100 pips

- Value per Pip: $10 (for a standard lot)

The trader calculates the position size as follows:

This means the trader will open a position size of 0.5 standard lots to ensure that a 100-pip move against their position results in a maximum loss of $500.

Example Scenarios with Different Capital Sizes

- Small Account Example:

- Trading Capital: $5,000

- 1% Risk Amount: $50

- Stop-Loss Level: 20 pips

- Value per Pip: $1 (for a mini lot)

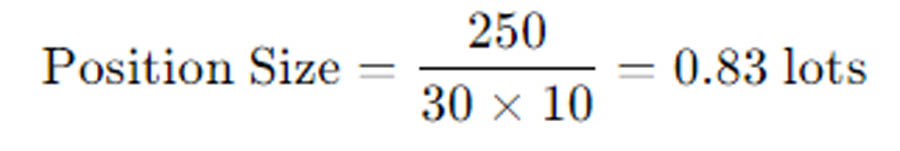

- Medium Account Example:

- Trading Capital: $25,000

- 1% Risk Amount: $250

- Stop-Loss Level: 30 pips

- Value per Pip: $10 (for a standard lot)

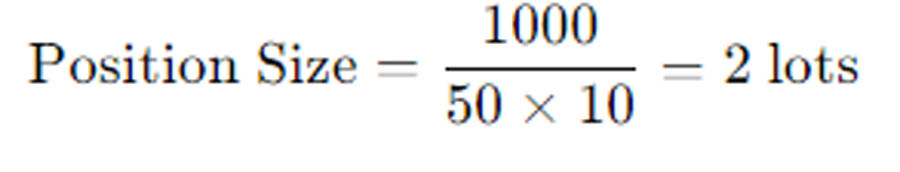

- Large Account Example:

- Trading Capital: $100,000

- 1% Risk Amount: $1,000

- Stop-Loss Level: 50 pips

- Value per Pip: $10 (for a standard lot)

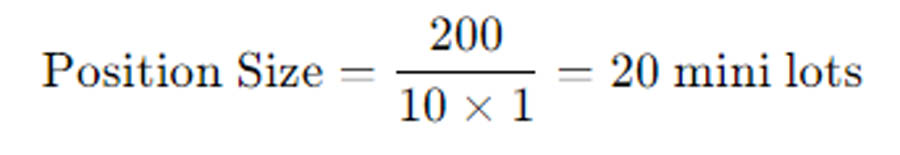

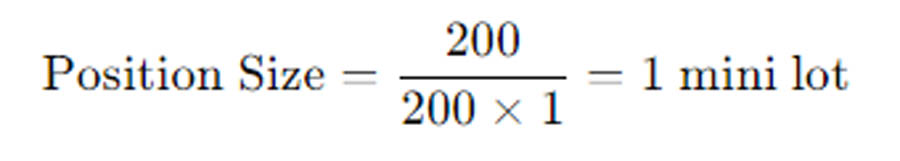

Additional Calculations for Various Stop-Loss Levels

Scenario 1: Tight Stop-Loss

- Trading Capital: $20,000

- 1% Risk Amount: $200

- Stop-Loss Level: 10 pips

- Value per Pip: $1 (for a mini lot)

Scenario 2: Wide Stop-Loss

- Trading Capital: $20,000

- 1% Risk Amount: $200

- Stop-Loss Level: 200 pips

- Value per Pip: $1 (for a mini lot)

By adjusting the stop-loss levels, traders can control the size of their positions to ensure that they remain within the 1% risk threshold.

Read more: Risk management principles

Importance of Risk Management and the 1% Risk Rule

Figure 1Importance of Risk Management and the 1% Risk Rule

Risk management is the backbone of successful forex trading. The 1% rule is a fundamental aspect of risk management for several reasons:

- Capital Preservation: By limiting losses to 1% per trade, traders can endure a series of losses without depleting their trading capital.

- Stress Reduction: Knowing that only a small portion of their capital is at risk reduces stress and emotional decision-making.

- Consistency: The 1% rule promotes a disciplined approach to trading, essential for long-term success.

- Survivability: In the volatile world of forex, survival is key. The 1% rule enhances a trader’s ability to stay in the market during downturns.

Read more: Margin in Forex

The Role of Stop-Loss Orders

Stop-loss orders are integral to implementing the 1% rule. A stop-loss order is a predetermined price level at which a trader will exit a losing position to prevent further losses. By setting a stop-loss, traders ensure that they adhere to the 1% risk rule, as it automatically limits the potential loss on a trade.

Comparison with Other Risk Management Strategies

- Fixed Dollar Risk: Some traders prefer to risk a fixed dollar amount on each trade, regardless of their account size. While this can be simpler, it doesn’t scale with the trader’s capital as effectively

as the 1% rule. The 1% rule adjusts risk based on the trader’s account size, ensuring that risk management remains proportionate and effective regardless of account growth or contraction.

- Fixed Percentage Risk: Similar to the 1% rule, but with varying percentages (e.g., 2% or 0.5%). The fixed percentage risk approach offers flexibility, allowing traders to adjust risk based on their confidence in a trade or market conditions. However, the 1% rule is often recommended for its conservative approach, especially for new traders.

- Kelly Criterion: A mathematical formula used to determine the optimal size of a series of bets to maximize wealth over time. While theoretically sound, the Kelly Criterion can lead to aggressive position sizing, which might not be suitable for all traders, particularly those with lower risk tolerance.

Psychological Benefits of Using the 1% Risk Rule

Figure 2Psychological Benefits of Using the 1% Risk Rule

Trading is as much a psychological endeavor as it is a technical one. The 1% rule offers significant psychological benefits:

- Reduced Emotional Impact: Limiting losses to 1% of the trading capital per trade helps mitigate the emotional impact of losing trades, making it easier for traders to maintain composure and stick to their trading plan.

- Increased Confidence: Knowing that losses are controlled allows traders to trade with greater confidence and less fear, which is crucial for executing trades based on sound analysis rather than emotions.

- Focus on Process Over Outcome: The 1% rule shifts the trader’s focus from individual trade outcomes to the overall trading process. This long-term perspective is vital for sustainable trading success.

- Prevention of Catastrophic Losses: By adhering to the 1% rule, traders can avoid catastrophic losses that can wipe out significant portions of their trading capital, preserving their ability to trade and recover from drawdowns.

Managing Trading Psychology

Implementing the 1% rule can significantly improve a trader’s psychological state by promoting a disciplined and structured approach to risk management. Here are some psychological benefits and techniques for maintaining emotional control:

Techniques for Maintaining Emotional Control

- Meditation and Mindfulness: Regular practice of meditation and mindfulness can help traders stay calm and focused, reducing the impact of emotional swings.

- Journaling: Keeping a trading journal to record emotions, decisions, and outcomes can provide valuable insights and help identify patterns in behavior.

- Regular Breaks: Taking regular breaks from the screen can prevent burnout and reduce stress, helping traders maintain a clear mind.

Advanced Trading Strategies According to the 1% Rule

The 1% rule is not just for beginners; it can be integrated into advanced trading strategies to enhance performance and manage risk. Here are some advanced techniques:

1. Scaling In and Out

Advanced traders can use the 1% rule to scale into and out of positions. By breaking a large position into smaller parts, they can enter or exit trades incrementally, managing risk more effectively. For example, instead of entering a full position at once, a trader might enter with half the position size and add to it as the trade moves in their favor.

2. Diversification

Traders can apply the 1% rule across multiple trades and currency pairs, diversifying their risk while still adhering to strict risk management principles. Diversification helps spread risk and reduces the impact of a single losing trade on the overall trading account.

3. Adjusting for Volatility

Sophisticated traders adjust their position sizes based on market volatility. Higher volatility might warrant smaller positions, while lower volatility allows for larger positions within the 1% risk framework. Volatility can be measured using indicators such as the Average True Range (ATR), which helps traders determine appropriate stop-loss levels.

4. Correlation Management

By understanding the correlations between different currency pairs, traders can avoid overexposure to correlated assets, further mitigating risk. For example, if a trader is long on both EUR/USD and GBP/USD, they need to be aware that these pairs are often positively correlated, meaning they might move in the same direction. Managing such correlations is crucial for effective risk management.

5. Risk-Reward Ratios

Incorporating the 1% rule with favorable risk-reward ratios enhances trading strategies. A risk-reward ratio of 1:2 or higher means that for every dollar risked, the potential reward is two dollars. By combining this with the 1% rule, traders can ensure that their winning trades more than compensate for their losing trades.

6. Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on predefined criteria. The 1% rule can be integrated into these algorithms to ensure that risk management principles are automatically applied, reducing the likelihood of human error.

Technical Analysis and the 1% Rule

Technical analysis involves using past price data and technical indicators to forecast future price movements. The 1% rule can be integrated with technical analysis in the following ways:

- Identifying Stop-Loss Levels: Use technical indicators such as moving averages, Bollinger Bands, or Fibonacci retracements to set stop-loss levels that align with the 1% rule.

- Entry and Exit Points: Combine the 1% rule with technical entry and exit signals to enhance precision and risk management.

- Pattern Recognition: Use chart patterns like head and shoulders, triangles, or double tops/bottoms to identify potential trades and apply the 1% rule to manage risk.

Fundamental Analysis and the 1% Rule

Fundamental analysis involves evaluating economic, financial, and other qualitative and quantitative factors to predict currency price movements. The 1% rule can be applied in fundamental analysis by:

- Event-Based Risk Management: Before major economic announcements (like interest rate decisions or GDP reports), adjust position sizes to adhere to the 1% rule, mitigating the risk of market volatility.

- Economic Indicators: Use fundamental data to inform trading decisions, ensuring that each trade still adheres to the 1% risk rule.

- Long-Term Trends: Combine long-term fundamental trends with the 1% rule to manage risk in longer-term positions.

Back testing the 1% Rule

Back testing involves applying a trading strategy to historical data to evaluate its effectiveness. Here’s how to back test the 1% rule:

- Historical Data: Gather historical price data for the currency pairs you trade.

- Simulated Trades: Apply your trading strategy to this data, ensuring that the 1% rule is followed for each trade.

- Analyze Results: Evaluate the performance, focusing on metrics like drawdowns, win/loss ratio, and overall profitability. Adjust the strategy as needed to improve results while adhering to the 1% rule.

Read more: Consistent Profits in Forex

Adapting the 1% Rule for Different Markets

While the 1% rule is particularly popular in forex trading, it can be adapted for other financial markets:

- Stocks: Apply the 1% rule to stock trading by calculating the risk per trade based on the stock’s volatility and your total capital.

- Commodities: Use the 1% rule in commodities trading by adjusting for the unique characteristics and volatility of each commodity.

- Cryptocurrencies: Given the high volatility of cryptocurrencies, the 1% rule can be crucial in managing risk and preserving capital.

Case Studies and Real-World Examples

Successful Traders Who Use the 1% Rule

- Trader A: With a $100,000 account, Trader A strictly adhered to the 1% rule. Over two years, despite experiencing a series of losses, the trader’s account grew by 25% annually due to disciplined risk management and consistent strategy application.

- Trader B: Starting with $50,000, Trader B initially ignored risk management principles, resulting in significant losses. After adopting the 1% rule, Trader B stabilized their performance and achieved a steady growth rate of 15% per year.

Analyzing Historical Trades with and without the 1% Rule

- Without the 1% Rule: Historical analysis of trades made without adhering to the 1% rule often shows larger drawdowns and higher volatility in account equity.

- With the 1% Rule: Trades made with the 1% rule show smoother equity curves, lower drawdowns, and more consistent performance, highlighting the effectiveness of disciplined risk management.

Detailed Back testing Example

To provide a more comprehensive understanding, let’s walk through a detailed backtesting example using the 1% rule:

Step 1: Gather Historical Data

Collect historical price data for a specific currency pair, such as EUR/USD, for the past five years.

Step 2: Define Trading Strategy

Develop a trading strategy that includes entry and exit signals, stop-loss levels, and the application of the 1% rule for position sizing.

Step 3: Simulate Trades

Apply the trading strategy to the historical data, ensuring that each trade follows the 1% rule. Record the results, including entry and exit prices, position sizes, and profits or losses.

Step 4: Analyze Results

Evaluate the performance of the trading strategy by analyzing key metrics such as:

- Win/Loss Ratio: The number of winning trades compared to losing trades.

- Average Win and Loss: The average profit or loss for winning and losing trades.

- Drawdown: The largest peak-to-trough decline in the trading account.

- Overall Profitability: The total profit or loss over the backtesting period.

By following these steps, traders can assess the effectiveness of the 1% rule in their trading strategy and make necessary adjustments to improve performance.

Conclusion

The 1% rule in forex trading is a powerful tool for managing risk, preserving capital, and maintaining emotional control. By limiting the potential loss on any single trade to 1% of the trading capital, traders can navigate the volatile forex market with greater confidence and consistency. Whether you are a beginner or an advanced trader, integrating the 1% rule into your trading strategy can significantly enhance your chances of long-term success. By understanding and applying this rule, along with other advanced risk management techniques, traders can build a solid foundation for sustainable and profitable trading.

How does the 1% rule apply to leveraged trading?

In leveraged trading, the 1% rule becomes even more critical due to the increased risk associated with leverage. Traders must calculate their position sizes carefully to ensure that the potential loss on a leveraged position does not exceed 1% of their total trading capital. This involves adjusting the position size based on the leverage ratio and the stop-loss level.

Can the 1% rule be used in day trading?

Yes, the 1% rule can be effectively applied in day trading. Day traders, who typically execute multiple trades within a single day, can use the 1% rule to manage risk on each trade. By limiting the risk to 1% of their trading capital per trade, day traders can prevent significant losses from any single trade, allowing them to maintain a steady and disciplined approach to their trading activities.

What are some common mistakes traders make when applying the 1% rule?

Some common mistakes include:

Not adhering strictly to the rule: Deviating from the 1% rule during periods of high confidence or desperation can lead to significant losses.

Incorrect position sizing: Failing to calculate the correct position size based on the stop-loss distance and the 1% risk amount.

Ignoring slippage: Not accounting for slippage, which can cause actual losses to exceed the 1% risk limit.

How can beginners start implementing the 1% rule?

Beginners can start by:

Educating themselves: Understanding the principles of risk management and the importance of the 1% rule.

Using demo accounts: Practicing the application of the 1% rule in a risk-free environment before trading with real money.

Consistently applying the rule: Ensuring that every trade adheres to the 1% risk limit, regardless of the market conditions or trading strategy.

Is the 1% rule applicable in automated trading systems?

Yes, the 1% rule can be integrated into automated trading systems. Traders can program their trading algorithms to automatically calculate position sizes and set stop-loss levels based on the 1% rule. This ensures that each trade adheres to the risk management principle, reducing the likelihood of human error and maintaining a disciplined approach to trading.