Are you ready to dive into the fast-paced world of XAUUSD scalping? If you’re a day trader looking to capitalize on minute price movements in the gold market, mastering a XAUUSD scalping strategy could be your ticket to consistent profits. Scalping XAUUSD, also known as gold scalping, involves making numerous quick trades to profit from small price fluctuations in the gold market. This high-frequency trading approach requires precision, discipline, and a deep understanding of market dynamics.

To succeed in XAUUSD scalping, you’ll need more than just a strategy – you’ll need a reliable online forex broker that can provide the speed and execution necessary for this intense trading style. In this comprehensive guide, we’ll explore the ins and outs of XAUUSD scalping, equipping you with the knowledge and tools to develop a winning strategy.

We’ll cover everything from the basics of gold trading to advanced scalping techniques, common pitfalls to avoid, and how to choose the right broker for your scalping needs. Whether you’re a seasoned trader looking to refine your skills or a newcomer eager to explore the potential of XAUUSD scalping, this article will provide valuable insights to help you navigate the golden waters of forex trading.

Understanding XAUUSD and Scalping

What is XAUUSD?

XAUUSD is the symbol used in forex trading to represent the exchange rate between gold and the US dollar. In simpler terms, it tells you how many US dollars it takes to buy one troy ounce of gold. Gold, often considered a safe-haven asset, plays a crucial role in the global financial markets. Its price is influenced by various factors, including economic conditions, geopolitical events, and currency fluctuations.

Gold has been a valuable commodity for thousands of years, prized for its rarity, beauty, and usefulness in various industries. In modern financial markets, gold serves as a hedge against inflation and economic uncertainty, making it a popular asset for investors and traders alike.

Defining Scalping as a Trading Method

Scalping is a trading strategy that aims to profit from small price movements by making numerous trades within a short time frame. Scalpers typically hold positions for a few seconds to minutes, rarely longer than an hour. The goal is to accumulate small profits from each trade, which can add up to significant gains over time.

This high-frequency trading approach requires:

- Quick decision-making skills

- Excellent analytical abilities

- Strong emotional control

- Advanced trading tools and platforms

- A deep understanding of market microstructure

Why Scalp XAUUSD?

There are several compelling reasons why traders choose to scalp XAUUSD:

- Liquidity: The gold market is highly liquid, meaning there are always buyers and sellers ready to trade. This ensures quick execution of trades, which is crucial for scalping.

- Volatility: Gold prices can be quite volatile, especially during key economic releases or geopolitical events. This volatility creates opportunities for scalpers to profit from short-term price movements.

- Popularity: Gold is a widely traded asset, which means there’s ample market analysis and information available to inform trading decisions.

- 24-hour market: The gold market operates 24 hours a day, five days a week, providing ample opportunities for traders in different time zones.

- Technical analysis applicability: Gold prices often respect technical indicators and chart patterns, making it suitable for scalpers who rely heavily on technical analysis.

- Global economic indicator: Gold prices often reflect global economic health, providing insights into broader market trends.

- Portfolio diversification: For traders managing a diverse portfolio, gold scalping can offer a unique opportunity to balance risk and reward.

Key Components of a Successful XAUUSD Scalping Strategy

To develop a robust XAUUSD scalping strategy, you need to master several key components:

Technical Analysis Tools

- Moving Averages: These indicators help identify trends and potential support/resistance levels. Scalpers often use short-term moving averages (e.g., 5, 10, or 20 periods) to spot quick trend changes.

- Bollinger Bands: These bands help identify overbought or oversold conditions and potential breakouts. Scalpers look for price touches on the upper or lower bands for potential reversal trades.

- Relative Strength Index (RSI): This momentum oscillator helps identify overbought or oversold conditions. Scalpers might look for divergences between price and RSI for potential trade entries.

- MACD (Moving Average Convergence Divergence): This indicator helps identify trend direction and momentum. Scalpers can use MACD histogram for quick momentum shifts.

- Stochastic Oscillator: This indicator helps identify potential reversal points by comparing the closing price to the price range over a specific period.

- Fibonacci Retracements: These levels can help identify potential support and resistance areas, which are crucial for setting entry and exit points in scalping trades.

- Volume Indicators: Volume can confirm trend strength and potential reversals, providing additional context for scalping decisions.

Read More: dow jones scalping strategy

Price Action Analysis

- Support and Resistance Levels: Identifying key price levels where the market has previously reversed can provide valuable entry and exit points for scalpers.

- Candlestick Patterns: Recognizing patterns like doji, engulfing, or pin bars can signal potential reversals or continuations in short-term price action.

- Trend Lines: Drawing trend lines can help scalpers identify the overall direction of the market and potential areas for trade entries.

- Chart Patterns: Spotting patterns like triangles, flags, or double tops/bottoms can provide scalpers with high-probability trade setups.

- Price Gaps: Identifying and trading gaps can be a lucrative strategy, especially during market openings or significant news events.

- Momentum Analysis: Recognizing periods of strong price momentum can help scalpers ride short-term trends for quick profits.

News and Economic Calendar Awareness

While technical analysis forms the backbone of most XAUUSD scalping strategies, being aware of important news events and economic releases is crucial for managing risk and avoiding potential pitfalls. Major economic indicators like GDP, employment reports, or central bank decisions can cause significant volatility in gold prices, presenting both opportunities and risks for scalpers.

Key economic events to watch for XAUUSD scalping include:

- Federal Reserve announcements

- Non-Farm Payrolls (NFP) reports

- Inflation data releases

- Geopolitical events affecting global economic stability

- Major central bank policy decisions

Being aware of these events can help scalpers adjust their strategies or avoid trading during potentially volatile periods.

XAUUSD Scalping Strategies

Now that we’ve covered the key components, let’s explore some specific XAUUSD scalping strategies:

1. Momentum Scalping

This strategy involves identifying and trading in the direction of strong price movements. Scalpers look for signs of momentum using indicators like RSI or MACD, entering trades when the momentum is strong and exiting quickly when it shows signs of weakening.

Key steps in momentum scalping:

- Identify the overall trend using longer-term charts

- Look for strong moves in the trend direction on shorter timeframes

- Enter trades when momentum indicators confirm the move

- Set tight stop-losses and take-profit levels

- Exit trades at the first sign of momentum weakening

2. Range Scalping

When XAUUSD is trading within a defined range, scalpers can profit by buying near support levels and selling near resistance levels. This strategy requires quick identification of range-bound conditions and precise entry/exit timing.

Implementing range scalping:

- Identify clear support and resistance levels

- Wait for price to approach these levels

- Look for confirming signals (e.g., candlestick patterns) before entering

- Set stop-losses just beyond the support/resistance level

- Take profits before price reaches the opposite end of the range

3. News Scalping

This high-risk, high-reward strategy involves trading during major news releases affecting gold prices. Scalpers aim to capitalize on the increased volatility and potential price gaps that occur immediately after news announcements.

News scalping tips:

- Stay informed about upcoming economic releases

- Prepare multiple scenarios based on potential outcomes

- Enter trades quickly after the news release

- Use wider stop-losses to account for increased volatility

- Be prepared to exit trades rapidly if the market moves against you

Read More: eur usd scalping strategy

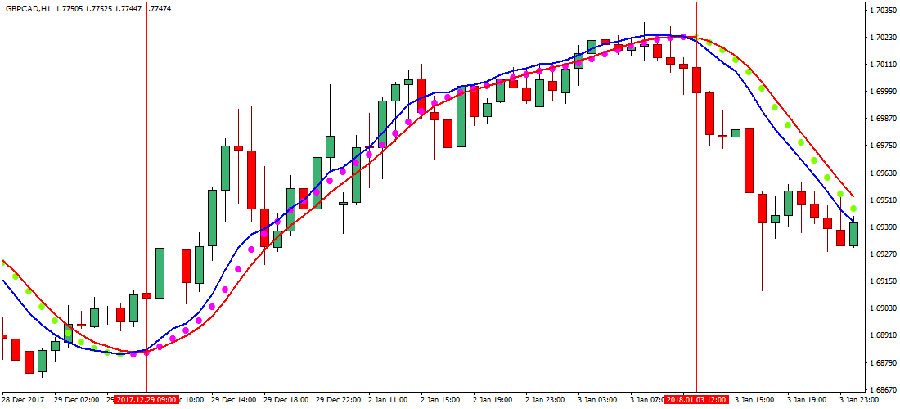

4. Trend-Following Scalping

In this approach, scalpers identify the overall trend using longer-term moving averages and then look for short-term pullbacks to enter trades in the direction of the main trend. This strategy can be particularly effective during strong trending markets.

Trend-following scalping process:

- Identify the main trend using higher timeframe charts

- Switch to lower timeframes to spot pullbacks

- Use oscillators to identify oversold/overbought conditions in counter-trend moves

- Enter trades in the direction of the main trend when the pullback shows signs of ending

- Trail stops to protect profits as the trade moves in your favor

5. Breakout Scalping

Breakout scalpers look for price movements that break through significant support or resistance levels, indicating the start of a new trend. Quick entries and tight stop-losses are crucial for this strategy to be successful.

Executing breakout scalps:

- Identify key support and resistance levels

- Watch for increasing volume as price approaches these levels

- Enter trades when price decisively breaks through the level

- Set stop-losses just below the breakout level for buys (or above for sells)

- Take profits quickly, as breakouts can often retrace

Developing Your XAUUSD Scalping Strategy

Creating a successful XAUUSD scalping strategy requires careful planning and continuous refinement. Here are some steps to guide you:

1. Choose Your Timeframe

Decide on the timeframe you’ll focus on for your scalping activities. Most XAUUSD scalpers work with 1-minute or 5-minute charts, but some may use 15-minute charts for a slightly longer-term perspective.

Consider these factors when selecting your timeframe:

- Your reaction speed and decision-making abilities

- The average volatility of XAUUSD during your trading hours

- Your risk tolerance and profit expectations

- The transaction costs associated with your chosen broker

2. Set Clear Entry and Exit Rules

Define specific conditions for entering and exiting trades. This might include particular indicator readings, price action patterns, or a combination of factors. Having clear rules helps maintain discipline and consistency in your trading.

Example of entry rules:

- Price breaks above a specific moving average

- RSI crosses above 50 from oversold territory

- MACD histogram turns positive

Example of exit rules:

- Fixed pip target is reached

- Trailing stop is hit

- Opposite entry signal appears

Read More: usd jpy scalping strategy

3. Implement Proper Risk Management

Determine your risk tolerance and set appropriate stop-loss and take-profit levels for each trade. A common rule of thumb is to risk no more than 1-2% of your trading account on any single trade.

Risk management considerations:

- Use a positive risk-reward ratio (e.g., risking 5 pips to gain 10 pips)

- Adjust position sizes based on market volatility

- Set daily loss limits to protect your account

- Use guaranteed stop-losses when available to protect against slippage

4. Practice and Refine

Start by paper trading or using a demo account to test your strategy without risking real money. Keep detailed records of your trades and analyze your performance regularly. Use this data to refine and improve your strategy over time.

Steps for strategy refinement:

- Track key metrics like win rate, average profit/loss, and maximum drawdown

- Identify patterns in your winning and losing trades

- Adjust your strategy based on your findings

- Gradually increase your position sizes as you gain confidence and consistency

Common Pitfalls to Avoid in XAUUSD Scalping

While XAUUSD scalping can be profitable, it’s not without risks. Here are some common pitfalls to be aware of:

- Overtrading: The fast-paced nature of scalping can lead to excessive trading, resulting in higher transaction costs and potential burnout.

- Ignoring Transaction Costs: Frequent trading means more commissions and spreads, which can eat into your profits if not carefully managed.

- Emotional Trading: The rapid decision-making required in scalping can lead to emotional reactions. Stick to your strategy and avoid impulsive trades.

- Neglecting Market Context: While focusing on short-term movements, don’t lose sight of the bigger picture and overall market trends.

- Inadequate Technology: Scalping requires fast execution and real-time data. Ensure your trading platform and internet connection are up to the task.

- Lack of Adaptability: Market conditions change quickly. Be prepared to adjust your strategy or sit out when conditions are unfavorable.

- Overleverage: The allure of quick profits can tempt traders to use excessive leverage, amplifying both gains and losses.

- Ignoring Correlation: Gold prices can be influenced by movements in other markets, such as currencies or stock indices. Be aware of these correlations.

- Failing to Manage Stress: Scalping can be mentally and emotionally demanding. Develop techniques to manage stress and maintain focus during trading sessions.

- Neglecting Continuous Learning: Markets evolve, and so should your strategies. Stay informed about new trading techniques and market developments.

OpoFinance Services: Your Partner in XAUUSD Scalping

When it comes to executing your XAUUSD scalping strategy, choosing the right broker is crucial. OpoFinance, an ASIC-regulated broker, offers a range of features that make it an excellent choice for gold scalpers:

- Lightning-fast execution speeds to capitalize on fleeting opportunities

- Tight spreads on XAUUSD to minimize transaction costs

- Advanced charting tools and technical indicators for precise analysis

- Robust risk management features to protect your capital

- 24/7 customer support to address any issues promptly

Moreover, OpoFinance offers a unique social trading service, allowing you to learn from and copy the trades of successful XAUUSD scalpers. This feature can be particularly valuable for newcomers looking to gain insights into effective scalping techniques or for experienced traders seeking to diversify their strategies.

Benefits of Social Trading for XAUUSD Scalpers

- Learn from Experienced Traders: Observe the strategies and decision-making processes of successful XAUUSD scalpers in real-time.

- Diversify Your Approach: Copy trades from multiple traders to create a diversified scalping portfolio.

- Save Time: Benefit from the expertise of others while you continue to develop your own skills.

- Risk Management: Set limits on how much capital you allocate to copy trading to manage your overall risk exposure.

- Performance Analysis: Evaluate the historical performance of traders before deciding to copy their trades.

By leveraging OpoFinance’s advanced trading platform and social trading features, you can enhance your XAUUSD scalping strategy and potentially improve your trading results.

Conclusion

Mastering XAUUSD scalping strategy requires a combination of technical skills, market knowledge, and disciplined execution. By understanding the intricacies of gold trading, leveraging powerful technical analysis tools, and implementing sound risk management practices, you can develop a strategy that suits your trading style and goals.

Remember, successful scalping is not just about making quick profits – it’s about consistent performance over time. Continual learning, practice, and adaptation are key to long-term success in the fast-paced world of XAUUSD scalping.

As you embark on your XAUUSD scalping journey, always prioritize responsible trading. Start small, use demo accounts to refine your strategy, and never risk more than you can afford to lose. With patience, persistence, and the right approach, you can unlock the potential of XAUUSD scalping and take your trading to new heights.

How much capital do I need to start XAUUSD scalping?

The capital required for XAUUSD scalping can vary depending on your broker’s requirements and your risk management strategy. While some brokers offer micro-lots that allow you to start with as little as $100, it’s generally recommended to have at least $1,000 to $5,000 to effectively manage risk and withstand potential drawdowns. Remember, it’s not just about the minimum requirement – having more capital can provide a buffer against losses and allow for more strategic position sizing.

Can I use automated trading systems for XAUUSD scalping?

Yes, automated trading systems, also known as Expert Advisors (EAs) or trading bots, can be used for XAUUSD scalping. These systems can execute trades based on pre-programmed rules, potentially offering faster reaction times than manual trading. However, it’s crucial to thoroughly backtest and forward test any automated system before using it with real money. Additionally, keep in mind that market conditions change, so regular monitoring and adjustments to your automated strategy may be necessary.

How do I handle slippage in XAUUSD scalping?

Slippage, which occurs when the execution price differs from the expected price, can be particularly problematic in scalping due to the small profit targets. To handle slippage:

Use a broker known for fast execution and low slippage.

Avoid trading during major news releases when slippage is more likely.

Use limit orders instead of market orders when possible.

Factor potential slippage into your risk management calculations.

Consider widening your profit targets slightly to account for occasional slippage.