Forex trading, the practice of buying and selling currencies in the foreign exchange market, is a popular venture for those looking to make a profit through currency fluctuations. However, one of the most common questions asked by potential traders is, “Is forex trading hard?” The short answer is yes; forex trading can be hard. Working with a regulated forex broker can make a significant difference in ensuring a secure and transparent trading experience. This article will delve into the complexities of the forex market, the learning curve for beginners, the psychological challenges, and the importance of effort, consistency, and realistic expectations. We’ll also provide case studies and examples to illustrate these points.

The Complexities of the Forex Market

Understanding Market Dynamics

The forex market is vast, decentralized, and operates 24 hours a day, five days a week. This continuous operation provides ample opportunities but also adds layers of complexity. Unlike the stock market, which has set trading hours, forex trading requires traders to be aware of market openings and closings across different time zones. Major trading sessions include those in New York, London, Tokyo, and Sydney, each contributing to varying degrees of market activity and volatility.

Case Study: Trading During Different Sessions

John, a beginner trader, started trading forex without understanding the different market sessions. He often traded during the Asian session, expecting the same volatility he observed during the London session. As a result, his strategies failed due to lower liquidity and smaller price movements. After adjusting his trading schedule to align with the London and New York sessions, he noticed improved results.

Leverage: A Double-Edged Sword

One of the unique aspects of forex trading is leverage, which allows traders to control large positions with relatively small amounts of capital. While leverage can amplify profits, it also significantly increases the risk of substantial losses. Novice traders often underestimate the power of leverage, leading to mistakes that can quickly wipe out their trading accounts.

Example: The Dangers of Overleveraging

Sarah, a new trader, used maximum leverage offered by her broker to increase her potential profits. Initially, she saw some gains, but a sudden market downturn wiped out her account within minutes. This experience taught her the importance of using leverage cautiously and implementing strict risk management strategies.

Impact of News and Economic Events

The forex market is highly sensitive to global news and economic events. Economic indicators such as GDP, employment figures, interest rates, and geopolitical events can cause sudden and significant price movements. Traders must constantly monitor the news and be able to interpret how different events might impact currency values.

Case Study: Trading the Brexit Referendum

During the Brexit referendum, the GBP/USD pair experienced extreme volatility. Traders who anticipated a “Remain” vote were caught off guard by the “Leave” result. Tom, a trader with a short position on GBP/USD, capitalized on the market’s reaction, while others faced significant losses. This event underscored the importance of being prepared for unexpected outcomes in forex trading.

Market Manipulation

Given its size and the involvement of large financial institutions, the forex market is not immune to manipulation. While regulatory bodies strive to maintain market integrity, instances of price manipulation can still occur, adding another layer of difficulty for traders.

Liquidity and Market Depth

The forex market is known for its high liquidity, especially for major currency pairs. However, liquidity can vary significantly during different times of the day and in response to global events. Understanding market depth and how liquidity impacts price movements is crucial for effective trading.

Currency Pairs and Their Characteristics

Different currency pairs exhibit unique behaviors and volatility patterns. Major pairs like EUR/USD or GBP/USD are typically less volatile compared to exotic pairs. Traders must understand the specific characteristics and historical performance of the currency pairs they are trading to make informed decisions.

The Role of Brokers and Trading Platforms

Brokers and trading platforms play a significant role in forex trading. Selecting a reliable broker with competitive spreads, robust trading platforms, and excellent customer support is crucial. Traders must also be aware of the different types of brokers, such as market makers and ECN brokers, and how their operations can impact trading conditions.

Read more: Market Makers in Forex

Case Study: Choosing the Right Broker

Lisa, an aspiring forex trader, initially chose a broker based solely on low spreads. However, she soon realized that the broker’s trading platform was unreliable, often freezing during high volatility periods. After switching to a broker with a more robust platform and better customer service, her trading experience improved significantly.

Acquiring Technical Knowledge

Learning forex trading involves mastering technical analysis, which includes understanding charts, patterns, and indicators. Tools such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) are essential for making informed trading decisions. Beginners need to invest significant time in learning how to interpret these tools effectively.

Read more: Forex Trading

Example: Using Technical Indicators

Jane, a novice trader, struggled initially with identifying trading opportunities. After spending time learning about technical indicators like the MACD and RSI, she started using these tools to identify potential entry and exit points. Her trading performance improved as she gained confidence in her technical analysis skills.

Understanding Fundamental Analysis

In addition to technical analysis, traders must grasp fundamental analysis, which involves evaluating economic indicators, political stability, and other factors that can affect currency prices. This dual analysis approach can be overwhelming for newcomers.

Developing a Trading Strategy

A successful trader needs a well-defined trading strategy that outlines entry and exit points, risk management, and position sizing. Developing and refining a strategy that consistently works in different market conditions requires extensive practice and patience.

Simulated Trading

Many beginners start with simulated trading accounts, also known as demo accounts. These accounts allow traders to practice without risking real money. While beneficial, simulated trading lacks the emotional intensity of real trading, which can lead to a false sense of security.

Continuous Education

Forex trading is not a static field. Continuous education through webinars, courses, and reading up-to-date market analysis helps traders stay informed about the latest strategies and market conditions. Keeping abreast of changes in market dynamics is crucial for long-term success.

Mentorship and Community Support

Joining trading communities and seeking mentorship can significantly enhance a beginner’s learning curve. Experienced traders can offer valuable insights, share their strategies, and provide feedback on trade ideas, helping newcomers avoid common pitfalls.

Read more: How Long Does It Take to Learn Forex?

Case Study: Learning from a Mentor

Alex, a beginner trader, joined a forex trading community and found a mentor who guided him through the initial learning phase. The mentor’s experience and advice helped Alex avoid common mistakes and develop a more disciplined approach to trading. This support system accelerated his learning and improved his trading performance.

The Role of Automated Trading Systems

Automated trading systems, or forex robots, can assist beginners by executing trades based on predefined criteria. While these systems can reduce emotional bias and improve consistency, they require careful monitoring and adjustment to ensure they remain effective under different market conditions.

Importance of Practice and Backtesting

Practicing trading strategies through demo accounts and backtesting them on historical data is essential for beginners. This process helps traders understand how their strategies perform under various market conditions and make necessary adjustments.

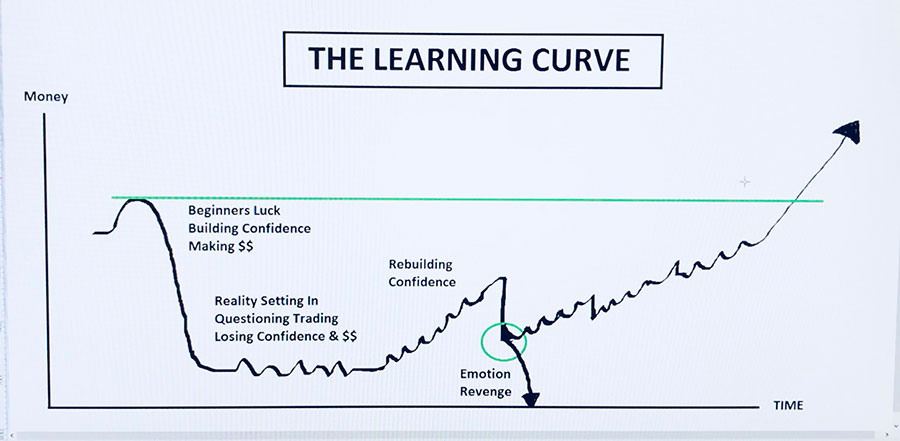

Building Confidence

Confidence in trading comes from knowledge and experience. As beginners practice and refine their strategies, their confidence grows, enabling them to make better trading decisions.

Psychological Preparedness

Understanding the psychological aspects of trading, such as managing emotions and dealing with stress, is crucial for beginners. Developing a strong mental framework can help traders stay disciplined and focused, even during challenging times.

The Role of Technology in Learning

Technology has made learning forex trading more accessible. Online courses, webinars, and trading simulators provide beginners with valuable resources to build their skills and knowledge. Utilizing these tools can accelerate the learning process.

Challenges of Forex Psychology

Emotional Discipline

Emotional discipline is one of the biggest challenges in forex trading. The market’s volatility can lead to emotional reactions such as fear and greed, which can cloud judgment and lead to impulsive decisions. Successful traders must learn to manage their emotions and stick to their trading plan, even during periods of loss.

Coping with Losses

Losses are inevitable in forex trading. The ability to accept and learn from losses without becoming discouraged is crucial. Many traders struggle with this aspect, leading to a cycle of revenge trading, where they make increasingly risky trades to recover losses, often resulting in further losses.

Example: The Consequences of Revenge Trading

Mike, an experienced trader, faced a significant loss after a poor trade. Instead of stepping back and analyzing his mistake, he immediately entered another trade to recover his losses. This revenge trading led to even greater losses, highlighting the importance of emotional control and sticking to a trading plan.

Maintaining Focus and Patience

Forex trading requires constant vigilance and the ability to wait for the right opportunities. The market does not always present clear signals, and traders must be patient and avoid the temptation to trade excessively.

Managing Stress

The fast-paced and often unpredictable nature of forex trading can be stressful. High levels of stress can impair decision-making and lead to burnout. Traders must develop stress management techniques, such as taking regular breaks, exercising, and maintaining a balanced lifestyle.

Developing a Positive Mindset

A positive mindset is crucial for overcoming the challenges of forex trading. Traders should focus on continuous improvement and learning rather than dwelling on losses. Celebrating small victories and maintaining a growth mindset can enhance resilience and long-term success.

Understanding Cognitive Biases

Cognitive biases, such as confirmation bias and recency bias, can impact trading decisions. Recognizing and addressing these biases can help traders make more objective decisions and improve their overall performance.

Dealing with Overconfidence

Overconfidence can lead to excessive risk-taking and significant losses. Traders must balance confidence with caution and continuously evaluate their performance to avoid becoming complacent.

The Role of Self-Reflection

Regular self-reflection and performance review can help traders identify areas for improvement and make necessary adjustments to their strategies. Keeping a trading journal can be a valuable tool for tracking progress and learning from past experiences.

Building Resilience

Resilience is the ability to recover from setbacks and continue moving forward. Developing resilience through experience and a positive mindset can help traders navigate the ups and downs of forex trading.

Setting Realistic Expectations

Having realistic expectations about profits and the time required to achieve success can help traders stay motivated and focused. Unrealistic expectations can lead to disappointment and impulsive decisions.

Effort, Consistency, and Time Commitment

Continuous Learning

The forex market is dynamic, and strategies that work today might not be effective tomorrow. Continuous learning and adapting to new market conditions are essential. This ongoing education involves reading market reports, following financial news, and participating in trading forums and webinars.

Practice and Consistency

Consistency in trading comes from disciplined practice. Regularly analyzing past trades to understand what worked and what didn’t can help refine strategies. This process requires dedication and a willingness to learn from mistakes.

Time Commitment

Forex trading is not a get-rich-quick scheme. It demands a significant time commitment, especially in the early stages. Traders need to spend hours each day studying the market, analyzing data, and planning trades. Balancing this with other responsibilities can be challenging.

Building and Sticking to a Routine

Establishing a daily trading routine can help traders stay organized and focused. This includes setting specific times for market analysis, executing trades, and reviewing performance. A structured approach can improve efficiency and reduce the likelihood of impulsive decisions.

Leveraging Technology

Using trading platforms and tools effectively can save time and enhance trading performance. Automated trading systems, alerts, and analytical tools can help traders manage their trades more efficiently and stay informed about market movements.

Networking and Community Involvement

Engaging with other traders through forums, social media, and local trading groups can provide support and opportunities for learning. Sharing experiences and strategies can help traders stay motivated and improve their skills.

Balancing Trading with Other Responsibilities

Many traders start forex trading while maintaining other jobs or responsibilities. Finding a balance between trading and other commitments is crucial for long-term success and avoiding burnout.

Long-Term Commitment

Successful forex trading requires a long-term commitment. Traders must be prepared to invest time and effort over several years to achieve consistent profitability. Short-term setbacks should be viewed as learning opportunities rather than reasons to quit.

Financial Management

Effective financial management, including budgeting for trading capital and managing personal finances, is essential for traders. Maintaining financial stability outside of trading can reduce stress and allow traders to focus on their strategies.

Health and Wellbeing

Maintaining physical and mental health is important for sustained trading success. Regular exercise, a healthy diet, and sufficient rest can improve focus, decision-making, and overall performance.

Realistic Expectations

Setting Achievable Goals

Having realistic expectations is crucial for long-term success in forex trading. While it is possible to make substantial profits, expecting to become wealthy overnight is unrealistic. Setting achievable goals based on available time, risk tolerance, and capital can help maintain motivation and prevent frustration.

Understanding the Nature of Returns

The returns in forex trading are not always consistent. Traders must understand that there will be periods of gains and losses. Preparing mentally for these fluctuations can help maintain a steady course.

Risk Management

Effective risk management is vital for long-term success. This includes setting stop-loss orders to limit potential losses, diversifying trades, and not risking more than a small percentage of trading capital on a single trade. By managing risk, traders can protect their accounts from significant drawdowns.

Professional Help and Mentorship

Seeking professional help or mentorship from experienced traders can provide valuable insights and shorten the learning curve. Mentors can offer personalized advice, help develop trading strategies, and provide psychological support.

Accepting the Learning Process

Becoming proficient in forex trading is a journey that requires time and patience. Accepting that learning is a gradual process can help traders stay focused and motivated. Realistic expectations about the time and effort needed to achieve proficiency are essential for maintaining a positive outlook.

Diversification of Strategies

Relying on a single trading strategy can be risky. Diversifying strategies across different market conditions can help stabilize returns and reduce dependency on one method. This approach requires continuous testing and adaptation.

Managing Expectations During Market Volatility

Understanding that market conditions can change rapidly and affect trading performance is crucial. Traders should be prepared for periods of high volatility and adjust their strategies accordingly to manage risks.

The Importance of a Trading Plan

Having a well-defined trading plan that includes goals, risk management rules, and strategies is essential. A trading plan helps traders stay focused and disciplined, reducing the likelihood of impulsive decisions.

Case Study: Setting Realistic Goals

Michael, a forex trader, initially set unrealistic profit goals, leading to frustration and reckless trading. After reassessing his approach and setting more achievable targets, he found that his performance improved, and he became more consistent in his trading.

Conclusion

Forex trading is undeniably challenging, requiring a combination of technical knowledge, market understanding, and psychological resilience. The complexities of the forex market, including its 24-hour nature, high leverage, and sensitivity to global events, demand a disciplined and strategic approach. For beginners, the steep learning curve and the need for continuous education can be daunting, but with dedication, practice, and the right resources, these challenges can be overcome.

Effort, consistency, and realistic expectations are crucial for long-term success in forex trading. Traders must commit to continuous learning, effective risk management, and maintaining emotional discipline. By setting achievable goals, seeking mentorship, and staying motivated, traders can navigate the difficulties of forex trading and work towards achieving consistent profitability.

Ultimately, while forex trading is hard, it is not insurmountable. With the right mindset, resources, and support, traders can develop the skills and strategies needed to succeed in this dynamic and rewarding market.

Is Forex Trading Hard to Learn?

Yes, forex trading can be hard to learn. It requires understanding both technical and fundamental analysis, developing a trading strategy, and practicing emotional discipline. Beginners often find the steep learning curve challenging but with dedication and consistent practice, it can be mastered over time.

Is Forex Trading Difficult to Learn for Beginners?

Forex trading can be difficult to learn for beginners due to the vast amount of information and skills required. New traders must learn about market dynamics, leverage, risk management, and the psychological aspects of trading. However, with the right resources and guidance, beginners can gradually build their knowledge and confidence.

Why is Forex Trading So Hard?

Forex trading is hard because it involves a combination of technical skills, market knowledge, and psychological discipline. The market’s volatility, the impact of global news, and the high leverage available can make it challenging. Additionally, the need for continuous learning and adaptation adds to the difficulty.

How Can I Overcome the Challenges of Forex Trading?

Overcoming the challenges of forex trading involves continuous learning, practicing with demo accounts, developing a robust trading strategy, and maintaining emotional discipline. Seeking mentorship and joining trading communities can also provide support and valuable insights. Additionally, implementing effective risk management techniques and setting realistic goals can help traders navigate the complexities of the forex market.

How Long Does It Take to Become Proficient in Forex Trading?

The time it takes to become proficient in forex trading varies depending on the individual’s dedication, learning pace, and prior knowledge. On average, it may take several months to a few years of consistent practice and learning to become proficient. The key is to remain patient, continuously educate oneself, and adapt to changing market conditions.

What Are the Common Mistakes Made by Beginner Forex Traders?

Common mistakes made by beginner forex traders include overleveraging, not having a trading plan, failing to manage risk, and allowing emotions to drive trading decisions. Lack of continuous learning and unrealistic expectations can also lead to significant losses. Beginners often make the mistake of chasing quick profits without thoroughly understanding the market dynamics and risk involved.

How Can I Overcome the Challenges of Forex Trading?

Overcoming the challenges of forex trading involves continuous learning, practicing with demo accounts, developing a robust trading strategy, and maintaining emotional discipline. Seeking mentorship and joining trading communities can also provide support and valuable insights. Additionally, implementing effective risk management techniques and setting realistic goals can help traders navigate the complexities of the forex market.

How Long Does It Take to Become Proficient in Forex Trading?

The time it takes to become proficient in forex trading varies depending on the individual’s dedication, learning pace, and prior knowledge. On average, it may take several months to a few years of consistent practice and learning to become proficient. The key is to remain patient, continuously educate oneself, and adapt to changing market conditions.

What Are the Common Mistakes Made by Beginner Forex Traders?

Common mistakes made by beginner forex traders include overleveraging, not having a trading plan, failing to manage risk, and allowing emotions to drive trading decisions. Lack of continuous learning and unrealistic expectations can also lead to significant losses. Beginners often make the mistake of chasing quick profits without thoroughly understanding the market dynamics and risk involved.

Can You Make a Living from Forex Trading?

Yes, it is possible to make a living from forex trading, but it requires substantial knowledge, experience, and capital. Successful traders treat it as a business, with a well-defined trading plan and risk management strategies. Consistent profitability typically comes after years of practice and learning. Traders who approach forex trading with a long-term perspective and disciplined approach are more likely to achieve sustainable success.

What Resources Are Available for Learning Forex Trading?

Numerous resources are available for learning forex trading, including online courses, trading books, webinars, forums, and mentorship programs. Many brokers also offer educational materials and demo accounts to help beginners practice trading without financial risk. Utilizing these resources can accelerate the learning process and help traders develop a comprehensive understanding of the market.

How Important is Risk Management in Forex Trading?

Risk management is crucial in forex trading as it helps protect trading capital from significant losses. Effective risk management involves setting stop-loss orders, diversifying trades, and only risking a small percentage of capital on each trade. It ensures long-term survival and success in the market. Traders who prioritize risk management are better positioned to withstand market fluctuations and achieve consistent returns.