Carry trading strategies have long been a cornerstone of successful forex trading, offering savvy investors the opportunity to capitalize on interest rate differentials between currencies. At its core, a carry trade strategy involves borrowing in a low-interest-rate currency and investing in a higher-yielding one, pocketing the difference as profit. This approach can be particularly lucrative in the forex market, where traders can leverage currency pairs to maximize their returns. To implement such strategies effectively, choosing a reliable forex trading broker is essential for accessing competitive spreads and efficient execution.

In this comprehensive guide, we’ll delve deep into the world of carry trading strategies, exploring how you can implement these techniques to potentially boost your forex returns. Whether you’re a seasoned trader or just starting out, understanding the ins and outs of carry trades can give you a significant edge in the competitive forex landscape.

Understanding Carry Trading Strategies

What Is a Carry Trade?

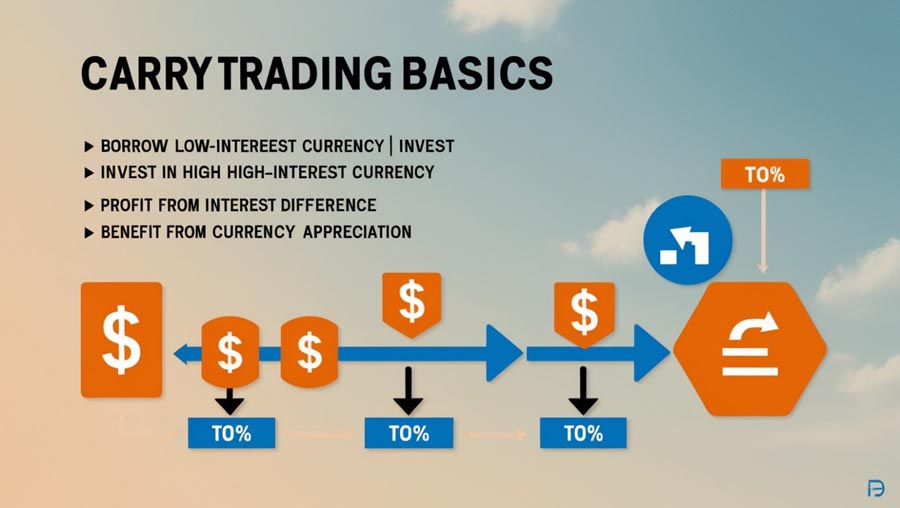

A carry trade is a trading strategy where an investor borrows money in a low-interest-rate currency and invests it in a high-interest-rate currency. The goal is to profit from the interest rate differential between the two currencies, as well as any potential appreciation in the value of the higher-yielding currency.

The Mechanics of Carry Trading

To execute a carry trade strategy in forex, traders typically follow these steps:

- Identify currency pairs with significant interest rate differentials

- Borrow in the low-interest-rate currency (the funding currency)

- Convert the borrowed funds into the high-interest-rate currency

- Invest in high-yielding assets denominated in the target currency

- Profit from both interest earned and potential currency appreciation

Key Factors Influencing Carry Trades

Several factors can impact the success of carry trading strategies:

- Interest rate differentials: The primary driver of carry trade profitability

- Currency volatility: Can affect the stability of returns

- Economic indicators: GDP growth, inflation, and employment data influence currency values

- Political stability: Impacts investor confidence in a currency

- Market sentiment: Risk-on or risk-off environments affect carry trade attractiveness

- Global economic conditions: Trade balances, commodity prices, and international relations

Read More: strategies for trading volatility indices

Popular Carry Trading Strategies

1. The Classic Carry Trade

The most straightforward carry trade strategy involves going long on high-yielding currencies while shorting low-yielding ones. For example, a trader might borrow Japanese yen (JPY) at a low interest rate and invest in Australian dollars (AUD) or New Zealand dollars (NZD), which typically offer higher yields.

Strategy specifics:

- Choose currency pairs with the widest interest rate differentials

- Monitor central bank policies for potential rate changes

- Consider the economic outlook for both countries involved

- Implement proper risk management techniques, such as stop-loss orders

2. The Forward Carry Trade

This strategy involves using forward contracts to lock in future exchange rates. Traders can potentially profit from both the interest rate differential and any favorable movements in the exchange rate.

Key aspects:

- Utilize forward contracts to hedge against currency fluctuations

- Calculate the forward rate to ensure profitability

- Consider transaction costs associated with forward contracts

- Analyze potential scenarios for exchange rate movements

3. The Leveraged Carry Trade

By using leverage, traders can amplify their potential returns from carry trades. However, this approach also increases risk, as losses can be magnified as well.

Important considerations:

- Carefully assess risk tolerance before applying leverage

- Use proper risk management techniques, such as stop-loss orders

- Be aware of margin requirements and potential margin calls

- Regularly monitor and adjust positions based on market conditions

4. The Basket Carry Trade

Instead of focusing on a single currency pair, traders can create a diversified portfolio of carry trades across multiple currencies. This approach helps spread risk and potentially smooth out returns.

Implementation tips:

- Select a mix of high-yielding and stable currencies

- Balance risk across different economic regions

- Regularly rebalance the basket based on changing market conditions

- Consider correlation between currency pairs to maximize diversification benefits

5. The Conditional Carry Trade

This strategy involves implementing carry trades only when certain market conditions are met, such as low volatility or strong trends in the target currencies.

Key factors to consider:

- Develop clear criteria for entry and exit points

- Use technical indicators to confirm market conditions

- Be patient and wait for optimal trading opportunities

- Combine with fundamental analysis for a more robust approach

Read More: volatility index trading strategies

Implementing Carry Trading Strategies in Forex

Selecting Currency Pairs

When choosing currency pairs for carry trades, consider:

- Interest rate differentials: Look for the widest spreads

- Historical volatility: Lower volatility can provide more stable returns

- Correlation with other major currencies: Diversify to reduce risk

- Economic outlook for both countries: Strong economies often support currency appreciation

- Liquidity: Ensure sufficient market depth for easy entry and exit

Popular carry trade currency pairs include:

- AUD/JPY: High-yielding Australian dollar vs. low-yielding Japanese yen

- NZD/JPY: New Zealand dollar offers attractive yields against the yen

- USD/JPY: U.S. dollar typically has higher yields than the yen

- EUR/JPY: Euro can offer yield advantage over the yen

- GBP/JPY: British pound often provides higher yields than the yen

- TRY/JPY: Turkish lira can offer high yields but comes with higher risk

Risk Management in Carry Trading

Effective risk management is crucial for successful carry trading. Key strategies include:

- Setting stop-loss orders to limit potential losses

- Diversifying across multiple currency pairs to spread risk

- Monitoring economic indicators and central bank policies for potential market shifts

- Adjusting position sizes based on market volatility and risk tolerance

- Using options or other hedging instruments to protect against adverse movements

- Regularly reviewing and adjusting your carry trade portfolio

- Implementing trailing stops to lock in profits as trades move in your favor

- Avoiding overexposure to a single currency or economic region

- Staying informed about global economic events that could impact carry trades

Read More: 4 hour forex trading strategy

Timing Your Carry Trades

While carry trades can potentially generate steady returns over time, timing your entry and exit points can significantly impact profitability. Consider:

- Entering trades during periods of low market volatility for more stable returns

- Exiting or reducing positions when interest rate differentials narrow

- Taking profits when the target currency has appreciated significantly

- Being aware of major economic events that could impact your carry trades

- Using technical analysis to identify optimal entry and exit points

- Monitoring sentiment indicators to gauge market risk appetite

- Considering seasonal patterns in currency movements

- Paying attention to long-term trends in interest rates and economic growth

Advanced Carry Trading Techniques

Combining Carry Trades with Technical Analysis

Integrating technical analysis tools can enhance your carry trading strategy. Consider using:

- Moving averages to identify trends in currency pairs

- Relative Strength Index (RSI) to gauge overbought or oversold conditions

- Fibonacci retracements to identify potential support and resistance levels

- Bollinger Bands to measure volatility and potential reversal points

- Ichimoku Cloud for a comprehensive view of trend, momentum, and support/resistance

- MACD (Moving Average Convergence Divergence) for trend confirmation

- Stochastic oscillator to identify potential turning points in price action

Fundamental Analysis in Carry Trading

Stay informed about key economic indicators and events that can impact your carry trades, such as:

- Central bank interest rate decisions and monetary policy statements

- GDP growth rates and economic performance indicators

- Inflation data, including Consumer Price Index (CPI) and Producer Price Index (PPI)

- Employment reports, such as Non-Farm Payrolls in the U.S.

- Geopolitical developments that could affect currency values

- Trade balance data and international trade agreements

- Credit ratings and sovereign debt levels

- Political stability and election outcomes

- Natural disasters or other unforeseen events that could impact economies

Algorithmic Carry Trading

Advanced traders may employ algorithmic trading systems to execute carry trades automatically based on predefined criteria. This approach can help:

- Eliminate emotional decision-making in trading

- Execute trades quickly and efficiently across multiple currency pairs

- Backtest strategies using historical data to optimize performance

- Implement complex multi-currency basket trades with precise rebalancing

- Monitor and adjust positions 24/7 based on market conditions

- Incorporate multiple data sources and indicators for more informed decisions

- Adapt to changing market conditions through machine learning algorithms

Pros and Cons of Carry Trading Strategies

Advantages

- Potential for steady, passive income from interest rate differentials

- Opportunity to profit from both interest and currency appreciation

- Ability to diversify across multiple currency pairs

- Can be combined with other trading strategies for enhanced returns

- Relatively low volatility compared to other forex trading strategies

- Potential for long-term trends in currency movements

- Leverage can amplify returns (when used responsibly)

- Provides exposure to global economic trends

Disadvantages

- Exposure to currency fluctuations and exchange rate risk

- Potential for significant losses if the market moves against your position

- Carry trades can become crowded, leading to sudden unwinding and market volatility

- Interest rate changes can quickly erode profitability

- Requires ongoing monitoring of global economic conditions

- Can be affected by unexpected geopolitical events or economic crises

- High leverage can lead to substantial losses if not managed properly

- Complex strategies may require advanced knowledge and tools

Case Study: Successful Carry Trading in Action

To illustrate the potential of carry trading strategies, let’s examine a hypothetical case study:

In 2020, a forex trader implemented a carry trade strategy by borrowing 10 million Japanese yen (JPY) at an interest rate of 0.1% and investing in Australian dollars (AUD) yielding 0.75%. Over the course of one year:

- Interest earned on AUD investment: 75,000 AUD

- Interest paid on JPY loan: 10,000 JPY (approximately 122 AUD)

- Net interest profit: 74,878 AUD

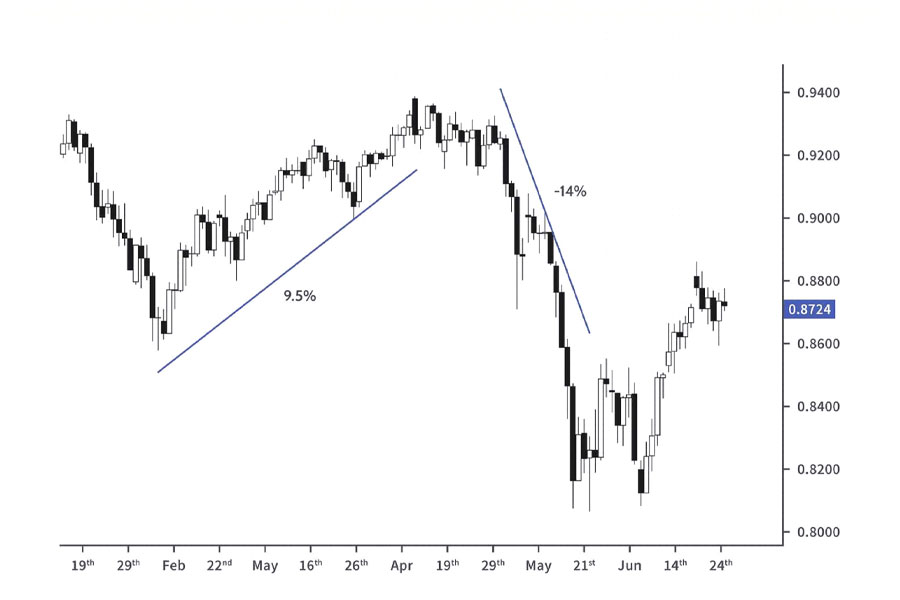

Additionally, the AUD/JPY exchange rate moved from 74.50 to 78.00 during this period, resulting in a currency appreciation profit of 469,798 AUD.

Total profit: 544,676 AUD (approximately 7.3% return on investment)

This example demonstrates how carry trades can generate profits from both interest rate differentials and currency movements. However, it’s important to note that real-world results can vary significantly based on market conditions and risk management practices.

OppoFinance Services

Experience the power of professional carry trading with OppoFinance, your trusted forex broker. We understand the intricacies of carry trading strategies and are committed to providing you with the tools and support you need to succeed in the forex market.

At OppoFinance, we offer:

- Competitive spreads on popular carry trade currency pairs

- Advanced trading platforms with real-time market data and analysis tools

- Generous leverage options to maximize your carry trade potential

- Dedicated customer support from forex experts

- Comprehensive educational resources, including webinars and tutorials on carry trading

- Fast and reliable trade execution

- A wide range of currency pairs, including exotic options for diverse carry trade opportunities

- Robust risk management tools to protect your investments

Whether you’re new to carry trading or an experienced trader looking to optimize your strategies, OppoFinance is your ideal partner. Our state-of-the-art technology, coupled with our commitment to transparency and security, ensures that you have everything you need to navigate the exciting world of carry trading.

Join OppoFinance today and take your forex carry trading to the next level!

Conclusion

Carry trading strategies offer forex traders a unique opportunity to potentially generate steady returns by capitalizing on interest rate differentials between currencies. By carefully selecting currency pairs, managing risks, and staying informed about market conditions, traders can harness the power of carry trades to enhance their overall forex trading performance.

However, it’s crucial to remember that carry trading, like all investment strategies, comes with inherent risks. Currency fluctuations, changing interest rate environments, and global economic factors can all impact the profitability of carry trades. Successful traders must remain vigilant, adapt their strategies to changing market conditions, and always prioritize risk management.

As you explore carry trading strategies, consider leveraging the expertise and resources available through reputable forex brokers. With the right approach, tools, and support at your disposal, carry trading can become a valuable component of your forex trading arsenal, potentially boosting your returns and diversifying your investment portfolio.

Remember, the key to successful carry trading lies in continuous learning, careful analysis, and disciplined execution. Start small, refine your strategies, and gradually build your expertise to unlock the full potential of carry trading in the forex market. With dedication and the right resources, you can navigate the complexities of carry trading and work towards achieving your financial goals in the dynamic world of forex trading.

How does currency volatility affect carry trades?

Currency volatility can significantly impact the profitability of carry trades. While low volatility periods can provide stable returns from interest rate differentials, high volatility can lead to rapid price movements that may offset or even exceed the interest gains. Traders must carefully monitor volatility levels and adjust their positions accordingly, potentially reducing exposure during turbulent market conditions or implementing tighter stop-loss orders to manage risk.

Can carry trades be profitable in a low interest rate environment?

While carry trades are typically more challenging in a low interest rate environment, they can still be profitable under certain conditions. Traders may need to focus on currency pairs with wider interest rate differentials, even if the absolute rates are lower than historical norms. Additionally, leveraging technical analysis and fundamental factors to identify potential currency appreciation opportunities can help enhance returns. Some traders also explore alternative carry trade strategies, such as using commodity currencies or emerging market pairs to find yield advantages.

How do central bank policies influence carry trading strategies?

Central bank policies play a crucial role in shaping carry trading opportunities and risks. Interest rate decisions directly impact the yield differentials that drive carry trades, while quantitative easing or tightening measures can affect currency values. Traders must stay informed about monetary policy shifts, forward guidance, and economic outlooks provided by central banks. Unexpected policy changes can lead to rapid unwinding of carry trade positions, potentially causing significant market volatility. Successful carry traders often closely monitor central bank communications and economic data releases to anticipate potential policy shifts and adjust their strategies accordingly.