Imagine a market that never sleeps, immune to economic news, political upheavals, and market gaps—a market where you can trade 24/7, with predictable volatility and endless opportunities for profit. Welcome to the world of synthetic indices trading, a groundbreaking arena that’s transforming the way traders approach the financial markets. If you’re seeking a controlled, transparent, and consistently exciting trading environment, then mastering synthetic indices trading strategies is your key to success. Partnering with a reliable forex trading broker can further enhance your trading experience, providing you with the right tools and resources to navigate this dynamic market effectively.

In this comprehensive guide, we’ll delve deep into the intricacies of synthetic indices trading strategies, covering everything from the basics to advanced techniques. We’ll explore effective strategies, risk management practices, and provide you with valuable insights and actionable tips to elevate your trading game. Whether you’re a beginner looking to understand the fundamentals or an advanced trader seeking to refine your approach, this article is designed to meet your specific needs and answer your burning questions. Let’s embark on this journey to unlock the full potential of synthetic indices trading!

What Are Synthetic Indices?

Synthetic indices are simulated trading instruments that replicate real-world market conditions without being influenced by external economic factors. They are generated by cryptographically secure random number generators, ensuring fairness, unpredictability, and consistent volatility levels. This unique characteristic makes them an attractive alternative to traditional trading assets like forex pairs, commodities, or stocks.

Key Features of Synthetic Indices:

- Predictability: Fixed volatility levels allow for consistent synthetic indices trading strategies.

- 24/7 Availability: Trade anytime, without restrictions from market hours or holidays.

- No External Influences: Immune to geopolitical events, economic news, and market manipulations.

- Transparent and Fair: Powered by secure algorithms that ensure unbiased market movements.

By offering a stable and controlled trading environment, synthetic indices provide an excellent platform for both beginners and experienced traders to hone their skills and implement effective trading strategies.

Why Synthetic Indices Trading Is Gaining Popularity

The surge in popularity of synthetic indices trading can be attributed to several compelling advantages that set it apart from traditional forex trading. If you’ve ever been blindsided by sudden market shifts due to unexpected news releases or political events, you’ll appreciate the stability that synthetic indices bring to the table.

Advantages Over Traditional Forex Trading:

- Immunity to Market News: Since synthetic indices are not tied to real-world assets, they’re unaffected by economic indicators, interest rate decisions, or geopolitical tensions. This means you can implement your synthetic indices trading strategies with confidence, knowing that sudden news won’t derail your plan.

- Consistent Volatility: Each synthetic index comes with a predefined volatility level, allowing you to choose instruments that match your risk appetite. Whether you prefer high-volatility indices for quick gains or lower-volatility options for steady growth, there’s something for everyone.

- Round-the-Clock Trading: Markets never close with synthetic indices. This 24/7 availability provides unmatched flexibility, especially for traders in different time zones or those who wish to trade outside conventional market hours.

- Transparency and Fairness: The use of secure algorithms ensures that price movements are random and free from manipulation. This transparency builds trust and allows traders to focus solely on their strategies.

- Enhanced Risk Management: The predictable nature of synthetic indices facilitates better risk assessment and management. You can set stop-loss and take-profit levels with greater confidence, knowing that unexpected market gaps are unlikely.

In essence, synthetic indices offer a level playing field where skill, strategy, and discipline are rewarded, making it an appealing choice for traders looking to diversify their portfolios and explore new opportunities.

Read More: What Are Synthetic Indices in Trading?

Effective Synthetic Indices Trading Strategies

To succeed in synthetic indices trading, it’s crucial to employ strategies that leverage the unique characteristics of these instruments. Below, we delve into some of the most effective synthetic indices trading strategies, complete with detailed explanations and actionable steps.

Explore effective strategies to master synthetic indices trading.

1. Trend Following Strategy: Ride the Waves of the Market

The trend is your friend until it bends. This age-old adage holds true in synthetic indices trading, where trends can be more stable and prolonged due to the absence of external disruptions.

How to Implement:

- Identify the Trend: Use technical indicators like Moving Averages (MA) to determine the market direction. A common approach is to use a combination of short-term and long-term MAs (e.g., 50-day and 200-day) to spot crossovers that signal bullish or bearish trends.

- Confirm Trend Strength: Utilize the Average Directional Index (ADX) or the Relative Strength Index (RSI) to gauge the strength of the trend. An ADX value above 25 often indicates a strong trend.

- Enter Trades on Pullbacks: Instead of chasing the market, wait for price pullbacks to key support levels within the trend. This increases the likelihood of entering at a favorable price and reduces risk.

- Set Stop-Loss and Take-Profit Levels: Place stop-loss orders below recent swing lows (for long positions) or above swing highs (for short positions). Determine your take-profit targets based on risk-reward ratios or key resistance/support levels.

Why It Works:

- Consistency: Trends in synthetic indices are less prone to sudden reversals caused by news events.

- Predictability: Fixed volatility levels make it easier to anticipate price movements.

- Risk Management: Clear trends allow for better placement of stop-loss and take-profit orders.

By aligning your trades with the prevailing market trend, you enhance your chances of success and capitalize on the momentum driving the market.

Read More: Strategies for trading volatility indices

2. Range-Bound Trading: Profit from Market Consolidation

At times, synthetic indices may trade within well-defined ranges, bouncing between support and resistance levels. Range-bound trading aims to exploit these oscillations for profit.

Tools and Indicators:

- Support and Resistance Levels: Identify key horizontal levels where the price has historically reversed.

- Bollinger Bands: These help visualize the volatility and potential reversal zones within the range.

- Stochastic Oscillator: Use this momentum indicator to spot overbought and oversold conditions within the range.

How to Apply:

- Identify the Range: Look for a series of highs and lows that occur at similar price levels over time.

- Enter at Extremes: Buy near the support level when the price is oversold, and sell near the resistance level when the price is overbought.

- Confirm with Indicators: Ensure that oscillators like the Stochastic or RSI support your entry decision.

- Set Tight Stop-Loss Orders: Place stop-loss orders just outside the range boundaries to protect against breakouts.

Pro Tip:

- Avoid Over-Leveraging: Since ranges can eventually break, it’s essential to manage your position size to mitigate potential losses.

Why It Works:

- Predictable Movements: In a range-bound market, prices tend to revert to the mean, providing multiple trading opportunities.

- Controlled Risk: Clear support and resistance levels make it easier to set stop-loss and take-profit points.

Range-bound trading allows you to profit from markets that lack a clear trend, adding versatility to your trading arsenal.

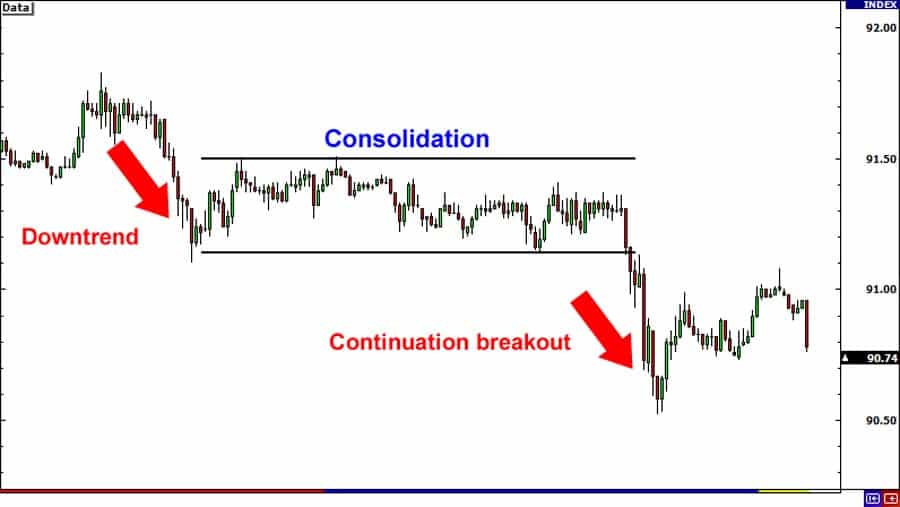

3. Breakout Strategy: Capture Powerful Price Movements

Breakouts occur when the price moves beyond established support or resistance levels, often leading to significant price movements. The breakout strategy aims to capitalize on these powerful shifts.

How to Apply:

- Identify Consolidation Zones: Look for periods where the price moves within a tight range, indicating accumulation or distribution.

- Use Volume Indicators: Increased volume during a breakout adds credibility to the move. While synthetic indices may not have traditional volume data, you can use tick volume as a proxy.

- Set Entry Orders: Place buy stop orders above resistance levels and sell stop orders below support levels to automatically enter trades when a breakout occurs.

- Place Protective Stop-Loss Orders: For long positions, set stop-loss orders below the breakout point; for short positions, place them above.

- Monitor for False Breakouts: Use confirmation signals like closing prices beyond the breakout level or additional technical indicators to reduce the risk of false signals.

Fact:

- Higher Risk-Reward Ratios: Breakouts can lead to substantial price movements, offering the potential for significant profits relative to risk.

Why It Works:

- Momentum Trading: Breakouts often signify the start of a new trend driven by increased market participation.

- Clear Entry and Exit Points: The breakout levels provide natural points for stop-loss and take-profit orders.

By mastering the breakout strategy, you can position yourself to capture large market moves and enhance your overall trading performance.

Read More: What Are Synthetic Indices

Risk Management in Synthetic Indices Trading

Effective risk management is the cornerstone of successful trading, especially in the realm of synthetic indices trading. Understanding the risks and implementing robust risk management techniques can mean the difference between consistent profits and significant losses.

Secure your trading journey with effective risk management techniques.

Understanding the Risks Associated with Synthetic Indices

While synthetic indices offer many advantages, they are not without risks:

- Leverage Risk: High leverage can amplify both profits and losses. Without proper management, traders can quickly deplete their capital.

- Algorithmic Price Determinants: Since synthetic indices are algorithmically generated, relying solely on technical analysis without understanding the underlying mechanics can be risky.

- Overtrading: The 24/7 availability may tempt traders to overtrade, leading to fatigue and poor decision-making.

Implementing Effective Risk Management Techniques

- Set Risk Limits: Determine the maximum percentage of your capital you’re willing to risk on any single trade, typically no more than 1-2%.

- Use Stop-Loss Orders: Always set stop-loss orders to limit potential losses. This is especially important in markets that can move rapidly.

- Diversify Your Trades: Don’t put all your eggs in one basket. Spread your risk across different synthetic indices and strategies.

- Keep a Trading Journal: Document your trades, including the rationale, outcomes, and lessons learned. This helps in refining your synthetic indices trading strategies over time.

- Regularly Review and Adjust: Markets evolve, and so should your strategies and risk management practices. Regularly assess your performance and make necessary adjustments.

Avoiding Over-Reliance on Algorithmic Price Determinants

While synthetic indices are algorithmically generated, it’s important not to over-rely on the predictability of these algorithms:

- Stay Informed: Understand that while the indices are not influenced by external events, market dynamics can still change.

- Avoid Complacency: Don’t assume that past patterns will always repeat. Be prepared for unexpected price movements.

- Combine Technical and Fundamental Analysis: While fundamental analysis may not apply in the traditional sense, understanding the mechanics of the indices and the trading environment is crucial.

Effective risk management ensures that you preserve your capital and stay in the game long enough to realize consistent profits from your trading activities.

Advanced Trading Strategies

For traders looking to take their synthetic indices trading strategies to the next level, exploring advanced techniques can provide new avenues for profit and diversification.

Exploring Volatility-Based Strategies

Volatility is a trader’s best friend, and synthetic indices offer instruments with fixed volatility levels.

How to Leverage Volatility:

- Trade High-Volatility Indices: Instruments like the Volatility 75 Index (VIX) offer significant price movements, ideal for strategies that capitalize on large swings.

- Use Volatility Indicators: Tools like Bollinger Bands and Average True Range (ATR) can help identify periods of high and low volatility, informing your entry and exit points.

- Implement Volatility Breakout Strategies: Trade when the price breaks out of a period of low volatility, often leading to significant movements.

Leveraging Correlation Trading Techniques

Correlation trading involves analyzing the relationships between different synthetic indices or between synthetic indices and other markets.

How to Apply:

- Identify Correlated Indices: Some synthetic indices may move in tandem or inversely to others. Understanding these relationships can provide additional trading opportunities.

- Hedge Positions: Use correlated indices to hedge your positions, reducing overall risk.

- Diversify Strategies: Employ different strategies on correlated indices to maximize profit potential.

Utilizing Statistical Arbitrage Methods

Statistical arbitrage involves exploiting price inefficiencies between correlated instruments.

Steps to Implement:

- Pair Trading: Identify pairs of synthetic indices that historically move together.

- Monitor Divergence: When the price relationship deviates from the historical norm, enter trades expecting the prices to converge.

- Use Statistical Tools: Employ statistical measures like Z-scores to determine the extent of divergence and convergence.

Caution:

- Transaction Costs: Ensure that potential profits outweigh transaction costs.

- Speed of Execution: Arbitrage opportunities can be fleeting; timely execution is critical.

Advanced strategies require a deeper understanding of the market and a disciplined approach. They can offer higher profit potential but also come with increased risk.

Pro Tips for Advanced Traders

To further elevate your synthetic indices trading experience, consider incorporating the following advanced techniques:

- Automate Your Strategies: Utilize Expert Advisors (EAs) or algorithmic trading systems on platforms like MetaTrader 5 to execute your advanced strategies automatically.

- Backtesting and Optimization: Before deploying new strategies, backtest them using historical data to assess their effectiveness.

- Stay Updated on Technological Developments: Keep abreast of the latest tools and platforms that can enhance your trading, such as AI-driven analytics or advanced charting software.

By continuously refining your skills and embracing advanced strategies, you position yourself to capitalize on a wider range of market opportunities.

Read More: Most Volatile Synthetic Indices

Opofinance Services: Your Trusted Partner in Trading

Selecting the right broker is a crucial step toward achieving success in synthetic indices trading. Opofinance, an ASIC-regulated forex broker, stands out as a reliable and feature-rich platform that caters to traders of all levels.

Why Choose Opofinance?

- Regulation and Security: As a broker regulated by the Australian Securities and Investments Commission (ASIC), Opofinance adheres to stringent regulatory standards, ensuring your funds are secure.

- Social Trading Platform: Benefit from social trading services that allow you to follow and copy the strategies of successful traders. This is an excellent way for beginners to learn and for advanced traders to diversify their approaches.

- Official MT5 Broker: Opofinance is officially featured on the MetaTrader 5 (MT5) brokers list, offering you access to advanced trading tools, indicators, and automated trading capabilities.

- Convenient Banking Options: Enjoy safe and convenient deposits and withdrawals through various methods, including bank transfers, credit cards, and e-wallets.

- Exceptional Customer Support: Dedicated support teams are available to assist you with any queries, ensuring a smooth trading experience.

Key Features:

- Competitive Spreads and Commissions

- Wide Range of Trading Instruments

- Educational Resources and Webinars

- User-Friendly Trading Platforms

Ready to take your trading to the next level? Join Opofinance today and experience the benefits of trading with a trusted and innovative online forex broker. Your journey to mastering synthetic indices trading strategies starts here!

Conclusion: Trade Smarter and Achieve Success with Synthetic Indices

In the ever-evolving landscape of trading, synthetic indices present a unique and exciting opportunity to diversify your portfolio and capitalize on market movements in a controlled environment. By understanding the mechanics of synthetic indices and implementing effective trading strategies, you can unlock new avenues for profit and enhance your trading prowess.

Whether you’re drawn to the predictability and stability they offer or the thrill of 24/7 trading, synthetic indices cater to a wide range of trading styles and preferences. Remember, success in trading doesn’t happen overnight. It requires continuous learning, disciplined execution, and the right support system.

By choosing a reputable broker like Opofinance, leveraging advanced strategies, and staying committed to your trading plan, you’re well on your way to mastering synthetic indices trading. Embrace the journey, stay adaptable, and watch your trading achievements soar.

Key Takeaways

- Synthetic indices trading offers a stable, predictable, and transparent alternative to traditional forex trading, ideal for traders at all levels.

- Implementing effective synthetic indices trading strategies such as trend following, range-bound trading, and breakout trading can significantly enhance your trading success.

- Risk management is crucial in synthetic indices trading. Understanding the risks and implementing robust risk management techniques ensures long-term success.

- Advanced trading strategies like volatility-based strategies, correlation trading, and statistical arbitrage can unlock new profit opportunities for experienced traders.

- Opofinance, an ASIC-regulated forex broker, provides a secure and feature-rich platform, including social trading services, to support your trading journey.

- Continuous Learning and Adaptation: Stay informed and adaptable to market changes to maintain a competitive edge.

- Risk Management is Essential: Always employ sound risk management practices to protect your capital and ensure long-term success.

How Do Synthetic Indices Differ from Traditional Forex Pairs?

Synthetic indices are simulated instruments that replicate market conditions without being tied to actual assets like currencies or commodities. Unlike forex pairs, they are immune to real-world economic events, providing a stable and predictable trading environment. This means traders can implement synthetic indices trading strategies without worrying about sudden market gaps or volatility spikes caused by news releases.

Can I Apply Forex Trading Strategies to Synthetic Indices?

Yes, many forex trading strategies can be adapted for synthetic indices trading. However, it’s essential to account for the unique characteristics of synthetic indices, such as fixed volatility levels and 24/7 trading. Strategies may need adjustments in terms of risk management and indicator settings to align with the behavior of synthetic indices.

Is Synthetic Indices Trading Suitable for Beginners?

Absolutely! Synthetic indices offer a controlled environment that’s ideal for beginners to learn trading fundamentals. The absence of external market influences simplifies analysis and strategy development. Additionally, tools like demo accounts and social trading platforms, like those offered by Opofinance, can help beginners practice and learn from experienced traders without risking real money.