Are you tired of spending countless hours glued to your trading screen, desperately trying to catch every market move? Look no further! The 4-hour forex trading strategy, a proven method used by many successful forex broker professionals, is your ticket to financial freedom and a balanced lifestyle. This powerful approach enables you to capitalize on significant market trends while freeing up your time for other pursuits.

In this comprehensive guide, we’ll dive deep into the world of 4-hour forex trading, revealing the secrets that professional traders use to consistently rake in profits. Whether you’re a beginner looking to start your forex journey or an experienced trader seeking to optimize your strategy, this article will equip you with the knowledge and tools you need to succeed in the dynamic world of currency trading.

What is the 4-Hour Forex Trading Strategy?

The 4-hour forex trading strategy is a popular approach that focuses on analyzing and trading currency pairs using 4-hour candlestick charts. This method strikes a perfect balance between short-term and long-term trading, allowing traders to capture significant price movements while avoiding the noise and stress associated with day trading. By concentrating on the 4-hour timeframe, traders can identify key trends, support and resistance levels, and potential entry and exit points with greater clarity and precision.

Why Choose the 4-Hour Timeframe?

- Balanced perspective: The 4-hour chart provides a comprehensive view of market trends without getting lost in short-term fluctuations.

- Reduced stress: With fewer trades to manage, you can make more informed decisions and avoid the burnout often associated with day trading.

- Improved work-life balance: This strategy allows you to maintain a regular job or pursue other interests while still actively participating in the forex market.

- Higher-quality setups: The 4-hour timeframe often produces more reliable trading signals, leading to potentially more profitable trades.

- Lower transaction costs: Fewer trades mean reduced spreads and commissions, ultimately improving your bottom line.

Read More: strategies for trading volatility indices

Key Components of a Successful 4-Hour Forex Trading Strategy

When developing a price action-based 4-hour forex trading strategy, it’s crucial to focus on the following key components:

1. Chart Analysis

Chart analysis forms the backbone of any effective price action trading strategy. By studying raw price movements on your charts, you can identify potential entry and exit points for your trades. Key elements to focus on include:

- Support and resistance levels

- Trend lines and channels

- Chart patterns (e.g., head and shoulders, triangles, flags)

- Candlestick patterns (e.g., engulfing patterns, doji, pin bars)

2. Market Structure

Understanding market structure is crucial for price action trading. This involves identifying:

- Higher highs and higher lows in uptrends

- Lower highs and lower lows in downtrends

- Ranging markets and consolidation periods

- Key swing points and market pivots

By recognizing these structures, you can better anticipate potential price movements and identify optimal entry and exit points.

3. Price Action Patterns

Familiarize yourself with common price action patterns that occur on the 4-hour timeframe. These may include:

- Inside bars

- Outside bars

- Fakey patterns

- Pin bars (bullish and bearish)

- Engulfing patterns

These patterns can provide valuable insights into potential trend continuations or reversals.

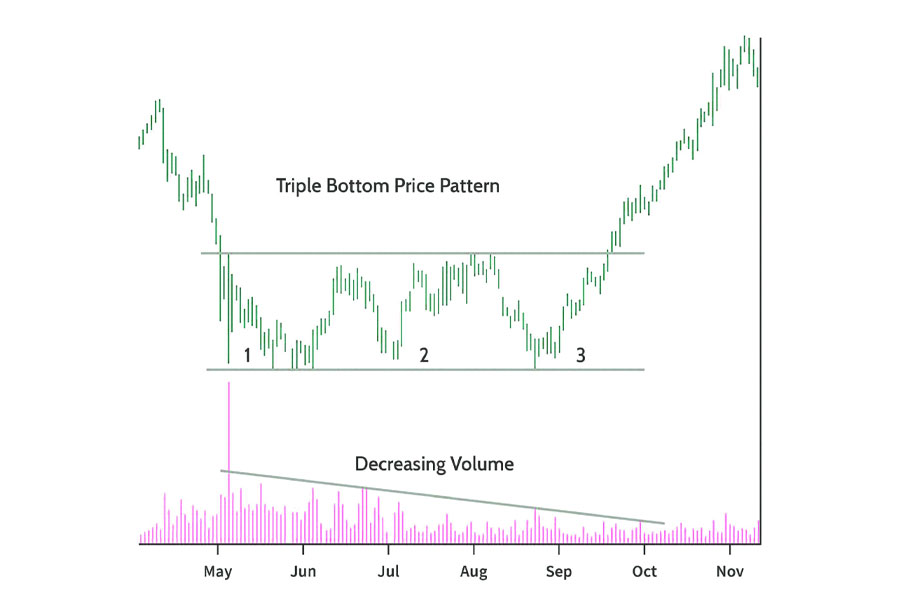

4. Volume Analysis

While not a direct form of price action, volume can provide context to price movements. On the 4-hour chart, look for:

- Increasing volume on breakouts

- Decreasing volume during consolidations

- Volume divergences (price moving up on decreasing volume, or vice versa)

5. Multiple Timeframe Analysis

While focusing on the 4-hour chart, it’s beneficial to incorporate analysis from other timeframes:

- Higher timeframes (daily, weekly) for overall trend direction

- Lower timeframes (1-hour, 30-minute) for fine-tuning entries and exits

This multi-timeframe approach can help confirm your analysis and improve your trading decisions.

6. Risk Management

Effective risk management remains crucial in price action trading:

- Set clear stop-loss levels based on recent swing highs/lows or key support/resistance levels

- Use proper position sizing, risking no more than 1-2% of your account on a single trade

- Maintain a favorable risk-reward ratio, aiming for at least 1:2

- Consider scaling in and out of positions to manage risk and lock in profits

7. Trading Plan and Journal

Develop a comprehensive trading plan that outlines your price action strategy, risk management rules, and trading goals. Consistently maintain a trading journal to track your performance, identify areas for improvement, and refine your approach over time.

8. Fundamental Awareness

While price action trading primarily focuses on chart analysis, it’s important to stay aware of key fundamental factors that can impact currency movements. Keep an eye on:

- Major economic releases

- Central bank decisions

- Geopolitical events

This awareness can help you avoid entering trades just before major market-moving events and understand the context behind significant price movements.

By focusing on these key components, you’ll be well-equipped to develop and implement a robust price action-based 4-hour forex trading strategy. Remember, mastering price action takes time and practice, so be patient and consistent in your approach.

Read More: volatility index trading strategies

5 Powerful Price Action-Based 4-Hour Forex Trading Strategies

1. The Support and Resistance Breakout Strategy

This strategy capitalizes on price breaking through key levels:

- Identify: Mark clear support and resistance levels on your 4-hour chart.

- Entry: Enter a long position when price breaks and closes above resistance, or a short position when price breaks and closes below support.

- Confirmation: Look for increased volume on the breakout candle.

- Stop-loss: Place your stop-loss just below the broken resistance for longs, or above the broken support for shorts.

- Take-profit: Target the next major support or resistance level, or use a risk-reward ratio of at least 1:2.

2. The Double Top/Bottom Reversal Strategy

This strategy focuses on classic reversal patterns:

- Identify: Look for a double top (for shorts) or double bottom (for longs) pattern on the 4-hour chart.

- Entry: Enter a short position when price breaks below the neckline of a double top, or a long position when price breaks above the neckline of a double bottom.

- Confirmation: Wait for a retest of the broken neckline before entering.

- Stop-loss: Place your stop-loss above the highest point of the double top for shorts, or below the lowest point of the double bottom for longs.

- Take-profit: Measure the height of the pattern and project it from the breakout point.

3. The Inside Bar Breakout Strategy

This strategy takes advantage of periods of consolidation followed by breakouts:

- Identify: Look for an inside bar on the 4-hour chart (a bar completely contained within the range of the previous bar).

- Entry: Enter a long position if price breaks above the high of the mother bar, or a short position if price breaks below the low of the mother bar.

- Confirmation: Ensure the breakout occurs with conviction, preferably with increased volume.

- Stop-loss: Place your stop-loss at the opposite side of the mother bar.

- Take-profit: Use a minimum risk-reward ratio of 1:2, or target the next significant support or resistance level.

4. The Swing High/Low Failure Strategy

This strategy aims to catch the beginning of new trends:

- Identify: Look for a failed attempt to make a new higher high in an uptrend, or a new lower low in a downtrend.

- Entry: Enter a short position when price fails to make a new higher high and breaks below the previous swing low. Enter a long position when price fails to make a new lower low and breaks above the previous swing high.

- Confirmation: Look for a strong closure beyond the previous swing point.

- Stop-loss: Place your stop-loss above the recent swing high for shorts, or below the recent swing low for longs.

- Take-profit: Target the next major support or resistance level, or use a trailing stop to maximize profits.

5. The Three-Push Pattern Strategy

This strategy identifies potential reversals after strong trends:

- Identify: Look for three consecutive pushes in the direction of the trend, with each push showing less momentum (smaller candles or longer wicks).

- Entry: Enter a counter-trend position after the third push shows clear signs of exhaustion (such as a reversal candlestick pattern).

- Confirmation: Wait for a break of the trendline connecting the three pushes.

- Stop-loss: Place your stop-loss beyond the extreme of the third push.

- Take-profit: Target the origin of the three-push move, or use a risk-reward ratio of at least 1:2.

Remember, these price action strategies require practice and a deep understanding of market structure. Always combine them with proper risk management and be aware of key fundamental factors that might influence the market. It’s crucial to practice these strategies on a demo account, keep detailed trading journals, and continuously refine your approach based on your results and changing market dynamics.

By focusing on price action, you’re developing skills to read the market directly, which can lead to more confident and informed trading decisions. However, don’t hesitate to use basic indicators as supplementary tools if they help confirm your price action analysis.

Read More: carry trading strategies

Step-by-Step Guide to Implementing Your 4-Hour Forex Trading Strategy

- Set up: Choose liquid currency pairs and set up clean 4-hour candlestick charts without indicators.

- Analyze: Identify key levels, market structure, and price action setups. Confirm with multiple timeframe analysis.

- Plan: Define your entry, stop-loss, and take-profit levels based on price action and risk management rules.

- Execute: Enter trades only when all criteria are met. Set orders immediately.

- Manage: Monitor positions, adjusting as needed based on changing market conditions.

- Review: Record trade details in your journal and regularly analyze your performance to refine your strategy.

- Improve: Continuously educate yourself on price action techniques and practice patience and discipline in your trading.

This condensed guide covers the essential steps while maintaining focus on price action-based trading in the 4-hour timeframe.

Advanced Techniques for 4-Hour Forex Trading

1. Multi-Candle Price Action Patterns

Look for patterns that form over multiple 4-hour candles:

- Three-bar reversal patterns

- Two-bar reversal patterns

- Fakey patterns (false breakouts)

- 123 patterns for trend reversals

These complex patterns often provide stronger signals than single-candle formations.

2. Order Block Trading

Identify and trade from significant order blocks:

- Locate areas of strong buying or selling pressure

- Look for price to return to these levels

- Enter trades when price reacts at these order blocks

This technique helps you trade in line with major market players.

3. Supply and Demand Zones

Trade from key supply and demand areas:

- Identify zones where price has reversed strongly in the past

- Wait for price to return to these zones

- Look for confirming price action before entering trades

This approach allows you to trade from areas of potential trend continuation or reversal.

4. Wyckoff Method

Apply Wyckoff analysis to the 4-hour timeframe:

- Identify accumulation and distribution phases

- Look for signs of institutional trading activity

- Trade breakouts from these phases

This method helps you align with larger market forces.

5. Volume Price Analysis (VPA)

Incorporate volume analysis into your price action trading:

- Look for volume spikes at key levels

- Identify volume divergences with price movement

- Use volume to confirm breakouts and reversals

While not pure price action, VPA can provide valuable context to price movements.

By mastering these advanced techniques, you can enhance your 4-hour forex trading strategy and potentially improve your trading results. Remember to practice these methods thoroughly before applying them to live trading.

Common Pitfalls to Avoid in 4-Hour Forex Trading

- Overtrading: Resist the urge to place trades just because you’re monitoring the charts. Patience is key in 4-hour trading.

- Ignoring fundamental factors: Don’t rely solely on technical analysis; stay informed about market-moving events.

- Emotional trading: Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

- Neglecting risk management: Always prioritize capital preservation over potential profits.

- Failing to adapt: Markets evolve, so be prepared to adjust your strategy as conditions change.

Tips for Success in 4-Hour Forex Trading

- Develop a routine: Set specific times to analyze charts and place trades, creating a structured approach to your trading.

- Stay disciplined: Follow your trading plan consistently, even during challenging market conditions.

- Continuously educate yourself: Stay up-to-date with market trends, trading strategies, and economic developments.

- Practice patience: Wait for high-probability setups rather than forcing trades out of boredom or FOMO.

- Use demo accounts: Test and refine your strategy using demo accounts before risking real capital.

- Join a trading community: Connect with other 4-hour forex traders to share insights and learn from their experiences.

- Embrace technology: Utilize trading tools and automation to streamline your analysis and execution processes.

OpoFinance Services

Are you ready to take your forex trading to the next level? Look no further than OpoFinance! As a leading online broker, OpoFinance offers a cutting-edge trading platform tailored to the needs of 4-hour forex traders. With advanced charting tools, competitive spreads, and a wide range of currency pairs, OpoFinance provides everything you need to implement your 4-hour trading strategy successfully.

But that’s not all – OpoFinance goes above and beyond by offering:

- Expert market analysis and insights

- Comprehensive educational resources for traders of all levels

- 24/7 customer support from experienced professionals

- Robust risk management tools to protect your investments

- Seamless integration with popular trading platforms and mobile apps

Don’t let this opportunity slip away! Join thousands of successful traders who have already discovered the OpoFinance advantage. Sign up today and experience the power of professional-grade trading tools combined with unparalleled support. Your journey to forex trading success starts here!

Conclusion

The 4-hour forex trading strategy, focused on price action, offers a powerful approach to navigating currency markets. It balances the potential for significant profits with a manageable time commitment. By mastering key price action patterns, understanding market structure, and implementing advanced techniques, you can develop a robust trading strategy.

Remember, success in forex trading requires dedication, discipline, and continuous learning. Implement the techniques and strategies outlined in this guide, stay informed about market developments, and always prioritize risk management. With patience and persistence, you can master price action-based 4-hour forex trading and work towards achieving your financial goals.

Are you ready to transform your trading journey? Start implementing these strategies today, and watch as your forex trading skills soar to new heights!

How many trades can I expect with a 4-hour price action strategy?

Typically, you might see 2-5 quality setups per week per currency pair. Focus on high-probability trades rather than quantity.

Can I combine price action with indicators?

While price action can stand alone, some traders use basic indicators for confirmation. However, prioritize price action signals in your decision-making.

Is the 4-hour price action strategy suitable for beginners?

Yes, it’s a good starting point. The 4-hour timeframe provides clearer signals than shorter timeframes and is less time-intensive than day trading. However, proper education and practice are essential.

One Response

Thank you so much for taking the time to share your thoughts—I really appreciate your kind words and constructive suggestions! I’m glad you’re enjoying the writing, and you’re absolutely right: adding more visual breaks and images would make the posts easier to navigate and more engaging. I’ll look into updating the layout to include extra spacing, headings, and graphics so readers can connect more easily with the content. Thanks again for your helpful feedback—it really helps me improve!