Confused by the jargon of forex trading? Feeling lost in a sea of charts and currency pairs? You’re not alone. Many aspiring traders find the initial steps into the forex market overwhelming. But here’s a secret weapon to cut through the noise and trade like a pro: understanding the different types of orders in forex trading.

Think of forex orders as your instructions to your forex broker, telling them exactly how you want to buy or sell currencies. Mastering these order types is not just about placing trades; it’s about controlling your risk, maximizing your profit potential, and executing your trading strategy with precision. Whether you are trading with a regulated forex broker or exploring the market with an online forex broker, knowing your order types is non-negotiable.

In this comprehensive guide, we will demystify the 8 essential types of orders in trading, complete with clear explanations and real-world examples. We’ll navigate through market orders, limit orders, stop orders, and beyond, equipping you with the knowledge to confidently navigate the dynamic world of forex. Ready to take control of your trades and elevate your forex game? Let’s dive in and unlock the power of strategic order placement! Understanding types of orders in trading with examples is crucial for any aspiring forex trader.

1. Market Orders: Seize the Moment

Imagine you’re watching the EUR/USD pair, and you spot a golden opportunity. The price is moving exactly as you predicted, and you need to jump in now. This is where the market order shines. Using market orders is one of the fundamental types of orders in trading.

Definition and Explanation:

A market order is the simplest and most direct type of order. It’s an instruction to your broker to buy or sell a currency pair at the best available current market price. Essentially, you’re saying, “I want to trade right now, at whatever price the market offers.” When learning about types of orders in trading with examples, market orders are always the starting point.

When and Why Traders Use Market Orders:

- Speed and Urgency: Market orders are perfect for traders who need to execute trades immediately. In fast-moving markets, especially during news releases or periods of high volatility, every second counts. A market order ensures you get into the market swiftly.

- Capitalizing on Immediate Opportunities: If you identify a short-term trading opportunity and believe the price will move quickly in your favor, a market order allows you to capitalize on that moment without delay.

- Simplicity: For beginners, market orders are easy to understand and execute. There’s no need to set specific price levels; you simply click “buy” or “sell.”

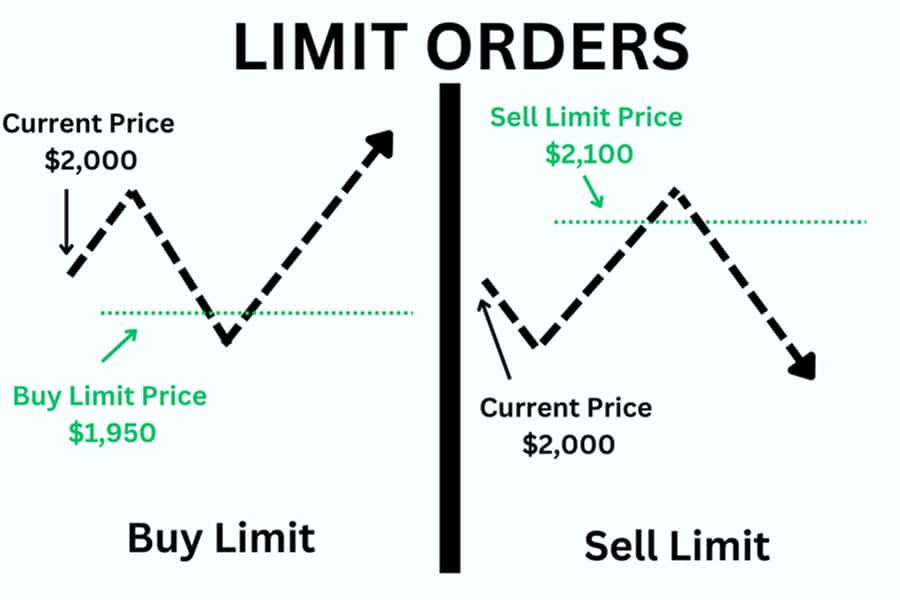

2. Limit Orders: Precision Entry and Profit Taking

Now, picture this: you’ve analyzed the market and identified a specific price level where you believe the EUR/USD pair will reverse its direction. You don’t need to be glued to your screen waiting for it to reach that exact point. Enter the limit order, your tool for precision and strategic entry. Limit orders are another key concept in types of orders in trading.

Definition and Explanation:

A limit order is an instruction to your broker to buy or sell a currency pair only at a specific price or better. This means:

- Buy Limit Order: You set a price below the current market price. The order will only be executed if the market price drops to your specified price or lower. You are essentially saying, “I want to buy EUR/USD, but only if the price falls to 1.0800 or less.”

- Sell Limit Order: You set a price above the current market price. The order will only be executed if the market price rises to your specified price or higher. You are saying, “I want to sell EUR/USD, but only if the price rises to 1.0900 or more.”

Difference Between Buy Limit and Sell Limit Orders:

The key difference lies in the price level relative to the current market price. Buy limit orders are placed below the current price to buy at a lower price, while sell limit orders are placed above the current price to sell at a higher price. Distinguishing between buy and sell limit orders is important when studying types of orders in trading with examples.

Advantages and Scenarios for Using Limit Orders:

- Precise Entry Points: Limit orders allow you to enter the market at your desired price, potentially improving your entry and maximizing your profit potential.

- Profit Taking: Traders often use sell limit orders to take profits at predetermined levels. If you expect a currency pair to reach a certain resistance level and then potentially reverse, a sell limit order at that level can automatically close your position and secure your profits.

- Disciplined Trading: Limit orders encourage a more disciplined approach to trading. You pre-plan your entry and exit points, avoiding impulsive decisions based on market fluctuations.

- Trading Breakouts: Limit orders can be used to enter breakout trades. For example, if you anticipate a price breakout above a resistance level, you can place a buy limit order just above that level, expecting the price to trigger your order as it breaks through.

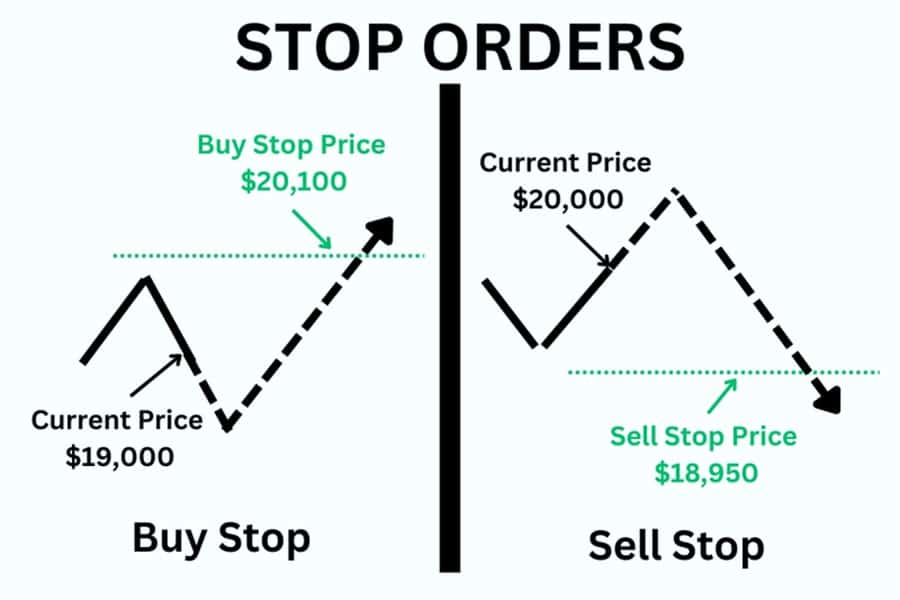

3. Stop Orders: Shielding Your Capital

Imagine you’re in a trade, and things start moving against you. You need a safety net to limit your potential losses. This is where stop orders, also known as stop-loss orders, become your indispensable allies in risk management. Understanding stop orders is crucial when learning about types of orders in trading.

Definition and Explanation:

A stop order is an instruction to your broker to buy or sell a currency pair once the price reaches a specified stop price. Once the stop price is triggered, the stop order converts into a market order and is executed at the best available market price.

- Buy Stop Order: You set a stop price above the current market price. The order will be executed if the market price rises to your stop price or higher.

- Sell Stop Order: You set a stop price below the current market price. The order will be executed if the market price falls to your stop price or lower.

Difference Between Buy Stop and Sell Stop Orders:

Similar to limit orders, the difference lies in the price level relative to the current market price. Buy stop orders are placed above the current price to buy when the price rises to a certain level, while sell stop orders are placed below the current price to sell when the price falls to a certain level. Differentiating between buy and sell stop orders is key to understanding types of orders in trading with examples.

Common Uses of Stop Orders in Trading Strategies:

- Limiting Losses (Stop-Loss Orders): The most crucial use of stop orders is to limit potential losses. By placing a sell stop order below your entry price for a long position, or a buy stop order above your entry price for a short position, you automatically exit the trade if the price moves against you beyond your predetermined risk tolerance.

- Entering Breakout Trades: Buy stop orders can be used to enter breakout trades. If you anticipate a price breakout above a resistance level, you can place a buy stop order just above that level. As the price breaks through the resistance, your stop order will be triggered, and you’ll enter a long position.

- Protecting Profits (Trailing Stops – discussed later): While primarily used for loss limitation, stop orders can also be adapted to protect profits as your trade moves in your favor.

4. Stop-Limit Orders: Combining Precision and Protection

Imagine wanting the loss-limiting protection of a stop order, but with the price control of a limit order. Enter the stop-limit order, a hybrid order type that offers a blend of both worlds. Stop-limit orders represent a more advanced understanding of types of orders in trading.

Definition and Explanation:

A stop-limit order is a conditional order that combines the features of both stop orders and limit orders. It requires you to set two prices:

- Stop Price: This price, when reached, triggers the order, just like a regular stop order.

- Limit Price: Once the stop price is triggered, a limit order is placed at your specified limit price.

How Stop-Limit Orders Combine Features of Stop and Limit Orders:

The stop price activates the order, and the limit price dictates the price at which the order will be filled. This means:

- Buy Stop-Limit Order: You set a stop price above the current market price and a limit price above the stop price (or at the stop price). When the market price reaches the stop price, a buy limit order is placed at your specified limit price.

- Sell Stop-Limit Order: You set a stop price below the current market price and a limit price below the stop price (or at the stop price). When the market price reaches the stop price, a sell limit order is placed at your specified limit price.

Situations Where Stop-Limit Orders Are Beneficial:

- Controlling Execution Price: Unlike a regular stop order which converts to a market order and can be filled at potentially unfavorable prices during fast market movements, a stop-limit order ensures your order is only filled at your specified limit price or better.

- Reducing Slippage Risk: In volatile markets, stop-limit orders can help reduce slippage compared to market orders triggered by stop prices. However, it’s crucial to understand that if the market moves too quickly past your stop price and then your limit price, your order might not be filled at all.

- Entering Breakout Trades with Price Control: If you want to enter a breakout trade but are concerned about slippage during a rapid price surge, a buy stop-limit order can provide more control over your entry price.

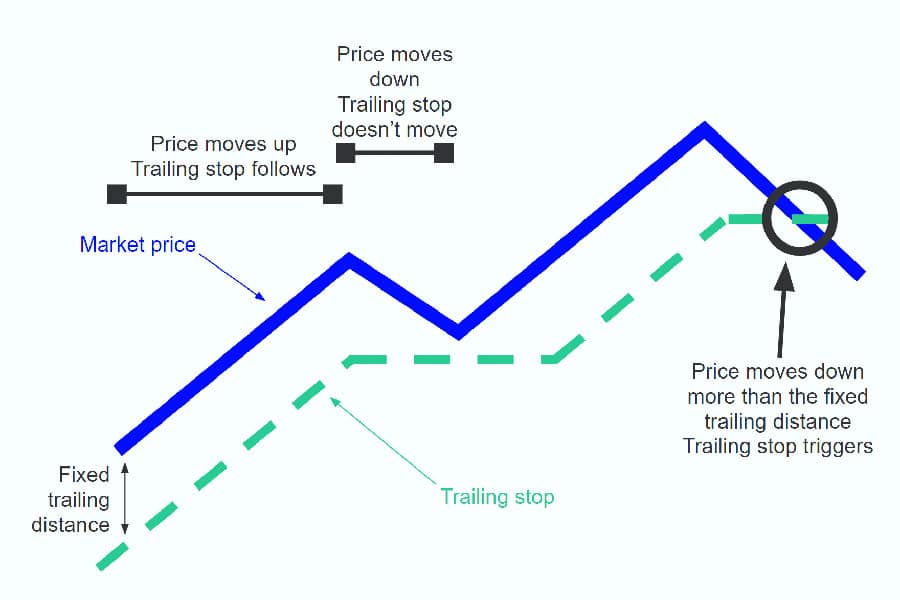

5. Trailing Stop Orders: Ride the Profit Wave

Imagine your trade is going exceptionally well, profits are accumulating, but you want to protect those gains without prematurely exiting the trade. Enter the trailing stop order, your dynamic profit protector. Trailing stop orders are a sophisticated tool among the types of orders in trading.

Definition and Explanation:

A trailing stop order is a type of stop order that adjusts automatically as the market price moves in your favor. It “trails” the price, maintaining a fixed pip distance from the current market price.

Mechanism of Trailing Stops and How They Adjust with Market Movements:

- Trailing Stop for Long Positions: You set a trailing stop a certain number of pips below the current market price. As the price rises, the trailing stop level also rises, maintaining the specified pip distance. If the price reverses and falls to the trailing stop level, your sell order is triggered, locking in profits.

- Trailing Stop for Short Positions: You set a trailing stop a certain number of pips above the current market price. As the price falls, the trailing stop level also falls, maintaining the specified pip distance. If the price reverses and rises to the trailing stop level, your buy order is triggered, securing profits.

Benefits of Using Trailing Stops for Profit Protection:

- Dynamic Profit Locking: Trailing stops automatically adjust to market movements, allowing you to capture profits as your trade becomes more profitable.

- Maximizing Potential Gains: Unlike fixed take-profit orders that limit potential upside, trailing stops allow your profits to run as long as the price continues to move in your favor.

- Hands-Off Management: Once set, trailing stops require minimal manual adjustment. They automatically adapt to market fluctuations, freeing you from constantly monitoring your trades.

- Reduced Emotional Trading: Trailing stops can help remove emotional decision-making from profit taking. They provide a systematic approach to locking in gains, preventing premature exits driven by fear of losing profits.

6. Good ‘Til Cancelled (GTC) Orders: Set It and Forget It (Almost)

Imagine you have a long-term trading strategy and want your orders to remain active until they are filled, regardless of market fluctuations. Enter Good ‘Til Cancelled (GTC) orders, your solution for persistent order placement. GTC orders offer a different perspective on managing types of orders in trading.

Definition and Explanation:

A Good ‘Til Cancelled (GTC) order is an order that remains active in the market until it is either executed or manually cancelled by you. Unlike day orders that expire at the end of the trading day, GTC orders stay in place indefinitely.

How GTC Orders Remain Active Until Executed or Manually Cancelled:

Once you place a GTC order, it will remain on the order book until one of two things happens:

- Execution: If the market price reaches your order price (for limit orders) or stop price (for stop orders), the order is executed as usual.

- Manual Cancellation: You can manually cancel the order at any time if you change your trading plan or no longer want the order to be active.

Appropriate Scenarios for Using GTC Orders:

- Long-Term Trading Strategies: GTC orders are ideal for traders who employ long-term trading strategies, such as swing trading or position trading. They allow you to set entry or exit points based on your long-term analysis and leave the orders active until they are triggered.

- Trading Based on Key Levels: If you identify significant support or resistance levels and want to enter or exit trades when the price reaches those levels, GTC orders ensure your orders remain active until those levels are tested.

- Trading Around the Clock: Forex markets operate 24/5. GTC orders allow you to place orders outside of your active trading hours and have them automatically executed if your conditions are met, even while you are away from your trading platform.

7. One-Cancels-the-Other (OCO) Orders: Trading with Options

Imagine you’re anticipating a major market move, but you’re unsure which direction it will take. You want to be prepared for both possibilities. Enter One-Cancels-the-Other (OCO) orders, your tool for trading with optionality. OCO orders offer strategic flexibility when using types of orders in trading.

Definition and Explanation:

A One-Cancels-the-Other (OCO) order is a pair of orders where executing one order automatically cancels the other order. Typically, an OCO order combines a limit order and a stop order.

How OCO Orders Allow Traders to Set Two Orders Simultaneously:

When you place an OCO order, you are essentially setting up two potential scenarios:

- Scenario 1 (Limit Order Triggered): If the price moves in your expected direction and triggers your limit order (e.g., for profit-taking or entering a pullback trade), the stop order (e.g., for loss limitation) is automatically cancelled.

- Scenario 2 (Stop Order Triggered): If the price moves against your initial expectation and triggers your stop order (e.g., for loss limitation), the limit order is automatically cancelled.

Examples of Using OCO Orders to Manage Trades:

- Breakout Trading: You can use an OCO order to prepare for a potential breakout in either direction. Place a buy stop order above a resistance level and a sell stop order below a support level. If the price breaks out upwards, the buy stop order will be triggered, and the sell stop order will be cancelled. Conversely, if the price breaks down, the sell stop order will be triggered, and the buy stop order will be cancelled.

- Trading Ranges: When trading within a range, you can use an OCO order to set both a profit target and a stop-loss simultaneously. Place a sell limit order at the range resistance and a buy stop order above the range resistance (or below the range support, depending on your risk tolerance). This allows you to manage risk and target profits within the range.

- News Trading: Before a major news event, you can use an OCO order to prepare for potential price spikes in either direction. Place a buy stop order above the current price and a sell stop order below the current price. Whichever order is triggered first as the market reacts to the news, the other order will be automatically cancelled.

8. Time-in-Force Instructions: Order Lifespan Control

Imagine needing your order to be executed immediately or cancelled if it cannot be filled instantly. Or perhaps you only want your order to be active for a very short period. This is where Time-in-Force (TIF) instructions come into play, giving you control over the lifespan of your orders. Time-in-force instructions add another layer of control when managing types of orders in trading.

Explanation of Different Time-in-Force Instructions:

Time-in-Force instructions are additional parameters you can specify when placing orders to control how long your order remains active in the market. Common TIF instructions include:

- Good ‘Til Cancelled (GTC): As discussed earlier, the order remains active until executed or manually cancelled.

- Day Order: The order is active only for the current trading day. If it is not filled by the end of the trading day, it is automatically cancelled. This is often the default setting for many order types.

- Immediate or Cancel (IOC): The order must be executed immediately and fully at the specified price or better. If the entire order cannot be filled instantly, the unfilled portion is cancelled.

- Fill or Kill (FOK): The order must be executed immediately and entirely at the specified price or better. If the entire order cannot be filled instantly, the entire order is cancelled.

Impact of Time-in-Force Instructions on Order Execution:

TIF instructions significantly impact how your orders are handled and executed. They allow you to:

- Control Order Duration: Specify whether your order should be active indefinitely (GTC), for a single day (Day Order), or for a very short duration (IOC, FOK).

- Demand Immediate Execution (IOC, FOK): Ensure your order is executed right away if possible, or cancelled if immediate full execution is not feasible. This is crucial for time-sensitive trading strategies.

- Manage Order Book Visibility: IOC and FOK orders, if not fully filled, are removed from the order book quickly, reducing their visibility to other market participants.

Pro Tips for Advanced Traders

- Combine Order Types: Don’t limit yourself to using just one type of order. Experienced traders often combine different order types to create sophisticated trading strategies. For example, use OCO orders with trailing stops for advanced risk and profit management.

- Master Order Entry Techniques: Practice placing different order types in a demo account to become proficient and comfortable with order entry. Speed and accuracy are crucial in fast-moving markets.

- Understand Market Conditions: The best order type to use depends on market conditions. In volatile markets, limit orders might not get filled, while market orders could experience slippage. Adapt your order type selection to the prevailing market environment.

- Automate with Expert Advisors (EAs): Consider using Expert Advisors (trading robots) that can automatically place and manage orders based on predefined strategies. EAs can execute complex order sequences with speed and precision, especially beneficial for strategies involving multiple order types.

- Monitor Order Execution: Always monitor the execution of your orders, especially market orders and stop orders, to understand the actual fill price and identify any potential slippage. This helps refine your order placement strategies in the future.

Trade Smarter with Opofinance – Your Gateway to Financial Success!

Looking for a reliable and innovative trading platform? Opofinance is your ultimate destination! With access to a diverse range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies, you can diversify your portfolio and seize global trading opportunities.

🚀 Why Choose Opofinance?

✔ Advanced Trading Platforms – Trade on MT4, MT5, cTrader, and OpoTrade with superior charting tools.

✔ Innovative AI Tools – Utilize AI Market Analyzer, AI Coach, and AI Support for smarter decision-making.

✔ Social & Prop Trading – Copy expert traders’ strategies or trade with funded accounts to amplify your profits.

✔ Comprehensive Education – Access live webinars, market insights, and exclusive trading courses.

✔ Secure & Flexible Transactions – Enjoy fast deposits and withdrawals, including crypto payments, with zero fees from Opofinance.

Join thousands of traders worldwide and maximize your potential with Opofinance! Start trading today and take advantage of cutting-edge technology, expert insights, and seamless execution.

Visit opofinance.com today and discover the Opofinance advantage!

Conclusion: Order Types – Your Key to Forex Mastery

Navigating the forex market requires more than just understanding currency pairs and market trends. Mastering types of orders in trading is the crucial bridge between your trading strategy and successful execution. From the immediacy of market orders to the strategic precision of limit orders, the protective shield of stop orders, and the dynamic profit capture of trailing stops, each order type serves a unique purpose. Understanding these types of orders in forex trading is paramount to success.

By understanding and effectively utilizing these 8 essential types of orders in forex trading, you gain the power to control your entries, manage your risks, and optimize your profit potential. Choosing the right order type for each trading scenario is not just a tactical decision; it’s a strategic imperative that can significantly impact your trading outcomes. Exploring types of orders in trading with examples enhances practical application.

As you continue your forex trading journey, remember that knowledge is power. Embrace the versatility of these order types, practice their application, and refine your order placement strategies. With a solid understanding of forex orders, you’ll be well-equipped to navigate the dynamic forex market and pursue your financial goals with confidence and precision. This guide to types of orders in trading provides a strong foundation.

Key Takeaways

- Market Orders: For immediate execution at the best available price.

- Limit Orders: For precise entry and profit-taking at specific price levels.

- Stop Orders: For limiting losses and entering breakout trades when price reaches a stop level.

- Stop-Limit Orders: Combine stop and limit features for price control and reduced slippage.

- Trailing Stop Orders: Dynamically protect profits as the price moves in your favor.

- GTC Orders: Remain active until executed or manually cancelled, ideal for long-term strategies.

- OCO Orders: Manage trades with optionality by setting two orders, where one cancels the other.

- Time-in-Force Instructions: Control the lifespan and execution requirements of your orders.

What is the difference between slippage and negative slippage in forex trading orders?

Slippage occurs when the actual execution price of your order differs from the expected price. Negative slippage happens when you get filled at a worse price than expected, commonly occurring with market orders during high volatility. Positive slippage, conversely, is when you get filled at a better price than expected, which is less frequent but still possible. Both are influenced by market liquidity and order type.

Can I modify or cancel an order after it has been placed?

Yes, in most cases, you can modify or cancel pending orders (like limit, stop, stop-limit, GTC, OCO) before they are executed. However, once a market order is placed, it’s generally executed almost instantaneously and cannot be cancelled. Modifications to pending orders might include changing the price level, stop-loss, or take-profit levels. Always check with your broker about their specific order modification and cancellation policies.

Are there any order types specifically designed for scalping strategies in forex trading?

While no order type is exclusively for scalping, market orders are frequently used due to the need for rapid entry and exit in short-term scalping strategies. Limit orders can also be used for precise entry points in scalping. Time-in-force instructions like IOC and FOK can be beneficial for scalpers needing immediate execution or cancellation. The key for scalping is speed and efficiency in order placement and execution, regardless of the specific order type chosen among the various types of orders in trading.