Thinking about getting into forex trading? It’s a smart move to learn about types of session in forex trading to boost your strategy. Imagine the forex market as a global hub, with different centers active at different times. These active periods are forex trading sessions explained. Each type of session in forex has its own rhythm, highs, and lows. Understanding forex market sessions and times is not just helpful – it’s essential for effective trading. Want to trade with more insight? Let’s explore how mastering types of session in forex trading can make a difference.

This guide will introduce you to the main type of session in forex, making it easy to grasp their importance. We’ll break down each session, discuss simple strategies, and answer common questions new traders ask about forex trading sessions explained. Are you searching for a good forex broker to begin? Or are you already trading with an online forex broker but want to refine your approach using knowledge of forex market sessions and times? Understanding these sessions is key to smarter trading. Let’s understand types of session in forex trading together!

Understanding Forex Market Sessions and Times

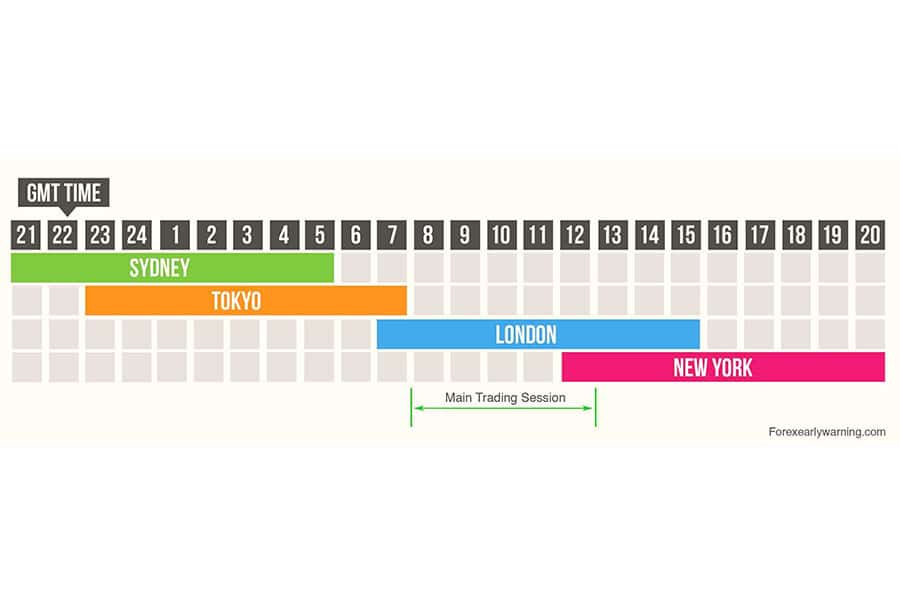

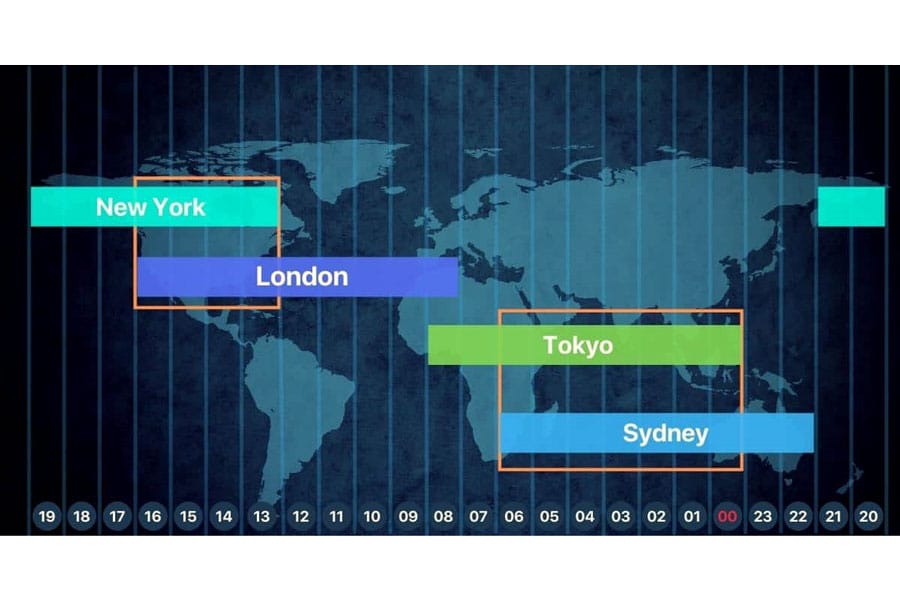

Unlike stock markets with fixed hours, the forex market operates 24/5! This continuous trading is due to global trading across different time zones. As trading slows in one zone, it picks up in another. This creates the 24-hour cycle of forex market sessions and times.

This 24-hour cycle is divided into key forex trading sessions explained, each named after a major financial center. Knowing this type of session in forex is crucial. The main types of session in forex trading are:

Key Forex Trading Sessions

Understanding the types of session in forex trading involves knowing the main players:

- Asian Session (Tokyo)

- European Session (London)

- North American Session (New York)

Learning about forex market sessions and times means understanding market behavior during each session. Each type of session in forex influences market dynamics, and this knowledge is power.

Read More: ICT Killzone Times

Why Forex Trading Sessions and Times Matter

Why should beginner traders focus on forex market sessions and times? Because each type of session in forex has a unique impact on your trading. Think of forex trading sessions explained as different phases of the trading day, each with its own energy. These sessions affect:

Market Movement (Volatility): Some types of session in forex trading are known for high volatility, where prices move a lot. Others have low volatility, with steadier prices. Knowing forex market sessions and times helps you choose strategies based on volatility.

Trading Ease (Liquidity): Liquidity, or trading ease, varies across forex trading sessions explained. High liquidity sessions mean easier trading and tighter spreads, reducing your trading costs.

Trading Activity (Volume): Trading volume changes throughout forex market sessions and times. Peak volume often occurs when major types of session in forex trading overlap, creating more opportunities and potentially faster price movements.

Currency Focus: Certain currencies are more active during specific forex trading sessions explained. For example, Yen pairs are more dynamic during the Asian session. Knowing forex market sessions and times helps you target the right currencies.

Understanding types of session in forex trading allows for smarter trading decisions. Ignoring forex market sessions and times is like trading blindfolded. Learning about each type of session in forex is essential for navigating the forex market effectively and finding the best forex trading sessions for your style.

Exploring the Different Types of Session in Forex Trading

Let’s explore each type of session in forex to see what makes them distinct and how they fit into forex trading sessions explained:

1. Asian Session (Tokyo Session): Trading in Asian Market Hours

The Asian session, also known as the Tokyo session, starts the forex day. It’s generally active from midnight to 9 AM GMT, encompassing key Asian financial hubs and defining the early hours of forex market sessions and times.

Characteristics of the Asian Session

Lower Volatility, Range-Bound Moves: Compared to other types of session in forex trading, the Asian session is typically less volatile. Prices often trade within ranges, making it a calmer period within forex market sessions and times. This lower volatility can be ideal for certain trading styles.

Asian Currency Focus: This session highlights currencies like the Japanese Yen (JPY), Australian Dollar (AUD), and New Zealand Dollar (NZD). Activity in these pairs reflects the geographical focus of this type of session in forex. Asian news and data releases are key drivers for these currencies during these forex market sessions and times.

Impact of Asian News: Economic news from Japan, Australia, and China can create short-term activity. Traders watching forex market sessions and times note that these announcements can influence Asian currency pairs, offering specific trading moments within this type of session in forex.

Trading Ideas for the Asian Session

Range Trading Strategies: Range trading is well-suited to the Asian session due to its range-bound nature. Identify support and resistance levels to trade price swings within these boundaries, a common approach during these forex market sessions and times.

Carry Trades: For carry trades, the Asian session’s lower volatility can be advantageous. The stability of this type of session in forex makes it suitable for holding positions overnight to capitalize on interest rate differentials, a strategy aligned with the calmer pace of these forex market sessions and times.

2. European Session (London Session): The Heart of Forex Trading Volume

As the Asian session ends, the European session, led by London, becomes the center of activity. The London session is known for high volume and activity, making it a central part of forex trading sessions explained. It runs from 8 AM to 5 PM GMT, representing peak European trading hours within forex market sessions and times.

What Makes the European Session Key

High Activity and Volatility: The European session is typically the most liquid and volatile. London’s status as a financial hub drives significant participation, defining this type of session in forex as a high-energy period within forex market sessions and times.

Global Trading Hub: A large portion of global forex trading occurs during the London session. This high volume creates opportunities but requires careful risk management during these active forex market sessions and times.

Euro, Pound, and Swiss Franc: Currencies like EUR, GBP, and CHF are most active, reflecting the geographical focus of this type of session in forex. However, all major pairs see increased activity due to London’s global importance in forex market sessions and times.

European Economic News: European news releases can significantly impact the market. Traders monitoring forex market sessions and times watch for UK and Eurozone economic data for potential trading signals during this type of session in forex.

Trend Setting Session: Trends often start in the London session, influencing the day’s market direction. Many traders look to this type of session in forex to gauge market sentiment and direction within forex market sessions and times.

Trading Strategies for the European Session

Breakout Trading: Breakout strategies are effective in the volatile European session. Identify key levels and trade breakouts for potential strong moves, capitalizing on the energy of these forex market sessions and times.

Trend Following: Trend-following is ideal as trends often emerge during this session. Identify early trends and trade with the momentum, aligning with the directional nature of these forex market sessions and times.

3. North American Session (New York Session): USD and North American Activity

Following Europe, the North American session, led by New York, takes over. The New York session, from 1 PM to 10 PM GMT, is the second most active and brings unique dynamics to forex trading sessions explained.

Features of the North American Session

Volatility, Especially with London Overlap: The New York session overlaps with the late European session, creating peak volatility. This overlap period within forex market sessions and times is known for the day’s most significant price swings, combining the forces of two major markets.

USD-Centric Pairs: USD pairs are central during this session. The US Dollar’s global reserve status means US news heavily influences forex market sessions and times, especially within this type of session in forex.

US Economic Data Impact: US economic news, like jobs and GDP reports, drives market moves. News trading is common during these forex market sessions and times, particularly within this type of session in forex.

Morning Overlap Intensity: The London/New York overlap is intensely liquid and volatile. This period of forex market sessions and times often sees the day’s biggest moves, offering active trading opportunities.

Afternoon Dynamics: After London closes, volatility can decrease in the New York afternoon. However, surprise US news can still cause volatility, reminding traders to stay alert throughout these forex market sessions and times.

Trading Approaches for the North American Session

USD Pair Focus: Trading USD pairs is strategic during the New York session. These pairs offer the best liquidity and opportunities, aligning with the session’s focus within forex market sessions and times.

News Trading: The New York session is prime for news trading. Develop strategies to trade around US economic releases, capitalizing on the expected volatility during these key moments in forex market sessions and times.

| Forex Session | Market Hours (GMT) | Key Characteristics |

| Asian Session (Tokyo Session) | 12:00 AM – 9:00 AM GMT | Low volatility, range-bound movements. Ideal for range traders and carry trade strategies. |

| European Session (London Session) | 8:00 AM – 5:00 PM GMT | High liquidity and volatility. Best for trend and breakout trading strategies. |

| North American Session (New York Session) | 1:00 PM – 10:00 PM GMT | USD pairs dominate trading activity. High volatility, especially during London overlap. Economic news releases drive price movements. |

| Sydney Session (Minor Session) | 10:00 PM – 7:00 AM GMT | Overlaps with the Tokyo session, moderate liquidity. AUD and NZD pairs see more action. Lower volatility compared to London/New York. |

Read More: Forex Market Hours

Session Overlaps: Prime Trading Times

The most dynamic times in forex trading are session overlaps. These occur when two major types of session in forex trading are simultaneously active, boosting volume and volatility, and creating prime trading conditions within forex market sessions and times.

Why Overlaps Boost Volatility

Overlaps increase volatility due to higher trader participation. More traders online mean more orders, tighter spreads, and potential for rapid price movements, making overlaps key moments in forex market sessions and times.

Key Session Overlaps to Note

London and New York Overlap (1 PM – 5 PM GMT): This is the top overlap, most liquid and volatile, combining London and New York forces. Expect tight spreads and strong moves, making it a peak period in forex market sessions and times and considered among the best forex trading sessions.

Sydney and Tokyo Overlap (Midnight – 7 AM GMT): Less volatile than London/New York but still active. Good for AUD/JPY and NZD/JPY, offering specific Asian-focused opportunities within forex market sessions and times.

London and Tokyo Overlap (8 AM – 9 AM GMT): A brief, active overlap in EUR/JPY and GBP/JPY as European and Asian sessions briefly combine, creating short, focused trading windows within forex market sessions and times.

Trading Strategies for Overlap Sessions

Volatility-Based Strategies: Overlaps suit volatility strategies. Use strategies that profit from price swings, like range expansion or volatility scalping, ideal for the dynamic conditions of these forex market sessions and times.

Breakout Strategies in Overlap: Breakout strategies are effective during the London/New York overlap. High volume and volatility can lead to strong breakouts, making it a prime time for such strategies within forex market sessions and times and considered among the best forex trading sessions.

| Overlap Session | Market Hours (GMT) | Key Features |

| London & New York Overlap | 1:00 PM – 5:00 PM GMT | Most volatile & liquid trading period. 🔹 Major moves in USD, EUR, GBP pairs. 🔹 High-impact news releases drive strong trends. |

| Sydney & Tokyo Overlap | 12:00 AM – 7:00 AM GMT | Moderate volatility, good for Asian currencies. Best for trading JPY, AUD, and NZD pairs. Lower liquidity but smoother price movements. |

| London & Tokyo Overlap | 8:00 AM – 9:00 AM GMT | Short but active session. Best for trading GBP/JPY, EUR/JPY pairs. Quick price movements due to session transition. |

Choosing the Best Forex Trading Sessions for Your Style

There’s no single “best forex trading sessions” – it depends on your trading style and goals. The ideal best forex trading sessions for you align with your personal trading preferences and strategy, considering the nuances of each type of session in forex trading.

Read More: Best Currency Pairs to Trade in London Session

Factors for Choosing a Session

Your Trading Style: Consider how types of session in forex trading match your style: Scalpers: May favor the London/New York overlap for fast trades, leveraging the high volatility of these forex market sessions and times.

Day Traders: Can trade in London and New York sessions for volatility and liquidity, making the most of active forex market sessions and times.

Swing Traders: May focus less on specific sessions, but session volatility still helps time entries and exits, using forex market sessions and times for strategic advantage.

Currency Pair Preference: Trade during sessions where your preferred pairs are most active. Align your currency focus with the geographical emphasis of each type of session in forex trading.

Time Availability: Choose sessions that fit your schedule. Match your trading to your available hours to effectively engage with forex market sessions and times.

Risk Comfort: If risk-averse, the calmer Asian session might suit you. If you prefer volatility, the London/New York overlap could be better, aligning session choice with your risk tolerance within forex market sessions and times.

Session Guide: Best Use Cases

Asian Session (Tokyo Session): Ideal for range trading and lower volatility strategies, best for those seeking calmer forex market sessions and times and trading Asian currencies.

European Session (London Session): Suited for trend following and high liquidity needs, perfect for traders wanting active forex market sessions and times and employing trend strategies.

New York Session (New York Session): Best for USD pairs and news trading, especially during the London/New York overlap, catering to traders focused on USD and news-driven forex market sessions and times and seeking the best forex trading sessions for volatility.

Pro Session Trading Tips

Overlap Scalping: During London/New York overlap, scalp for quick gains, using tight stops due to high volatility in these forex market sessions and times.

Pre-News Trading: Experienced traders can anticipate news impacts, trading before major releases in London and New York sessions, but risk management is crucial during these dynamic forex market sessions and times.

Session Analysis: Analyze how sessions link. London session trends can predict New York moves, offering insights across forex market sessions and times.

Automated Session Trading: Automate strategies for consistent session-based trading, using bots to trade preferred sessions, streamlining your approach to forex market sessions and times.

Opofinance: Your Forex Session Trading Partner

Ready to apply your knowledge of types of session in forex trading? Opofinance, a regulated broker for forex trading, is perfect for trading any session. Here’s why Opofinance is a strong choice for navigating forex market sessions and times:

- Advanced Platforms: Trade on MT4, MT5, cTrader, and OpoTrade for effective trading across all forex market sessions and times, providing tools for every type of session in forex.

- AI Trading Tools: Use AI Market Analyzer for session insights, AI Coach for guidance, and AI Support for assistance, enhancing your strategy across different forex market sessions and times.

- Social & Prop Trading: Join a trading community and explore prop trading to boost your capital and refine session strategies, leveraging community insights during key forex market sessions and times.

- Easy Transactions: Enjoy secure, zero-fee deposits and withdrawals, optimizing your trading capital across all forex market sessions and times.

Explore Opofinance today and start session-smart trading! Click here to explore Opofinance and start trading today!

Conclusion: Mastering Forex Trading Sessions Explained

Understanding types of session in forex trading is vital for improving your trading. By knowing each session’s characteristics, you refine strategies and manage risk, enhancing your trading during all forex market sessions and times. Mastering forex trading sessions explained is key to smarter forex trading.

The forex market is dynamic. Continuous learning about forex market sessions and times is essential for long-term success. Adapt strategies to session behaviors and prioritize risk management. Session mastery empowers you in forex trading, making you a more informed and effective trader across all types of session in forex trading and helps you identify the best forex trading sessions for your goals.

Key Takeaways:

- The forex market operates 24/7, divided into Asian, European, and North American types of session in forex trading.

- Each type of session in forex has unique volatility, liquidity, and currency focus, defining forex market sessions and times.

- Session overlaps, like London/New York, are high-activity periods within forex market sessions and times, offering prime trading opportunities and considered among the best forex trading sessions.

- Choose sessions matching your trading style, currency preferences, and time, personalizing your approach to forex market sessions and times.

- Mastering forex trading sessions explained is crucial for effective and profitable forex trading, helping you navigate all types of session in forex trading.

Best session if I have limited trading time?

For limited time, focus on the London/New York session overlap (1-5 PM GMT). It’s the most active, offering quick opportunities within forex market sessions and times, and often considered one of the best forex trading sessions for active traders. Manage risk due to higher volatility during this type of session in forex trading.

Are some sessions “bad” for trading?

No session is “bad,” but the Asian session‘s lower volatility may not suit all. It’s calmer, which is good for range trading but not for high-action strategies. Session choice depends on your trading style and preference within forex market sessions and times, and understanding each type of session in forex.

How to track forex session times and impacts?

Use session tools and trading diaries. Note session times, currency pairs, and outcomes to spot patterns. This helps understand how forex market sessions and times affect your trading and refine your session-based strategies across different types of session in forex trading to find your best forex trading sessions.

One Response

I think it’s important for new traders to understand that selecting the right account type is a huge factor in their success. For example, social trading might be a great option for those just starting out, as they can learn from more experienced traders.