Is Forex good in 2024? A Comprehensive Guide

Forex trading has gained significant popularity in recent years, attracting both experienced traders and newcomers looking to make a profit in the financial markets. With its potential for high returns and accessibility, many individuals are wondering whether it is a good time to invest in forex. In this comprehensive guide, we will delve into the factors that can influence your decision to invest in forex, the potential risks and rewards, and the strategies you can employ to maximize your chances of success.

Understanding the Forex Market

Forex, short for foreign exchange, is the largest financial market globally, with trillions of dollars traded daily. It involves buying and selling currencies with the aim of making a profit from the fluctuations in their exchange rates. Forex trading offers individuals the opportunity to participate in the global economy and potentially generate substantial returns. However, it is important to note that forex trading carries inherent risks, and success requires knowledge, experience, and a well-defined trading strategy.

Is It Good to Invest in Forex Now

Before deciding whether it is a good time to invest in forex, it is crucial to understand the fundamentals of the forex market. Unlike traditional stock markets, forex operates as a decentralized market, with trading taking place electronically over-the-counter (OTC). The primary participants in the forex market include commercial banks, central banks, institutional investors, corporations, and retail traders.

Currencies are traded in pairs, with the most actively traded pairs being the EUR/USD, GBP/USD, USD/JPY, and USD/CHF. The exchange rate of a currency pair reflects the value of one currency relative to another. Forex traders speculate on the direction of currency pairs, aiming to profit from the fluctuations in exchange rates.

Factors Influencing the Forex Market in 2024

The forex market is influenced by a multitude of factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. In 2024, several factors are likely to impact the forex market, shaping the investment landscape for traders. These factors include:

1. Economic Indicators

Economic indicators, such as GDP growth, inflation rates, employment data, and interest rates, play a significant role in determining the strength and stability of a country’s economy. Positive economic indicators often lead to a stronger currency, while negative indicators can weaken a currency.

2. Geopolitical Events

Geopolitical events, such as elections, trade disputes, and geopolitical tensions, can have a profound impact on currency markets. Uncertainty and instability resulting from geopolitical events can lead to increased volatility in forex markets.

3. Central Bank Policies

Central banks play a crucial role in managing a country’s monetary policy and interest rates. Changes in central bank policies, such as interest rate decisions or quantitative easing measures, can significantly impact currency values.

4. Market Sentiment

Market sentiment refers to the overall attitude of traders and investors towards a particular currency or market. Positive market sentiment can drive currency appreciation, while negative sentiment can lead to currency depreciation.

Pros and Cons of Investing in Forex

Before diving into forex trading, it is essential to consider the potential advantages and disadvantages. Understanding the pros and cons will help you make an informed decision about whether forex trading is suitable for you.

1. Pros of Investing in Forex

- High liquidity: The forex market is highly liquid, offering ample trading opportunities throughout the trading week.

- Accessibility: Forex trading is accessible to individuals with varying levels of capital, allowing for flexible investment options.

- Potential for profit: Forex trading offers the potential for high returns, especially when employing effective trading strategies.

- Diversification: Forex trading allows investors to diversify their investment portfolios by including currency pairs alongside other asset classes.

2. Cons of Investing in Forex

- Volatility and risk: Forex markets can be highly volatile, and trading without proper risk management strategies can lead to significant losses.

- Complexity: Forex trading requires a deep understanding of technical and fundamental analysis, as well as market dynamics.

- Emotional stress: Trading in the forex market can be emotionally challenging, as traders need to make decisions in a fast-paced and unpredictable environment.

- Potential for scams: The forex market attracts fraudulent brokers and investment schemes, making it crucial to choose a reputable broker.

Risk Management in Forex Trading

Managing risk is a fundamental aspect of successful forex trading. Without proper risk management strategies in place, traders risk significant losses and financial instability. Here are some key risk management techniques to consider:

1. Setting Stop Loss and Take Profit Levels

Stop loss and take profit orders are essential risk management tools. A stop loss order sets a predetermined exit point to limit potential losses, while a take profit order locks in profits by automatically closing a trade when a specific profit target is reached.

2. Proper Position Sizing

Determining the appropriate position size is crucial to manage risk effectively. Traders should calculate the position size based on their account balance, risk tolerance, and the specific trade setup.

3. Diversification

Diversifying your forex trading portfolio can help mitigate risk. By spreading investments across different currency pairs and possibly other asset classes, traders reduce their exposure to a single trade or currency.

4. Regularly Assessing and Adjusting Risk

Risk management is an ongoing process. Traders should regularly assess their risk exposure, adjust position sizes as needed, and stay updated on market conditions that may impact their trades.

Choosing the Right Trading Strategy

Having a well-defined trading strategy is crucial to succeed in forex trading. Various trading strategies can be employed, including day trading, swing trading, trend following, and range trading. Each strategy has its own set of rules and methodologies. It is important to choose a strategy that aligns with your risk tolerance, trading style, and investment goals.

Technical and Fundamental Analysis in Forex Trading

Technical and fundamental analysis are two primary methods used by forex traders to make informed trading decisions.

1. Technical Analysis

Technical analysis involves studying historical price data, chart patterns, and technical indicators to identify potential entry and exit points. Traders using technical analysis believe that past price movements can provide insights into future price movements.

2. Fundamental Analysis

Fundamental analysis involves evaluating economic factors, such as interest rates, GDP growth, and employment data, to determine the intrinsic value of a currency. Fundamental analysts aim to identify undervalued or overvalued currencies based on economic fundamentals.

Selecting a Reliable Forex Broker

Choosing a reliable forex broker is crucial for a successful trading experience. Consider the following factors when selecting a forex broker:

1. Regulation and Security

Ensure that the broker is regulated by a reputable financial authority. Regulation provides investor protection and ensures that the broker operates in accordance with industry standards.

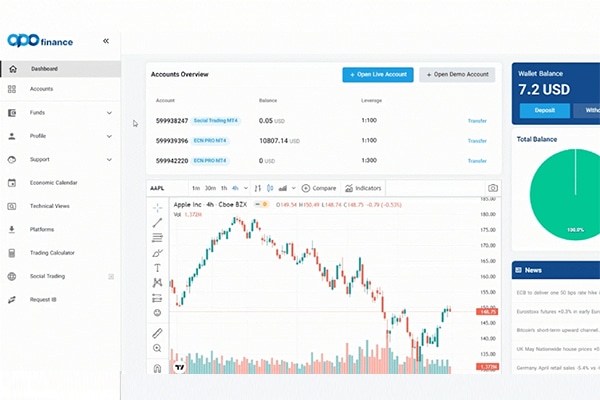

2. Trading Platform and Tools

Evaluate the trading platform’s features, functionality, and user-friendliness. A robust trading platform should offer real-time price quotes, advanced charting tools, and order execution capabilities.

3. Customer Support

Prompt and reliable customer support is essential in forex trading. Look for a broker that provides responsive customer support and offers multiple channels of communication.

4. Trading Costs and Spreads

Compare the trading costs, including spreads, commissions, and overnight fees, offered by different brokers. Low trading costs can significantly impact profitability, especially for frequent traders.

Steps to Start Investing in Forex

To get started with forex trading, follow these essential steps:

1. Educate Yourself

Invest time in learning about forex trading, risk management, trading strategies, and market analysis. Take advantage of educational resources, including online courses, webinars, and trading forums.

2. Open a Trading Account

Choose a reputable forex broker and open a trading account. Consider whether you prefer a live account or a demo account to practice trading strategies and familiarize yourself with the trading platform.

3. Develop a Trading Plan

Create a comprehensive trading plan that outlines your trading goals, risk tolerance, trading strategy, and money management rules. A trading plan will help guide your decision-making process and keep emotions in check.

4. Start with a Small Investment

It is advisable to start with a small investment and gradually increase your capital as you gain experience and confidence in your trading abilities. Avoid risking more than you can afford to lose.

5. Continuously Monitor and Adapt

Forex markets are dynamic and constantly changing. Stay informed about economic news, market trends, and geopolitical events that may impact currency values. Regularly review and adapt your trading strategies as needed.

Tips for Successful Forex Trading

To enhance your chances of success in forex trading, consider the following tips:

1. Emphasize Education and Continuous Learning

Never stop learning. Continuously educate yourself about market trends, trading strategies, and risk management techniques. Stay updated on economic news and global events that may impact currency markets.

2. Practice Patience and Discipline

Successful forex trading requires patience and discipline. Avoid impulsive decisions and stick to your trading plan. Emotions can cloud judgment, leading to poor trading decisions.

3. Practice Proper Risk Management

Implement effective risk management strategies, including setting stop loss orders and managing position sizes. Never risk more than a predetermined percentage of your trading capital on a single trade.

4. Keep Emotions in Check

Emotional control is crucial in forex trading. Avoid letting fear and greed dictate your trading decisions. Stick to your trading plan and remain objective in your analysis.

5. Maintain Realistic Expectations

Do not expect overnight riches from forex trading. It takes time, practice, and experience to become consistently profitable. Set realistic goals and focus on long-term success.

Conclusion

Investing in forex can be a potentially rewarding endeavor, but it requires careful consideration, education, and practice. By understanding the fundamentals, managing risks effectively, and employing sound trading strategies, you can increase your chances of success in the Forex Market. Remember to stay informed, adapt to changing market conditions, and continuously develop your trading skills. With diligence and perseverance, forex trading can offer an avenue for financial growth and investment opportunities