Exploring the Benefits of Forex Trading

Foreign exchange trading, commonly known as forex trading, is a popular investment practice that involves buying and selling currency values with the aim of making a profit. Many people view forex trading as a risky activity, but when approached with caution and proper research, it can be a lucrative venture. In this article, we will explore the reasons why forex is a good idea and the benefits it offers to traders

1. Access to a Large and Global Market

One of the primary advantages of forex trading is the vastness of the market itself. With an average daily trading volume exceeding $4 trillion USD, the forex market is the largest financial market in the world. It operates globally, with major financial centers in New York, London, Tokyo, and Hong Kong. This global reach provides traders with ample opportunities to profit from currency fluctuations and ensures high liquidity, making it easy to enter and exit trades.

Additionally, the size and scale of the forex market contribute to its accessibility. Unlike other markets, forex trading does not require a large initial investment. It is open to traders of all levels, including beginners, and offers flexibility in terms of trade sizes. This accessibility makes forex trading a viable option for individuals looking to enter the investment world with limited capital.

2. Potential for Profit and Income Generation

Forex trading offers significant profit potential due to the volatility of currency pairs. Currency values fluctuate constantly based on various factors such as economic stability, global events, political news, and trade deals. These fluctuations create opportunities for traders to buy low and sell high, generating profits from the price differences.

Moreover, forex trading allows traders to take advantage of leverage. Leverage is the ability to control a larger position with a smaller amount of capital. By using leverage, traders can amplify their potential profits. However, it’s important to note that leverage also increases the risk of losses, and it should be used with caution and proper risk management strategies.

3. Flexibility and Convenience

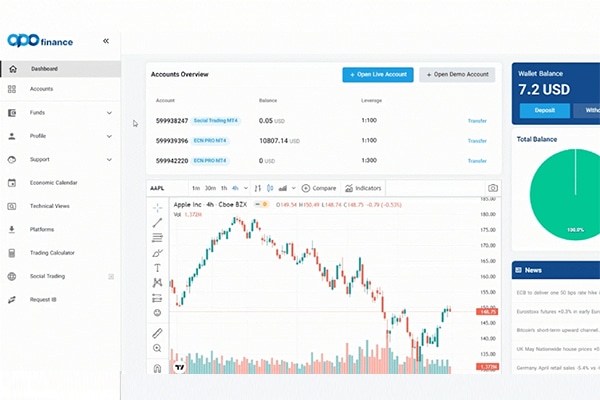

Forex trading offers flexibility and convenience to traders, making it an attractive option. Unlike traditional stock markets, the forex market operates 24 hours a day, five days a week. This means that traders can participate in trading activities at any time, depending on their preferred trading session or time zone. The ability to trade at any time provides flexibility to individuals with different schedules, allowing them to engage in forex trading alongside their main job or other commitments.

Furthermore, advancements in technology have made forex trading more accessible and user-friendly. Trading platforms and mobile applications provide traders with real-time quotes, advanced analytical tools, and the ability to execute trades efficiently. These technological innovations enable traders to monitor the market, manage their positions, and make informed trading decisions on the go.

4. Low Transaction Costs and Spreads

Another benefit of forex trading is the relatively low transaction costs involved. Unlike other financial markets, forex brokers typically make money from spreads, which are the differences between the buy and sell prices of currency pairs. Spreads in the forex market are usually low, making it cost-effective for traders to enter and exit positions. Additionally, some forex brokers offer commission-free trading, further reducing the overall transaction costs for traders.

5. High Liquidity and Volatility

The forex market is highly liquid, meaning that traders can easily buy and sell currency pairs without significant price variations. High liquidity ensures that traders can enter and exit trades at their desired prices, minimizing the impact of transaction costs. Moreover, liquidity contributes to the stability of prices, making it easier to implement trading strategies and manage risk effectively.

The forex market is also known for its volatility, which refers to the magnitude of price fluctuations. Volatility creates opportunities for traders to profit from short-term price movements. However, it’s important to note that increased volatility also comes with higher risks. Traders need to develop a solid understanding of market conditions, use appropriate risk management techniques, and implement effective trading strategies to navigate the volatility of the forex market successfully.

6. Diversification of Investment Portfolio

Forex trading provides an excellent opportunity for diversification within an investment portfolio. By including forex trading alongside other asset classes such as stocks, bonds, and commodities, traders can spread their risk and potentially enhance their overall portfolio performance. The forex market operates independently of other financial markets, allowing traders to capitalize on currency movements that may not necessarily align with the performance of other asset classes.

Diversification in forex trading can also be achieved through trading different currency pairs. Traders can choose to trade major currency pairs, such as EUR/USD or GBP/USD, as well as minor or exotic currency pairs. Each currency pair presents unique characteristics and trading opportunities, allowing traders to diversify their strategies and potentially increase their chances of success.

7. Educational Opportunities and Continuous Learning

Engaging in forex trading provides valuable educational opportunities for individuals interested in learning about global economies, currencies, and financial markets. Forex trading requires traders to stay informed about economic indicators, geopolitical events, and central bank policies that can influence currency values. By actively following news and market analysis, traders can develop a deep understanding of the factors driving currency movements and apply this knowledge to their trading decisions.

Additionally, many forex brokers offer educational resources and tools to help traders enhance their trading skills. These resources may include webinars, video tutorials, trading guides, and demo accounts. Demo accounts are particularly beneficial for beginners as they allow traders to practice trading strategies, test the functionalities of trading platforms, and gain hands-on experience without risking real money.

8. Regulation and Investor Protection

The forex market operates under strict regulations in various jurisdictions, providing a level of investor protection. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) ensure that forex brokers adhere to specific standards and guidelines. These regulations aim to protect traders from fraudulent activities, ensure fair trading practices, and maintain the integrity of the market.

When choosing a forex broker, it is important to consider the regulatory status and reputation of the broker. Working with a regulated broker provides traders with peace of mind, knowing that their funds are held in segregated accounts and that the broker operates in a transparent and accountable manner.

9. Community and Support

Forex trading has a vibrant community of traders, both online and offline, who share their experiences, insights, and trading strategies. Engaging with the forex trading community can provide valuable support, guidance, and networking opportunities. Online forums, social media groups, and trading communities allow traders to connect with like-minded individuals, exchange ideas, and learn from experienced traders.

Furthermore, many forex brokers offer customer support services to assist traders with their inquiries, technical issues, and account management. Having access to reliable customer support can be crucial, especially for beginners who may have questions or need assistance navigating the trading platform.

10. Potential for Career Growth and Independence

Forex trading offers individuals the opportunity to pursue a career in trading and achieve financial independence. With dedication, discipline, and continuous learning, traders can develop their skills, refine their strategies, and potentially generate consistent profits. Forex trading provides the flexibility to work from anywhere with an internet connection, allowing individuals to create their own schedule and achieve a work-life balance.

However, it’s important to note that forex trading requires a significant investment of time, effort, and perseverance. Success in forex trading is not guaranteed, and traders should be prepared to face challenges, setbacks, and potential losses. Developing a solid trading plan, managing risk effectively, and maintaining emotional discipline are key factors in achieving long-term success in the forex market.

Conclusion

Forex trading offers numerous benefits and opportunities for individuals looking to diversify their investment portfolio, generate income, and gain financial independence. With its global reach, high liquidity, and potential for profit, forex trading is a good idea for those willing to put in the time and effort to learn and develop their trading skills. However, it’s essential to approach forex trading with caution, conduct thorough research, and use proper risk management strategies to mitigate potential losses. By staying informed, continuously learning, and engaging with the trading community, traders can navigate the forex market successfully and potentially achieve their financial goals.

Remember, forex trading involves risks, and it may not be suitable for everyone. Before engaging in forex trading, it is important to consult with a financial advisor and assess your risk tolerance and investment objectives.