Introduction To The Best Metals to Invest

In the highly volatile world of Forex trading, metals have become compelling to traders and investors with various trading goals.

The focal reason that attracts investors to metal trading is the unique combination of stability and opportunity. From metals like gold, with a traditionally well-established value, to more attractive ones in the industrial era, such as palladium and copper.

However, this feature acts as a double-edged sword, offering a vast array of options while simultaneously making the choice of which metal to include in their portfolio difficult for traders.

This article, tailored for traders at all levels, will guide you on the basics of metal trading. It offers a list of prominent metals used in trading, factors that affect their prices, insights, analysis, and tips on how to strategize a metal trading approach aligned with your trading goals.

Understanding Metal Trading

Getting to know some generalities about metal trading is crucial before exploring what is the best metal for trading and diving into strategies and deeper insights. If you’re already familiar with the categories of metals and Forex metal trading, feel free to skip this section.

Another term used among traders to refer to metals suitable for trading is “precious metals,” which are categorized into two groups. The first type, such as gold and silver, has a historically well-established value, preserving it and acting as a hedge against inflation. On the other hand, industrial metals, such as copper and nickel, tend to reflect industrial demand and economic growth.

The difference between trading metals in forex and the traditional purchase of precious metals lies in the fact that Forex metal trading is not about physical ownership but rather investing in price movements.

The main benefits of this approach include:

- Benefiting from leverage

- The ability to trade on a margin

- The absence of storage concerns that are usually part of physical commodities trading.

1- Gold: A Historical Hedge Against Inflation

Gold holds significance in the Forex market due to its global, historical, and financial preciousness. Its value has been tested at various points in history, specifically during political and socioeconomic crises.

For instance, during economic downturns, like the 2008 financial crisis, global financial markets were highly precarious and faced severe disruptions. Investors once again placed their trust in gold. Consequently, its price surged during this period, reaffirming its traditional role as a trustworthy asset during times of economic chaos.

Therefore, it is essential to understand the nuances of gold trading, including its seasonal demand trends and the impact of global gold reserves on its price.

Hence, gaining a comprehensive understanding of gold trading is crucial, encompassing insights into its seasonal demand patterns and the influence of global gold reserves on its pricing.

2- Silver’s Industrial Demand and Trading Dynamics

The price of silver frequently demonstrates higher volatility compared to gold. This means that, in a robust market, silver may yield superior returns, but it also carries the potential for greater losses.

The analysis of the silver market is multifaceted since silver is influenced by both investment and industrial demand. Traders need to diligently monitor any industrial innovations where silver plays a crucial role, notably in sectors like solar energy and medical technologies.

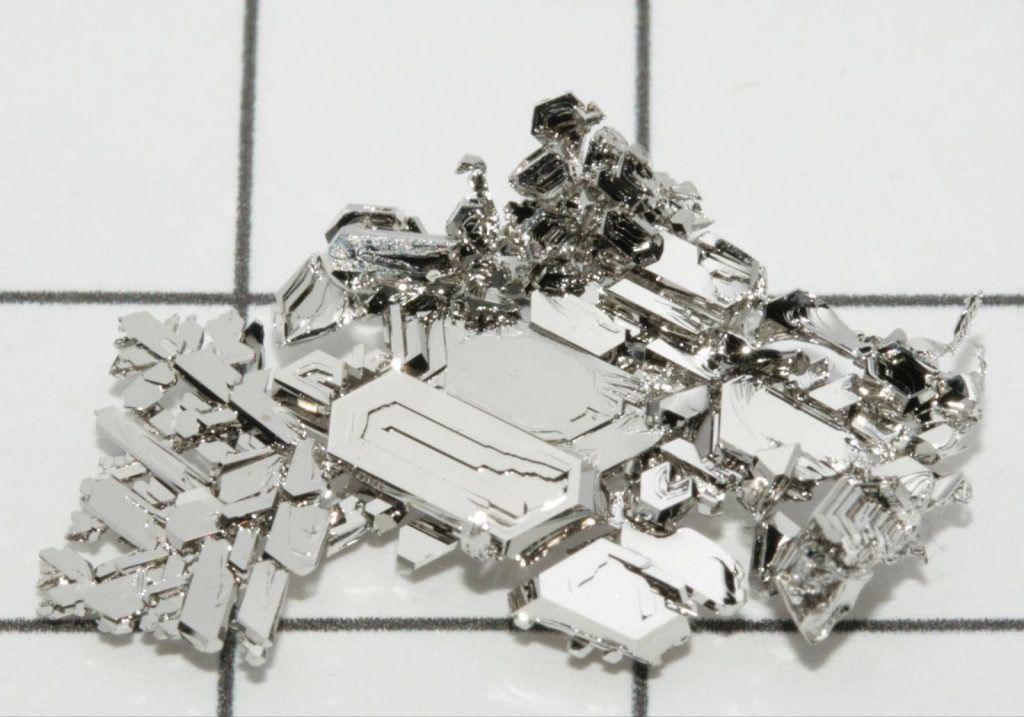

3- Platinum and Palladium: Supply Constraints, Automotive Industry Demand

These metals are rarer than gold and silver. This paucity may lead to more significant price fluctuations, due to supply chain disruptions.

Additionally, platinum and palladium, which are crucial in the automotive industry for manufacturing catalytic converters, are directly tied to fundamental factors like car sales and environmental regulations.

4- Copper, A Pivotal Indicator for Economic Health

Find the errors in this text and send me the corrected version: Copper, often called “Doctor Copper” for its unique ability to predict economic trends, acts as an indicator of economic health. The prevalence use of copper in both construction and electronics underscores that a growing economy can lead to increased demand for copper. More demand for copper leads to a surge in its price.

Factors Influencing Metal Prices

Economic Indicators

GDP growth rates, employment data, the Consumer Confidence Index, manufacturing indices, and other economic indicators can all influence metal prices. For instance, robust industrial production might suggest increased demand for copper.

Geopolitical Circumstances

Geopolitical factors, such as global conflicts, natural disasters, currency devaluations, and so on, especially in countries that supply the best precious metals to invest, can noticeably affect their prices. Additionally, trade agreements and tariffs can also impact prices.

Supply and Demand Dynamics

The recognition of new ore deposits, advancements in mining technology, and shifts in consumer demand play a role in metal pricing. For precious metals like gold, central banks and investors are additional sources of demand.

Currency Fluctuations

Since metals are priced in U.S. dollars, changes in the value of the dollar can inversely influence metal prices.

Technological Advances

Innovations and technological advancements affect the demand for specific metals. For example, a rise in the use of silver in electronic applications can heighten demand and influence its price.

Comparing The Best Metals to Invest

When it comes to trading, not all metals are created equal. Each metal has unique characteristics that can influence a trader’s decision based on their risk tolerance, market knowledge, and investment strategy. Despite being regarded as the top precious metals for investment, the best choice varies for each trader based on their strategy, trading purposes, risk tolerance, and market knowledge. Additionally, there is no one best metal to invest in for a trader at all times since different periods require different investment decisions.

Gold

Gold is often perceived as the most reliable precious metal due to its lower volatility compared to others, making it the best metal for trading for those traders who prefer steady, more predictable markets. Although short-term oscillations are common, its historical performance has shown a long-term uptrend. Gold’s liquidity is another advantage, allowing traders to enter and exit positions with ease.

Silver

Silver, on the other hand, offers greater volatility, which, as mentioned before, can be considered both risky and profitable. It presents the potential for higher returns, but like every profitable investment, it also carries increased risk. Its price changes can be sharp and sudden, which is why agile traders prefer it for short-term profit gains. But if your risk tolerance is not high, maybe you should reconsider your choice.

Platinum and Palladium

Platinum and palladium are not only rare but also mined in just a few countries, with South Africa and Russia dominating the market. Any geopolitical event in these regions can noticeably influence their prices, so if you have them in your basket, stay on top of the news in these countries.

Moreover, the rise of hybrid and electric vehicles is impacting the demand for these metals differently. Palladium is currently favored in catalytic converters for gasoline engines, while platinum is used in diesel engines.

Copper

The growth of the world’s economy and the expansion of infrastructure projects, particularly in developing countries, might increase the demand for copper. Additionally, copper’s importance in green technology, such as wind turbines and solar panels, could further drive its demand. Traders interested in investing in copper or making short-term trades should closely monitor global economic policies and keep an eye on investments in infrastructure and renewable energy. This can help them make informed decisions.

Liquidity

It is noteworthy that liquidity is a significant factor when comparing metals, as in all trades. In terms of liquidity, gold and silver boast the highest rates, making them suitable for both short-term trading and long-term investment. Platinum, palladium, and copper, on the other hand, are less liquid, which can lead to larger spreads and potentially higher transaction costs.

Trading Strategies for Precious Metals

Some traders predominantly depend on technical analysis, some on fundamental analysis, and some on both. Whichever strategy is deemed most suitable for you, it may be necessary to customize your trading approach to align with the characteristics of the market in which you are involved. Trading strategies for metals vary among traders and should be optimized in consideration of the inherent qualities and features of the precious metals market.

Fundamental Analysis: Macroeconomic Factors

As you may already be aware, this approach involves an examination of macroeconomic factors, including inflation rates, economic growth, and production data. When making trading decisions about what is the best metal to trade in Forex, it is necessary to consider macroeconomic factors influencing supply, demand, and overall pricing. For instance, central bank policies and interest rates hold significant influence in determining gold’s price.

Conversely, industrial metals such as palladium and platinum are notably impacted by manufacturing data, housing starts, and trends in consumer electronics. In conclusion, both before and following the selection of the precious metal that aligns with your trading objectives, consider the fundamental factors influencing its price. It is crucial to consistently remain informed about these factors to make informed and strategic decisions in your trading endeavors.

Technical Analysis for Trading Precious Metals

Although technical analysis is used primarily in the evaluation of stocks, commodities, and currencies, it is equally applicable in making decisions that involve metals trading.

The following points delineate key facets of employing technical analysis in the context of trading metals:

- Price Charts and Patterns

- Support and Resistance Levels:

- Technical Indicators

- Trend Analysis

- Volume Analysis

- Candlestick Patterns

- Timeframes and Periodicity

When conducting technical analysis on metals, traders ought to deliberate on the impacts of seasonality and cyclical trends. For instance, gold prices often move in anticipation of holiday gold-buying seasons in significant markets such as India and China or, in response to cyclical economic patterns.

What we strongly recommend for metals trading is integrating technical analysis with fundamental analysis and risk management techniques. While technical analysis might suffice for other markets like stocks and currencies, particularly for short-term profits, the precious metals market inherently differs. Macroeconomic factors play a substantial role in shaping the dynamics of the precious metals market

Risk Management

In more technical terms, risk management means the concurrent effort to enhance profits while controlling losses, entailing avoiding emotional decision-making. This approach mitigates the unfortunate outcome of potentially losing a substantial portion of your capital. The following list includes some examples of risk management strategies in the context of trading metals:

- Understanding the leverage

- Diversification

- Position Sizing

- Stop-Loss Orders

- Risk-Reward Ratio

- Take-Profit Orders

- Consistent education

- Understanding your Risk Tolerance

Beware that excessive leverage can increase losses, especially in the volatile metals market. Therefore, make sure to vigilantly monitor your leverage and resist the temptation to exceed your risk tolerance.

Practical Tips for Trading Metals

How to Start Trading Metals in Forex?

If you are a beginner in metal trading, it is advisable to start trading only after gaining a comprehensive understanding of the fundamentals of this specific market. You can initiate the process by monitoring metal markets to gain a profound insight into price fluctuations and the market’s responses to political and economic news.

For newcomers to metals trading in the Forex market, our solution is Opofinance’s demo account, where you can engage in trading without exposing your capital to risk. While deepening your theoretical knowledge, you will have the opportunity to apply it to the market, formulate a trading strategy, and refine it if necessary. Subsequently, you can engage in real trading with increased real-life experience and confidence in a well-considered strategy.

Choosing the Right Broker

Selecting the proper broker for metals trading in Forex is essential for optimizing trading conditions, managing risk effectively, and ensuring a secure and transparent trading environment. Conduct thorough research and take into account the broker’s specific trading requirements, regulations, commission conditions, and any factors that may impact your trading journey.

At Opofinance, we take pride in our commitment to transparency, competitive spreads, negative balance protection, and automated risk management tools, coupled with exceptional customer service. You can explore all the features of our accounts by perusing our website and reaching out to our customer service. If you have any concerns, do not hesitate to contact us.

Tools and Resources

When it comes to deriving benefits from trading tools, both their quantity and quality are significant. Nevertheless, their functionality is even more crucial than the number of tools you utilize.

At Opofinance, we provide a comprehensive economic calendar enabling you to remain up-to-date on economic news and data releases in chronological order.

Moreover, to enhance your trading decisions, you can utilize our Technical Views, which constitute a unique and invaluable combination of senior analyst expertise and automated algorithms. We encourage you to explore further details about Opofinance’s Technical Views tool, as it proves to be a valuable trading instrument not only for metal trading but also for all your trading decisions.

Staying Informed

In addition to Opofinance’s real-time news updates and expert analysis, you can subscribe to newsletters, attend webinars, and participate in trading forums to enhance your market understanding.

Developing a Trading Plan

Your trading plan should also take into account the tax implications of trading metals. Ensure that you are thoroughly informed about changes in tax regulations concerning profits from trading to effectively manage your investments.

Risk Management

Consider the utility of options in metal trading for risk management. Options offer a smart way to participate in metal prices while keeping risks in check. For example, purchasing call options for gold provides a method to capitalize on potential increases in gold prices, with the maximum potential loss limited to the amount paid for those options.

Continuous Learning

We cannot overstate the importance of ongoing education in trading. The markets are continually evolving, and so should your trading skills. You can engage with fellow traders, become part of investment communities, and participate in seminars and webinars offered by OpoFinance. Additionally, we offer The Social Trading Account, providing an opportunity to emulate the success of leading traders and amplify your profits. However, it is not solely about mirroring their trading strategies; you can also gain insights from the decisions they make at critical moments.

Future of Metal Trading

Historically, the most esteemed metals have included gold, silver, platinum, palladium, and copper. However, with the advancement of technology, particularly in battery technology and renewable energy, the demand for metals like lithium, nickel, and cobalt is on the rise. You can initiate trading with the more recognized metals now but consistently monitor these trends and enter their markets when you identify a favorable entry point in the future.

In other words, the future revolves around sustainability. Consequently, it will influence supply-demand trends, thus altering the prices for other metals. Traders who can anticipate and comprehend these shifts can position themselves advantageously in the market.

So far, the most precious ones were gold, silver, platinum, palladium, and copper. However, as technology, and specifically the use of battery technology and renewable energy, rises, so does the demand for metals like lithium, nickel, and cobalt.

You can start by trading the more known metals now but can constantly monitor these trends and enter their markets when you see a good entry point in the future.

The future is all about sustainability. Therefore, it will affect the supply-demand trends and thus alter the price for other metals. Traders who can anticipate and understand these shifts can position themselves advantageously in the market.

To remain agile enough to seize the shifts in trends in our rapidly evolving world, you require advancements in AI and machine learning to identify the trading landscape effectively.

Opofinance is at the forefront of this technology, furnishing traders with sophisticated tools to benefit from these advancements for enhanced decision-making. Stay informed with our regulatory updates to navigate these changes proficiently.

Conclusion

In the complex world of forex, metal trading offers a unique amalgamation of tradition and innovation. Whether seeking the stability of gold, the industrial pulse of copper, or the rare earth metals for high-tech opportunities, the choices are diverse.

What you need is a strategic approach, careful planning, and the right partnership with an appropriate broker.

With Opofinance, you can not only select the best metal to invest in and add to your portfolio but also adapt to the ever-changing market landscape.

In addition to the points highlighted in this blog post, having a trusted partner is an essential element for success in trading. Whether you’re refining your strategy with our demo account or utilizing our complete set of trading tools and resources, we’re here to support your journey to success. Start your trading experience with Opofinance, where the ideal blend of technology and tradition enables you to perform better in metal trading.