Currency futures trading represents a pivotal component of the forex market, offering traders and investors a structured means to hedge against currency risk or speculate on currency movements. Unlike the spot forex market, where currencies are traded immediately, currency futures are standardized contracts that stipulate the buying or selling of a currency at a predetermined price on a specific future date. This trading mechanism not only facilitates international business strategies but also provides opportunities for diverse investment tactics.

In this blog post, we will delve into the mechanics and benefits of currency futures trading, explore key markets including micro currency futures, and provide practical insights on how to interpret currency futures charts and prices. Whether you are a seasoned trader or new to forex, understanding currency futures could significantly enhance your trading portfolio.

Understanding Currency Futures

Definition and Basics

Currency futures are legally binding contracts that commit the buyer to purchase, and the seller to sell, a specified amount of currency at a predetermined price on a future date. Unlike spot forex trading, which involves immediate currency exchange, futures are standardized contracts traded on exchanges, enhancing market liquidity and transparency.

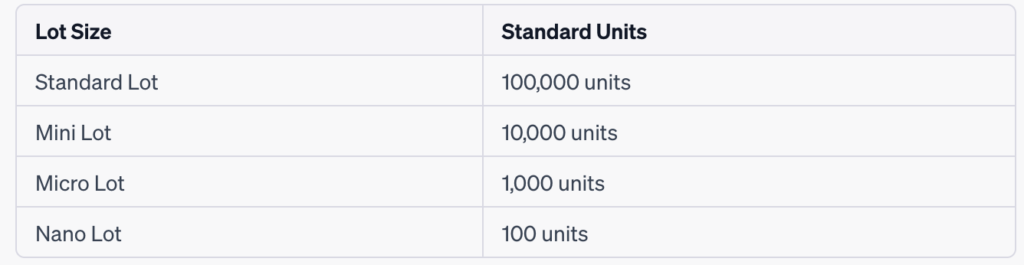

Standard vs. Micro Currency Futures

The market differentiates between standard and micro currency futures. Standard contracts involve large sums and are favored by institutional investors due to their significant financial impact. Micro currency futures, on the other hand, represent smaller sums that are more manageable for individual traders and small businesses. This distinction makes micro futures an excellent entry point for new traders and those with limited capital, while still providing the benefits of standard futures.

Settlement Dates

A critical feature of currency futures is their fixed settlement dates, which can range from a few weeks to several months into the future. This contrasts with spot forex transactions, which usually settle within two business days. The longer timeframe associated with futures allows traders to strategize based on anticipated economic changes or to hedge against potential currency fluctuations, offering a planning advantage that is particularly useful in managing exposures or speculating on future market movements.

How Currency Futures Work

Trading Mechanics

Currency futures are traded on established exchanges such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE), providing a regulated environment that ensures transparency and fairness. When trading currency futures, participants must open a brokerage account that specifically allows futures trading. Each contract is bought or sold through this account, and all transactions are facilitated and recorded by the exchange, which guarantees contract fulfillment and mitigates counterparty risk.

Price Quotation and Leverage

Prices of currency futures are quoted in terms of the exchange rate between two currencies. For example, if a futures contract is for EUR/USD, the price quoted will reflect how many U.S. dollars one Euro can buy at the future settlement date. Traders can leverage their positions in currency futures, meaning they can control large amounts of currency for a relatively small amount of invested capital. However, while leverage can amplify gains, it also increases the potential for significant losses.

Role of Margin

Trading in futures requires the use of a margin, which is a performance bond or a deposit maintained with the broker. Margin requirements can vary depending on market volatility and the specific contract being traded. The initial margin is the amount required to open a position, and the maintenance margin is the minimum amount that must be available in the account to keep the position open. If the account balance falls below this threshold due to market movements, a margin call will occur, requiring the trader to add funds to meet the minimum margin requirement.

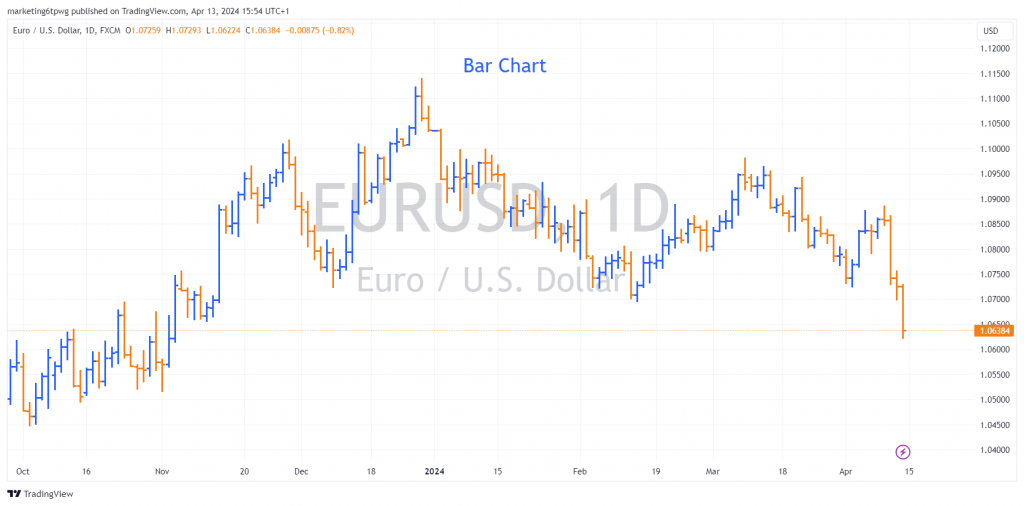

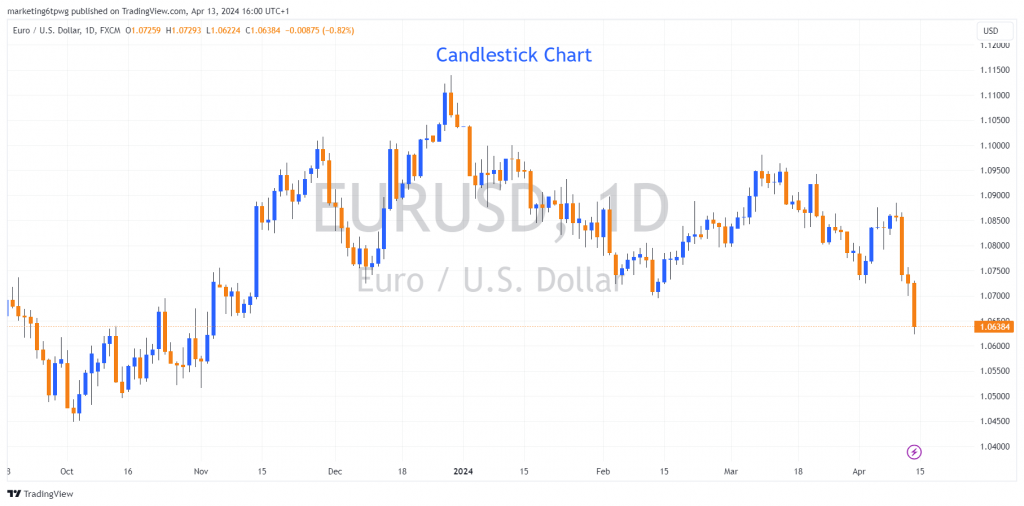

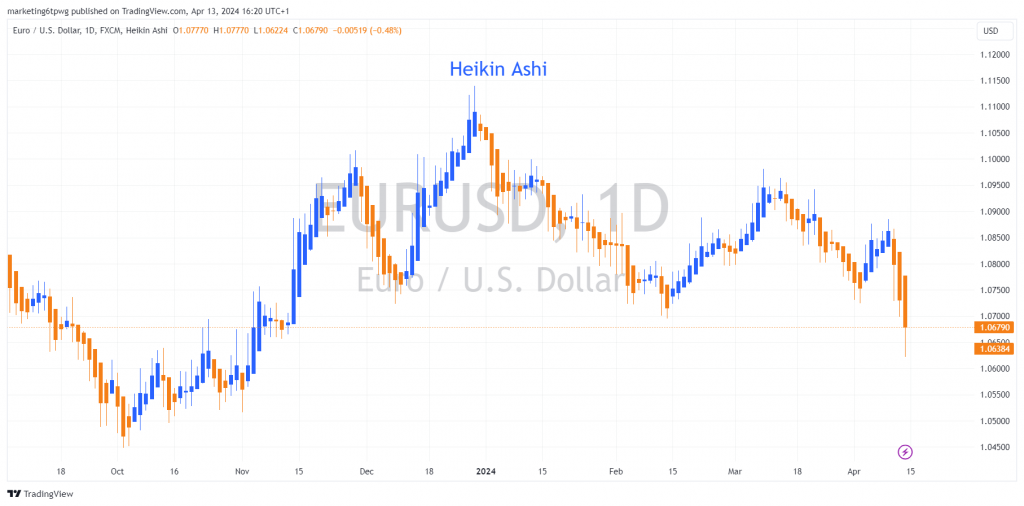

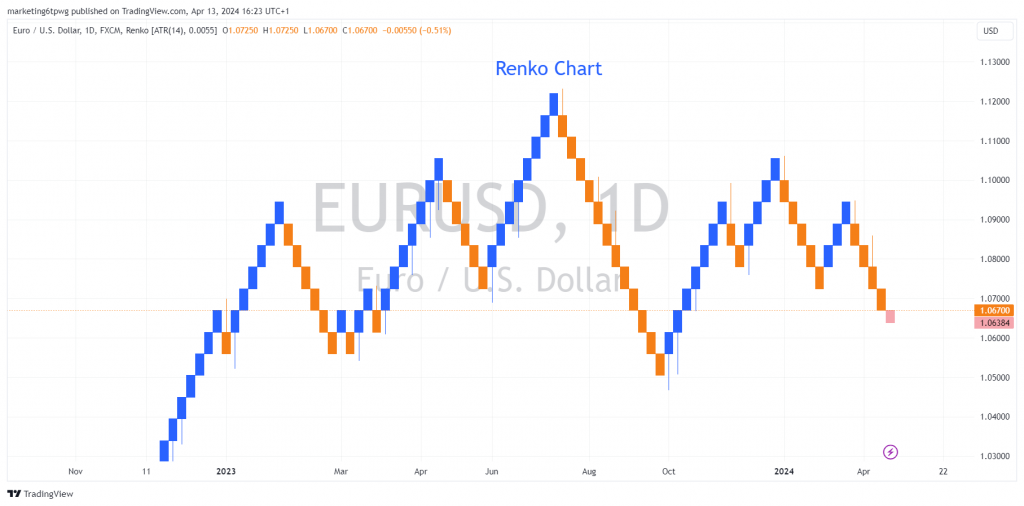

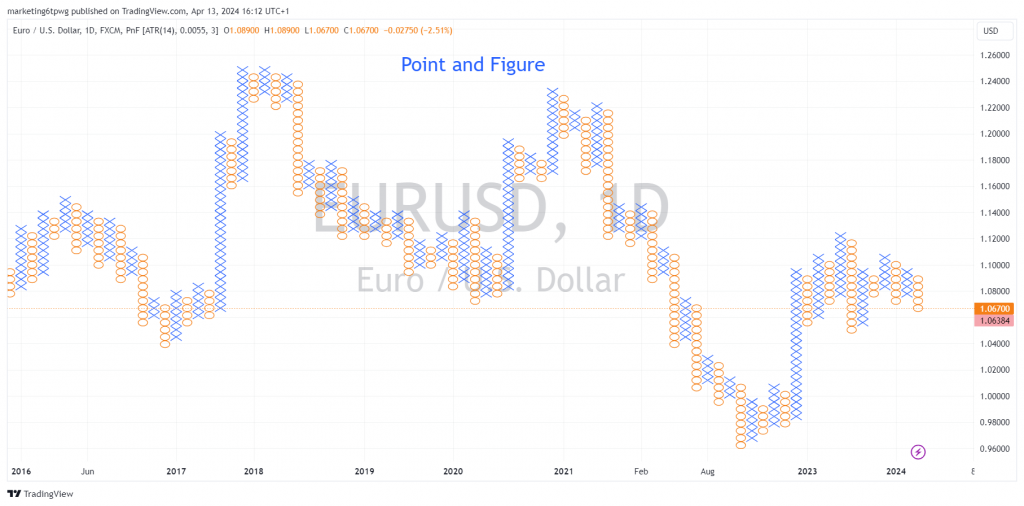

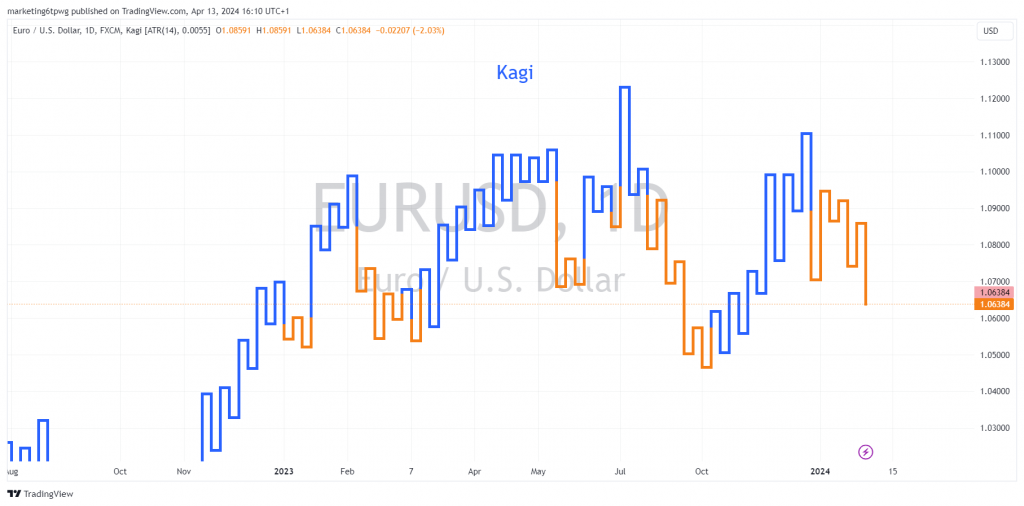

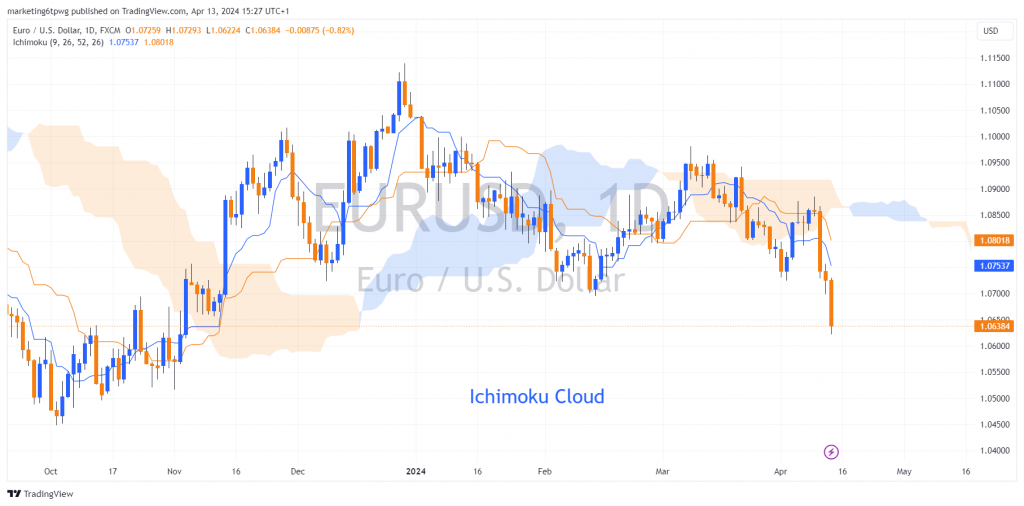

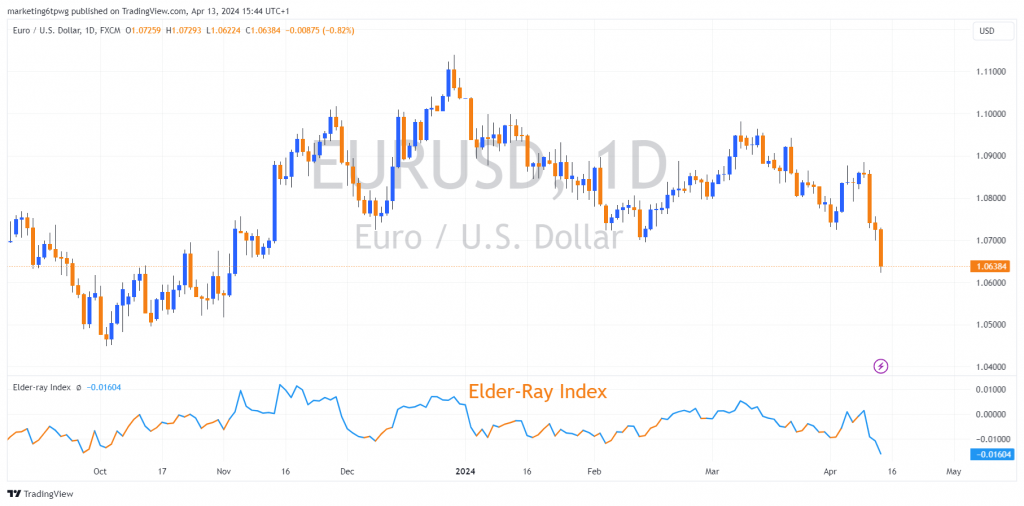

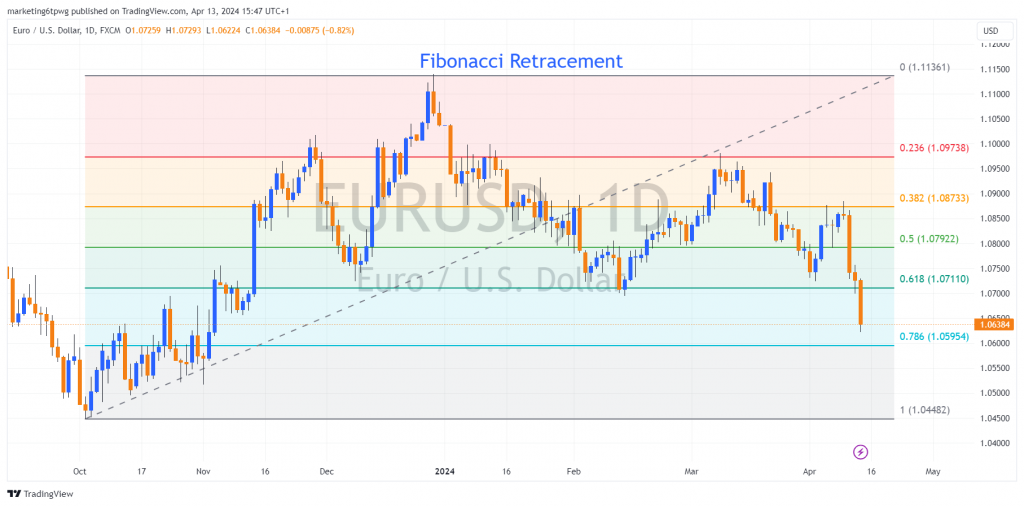

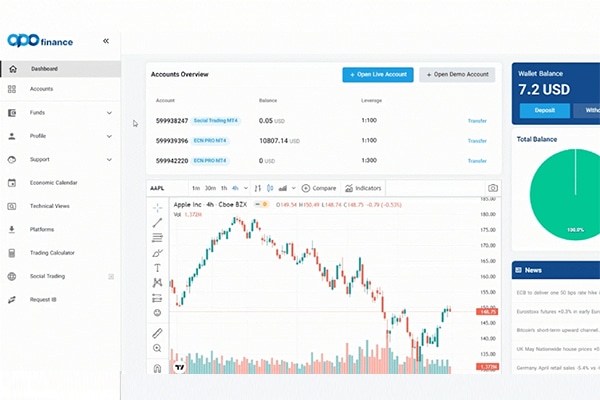

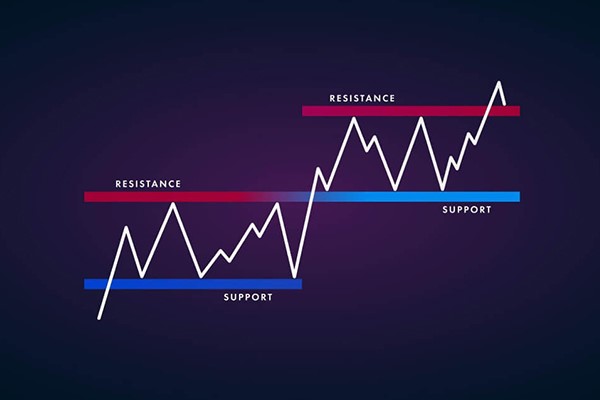

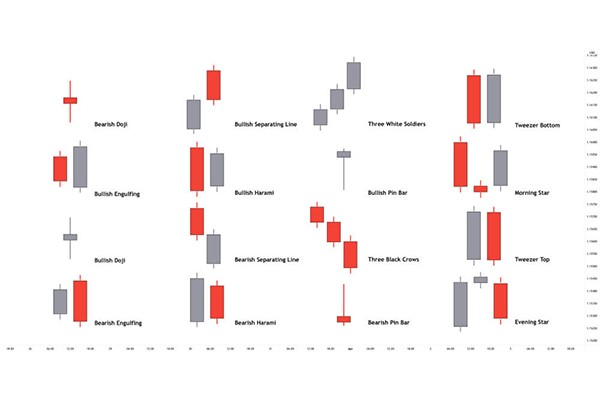

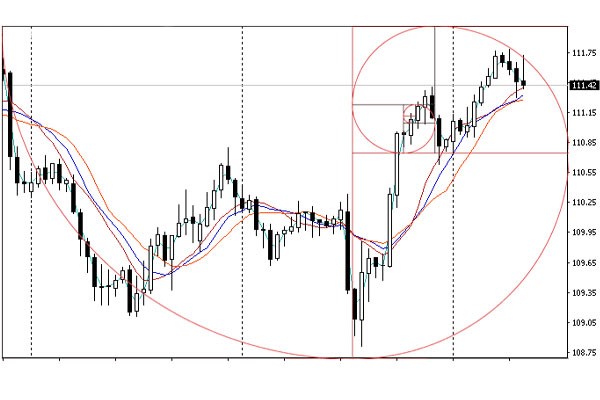

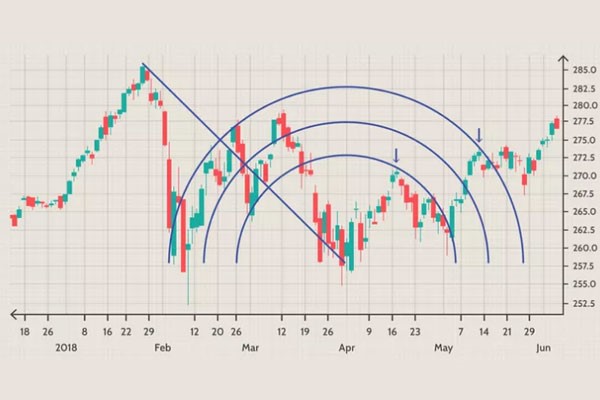

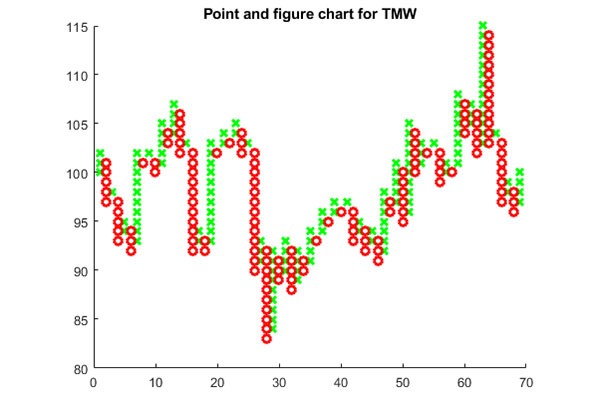

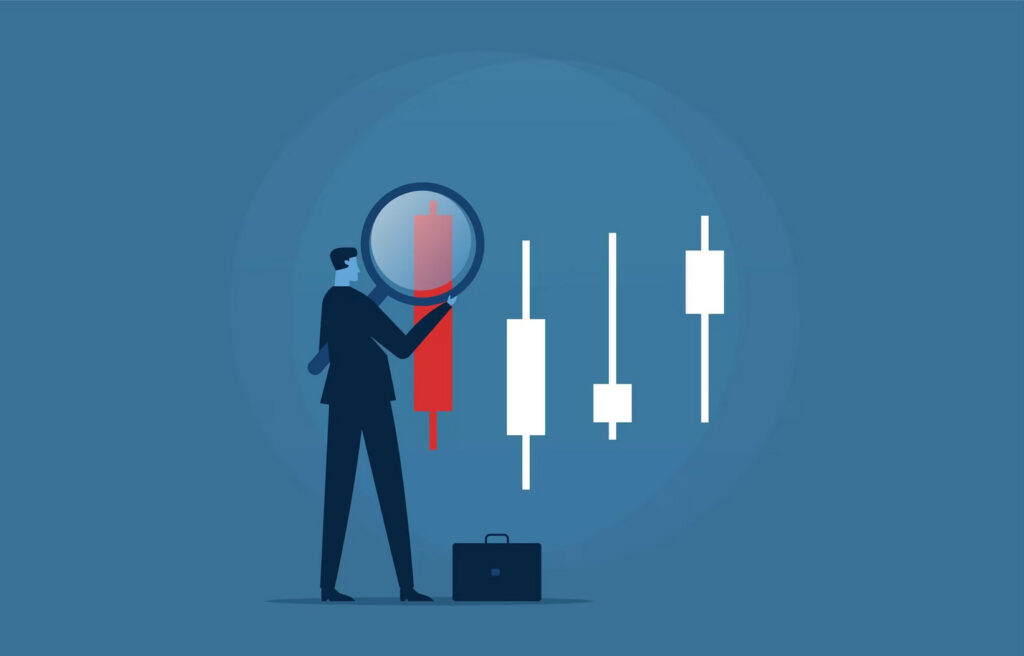

Use of Currency Futures Charts

Currency futures traders rely heavily on charts to make informed trading decisions. These charts provide a visual representation of price movements over time, helping traders identify trends, patterns, and potential entry and exit points. Key chart elements include the contract’s high, low, opening, and closing prices within a specific period, along with volume and open interest data, which indicate the liquidity and market activity for a particular contract.

Benefits of Trading Currency Futures

Hedging Against Forex Risk

One of the primary advantages of currency futures is the ability to hedge against forex risk. Businesses that operate across borders often face uncertainty due to fluctuations in exchange rates. By locking in a rate for a future date through a currency futures contract, these businesses can protect themselves against unfavorable movements in forex rates. This hedging strategy provides predictability in financial planning and protection against adverse currency shifts, which can significantly impact costs and revenues.

Leverage

Currency futures also offer the benefit of leverage, which allows traders to control large amounts of a currency with a relatively small amount of capital. This can significantly enhance profit potential. For example, with a small initial margin, traders can take on positions that are much larger than the actual cash they have invested. However, it’s important to manage leverage carefully, as it can also amplify losses if the market moves against the trader’s position.

Regulatory Benefits

Trading on regulated futures exchanges offers several regulatory benefits over the spot forex market. Futures markets are overseen by regulatory bodies such as the Commodity Futures Trading Commission (CFTC) in the United States, which helps ensure market integrity and protects against fraud and manipulation. These regulations provide a safer trading environment by enforcing strict rules on market participants and offering greater transparency in trading activities.

Market Accessibility and Transparency

Currency futures are traded on clear and transparent exchanges where prices are visible to all participants, ensuring fairness in market pricing. This transparency helps traders make informed decisions based on accurate market data. Moreover, the centralized nature of futures exchanges helps in reducing the counterparty risk that can be more prevalent in less regulated markets like spot forex.

Diverse Trading Opportunities

The standardized nature of currency futures contracts allows traders to access a wide range of currencies, including major, minor, and exotic pairs. This diversity provides traders with ample opportunities to speculate on different currencies based on their market analysis and economic forecasts. Additionally, the availability of micro currency futures makes the market accessible to smaller traders, enabling them to trade with lower capital requirements.

These benefits make currency futures an attractive option for traders looking to hedge forex exposure, capitalize on market movements with less capital, and trade within a regulated and transparent environment.

Strategies for Trading Currency Futures

Trading currency futures effectively requires a robust strategy that can include both fundamental and technical analysis methods. Here’s how traders can approach these markets:

Fundamental Analysis

- Economic Indicators: Traders should monitor key economic data such as GDP growth rates, employment figures, and inflation rates, as these can significantly affect currency values. For example, a stronger-than-expected economic report from the U.S. could boost the dollar, impacting USD-based currency futures.

- Central Bank Decisions: Interest rate decisions and monetary policy statements from central banks like the Federal Reserve (Fed) or the European Central Bank (ECB) play a crucial role in currency valuation. Traders use this information to predict movements in currency futures markets.

- Political Events: Elections, policy changes, and geopolitical tensions can lead to market volatility. Currency futures traders must stay informed about global events to manage risks associated with sudden market movements.

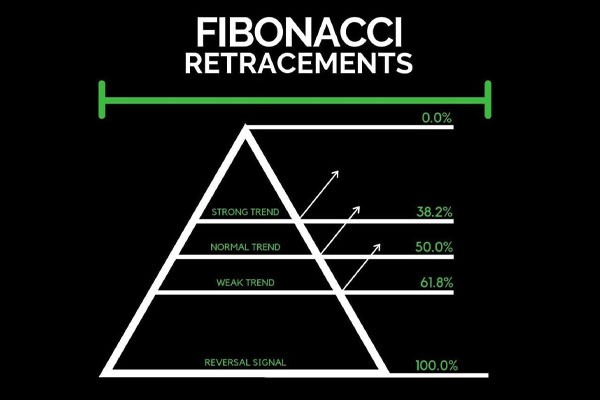

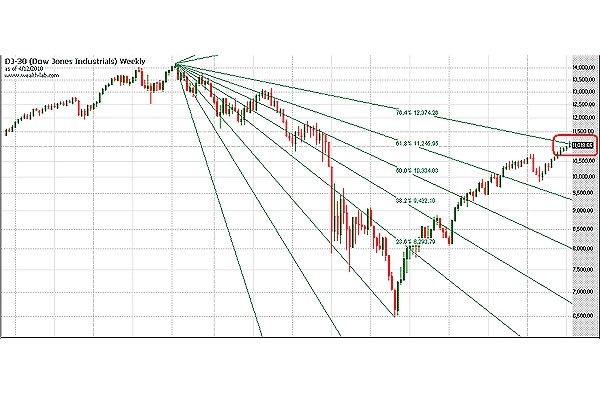

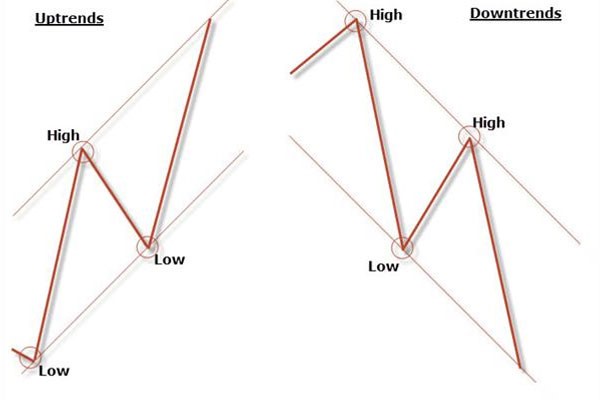

Technical Analysis

- Chart Patterns: Recognizing patterns on currency futures charts can help traders identify potential market movements. Common patterns include head and shoulders, flags, and triangles, each providing potential buy or sell signals.

- Technical Indicators: Tools like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are used to assess market trends and momentum. For instance, a moving average crossover can signal an upcoming trend reversal, which is critical for timing entries and exits.

- Volume and Open Interest: Analyzing trading volume and open interest can provide insights into the strength of a price move. For example, an upward price trend with increasing open interest and volume typically indicates a strong upward momentum.

Risk Management

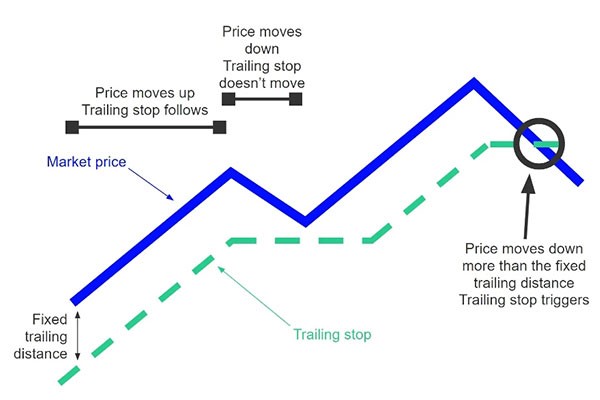

- Stop-Loss Orders: Placing stop-loss orders can limit potential losses if the market moves against a trader’s position. This is essential in managing the risks associated with leverage in currency futures trading.

- Position Sizing: Traders should determine their position size based on their risk tolerance and stop-loss placement. This helps in maintaining risk exposure within acceptable limits.

Diversification

- Cross-Market Analysis: Traders might look at related markets, such as commodities or bonds, which can impact currency values. For instance, a rise in gold prices might affect currency pairs involving the AUD due to Australia’s significant gold exports.

Risks and Considerations in Currency Futures Trading

Trading currency futures, like any investment, involves certain risks and considerations that must be managed to safeguard one’s trading capital and achieve long-term success.

Market Volatility

- Currency futures markets can experience significant volatility due to various factors such as economic announcements, changes in interest rates, political instability, or unexpected financial events. This volatility can lead to large price swings, which, while presenting trading opportunities, also increase the risk of substantial losses.

Impact of Leverage

- Leverage allows traders to control a large amount of currency with a relatively small amount of capital. However, while it can magnify profits, it also amplifies potential losses. Effective leverage management is crucial, as a small adverse move in currency prices can result in significant losses, potentially exceeding the initial investment.

Liquidity Risk

- While major currency futures are generally liquid, some lesser-traded futures might suffer from lower liquidity, leading to slippage or difficulty in entering and exiting positions at desired prices. Traders need to be aware of the liquidity of the currency futures they are trading, especially if dealing in minor or exotic currencies.

Regulatory and Counterparty Risks

- Although trading on established exchanges significantly reduces counterparty risks, traders need to understand the regulatory environment of the countries where these exchanges operate. Any changes in regulation can impact market conditions or trading strategies.

Complexity and Information Overload

- Currency futures involve various complexities related to contract specifications, settlement mechanisms, and the need for continuous monitoring of multiple factors that can affect prices. Additionally, the vast amount of economic data and news can lead to information overload, complicating decision-making processes.

Risk of Overtrading

- The ease of trading and access to high leverage can lead to overtrading, where traders make too many trades or trade excessively large positions relative to their capital. Overtrading often results in increased transaction costs and can diminish overall profitability.

Risk Management Strategies

To mitigate these risks, traders should employ sound risk management strategies such as:

- Setting Stop-Loss Orders: To limit potential losses, traders should use stop-loss orders, which automatically close a position at a predetermined price level.

- Risk-Reward Ratios: Before entering a trade, consider the potential risk compared to the potential reward. Successful traders often look for opportunities where the potential reward significantly outweighs the risk.

- Regular Market Analysis: Stay updated with market conditions, economic indicators, and other relevant news that can affect currency futures prices.

- Diversification: Spread trading risk across various instruments or markets to avoid exposure to a single currency or economic event.

Conclusion

Currency futures offer a dynamic and structured approach to trading within the forex market, providing both seasoned and novice traders with opportunities to hedge risks or capitalize on currency movements. This comprehensive guide has walked you through the foundational aspects of currency futures, from understanding what they are and how they work, to diving deep into trading mechanics, strategies, and risk management. We’ve explored the practicalities of trading currency futures, including choosing the right broker, leveraging advanced trading platforms, and developing a robust trading plan. As you embark on or continue your trading journey, remember that success in currency futures requires continuous learning, adaptability to market changes, and a disciplined approach to risk management. Whether you’re hedging international business transactions or seeking speculative gains, currency futures provide a transparent, regulated, and diverse environment for achieving your financial goals.